9/9 Recap

What a day, where to begin. Going back to my post from Wednesday which I will link, you can see I mentioned that the dollar was topping out and that was good for stocks Link

So how did the dollar follow through on that bearish engulfing? With a multi day sell off as it began to breakdown after a strong run, you can see that below here.

And what did that lead to? A multiday run in equities. I mentioned in yesterday’s post that the MACD was showing a bullish divergence and stocks were strengthening. As such one should put their economic bias aside and just focus on what the charts were saying. The SPY has reclaimed some key levels, for now. I still prefer selling put spreads lower at that trend line you see below around 395 “if” you want to get long.

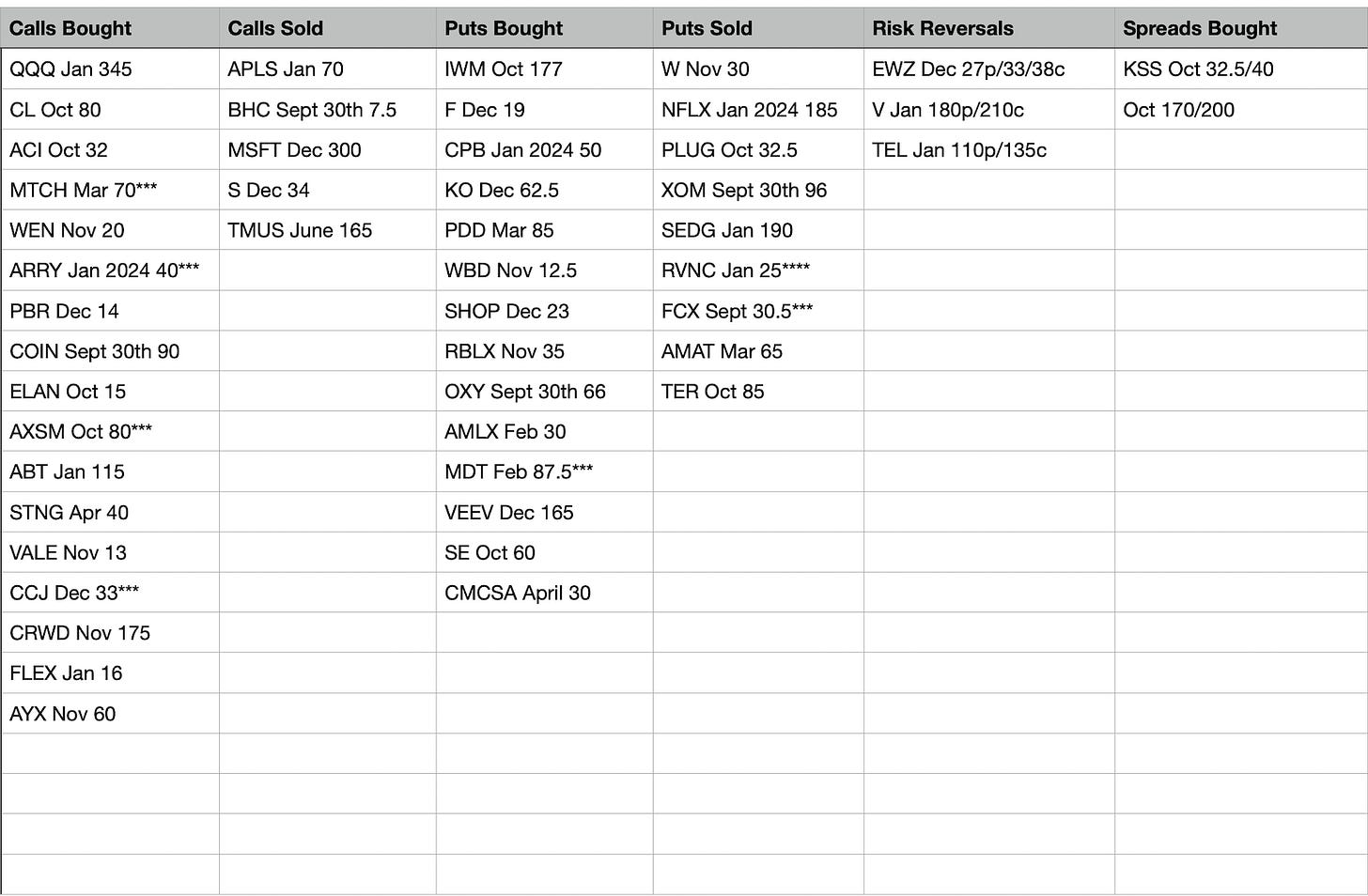

Today’s Unusual Options Activity & What Stood Out

MTCH saw the March $70 calls bought. I mentioned a few days back I believe 3 unusual trades in Match and it took off right after. You can see the MACD curling, interesting setup to me. I’m not involved but they continue to attack it and that 53 level looks like a nice spot to sell premium

ARRY is a name that continues to see bullish positioning, I’ve been noting unusual action on it for weeks here, they went after January 2024 40 calls today, that’s 100% higher than it is today.

CCJ continues to see unusual action near daily, this time over 10,000 December 33 calls were bought in the Nuclear energy leader

RVNC I mentioned a bunch of unusual trades in yesterday’s post and today it was up 12% what a move. Today it saw thousands of January 25 puts sold by someone looking to get long the name lower.

