9/11 Recap

We got a small rally today after CPI, we still haven’t broken over this cluster of moving averages below, but the day is young and so far we’re forming a nice hammer meaning buyers have stepped in. If we can close up over that 550 level and clear this major resistance we could be in for a run, this is all hypothetical until we get some confirmation of a breakout on the chart but it has been 7 sessions since we closed over the 8 ema and all our recent efforts have been rejected, so the trend is still down until that changes. Without getting too political you’re seeing today’s reaction as perceived winners of yesterday’s debate. Some are down, Bitcoin names and names like GEO, a prison name down 6%, those were “Trump” trades and you’re seeing things like TAN up 5% as solar names fly since those were “Kamala” trades. So take from that what you will, there is obviously still an election in 2 months but participants in the market are slowly making it known today what they think is coming with their positioning today.

The big one today is tech stocks, the QQQ is putting in this massively bullish candle so far and really trying to start fixing all this technical damage. There isn’t much to say big tech is all we have and this recent rotation into stuff like Mcdonald’s and other defensives is nice for a quick trade, but those aren’t long term buys here, and they were always coming back to big tech, it was a matter of when, which is why I bought MSFT last week and I’m happy with the move it’s made since. These megacaps are the market, over 30% the SPY is those 6 companies at the top, if they don’t go, the market doesn’t go. Which is why I tend to focus on them due to their safety and importance to the overall scheme of things.

Recent Trades

PLAY - 2 days ago in the recap here I mentioned these put sales on Dave and Busters, It had a monster move up to 34 and has faded all morning, it went from up 15% to red to slightly green now over 30 but those puts are not in today’s volume so they still have not moved and they’ve gone from 1.80 to .95 now for a really nice move in 2 days as a put seller. I’d keep an eye on the volume of these and see if this player gets out only 1950 traded so far today, when they do, that’s when you want to move aside as well. Overall the earnings reaction seemed solid for such a massive put sale, you want flat to up and that is just what it did.

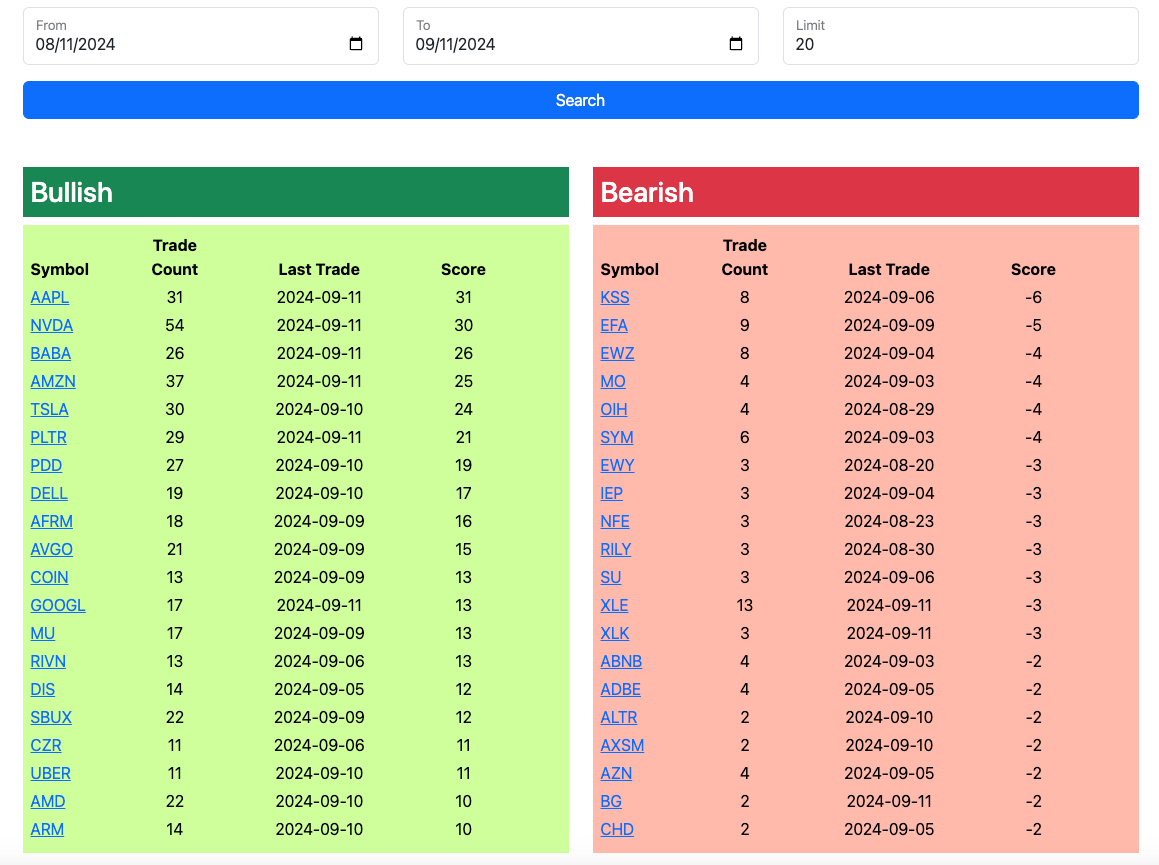

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database it will be open until tomorrow morning and the rest of today’s trades will be added by the afternoon.