9/6 Recap

We are continuing the breakdown that began on Tuesday this week when we lost the 21 ema. You know my stance on markets, when the 21 ema is lost you really shouldn’t be in anything except long term holdings you’re not selling for tax purposes. Otherwise weakness is coming and we’ve had 3 straight days of it since after 2 attempts back above and failing with the VIX spiking hard today. Look where rejected today, right at the 21 ema, so that has just become stiff resistance now. This period between earnings season is always a time for them to pull the market down before we ramp back up on our quarterly pre earnings ramp. If we lose that 100 day right below here, the next stop would likely be that 200 day just over 510. It didn’t help today with the jobs data which likely gets revised lower as always and one of the markets largest components in AVGO getting hit hard.

Tech remains the biggest issue with the QQQ nearly at the 200 day just over 440 below. It has been 18 months since the QQQ closed below the 200 day in March 2023, you can see in early August we tested below it but closed above it. The wreckage in megacap tech is astonishing because on one hand they’re all crushing earnings but it seems the market is pricing in a recession with big tech being sold, oil being sold and defensives being bought. Then you have things like WYNN green today with the NQ down 500 and casinos are the hardest hit in a recession, so to say this market is just weird right now would be an understatement. Apple has their Iphone event next week and that is the largest component in the Nasdaq, it was actually green for most of the morning with the NQ down 300 but now that the NQ completely collapsed, it is red. If Apple can have a blockbuster event and reaction next week, it could possibly begin the turnaround in large caps.

Oil continues hitting new lows daily and none of this price action lines up with what the current administration is telling us about the economy and how well it is supposedly doing. When oil breaks down like this, it is often a recessionary signal. We have the presidential debate next week and maybe after that the market will get a better gauge of who is leading and go from there, but right now, this market is a rudderless ship full of question marks and sellers are taking advantage, as bad as it feels we are still just 5% off highs in the SPY.

Recent Trades

I didn’t highlight this one yesterday because I rarely highlight puts but MBLY had this huge put buy in yesterday’s recap 24,000 came in for January

So they were loading these all day yesterday, you can see all these blocks of 3000 at a time all the way up to 38,000 traded. You can also see most were with MBLY over 13.50 with the last being 13.37. Afterhours news came that Intel was selling their stake and this thing got destroyed it is down to 11.72 right now and those puts are up a fortune overnight. This was an insane trade and it’s amazing they put it on just hours before the bad news dropped in such massive size. One would think something like this would sound the alarms at the SEC……..

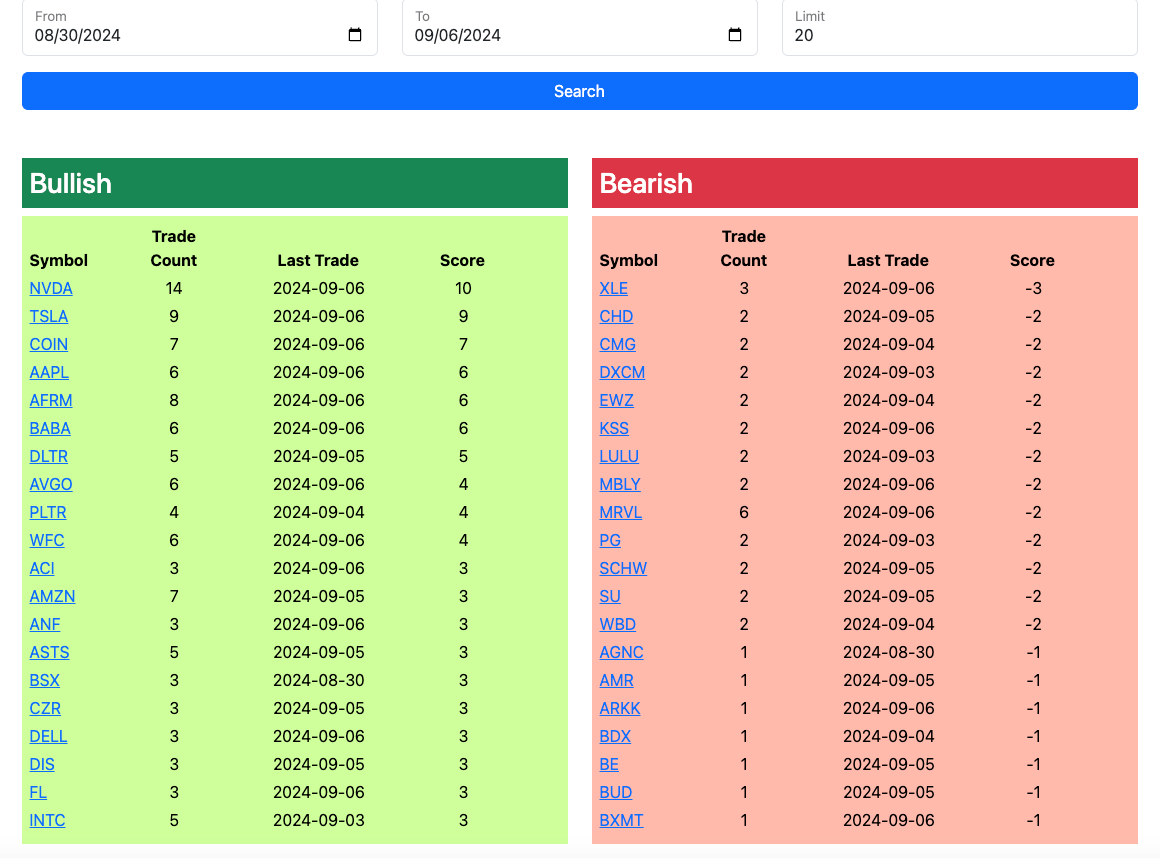

Trends

1 Week

2 Week

1 Month

Today’s Unusual Options Activity

Here is today’s link to the database it will be open until monday morning at the open and the rest of today’s trades will be added by this afternoon.