9/25/25 Recap

The SPY gapped down and tested that 21 ema perfectly and bounced so far. Are we out of the woods? I wouldn’t say yes until we reclaim that 8 ema just overhead(dark blue) Until then this setup is ripe for a continuation lower where the 8/21 bear crossover happens soon, the 8 ema is already sloping down. With that said I wasn’t too fearful and sold some puts much lower on some quality names as you will see in my book below. If I was long short term calls say 3 months or shorter to expiry, I would be removing those if I was you. Worst case I think we see a 5-7% pullback to that 100 day below just over 620. A breather would be healthy and as I said if we turn up and reclaim that 8 ema you can forget about the bearishness.

My Open Book

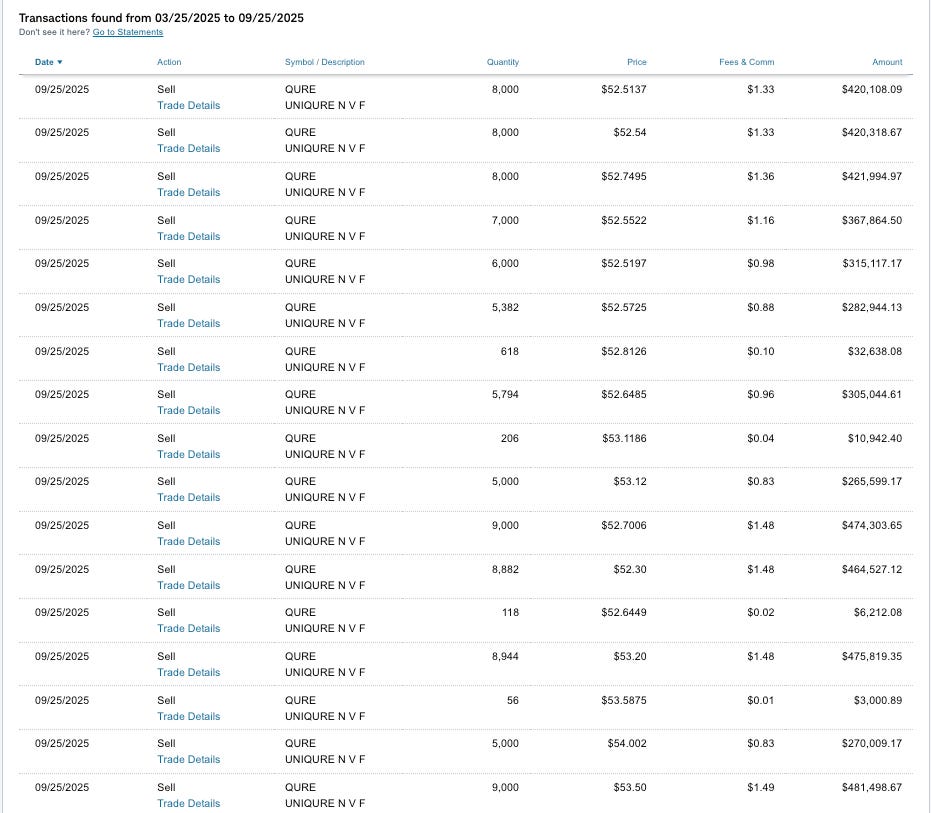

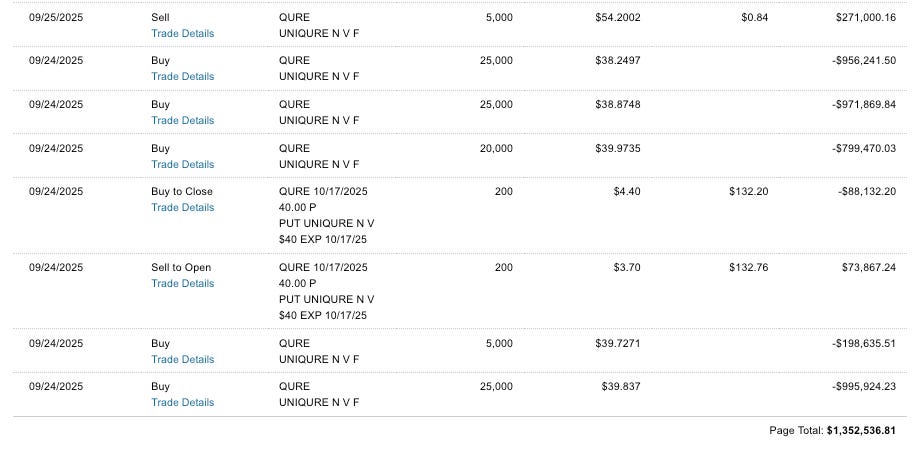

I don’t even know what to say here, the last 24 hours have been easily the craziest of my trading career on my own. I’ve never really made that amount of money in 24 hours and it just came out of nowhere considering I literally had not heard of QURE until Shkreli tweeted it. It’s a crazy story to say I made $1.4m in 24 hours based on a tweet, but I did. It was just one of those right place at the right time moments seeing the tweet on my feed and knowing Martin’s prowess in the space. I sold it all premarket today above 52.51, I couldn’t believe where the stock was this morning gapping up another 15% after an offering and I just slowly sold out trying not to move the stock. With a low float name like this you can’t just dump 100,000 shares like it’s Amazon, you will crash the stock. So I sold in blocks until I got out, the total gain was $1.35M in 1 day, that’s insanity, moreso considering I’d never make that in a session on any of the normal names I’d trade but I took a big risk and I got a big reward, that’s all there is to say. Here all the trades I made:

You’re never going to make a big gain without a big risk, sometimes it works, sometimes it doesn’t like when I swung hard at AMD a few weeks back and whiffed. It’s part of the fun of the game. I am fully out of it now. That’s what trading is about, pouncing on opportunities and I laid out why I took the shot I did yesterday, it could have easily gone the other way, thankfully it worked out. It’s nice managing your own money because you have nobody to answer to, you can take risk as you see fit and for those of you who’ve been here 3 years now, you’ve seen this book grow nearly 10x, you know I’ve said you need a separate trading book so you’re not thinking about risk management and you can be reckless where you see fit and I maintain that. All the things you’re taught about risk management are fine with your long term investments, I have mine I rarely check on, but with your trading book, you should be aggressive and unconstrained.

Trades I Added Today