9/7 Recap. I Just Had My Biggest Trading Day Ever.

Ok I’m gonna skip the market summary because I have alot to say. Twitter finally had its day today. Lots of you were messaging me the last week or so asking why I wasn’t making as many trades and I said I wasn’t too comfortable with the overall market because the dollar was strengthening and it would cause havoc for equities. I stated I was hiding in Twitter for the time being and you all saw all the puts spreads I was short and the shares I was long. I’ve never returned 8% overall on my entire trading book in 1 session, but today was a special day.

Well, I’ve made more money in one day in regards to my overall portfolio being up, but I keep things separate and really don’t discuss my buy and hold names because what’s the point, over time, most stocks go up. My trading account is where I focus on shorter term moves based on technicals,options flow,etc and that’s what I discuss here daily. THAT HAD AN INCREDIBLE DAY.

I was going to recap what happened with Twitter yesterday during the court date with Musk but there is no need to now. Twitter was up almost 7% today and as you know I’ve been building an enormous position for the last 2 weeks. I’ve stated repeatedly how mispriced the asset was as Musk was getting too much credit on his ability to get out of things in the past. The judge in Delaware had so many snarky remarks yesterday and then denied his request for an extension this morning, basically she’s not playing any of his games. Delaware has a repution to uphold as the leading business court in the country and if Elon got out of this, the concept of what a contract is would just be thrown out the window. This all boils down to a few simple things

Elon Musk did not do his due diligence, he waived it, blame his advisors, whoever, it wasn’t Twitter’s fault. The judge alluded to this yesterday when Twitter’s lawyers claimed Twitter lied in the diligence when she said “we will never know because you did no diligence”

Elon Musk did not read the 10-k this isn’t rocket science, clear as day, it says in the 10-k the numbers are best estimates and may not be accurate. Again yesterday Elon’s team said Buffett does his diligence to which I chuckled because Buffett obviously reads 10-k’s and these guys did not, Elon needs better advisors.

Twitter made a long case aboue how dragging this out would never end bc Elon is a slimeball and would continue doing it over and over which would materially hurt Twitter and its ability to retain employees

The bombshell of all bombshells, Elon texted his banker May 8th telling him he wants to take things slow because of World War 3 potential, so he wanted out 2 months before the made up bot nonsense. This was the nail in the coffin and I live tweeted it yesterday if you were paying attention

So the judge ruled in Twitter’s favor and it was off to the races today, from $38.65 at yesterday’s close to $41.20 at today’s finish line. Elon knows he has a lost cause here, his next move is likely to try and settle, but I don’t even know if Twitter wants to, this is a pretty opena and shut case now, hence today’s reaction.

