9/4 Recap

The market gapped down below the 21 ema this morning and as you can see we rose above it and sold right back off below it, that is now resistance. This would be our 3rd breakdown this year if it sticks into the close. That is again your barometer of a market trend, the small uptrend we were in would be over. Could it reverse course friday with a jobs number that excites the bulls? Absolutely, but you always have to begin being cautious below the 21 ema. This was the shortest uptrend of the year if it confirms today. Today’s jolts number was not good and it continues the tradition of all the bad economic data we’re getting. Tech remains our big laggard while defensive sectors like Utilites, Healthcare, and Consumer Staples are basically all at highs.

With the above said, I added MSFT shares today, I don’t add things often and I sold the NVDA shares I bought a month ago during that market crash around 94 per share. I ended up making 14/share. No complaints, I could have made more but I held through earnings, I didn’t like the big question mark that arose yesterday afterhours with NVDA and I exited. I still think NVDA probably goes much higher in time, but I also felt that buying MSFT here under the 200 day now, is something you don’t get to do often in life and it is a far superior company without even a real bear case in my book. The AI trade has cooled off but MSFT is still firing on all cylinders. More than that, MSFT will be hiking their dividend on the next earnings call, they’ve paid the same dividend 4 quarters in a row and they will be hiking, thus, the stock will likely follow suit when it does ie a 7% hike would be a 7% increase in the share price. I chose common vs calls because I felt like I had enough calls in my AMZN and AAPL leaps, that I didn’t more leveraged exposure to big tech. I think MSFT has an easy 10-15% upside on common by year end. Microsoft is over $60 off its highs and I feel like while it will be bumpy for a bit under the 200 day, just normal technical weakness, ultimately in 6 months I will be happy I bought these shares at 405 today and I don’t want to risk a morning gap up on something.

Recent Trades

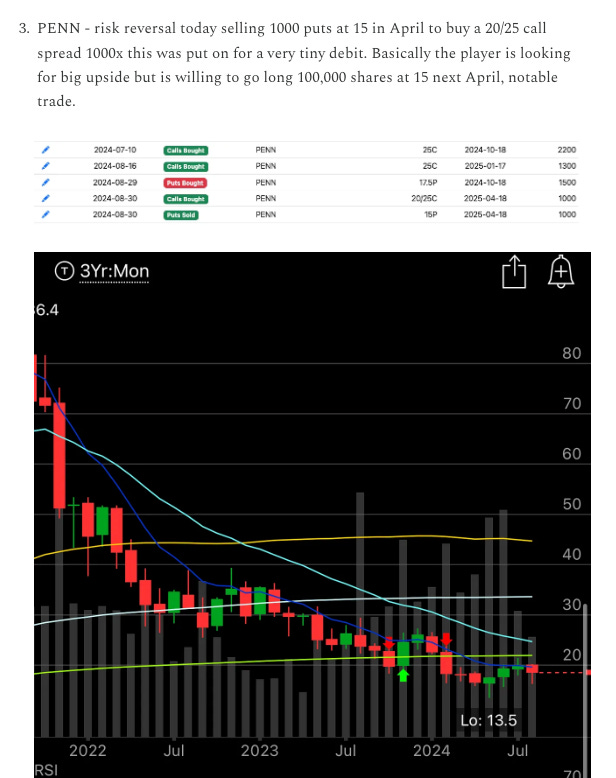

PENN - last week on 8/30 here I noted the PENN risk reversal and today we got news that the CEO made a sizable insider buy and the stock is up nearly 5% today going from 18.25 on 8/30 to 19.25 today.

Trends

1 Week

2 Week

1 Month

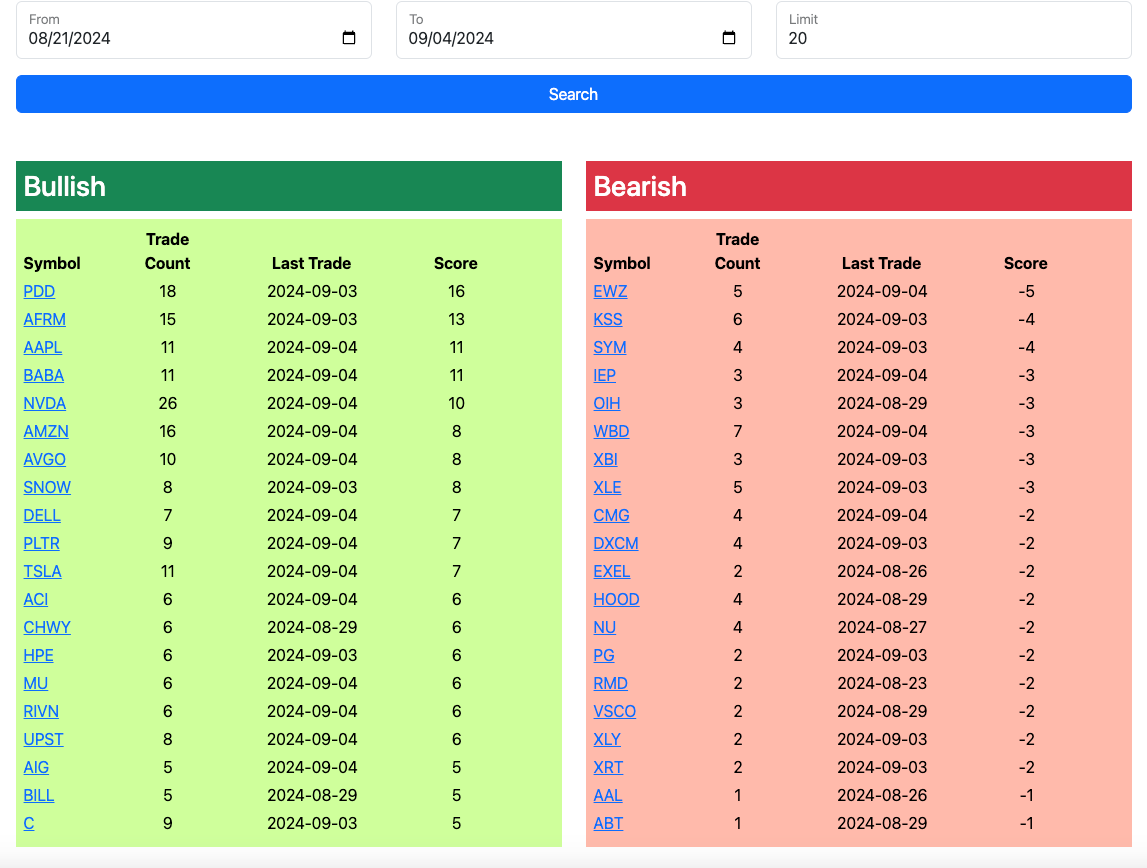

Today’s Unusual Options Flow

Here is today’s link to the database, as always it will expire tomorrow morning at the open and the rest of today’s action will be added by this afternoon.