9/14 Recap

We had a powerful up day after retail sales and PPI came in. Oddly retail sales were a huge upside surprise registering .6% vs .1% expected and the biggest beneficiaries of that ie the credit card companies like Visa and Mastercard along with big retailers like Amazon were red today. I’m not sure what that was about but all of those companies should be posting very nice numbers this quarter as the consumer continues to spend and all that nonsense we’ve heard for months about consumers being maxed out, savings running out, student loans restarting, etc did not matter today. The reality is we have heard the same song and dance for years about the consumer and yet forever, the consumer has been resilient.

So far the SPY has made a powerful move over this cluster of moving averages as we remain in the buy every dip phase of the uptrend. What more can bears do? CPI was hot, PPI wasn’t great, and yet the market continues on. That’s why it is easier for me to focus on the trend we’re in whether up or down and just play that.

LIVE

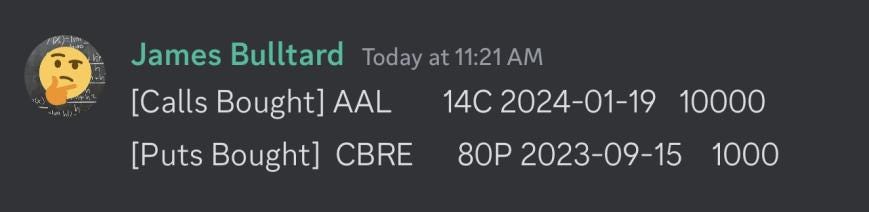

I get lots of questions asking me does getting the options flow live vs the recap make that big of a difference and the answer is in something like yesterdays recap with the CBRE weekly puts you can see in there. I noted those puts bought at 11:21 am in the live channel on the discord

and within minutes something had happened, someone was speaking at a conference and began discussing how awful the commercial market was right now and the name plunged down to -8%. The arrow is when I saw those puts come across, those very well could have been bought by someone there in attendance.

Later it was brought to my attention by someone who took the puts that they went up 12x for them.

Even today’s recap you will see below the URNM calls I noted today, someone took those right when I posted them and mentioned in the chat that they made a quick 8%

This is the options market, people make big bets and they sometimes move equities, quick. I’m trying to highlight the oddest ones I see with all this option flow daily, occasionally you get stuff like this. Now you still get that same data in the recap and I do try to get it out with enough time left in the day for you to act, but the reality is, for those who are active, there is nothing that can replace getting the data the instant the trade is placed and I do that by sitting at my screens for the first 4 hours of the day and posting every odd trade I see as they come across my scanner. By the time the recap has come out, many of these have moved that is just out of my control.

Trends

Week To Date

2 Week

1 Month