9/5 Recap

The SPY continues to look bad into tomorrow’s big jobs report, the data could change the whole trajectory tomorrow but right now just looking at this chart one has to think some bigger money is exiting markets before tomorrow. Look at the sustained weakness and rejecting the 21 ema for 2 sessions now and breaking below the 50 day now. There is a gap below at 545 and then the next spot of support would be the 100 day below 540. We are maybe 2 sessions away from an 8/21 bear cross on the SPY but all this can avoided with a good reaction tomorrow to the jobs data.

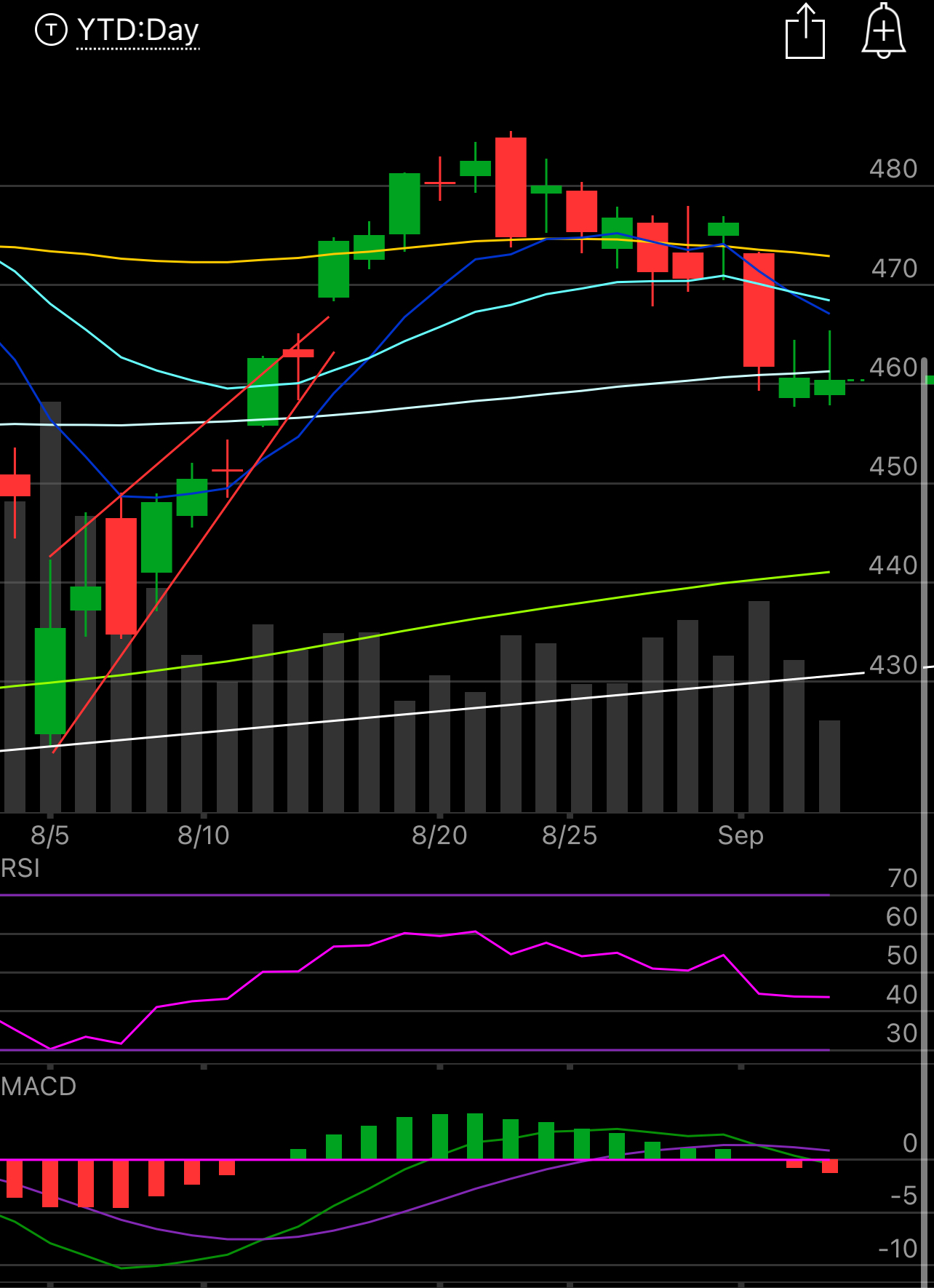

Tech continues to be our huge laggard as the uncertainty around rates, the election, and and the economy has pushed people into the defensives. 2 days in a row we rejected the underside of the 100 day on the QQQ, below. Every pop is being sold, simple as that, the 200 day is now just over 440 and we haven’t tested that since the early August crash, it appears we have a date with that in the near future.

