9/19 Recap

We got the breakout on the SPY today. Look at the last 2 sessions and we methodically rejected breaking out. Today we gapped up and ran. Now you can set your stops at 465.16 the previous breakout and close longs on a close below that. This is what I was looking for the last few months when I said I thought we’d go into the election at all time highs, here we are 45 days or so till the election and new all time highs achieved.

In our world of weaponized financial assets, the stock market is the key barometer of our societal happiness, so why wouldn’t we see new highs into the election to remind everyone how good things are even though the data continues to be pretty unremarkable. Think about all these macro guys and their long writeups about how poor all the data is and here we are with a literal textbook breakout in the market as that all occurs. Almost like none of that stuff the “smart” macro types discuss regarding the economy and markets matters and all that matters is stuff simpletons like me and other chartists watch such as “when do we go over the horizontal line”. Bottom line, these lines on the chart will never lie to you. I think today was more of a breakout on the fact that we have trillions in cash, money markets, cd’s, bonds and with lower yields that money will be exiting those and coming right back into assets like equities and real estate.

The reality of the matter is we have way too much cash out there in the world chasing way too few quality assets. This is going to be a huge problem for us going forward and you’re seeing it already with record valuations on these alternative assets like art work, classic cars, etc. There is only so much mag 6 you can stuff into your portfolio before you decide you need to diversify and you run into the same issue of lack of alternative assets that are safe and worth investing in. Powell just lit the match that is going to drive the market and all assets materially higher with the start of rate cuts. For those of us with assets, it isn’t bad, but it is going to dramatically widen the wealth gap between the haves and the have nots even more over time. Personally I would have loved to see rates stay high if the economy is as strong as they keep telling us it is……

Recent Trades

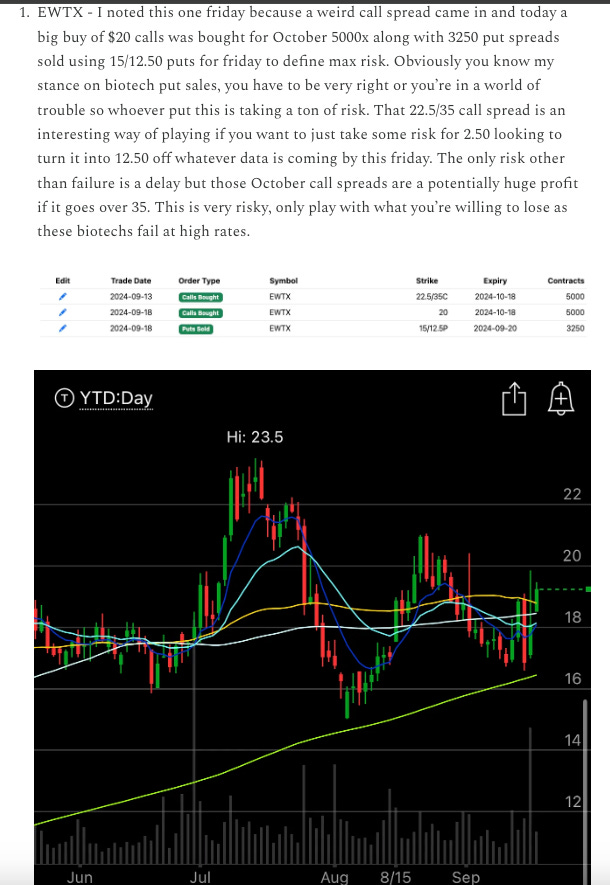

EWTX - up 55% right now to 29.48 after touching 30. I highlighted this twice in the last 3 recaps. Sometimes a trade gets egregious and a small cap biotech like this seeing a huge put sale into data yesterday was the tell for me. Like I joked about the other day, on a scale of 1-10 a biotech put sale into data is just off the charts as the player has to be right or they’re likely unemployed. Unbelievable call buy last friday from that buyer who now has calls they paid 2.50 for that have nearly quadrupled in just 3 days. Monster trade and if any of you followed I would be a seller today simply because these biotechs tend to do offerings after moves like this. Think of all the people who spent months discussing the fundamental thesis here and a bunch of people who read this recap and know nothing about the company made just as much money if not more simply from buying calls following the flow of money at the right time. In this casino we call the market, fundamentals are very far down the list in importance.

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will be open until tomorrow morning at the open, the rest of today’s trades will be added by the afternoon so check the database later to see all the updated trades and trends.