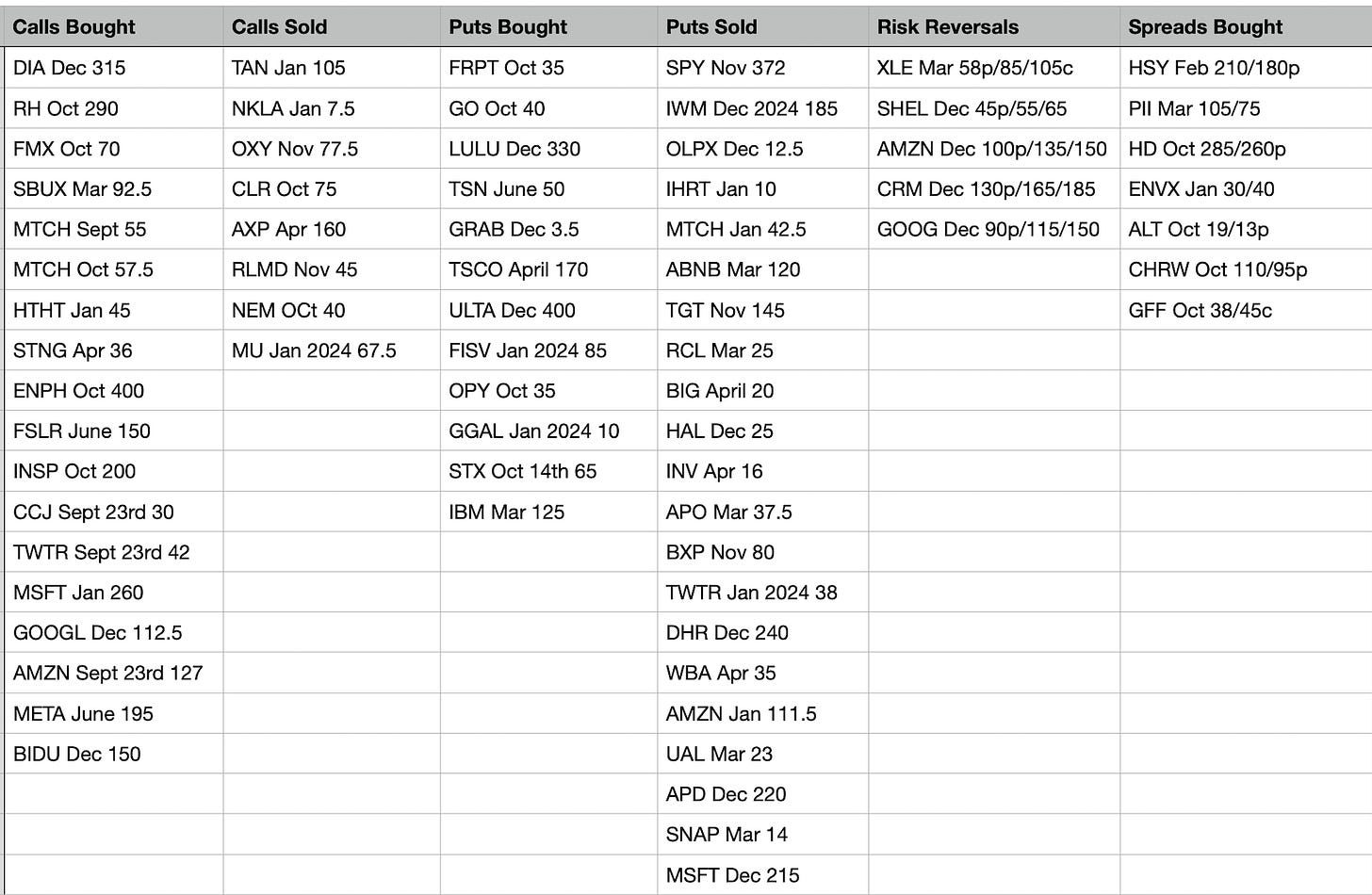

Today’s Unusual Options Activity

The Tech risk reversals were insane, look at AMZN,CRM, and GOOG with all these massive risk reverals in December today. Interesting bullish positions with Powell speaking tomorrow, we know what happened when he last spoke August 26th

CCJ continues to see bullish call buying, today it was 2 weeks out at $30

GFF is a good name a very good small cap name, it saw an interesting 38/45 call spread bought for October. Unusual action for the name which closed under 32

TWTR saw large put sales in January 2024 and a big call buy for Sept 23rd at 42

MTCH saw alot of action today, big call buys in Sept and Oct along with a put sale in January, this is Match, the online dating site company with many brands under the umbrella, its well off highs and looks like they’re trying to mark a bottom

HSY Feb 210/180 put spread bought stood out because that has been one of the strongest names of the year, are they finally going to hit these too?

Trade Of The Week Update

So I wasn’t able to put this trade on yesterday morning bc CCJ gapped up 5% and by the afternoon I was too busy with the Twitter court going on to worry about this, so as you saw yesterday I sold some CCJ puts in October instead but for those of you who sold those 27/26 put spreads yesterday if you did, its looking good now with 2 days left and the stock at 29.42 now

Overall

The market had a nice day, on nothing, Powell speaks tomorrow and he has made it pretty clear he wants to kill stocks. I’m not sure what all the contrarians are reading into the matter. He’d prefer that vs hiking more, but he will continue to hike until inflation cools if stocks don’t help out. The 1 saving grace for bulls today is the fact the DXY put in what looks like a top, a bearish engulfing candle. You can see that below

The dollar has been causing chaos for equities and it looks like its going to take a breather. Oil also completely collapsed over the last 2 weeks, down another 6% today to 81.xx at the close. This is obviously great for consumers all around, but I find it odd how oil is crashing as we hear about all the fundamental shortages in the space. The trade was probably too crowded and they needed to flush out some weak hands, it happens in everything.

Overall the SPY reclaimed its uptrend for now, but it is still below all the big moving averages, look where it stalled out today. I wouldn’t exactly get bullish, yet.

What Did I Do Today?

Put Spreads I Sold

TWTR 9/16 38/35 for .37

TWTR 9/16 38/36.5 for .26

OXY 11/18 55/52.5 for .61

OXY 10/21 55/50 for .78

That’s it, I have alot of positions expiring on 9/16 that will free up some margin, but for now I’m tapped out so to speak on Margin and what I want to keep free.

