9/12 Recap

Yesterday afternoon, the SPY went on a torrid run and closed up over all the moving averages after testing the 100 day early in the morning and looking like it was about to breakdown. Once we closed over the 21 ema yesterday that was your bull signal, we’re back in an uptrend, until the next time we’re not. Today is just a followthrough. The market is looking good again but we need to make new highs soon, we’re close, but until we do, these all technically remain lower highs which is not longer term bullish.

Tech appears to be back, we need confirmation on today’s close but the QQQ is piercing the 50 day right now and this thing was below the 100 day yesterday morning looking awful, 2 sessions later we could be back in a bullish phase. If we can close up over the 50 day, you can use that 100 day below as a stop loss on trades, a good level to sell puts at and hope the tech world builds higher. Today’s move up is even more impressive considering Apple and Microsoft are red and those are almost 20% of the QQQ.

Recent Trades

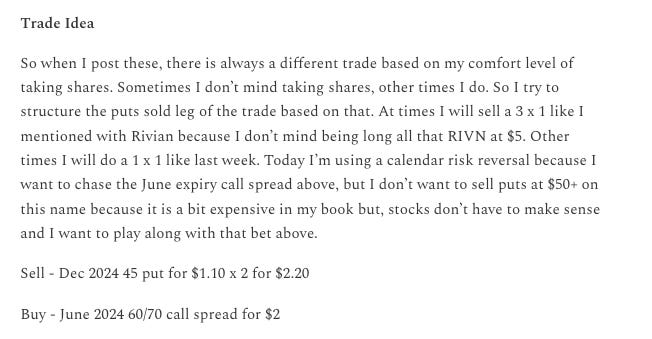

CARR - I wrote this one up as a weekend best idea back in March here and today was the first time I logged multiple trades on it since down below in today’s table, but this name is up almost 30% since this with the market up around 7% so it has been a huge outperformer and the trade I noted below. What you’ll notice is the calls I highlighted below, they did not work, well they did just not in that timeframe as the name is 73.xx now but because I suggested selling 2x the puts in december at 45 and those are now worthless, the trade ended up costing you nothing. Had you bought the call spreads you would have lost $2/share. This is why I’m always pointing out risk reversals and explaining why you need to utilize them because if done properly, you can be wrong and still not lose or even in this case you got a tiny credit of 20 cents and made money while wrong. That’s how options are to be utilized, they’re not the gambling tools everyone on Twitter makes them out to be, their real use is for calculated risk.

Trends

Alright, I’m not gonna post these trend tables anymore here, substack has all this top part as my free preview everyday up until where I post the link and I have way too many people casually using these on their substacks. I get so many messages from people showing me all these different writers just posting my trends table and thats fine but nobody even references my work. So from now on, it won’t be in the preview at the top and you can find the trends in the link I share everyday. I apologize if its an inconvenience to anyone, but the link below is a much cleaner look and allows you search far more than I post anyways.

Today’s Unusual Options Activity

Here is today’s link to the database, it will expire tomorrow at the open and I will have the rest of the day’s action added by the afternoon