9/21 Recap

What an ugly day, the Nasdaq is down over 200 and the ES is down 50. Jay Powell finally accomplished what he had been trying to for the last 2 years to no avail. He spooked investors by showing he has no clue what he is doing. Investors finally had to accept that they weren’t all knowing and they couldn’t price in rate cuts every few months out. Powell showed his dot plot showing rates were going to be higher for the next 2 years, why anyone believes him is beyond me. The same dot plots in 2021 showed 1% rates for the current timeframe and look where we are. The reality is something will go wrong if rates stay here and then he will have to swoop in and cut rates to save the day, it is all just a back and forth game at this point and Jay Powell is attempting to play God and it isn’t working.

The VIX exploded up 9% today and the SPY finally broke its uptrend for the 2nd time in the last 11 months, in March the 3 weeks we broke down were due to the banking crisis, will we reclaim that soon, I don’t know. If we don’t, it’s going to be a period of weakness until we settle, base and start the next uptrend. For now you should be removing leverage, closing things you’re concerned about, and focusing on only the best names. I have alot more on my positioning at the bottom of the recap but this chart is clear as day now and I’ve been pointing to that uptrend line for months now. We bounced off it countless times, but we finally broke down today, barring a miraculous bounce tomorrow, this will be the first weekly close below it since March. You shouldn’t fight it, things won’t be pretty for a little bit, it’s ok, stocks don’t go straight up, sometimes they go down too and the time has come, bulls had 11 great months. 420 looks like a natural spot to reset and base.

On a positive note, SPLK was acquired today by CSCO for $157/share. I have highlighted the unusual options flow for a long time and multiple times recently, even as recently as in the 9/18 recap 3 days ago.

