9/20 Recap

We had a perfect backtest of the breakout today, literally to the penny, and now it looks like we’re forming a hammer candle ontop. That is exactly what you want to see after a breakout, all dips are bought up. Will this hold into day end? I don’t know but as long as we remain over that breakout of 565.16 this market is not one to be selling into. Today’s weakness is likely due more to quadruple witching OPEX today because at this moment the VIX is down 3% with the market red, so just seems like a fake move down to me and on days like this market makers sort of push equities where they need them to be into expiration. Overall things are looking good, let’s see where we close.

Recent Trades

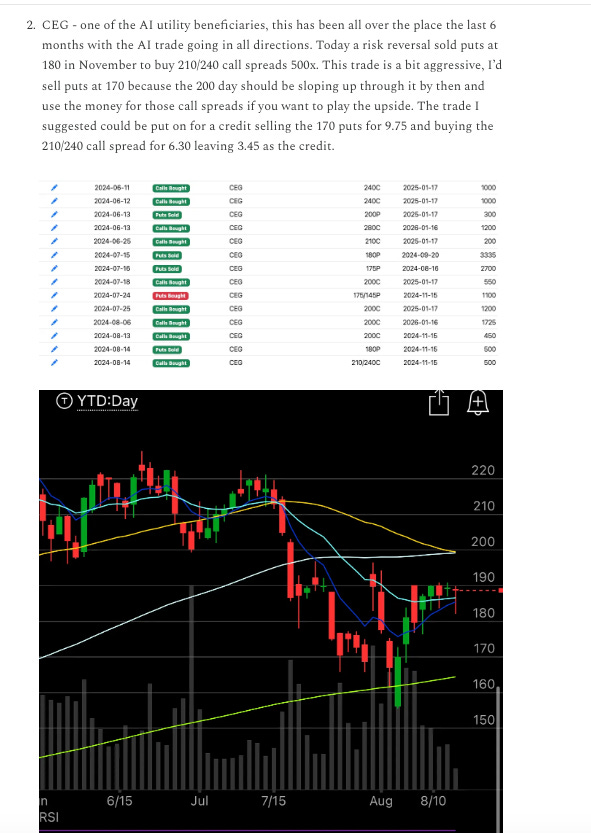

CEG - In the 8/14 Recap here I highlighted this utility that was trading below 190, that day a player put on a November risk reversal selling 180 puts to buy 210/240 call spreads. This morning it gapped up almost 16% now on the Microsoft headlines to restart a nuclear plant and the stock now sits just over 240. If you utilized the risk reversal I drew up you got paid $3.75 to put it on and now you’re up a fortune because those short puts have melted away and that call spread is

Today’s Unusual Options Activity

Here is today’s link to the database, it will expire monday morning at the open and the rest of today’s trades will be added by this evening so check back for those and the updated trends.