A Look At Every Trade I've Highlighted This Year

I do have a best idea for this week and it will be all the way at the bottom of this post but I wanted to start this off with a deeper look at the data behind all the trades I highlighted in my recaps this year. As you all know I post maybe 600-800 trades a week in my database, those are the results of the scanner I’ve built out over the years looking for oddities in all of the options trades placed daily in the market. Of those I highlight 5 daily, sometimes 6 if I feel one more needs to be noted, with a deeper look at the trade placed and how I would play it myself. This is going to be a long post, I’m going to post every single trade I highlighted in 2024 along with the 10 I highlighted coming into the year as my best ideas.

One particular member of this substack who I’ve gotten to know alot better over the last 2 years as he’s fine tuned his trading using the data I share reached out to me a couple weeks back and began to discuss a system he put together utilizing the daily recaps. You all know him in the discord as Luckmaster. He realized that directionally, alot of the names I was highlighting were working and he wanted to be selling puts lower like I highlight and see the results of it.

Again the reason I sell puts is because if I think a name is going higher, I want to get in lower with a margin of safety where should the trade not work, I can take shares and begin to sell covered calls to work out of it all while knowing there is institutional money looking for higher via the options trades I am highlighting.

Here are the results of his data he shared with me so far:

This year he has 176 trades I highlighted from 1/02 until now, actually there are more, but because I always say do not sell puts on biotechs into data, meaning the smaller cap biotech names, he simply just ignores the few biotech names I’ve highlighted through the year. Those were:

AMLX

ASND

AXSM

CLDX

CYTK

KALV

RXRX

SRPT

TEVA

TWST

VERA

RARE

AXNX

Alot of those did not work, one, VERA, was up 150% almost from the time I highlighted, you can search all these tickers 1 by 1 in the database and click expired trades to see what was posted and you can search the database to see what I highlighted. That is the biotech world, they are gambles, and why I really do not waste time on these things with any serious capital. Even VKTX had that monster move recently and a few of you hit on it, but I actually never highlighted in the 5 names I post. Biotechs are just all over the place and while fun to play with from time to time, just not things to dabble in with big money. With that said of the names above I still like CYTK to be taken out at some point, the flows are almost egregious there.

Anyhow, of those 176 trades that Luckmaster honed in on here are the final results:

If you sold puts 3 weeks out and 5% away from the price the day I sent out the recap, nearly 82% expired worthless meaning you were never put shares and made the full profit. 32 times this year the trade would not have worked short term and you would have been assigned shares. If you went a little further out to 10%, you would have received less premium but nearly 93% of the trades expired worthless and only 13 times this entire year would you have actually been assigned shares.

