9/9/25 Recap

The SPY is putting in another day of nothing as we await the Apple event. We did get a bit of recessionary data today with the big revision to payrolls of 911k vs the consensus of 682k which instantly pushed rates lower. There really isn’t much to say these last 2 days are just inside days waiting for a catalyst.

The real trade continues to unfold in China with KWEB continuing to be strong and BABA up big overnight today after BIDU was up big yesterday. None of this should be a shock to any of you as I’ve been highlighting China hard the last couple weeks just look at the database, over the last 3 weeks China is dominating the flows. This trade feels like it is just getting started and if we close a trade deal with them watch out.

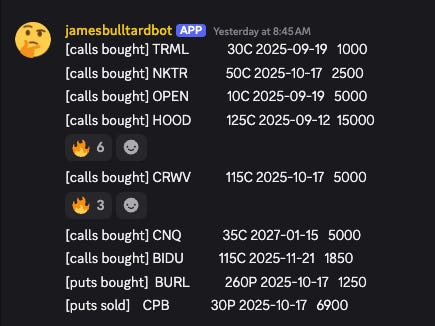

Lastly, today was I think the most egregious options trade I’ve ever seen play out in my 3 years sharing all this and if the SEC does nothing about it, the whole system is a joke. Yesterday at 8:45 am in the live room I logged 1000 lot of TRML $30 calls bought for next week. I didn’t think anything of it because it was at the money even though I had no trades in my database on it. This morning it was acquired and the name was up over 57%. This was an insane trade and that’s the thing with option flow is you see everything and that is really the only way to see how big players are positioning but no way this player randomly bought these calls yesterday without knowing it was being bought out a few hours later.

My Open Book

Trades I Made Today