FCX a big put sale in next week $30.5 puts interesting trade with only 5 days to go

Some charts of these names

MTCH - the 53 level looks like a nice spot to sell premium into all this call buying

ARRY with a textbook bull flag, that gap fill below a little over $18 is the level I would target for a long position

CCJ continues in its uptrend, all the moving averages sloping up, there are gaps below now but it continues to flag nicely and it just sees daily buying in the calls. Funds are definitely positioning here, I think anything in the 20’s is solid long term.

FCX has alot of gaps below, as you can see they targeted 30.5 put sales for next week, makes sense when you see where the gap is. I followed these even lower

RVNC not my cup of tea as a biotech, but it was up 22% followed up by 12% clearly something good happened here, likely good data being a biotech. The amount of options activity here is nuts and I assume the company has been derisked quite a bit this week. I don’t trade biotechs, but for those looking to trade trends, this is hot right now

Trade Of the Week Update

CCJ put spreads expired worthless and now 16 out of 17 of the best ideas I’ve posted worked(Damn you Google). I haven’t calculated the return on that, maybe one of you could go back and put together the ROI on $1000 of risk across all 17 of those and where you’d be today, but you’d be up alot. I will have another best idea posted tomorrow. I posted my weekly chart session this morning on youtube for those interested, its long, over 30 minutes of charts, but some ideas on the large caps moving forward

How Did I Do Today?