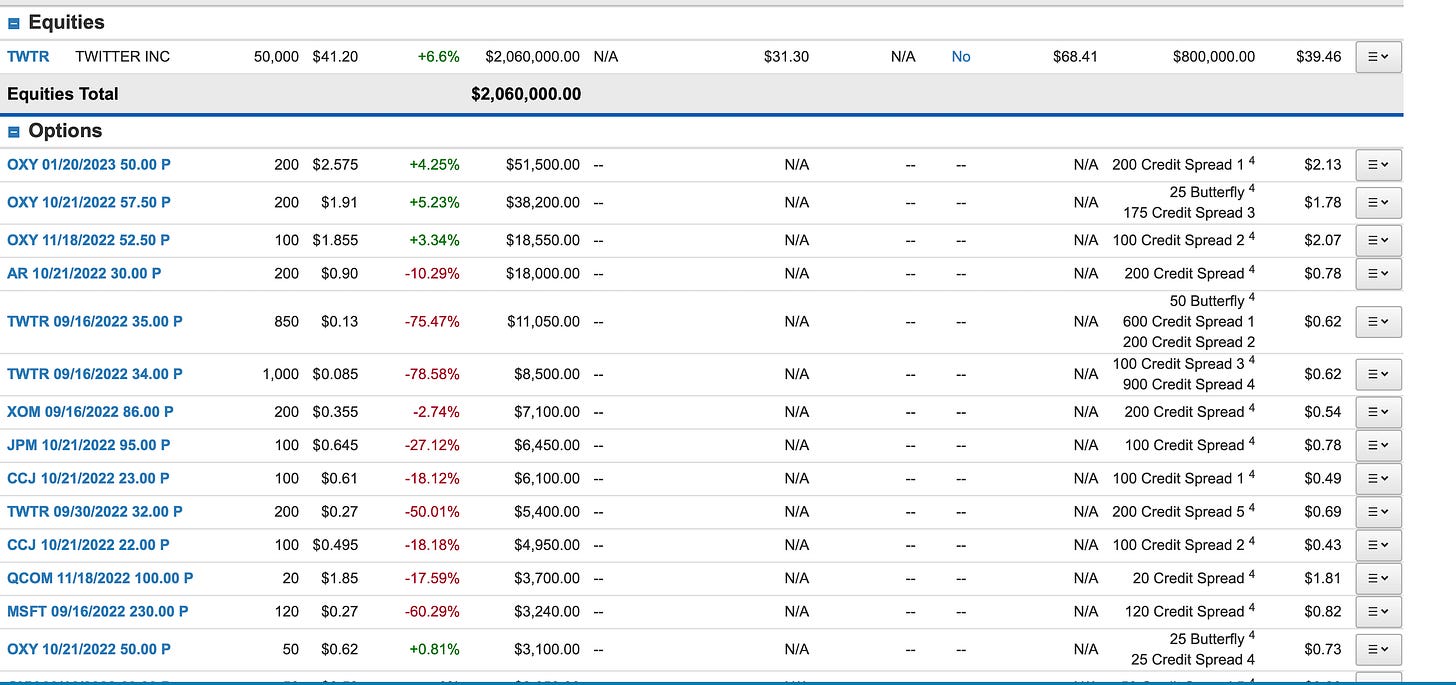

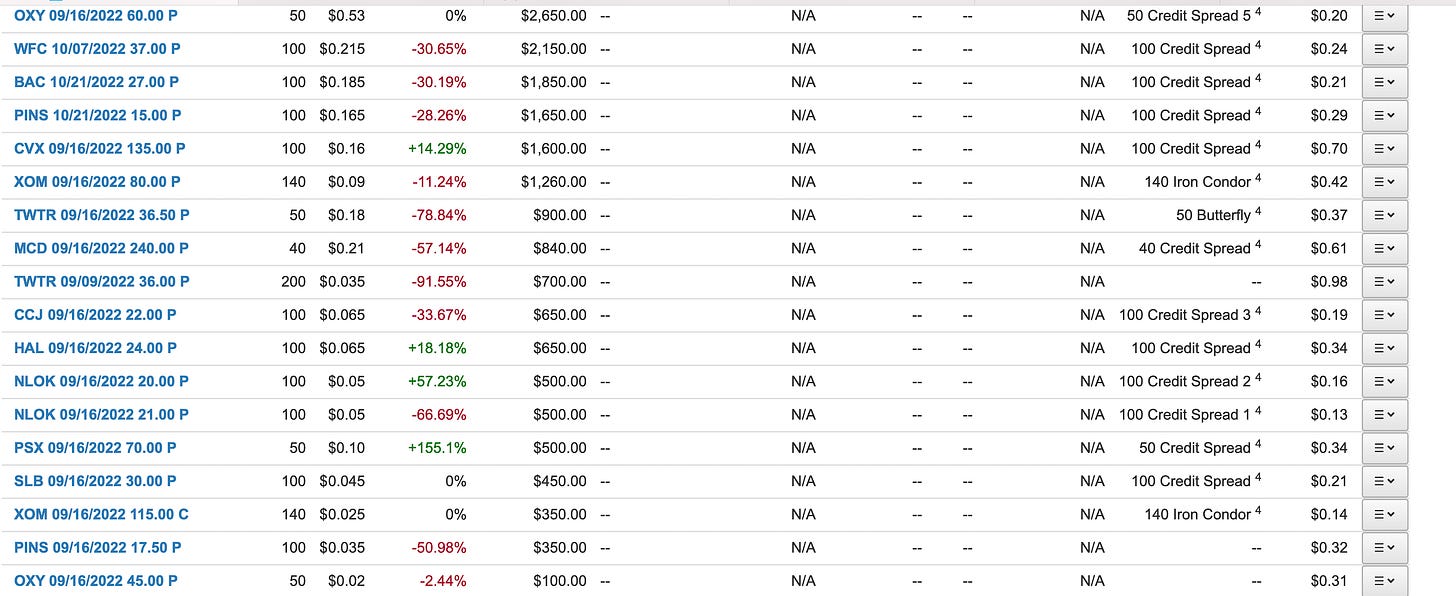

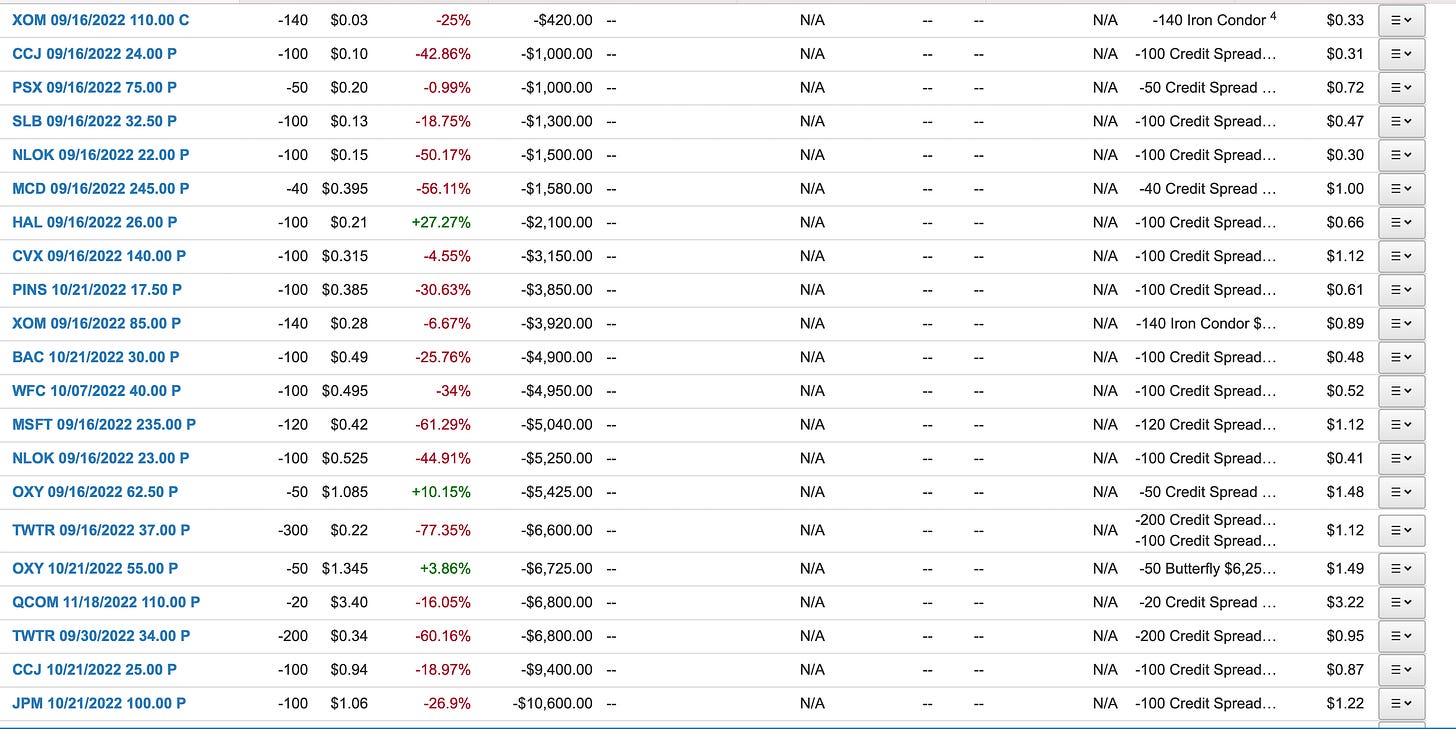

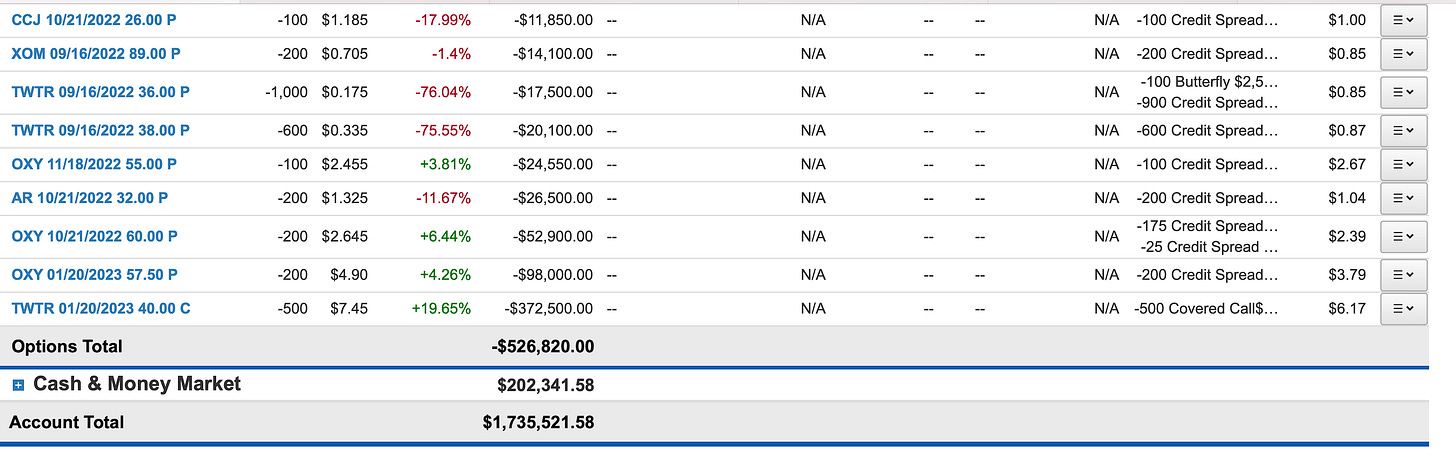

As always I post all my positions, usually on monday but yesterday due to the Twitter court hearings I couldn’t go through it all so here they are

Lots of my positions obviously have carried over for a few weeks, but that was by design because I was unhappy with the short term in the market. I’ve had some people tell me I’m too concentrated, my rebuttal is, this is a trading account, this isn’t a diversify into 50 names long only account, it’s where I make moves with the best short term returns in mind, so yes the moves are concentrated and if you notice often in the same ticker week after week, that’s because once a chart has a nice setup I’m going to attack that setup until I’m done with it.

Anyways, those are all my positions, you can see aside from TWTR I’m out of tech for the most part, just not really a space I want to be in for now, there will be a time I come back to it.

I think the one thing many traders do is overtrade, you have to know where your conviction is and stand by it. Twitter just went down for I think 7 days in a row and I never wavered on what I knew was coming. I had done my homework, I read the filings, and I wasn’t going to miss the opportunity, I levered into the name appropriately and thus far it has worked out.

Also if you have any questions about what I post in here, just ask, I reply to every question and email, I just hate hearing people quit my substack because they can’t keep up with what I post. I try to explain everything as best I can but I understand if some of you don’t get every trade I discuss, just ask, that’s what we’re all here for to discuss equities.

Anyways have a great night and let’s see what Powell has in store for us tomorrow

$TWTR is the real trade of the week 😂😂😂