Overall tomorrow doesn’t really concern me, the market looks bad, if we go lower, it wouldn’t shock me but it all hinges on that jobs number and how many rate cuts it could allow. We just have to so much panic over how many rate cuts are coming, what if the jobs number doesn’t allow for any? That’s a possibility still. If that happened the megacaps would rally hard as they’ve been the big losers as we price in countless rate cuts. We don’t know who the next president will be and there’s various trades that will and won’t work for both candidates, the market just hates question marks and we have alot right now. So the market does what it always does in these situations and it throws a fit for a few days.

Recent Trades

HPE fell around 6% this week and looking over their earnings report, I didn’t see anything concerning, the segments that would have mattered 2 months ago before the AI trade died, were booming, AI was up 39%, the company guided up, and it trades something like 10x forward earnings. In the short term it got hit bc FCF was lower because they’re investing just like every other company in the space and the name is fine. It reminds me alot of VSTS which I wrote up in May as a best idea here

As of this morning VSTS is up 25% from 12 at the time to 15.30 on rumors of an acquisition today. It took a little of time, that name struggled for a few weeks after I wrote it up but, those big call spreads the players took didn’t even work, but all those insider buys and all the analysts looking for higher were vindicated, it just took a little bit of time, 3 months in that case. The only open trade in my database is these $15 calls bought on VSTS in November back in May and they’re still there. These weekend best idea are names I think have longer term potential as just holds not just a quick trade.

Ultimately I do think HPE will be the same, not a buyout, but it will work and while it will be weak a few days after a move like this, it is a good name to keep adding, selling covered calls higher and letting the name work until you’re called away.

Trends

1 Week

2 Week

1 Month

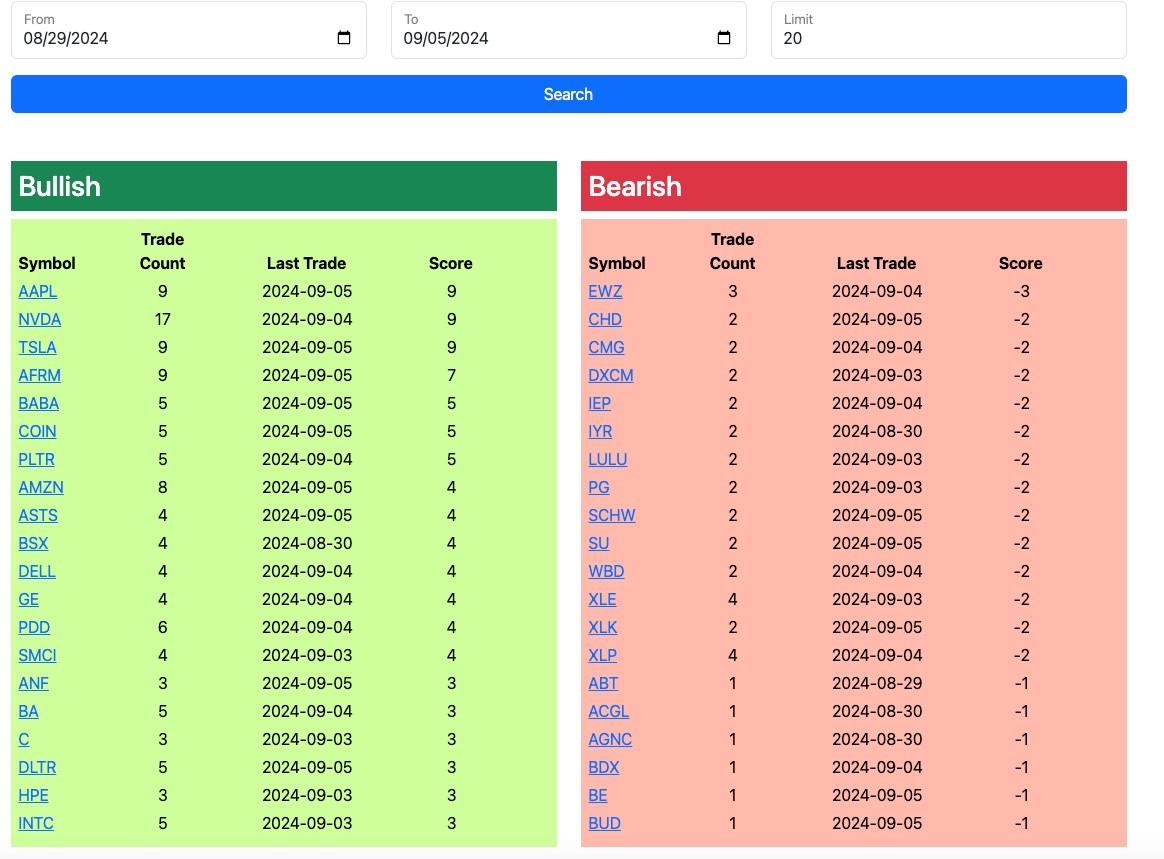

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will expire tomorrow at the open, the rest of today’s trades will be added by the afternoon.