9/15 Recap

Nasty selloff today in tech as yields rose. OPEX is always such a day of trickery. The TNX below is going to close at another high and these yields are just pressuring everything, including our own government. I’m not sure how much longer this can sustain but as you’ve heard for a long time from everyone, it is sustaining until something breaks.

The SPY continues to hold this uptrend as it continues to flirt with a breakdown. The trend remains bullish until this changes, this has been quite a run approaching nearly 1 year now. I imagine we likely hold this trend at least until earnings are over in 6-7 weeks. Typically there is a pre earnings run up, but seasonally the end of September is the worst time of the year.

Trends

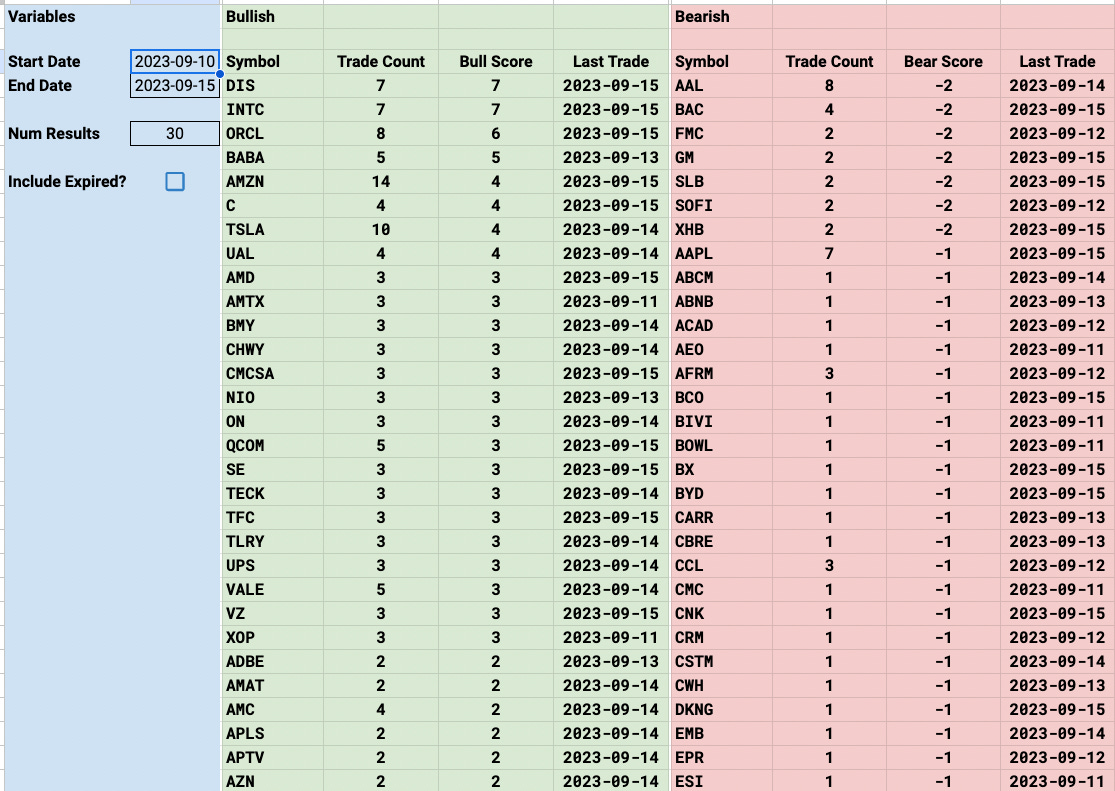

Disney has been the top trending name this week and it has seen quite a run. It is up 7% off the lows and was strong again in a weak tape. ORCL too had a very nice run after its earnings selloff and UAL was very strong today as well.