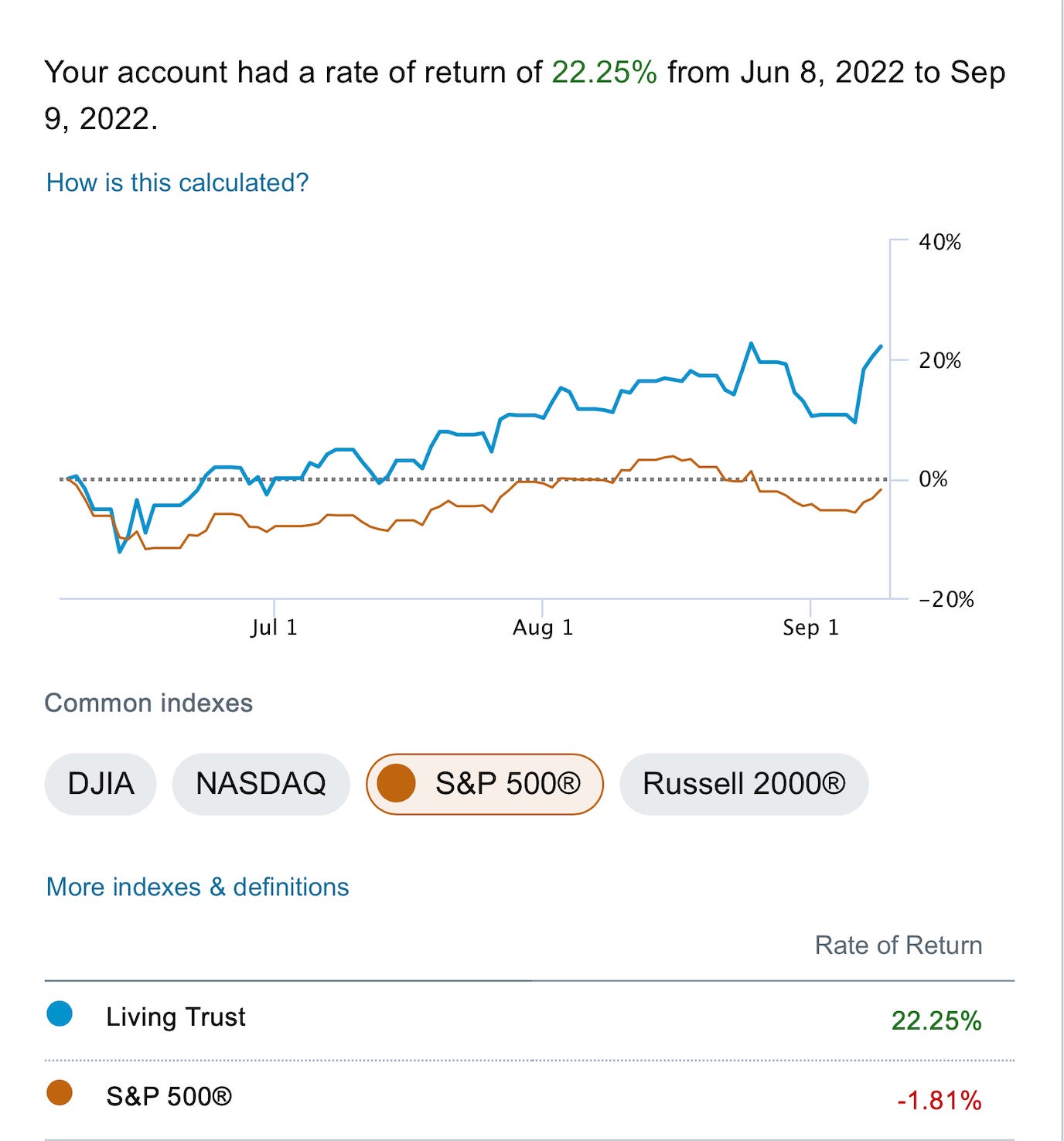

In underperformed by a little bit today, it was mostly due to Twitter short calls I had going up far in excess of what the shares went up, and those will throw off my performance short term until the premium fully comes out. As the week ends, obviously having had a monster week in TWTR, my outperformance from the start of this substack on June 8th continues to widen vs the market where I’m up 22.25% vs the market being DOWN 1.81% in that timeframe. On my end, I’m very satisfied as I continue to show you all that active management can work, and well, when stocks stop going up everyday. As bullish as everyone is now, pretty remarkable we’re actually negative over the last 3 months.

Put Spreads I Sold today

- MOS 10/21 45/42.5 for .19

- FCX 9/16 30/29.5 for .10

- TWTR 9/30 39/37 for .37

- TWTR 9/23 39/37 for .27

- PINS 10/21 20/17.5 for .28

- CMCSA 10/21 30/27.5 for .20

- AMZN 9/16 122/120 for .13

I put quite a few trades today. MOS is a name I really like going forward, obviously lower, which has had a nice pullback the last few days. FCX had the unusual put sales for next week and I like the setup. TWTR, I won’t bore you there as I’ve posted about it for 2 weeks, it’s move this week backs up my thoughts that Musk is losing. PINS I continue to favor at the $20 earnings gap fill from last Q, it had a monster day yesterday and I love the activist involved there. CMCSA is a downtrending name, but its cheap, it trades an almost 10% FCF yield I sold puts 15% lower from the 35 level its at. AMZN is still my favorite long term name in the market, it should have the biggest market cap and until it does, its undervalued but for now i’m just targeting that earnings gap as a level to get long.

I hope you all have a great weekend and I will have best idea posted tomorrow.