9/22 Recap

A bounce today with the NQ + 150 and the ES +21. There is still alot of technical damage done now so a recovery won’t be immediate but today was a welcome move. The daily chart below has room lower to a tad below 420. With all the moving averages now sloping down on this broken chart, all bounces will be sold until we flatten out and reclaim a few of those, typically a couple weeks at least.

As I pointed out yesterday, the uptrend below is officially broken. How much pain is inflicted now depends on the depth of the breakdown. Will it be months like the 2022 breakdown? Will it be weeks like the one we had earlier this year? It’s impossible to tell from now but for now assume the worst. If you put the last 12 months in context, we’re up nearly 30% off those 348 lows. A cooling period while everything resets is healthy. In the short term we have question marks and markets don’t like those. How will higher for longer rates hurt everyone? We were all expecting alot of rate cuts quickly that Powell shot down this week. How will oil impact things? What’s going on with China and Taiwan? Are markets starting to price in a new president in 12 months? Donald Trump did become the betting favorite this week. Lots of question marks usually lead to a period of digestion and the chart is telling you to be cautious in general, if you have conviction or a thesis on an individual name, go for it, but overall expect weakness as a whole. With that said the VIX is -10% today to 16 so we’re still not in a period of immense fear. Until the VIX is at least 30 I wouldn’t really say there is any true panic. We haven’t seen that since March.

Trends

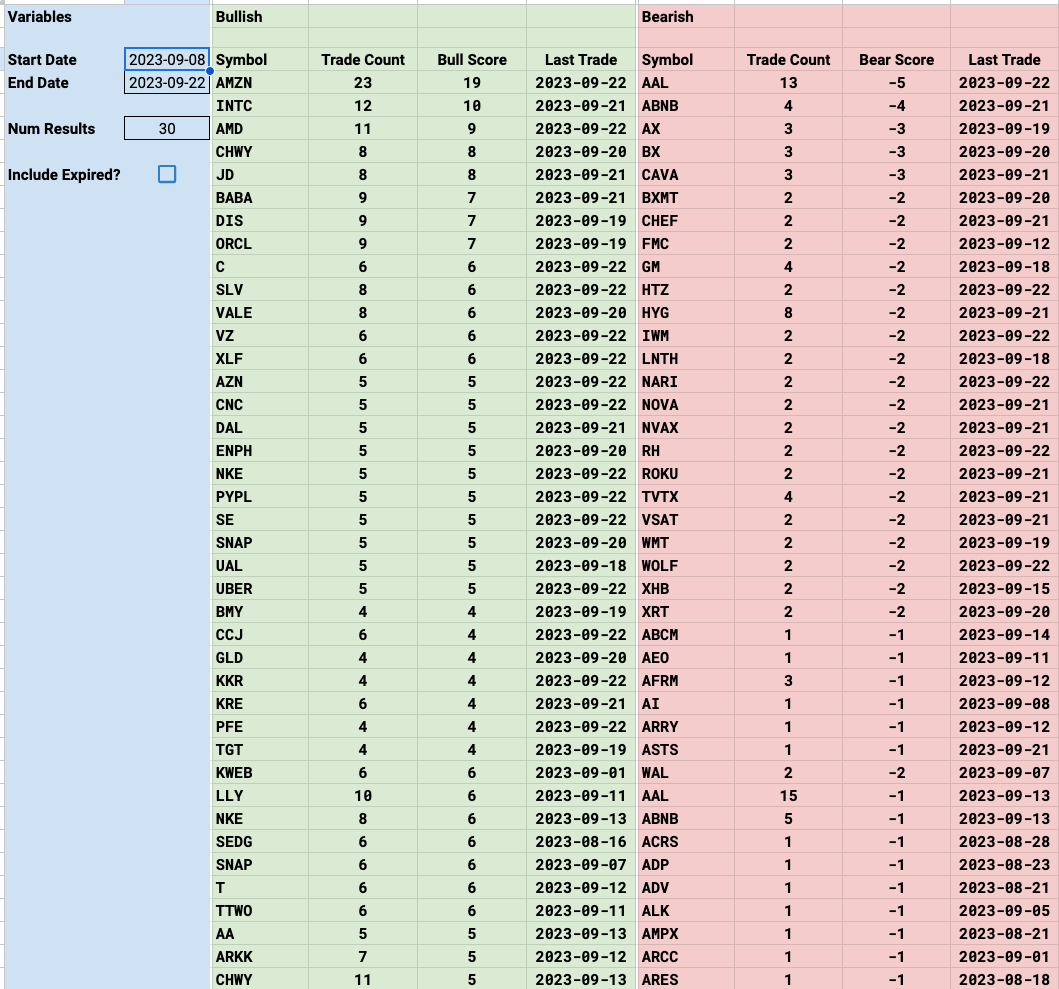

Interestingly Amazon is back to being the top trending name on all timeframes like it was a few months back before its big move. It saw a lot of bullish trades the last few days after the dip which tells you nobody is really worried about the FTC lawsuit finally coming next week. Some smaller names like KKR saw alot of trades this week after seeing none for months. AZN,CNC and FCX are other quality names that saw alot of bullish odd activity this week.

Week To Date

2 Week

1 Month

Today’s Unusual Options Activity