Week To Date

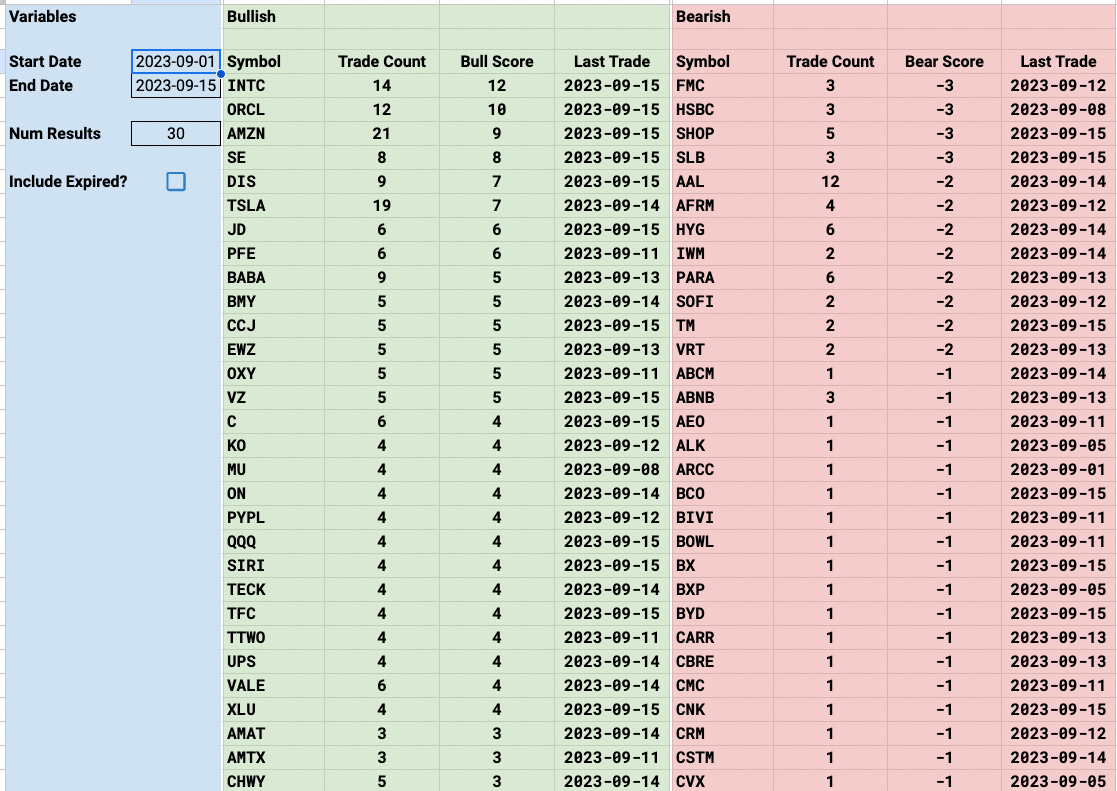

2 Week

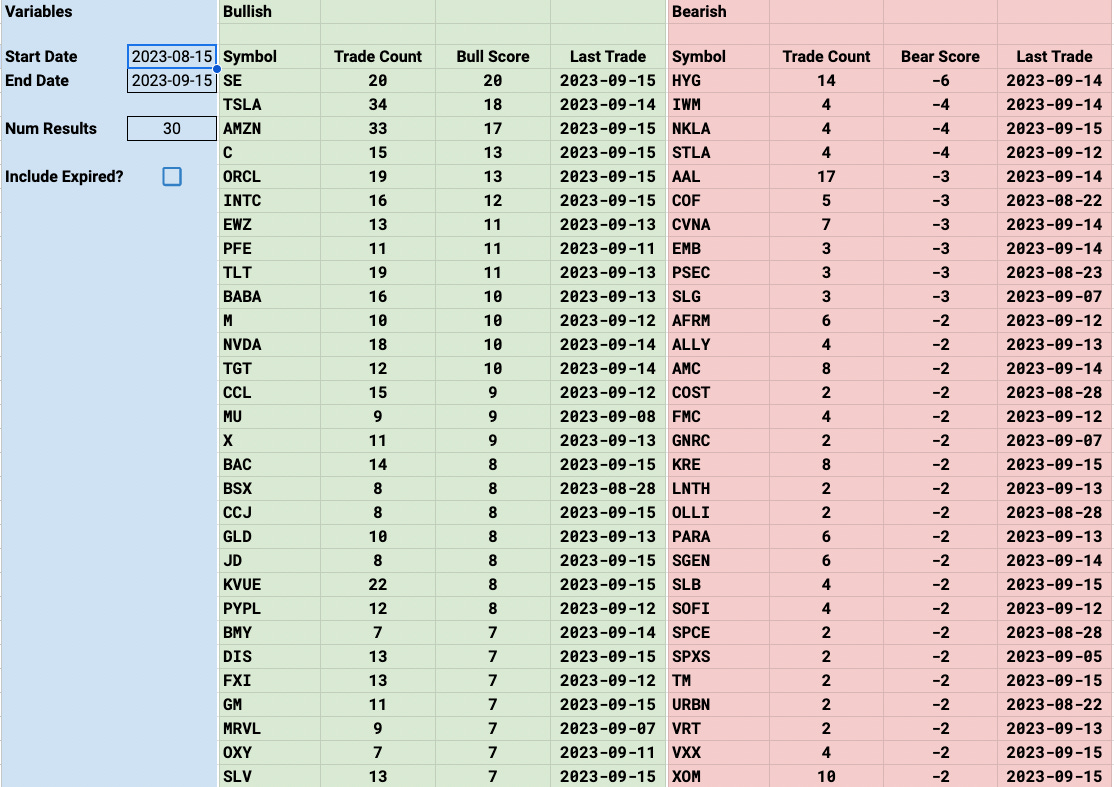

1 Month

Today’s Unusual Options Flow

Trades Of Interest