9/25 Recap

For now the TNX exploded higher over 45 pressuring equities early, but they reversed and the VIX just went red. The SPY is stuck below the 8 ema and in a position of weakness on the daily. When these moving averages slope down like that, it just takes some time for them to catch up to the candles and then flatten out and reclaim. Even now, every bounce into that blue 8 ema will likely be sold for a bit.

Here is a chart below of Apple recently breaking down from its very long uptrend, see the weakness since? It’s gone sideways for over 2 months since that move…..

The SPY below just broke its weekly uptrend last week, so I’m looking for a similar move of mostly sideways for a few weeks/months now.

Trends

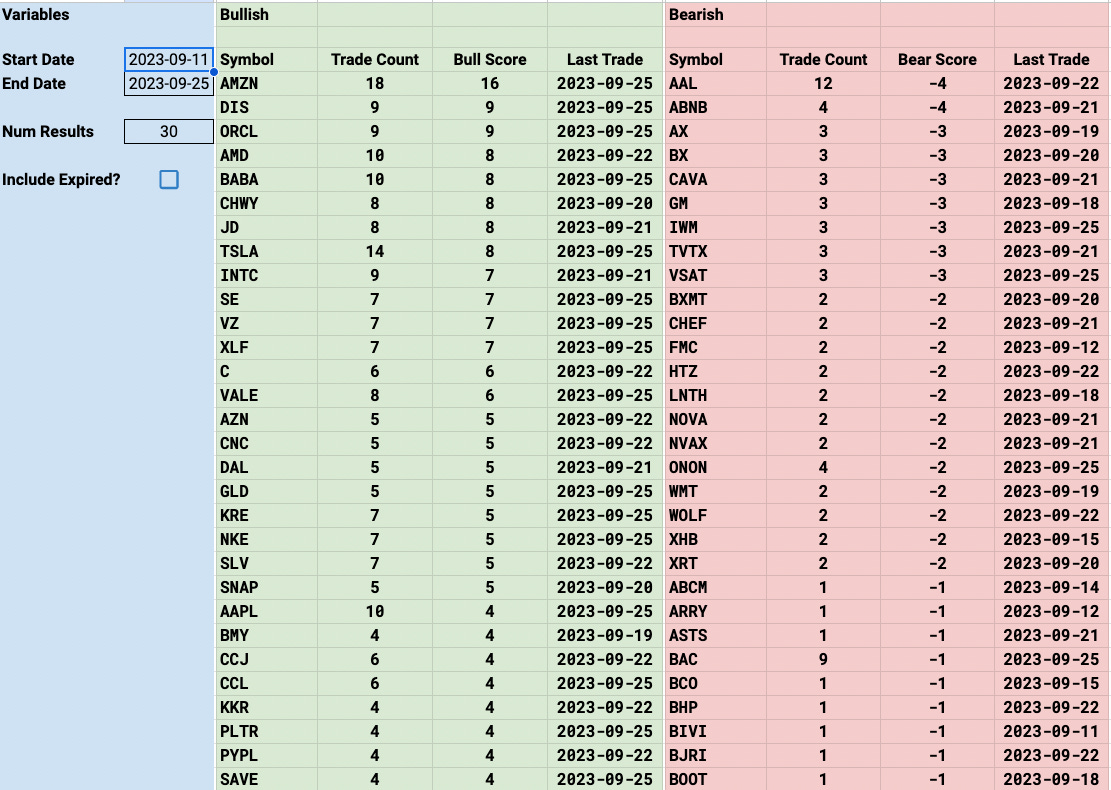

Right off the bat you’ll notice 2 of the 3 biggest trending names of the past month were AMZN and SE and both had big pumps this morning. For AMZN it was the $4B stake in Anthropic to take on ChatGPT and SE got a huge 12% move on a ban of TikTok shop in Indonesia. As is usually the case, the buildup in the options flow came before the actual news. Even over the past week there was lots of buying below of both AMZN and SE as they kept going lower. KKR was another of the top trends last week and it never sees any call buying, look at when I noted last week the day it saw 3 odd lots bought and today it is up 2.5%. Even as someone who has done this a long time, it still impresses me how dirty some of these moves are right after they’ve loaded their calls.

1 Week

2 Week

1 Month

Today’s Unusual Options Trades