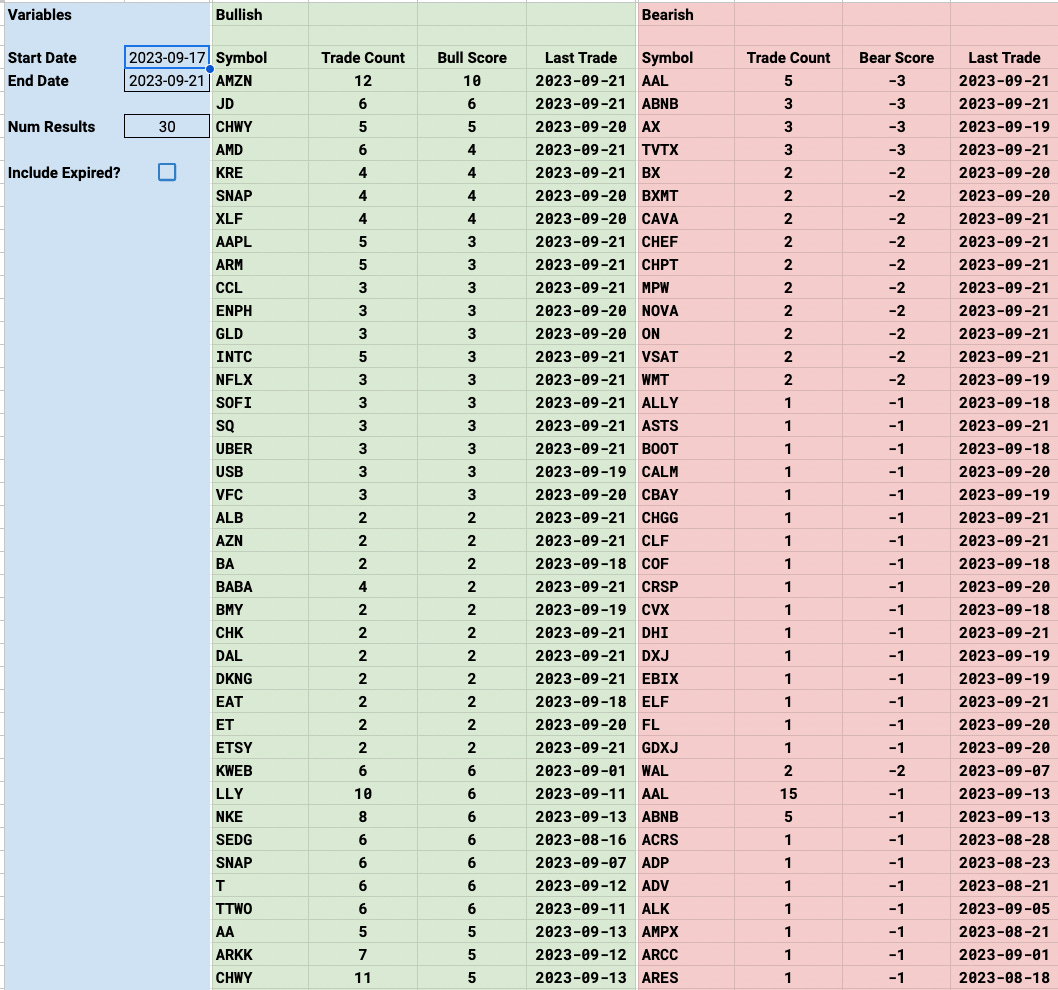

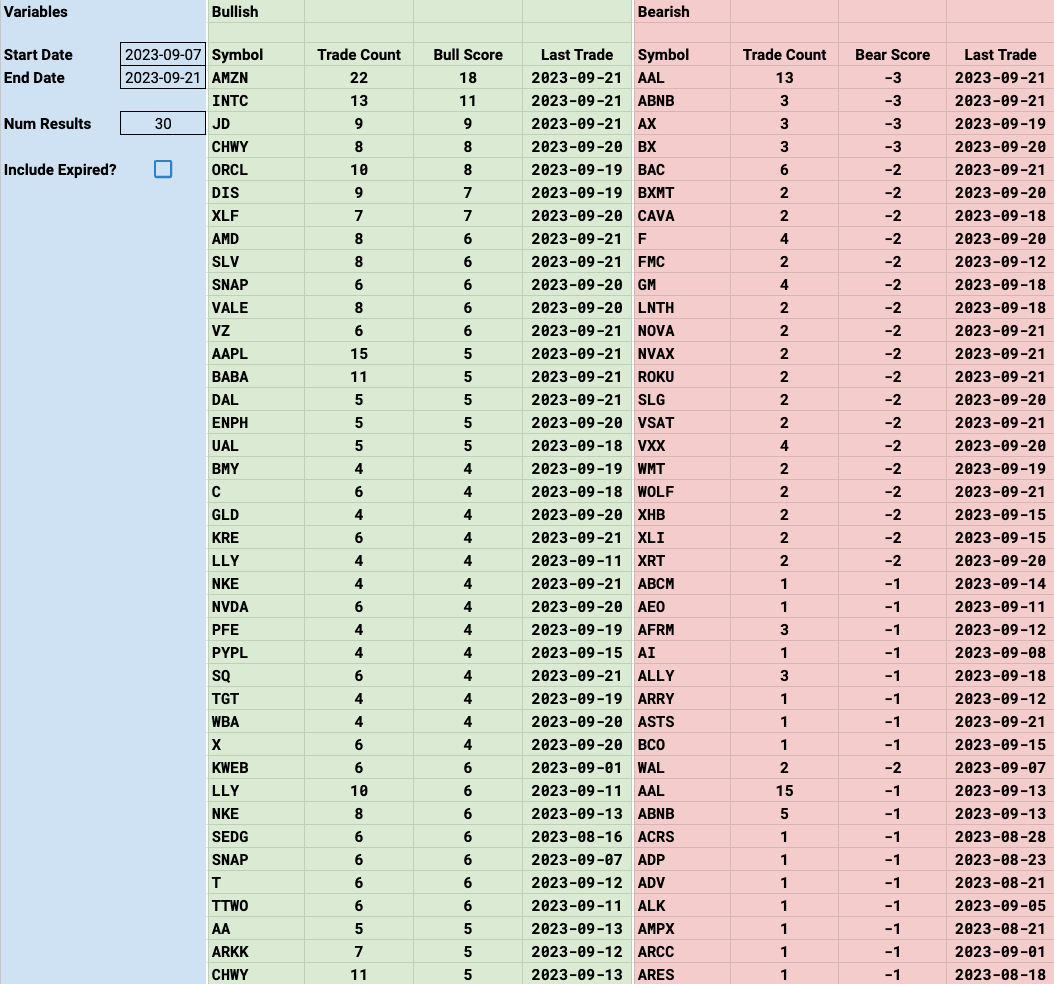

Trends

As the market weakens looking for opportunities in these smaller names is never a bad idea, look at the recaps the last 2 days you will notice the TVTX puts bought in size both days, even yesterday I mentioned to all the live people something odd was up with that 4000 lot put buy and today TVTX was -42%

so fear not, even as the market declines, there’s always opportunities, it may not be your household megacap names but there’s always dirty stuff going on in the options market so pay attention to these trends, TVTX was near the top for this week on the bearish trends.

Week To Date

2 Week

1 Month

Today’s Unusual Options Flow

What you will notice today is something I don’t think has happened ever in this table. More puts bought and more puts sold than calls bought. Calls bought are the overwhelming bulk of daily trades, that is reality, most people are bullish. Bears are few and far between hence why put buys are so much fewer daily, but I’m sure you noticed the last 2 recaps had way more put buying than usual and today we got the big move down.