9/24/25 Recap

The SPY is pulling into the 8 ema again as tech leads the weakness. We discussed this possibly happening yesterday as the energy flows were very strong. Today you got a followthrough with the whole energy space running nicely, I would say you really need to be cautious here if we lose that 8 ema(dark blue line). If we bounce off that 8 ema and continue to hold today, the coast is clear, until its not. This has been a nice couple weeks over the 8 ema, we really have been in an incredible uptrend but 2 straight days energy names are showing leadership and in the market that is a caution flag. I would be really careful putting on new longs today before I see how this closes end of day. Also note the VIX is perking up, just remember you don’t always have to do something sometimes you need to let the market play out without pressing things.

My Open Book

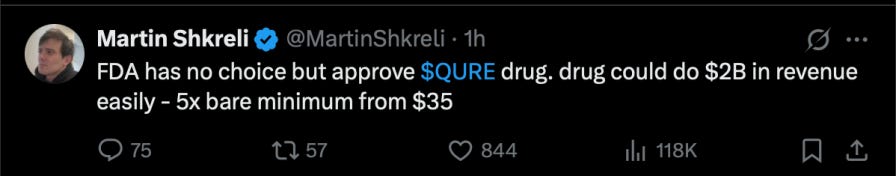

This was maybe the most insane session of my life. I made really one huge change today and that was I took a large stake in QURE this morning after their data release. I don’t like biotech stocks, I don’t gamble on data releases, and I think the entire space is littered with junk but like all things you have to know the players in the space and in this space, nobody in my opinion is sharper than Martin Shkreli. Yes he did spend time in jail for running a ponzi scheme, but when it comes to biotech discussion and analysis he is right way more than he’s not. He tweeted 2 hours ago that QURE was a 5-10x from $35, will it play out I don’t know but I am up so much this year that I’m willing to take a shot here.

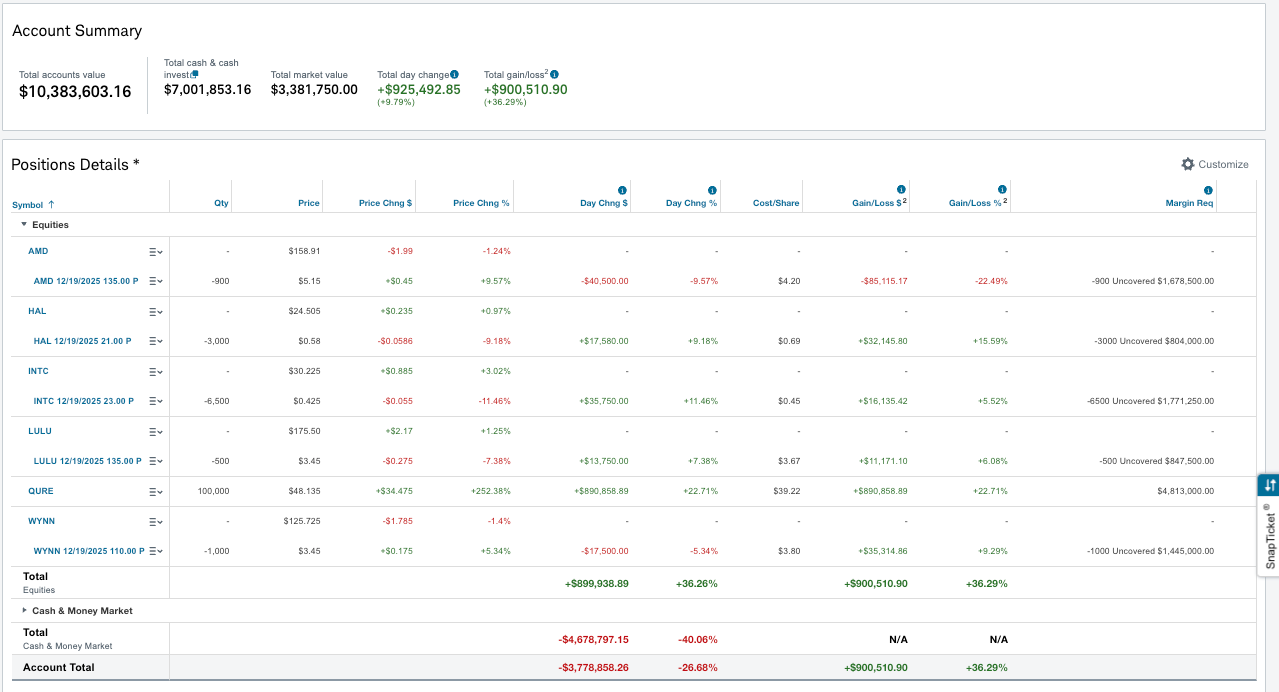

When you look at my book below, aside from the huge capital gain I already have this year, remember I started the year around $6m, I have a ton of short puts expiring this year which should net near $1m by December so my thinking with this trade is yes 100,000 shares is a ton but I have $10 of downside protection let’s say to where if my short puts go to $0 and I believe they will, they would cancel out a big loss in this should it come. If it goes beyond that, great, it dips into my capital gain tax bill I have coming. So again, my situation is not yours, so please don’t take a crazy risk like me unless you have a plan in mind. I have mine here and I’m fully aware there will likely be a capital raise and likely some sort of short piece out soon because that’s what happens with biotechs, they’re junk ripe for attacks. So the TLDR of this is if my short puts work and I even sell this for a big loss at $32 by year end, I will still be up overall from where I am today.

The risk/reward, for me, is exactly what I’ve been looking for with 3 months to go and a huge capital gain already. I already have a huge gain just from today but I’m going to ride this for a little bit for the reasons above. This is why it pays to know who you’re following on twitter there are some brilliant people on there and just following Shkreli and seeing his tweet gave me a $800k+ gain today, think about that? Lastly, I hit a really big milestone for me and this substack today which was that my original goal was to document turning what I started with back in June 2022, which was $1.4M into $10m and it took me 39 months or 1,204 days to be exact to do that, but I’ll write more about later probably this weekend if it holds up.

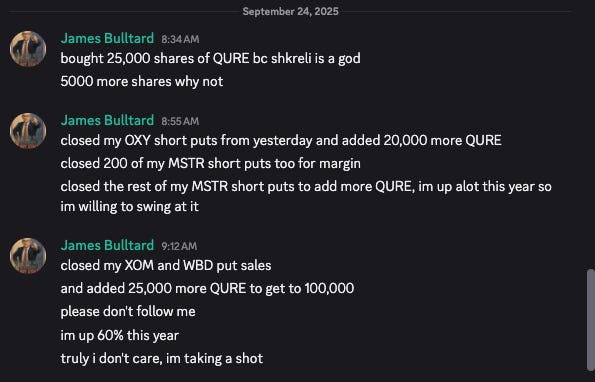

And here’s the thing I took most of these right off the open at 8:34, in the live part of the discord there’s a channel where I post all I’m doing. I began to add it right after I saw his tweet with my first buy and then I kept adding as it dipped for the next 30 minutes.

Today’s Unusual Options Activity

Here is today’s link to the database it will be up until tomorrow morning