9/15 Best Idea For The Week Ahead

The SPY closed up last week with its 3rd highest weekly close ever. We are back over the 8 week and the market seems to have found its footing once we got more clarity after the CPI report and the debate on the direction we’re headed. Most big tech names remain well off highs and if they pick up the pace, this market can go much higher as they’re most of the weighting here. That 21 week below remains massive support as the market continues to bounce right there every time it approaches, that looks like a great spot to sell puts or put spread on the SPY sub 540 until that breaks.

The real shocker here is these dividend names, I get locking in yields before rates are cut but it isn’t often you see a chart like this below, the XLP weekly. This is consumer staples and it is up almost 30% since the October 2023 lows. Look how overbought this is……

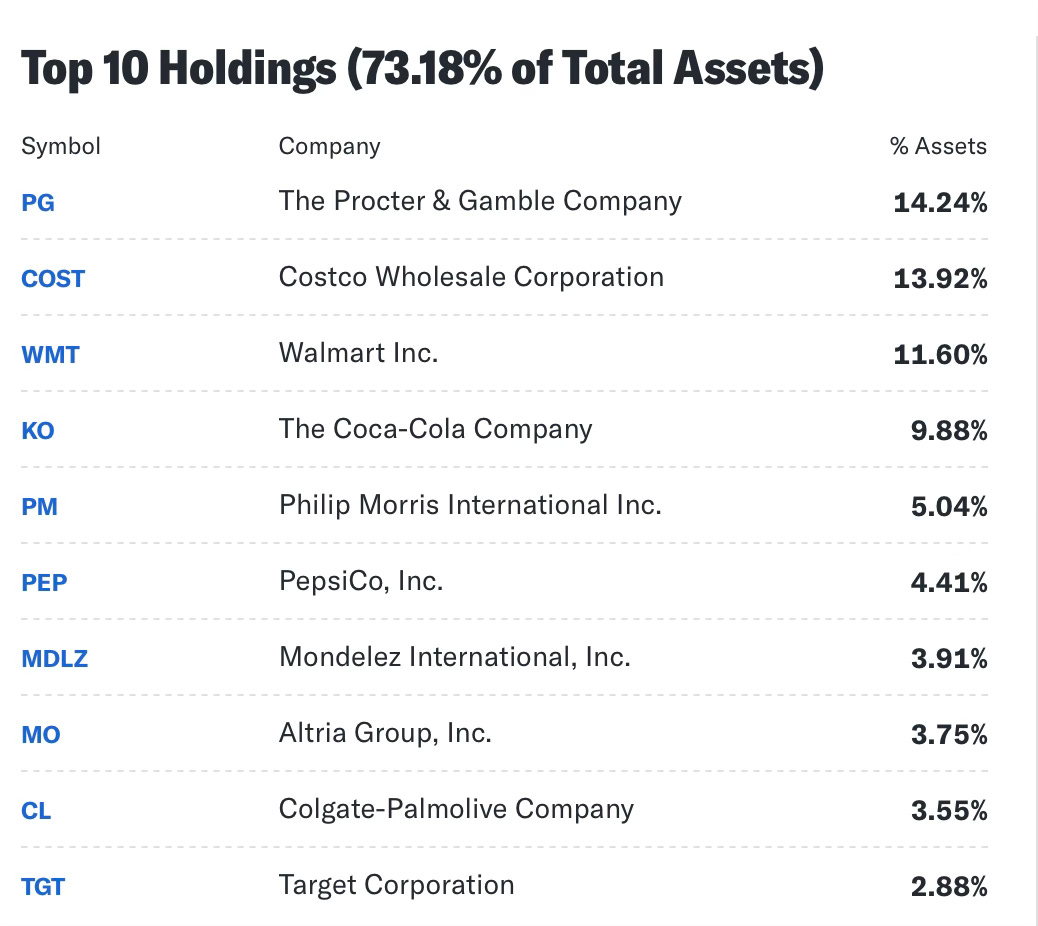

Here is the weighting of the XLP, Coca Cola and Walmart have been unstoppable all year, Walmart is up over 50% YTD. WALMART, these aren’t some hot new tech companies that are guiding on an AI future of massive earnings beats, these are toilet paper companies, soda companies, low margin retailers and right now the RSI is off the charts as this has been the crowded trade of 2024. These aren’t even good values with Costco at 50x earnings and Walmart at 40x earnings when names like META and GOOGL trade half the multiple with far more growth and profits. It’s funny that these are called the “value” names. Tech is not the bubble in this market, these names below are because there is no growth to justify these multiples but that’s why fundamentals are secondary to the flow of money. If this is what is being bought, then that’s all that matters, until those charts break.

This week’s best idea is not in the hottest space, but it had a monster put sale this week that should mark the bottom, actually 3 trades in the last month of 20,000 put sales across various strikes that are still in the open interest. You know my stance on the put sales, those are always the most important of the trades I log because those are not hedges and we can see levels big money wants to get long. This past week that huge put sale on PLAY 2 days before earnings worked out and you knew it would, nobody sold 20,000 puts like that right before earnings without knowing what was coming.