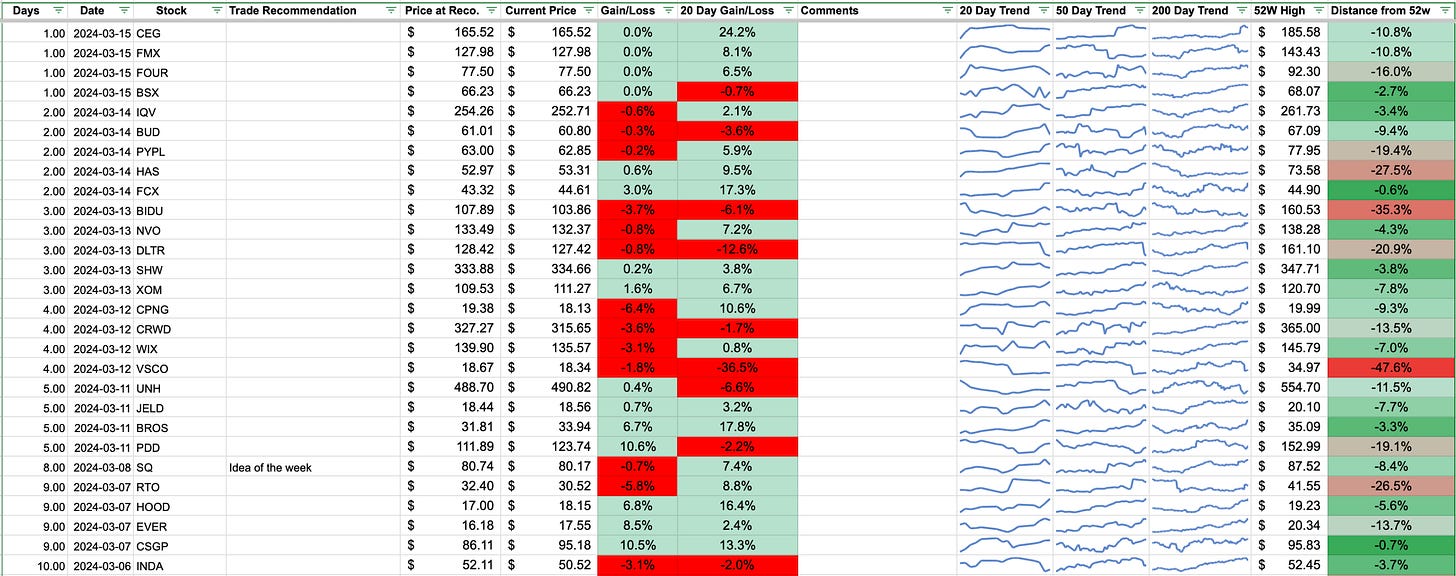

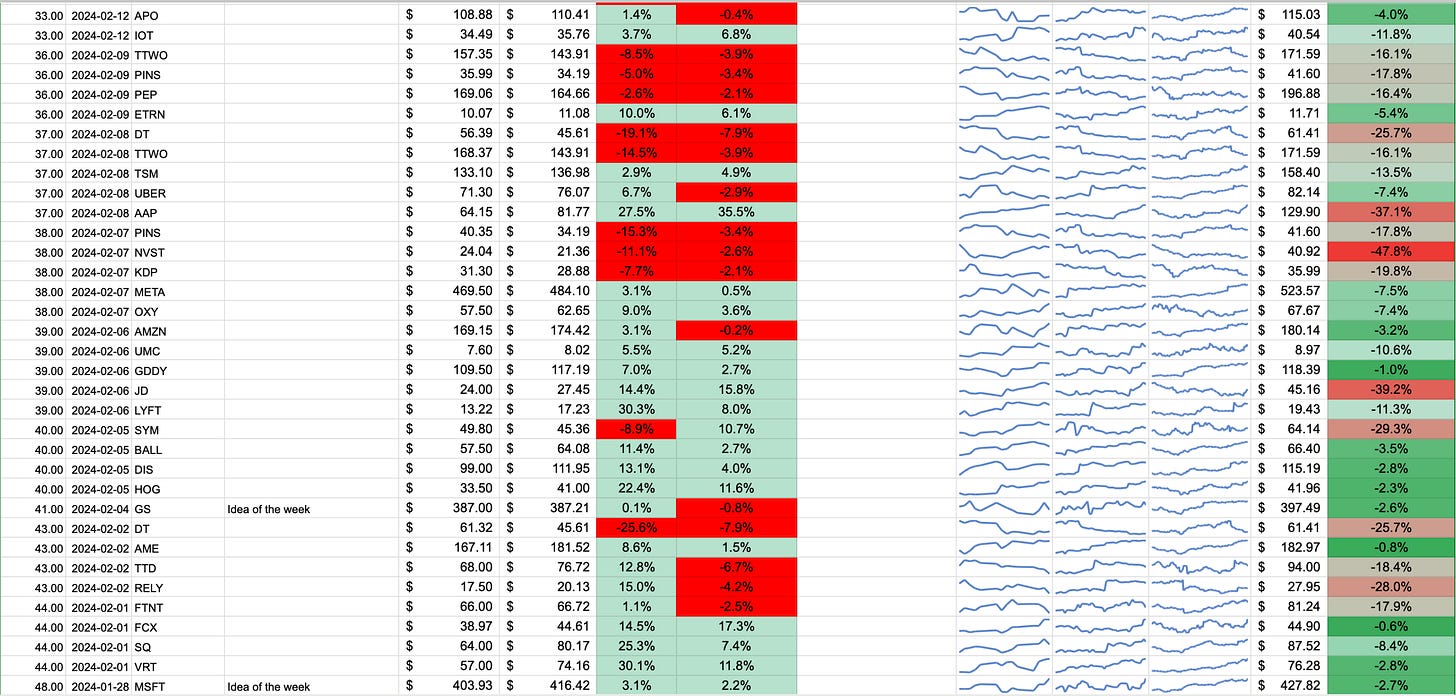

Here are all the trades I posted, ex biotech, in the data he shared with me, they are in order with the date on the far left starting from the bottom up.

Here were the biggest winners

And Here were the biggest losers

13 double digit losers this year, lets look deeper into those, off the top 2 are small cap tickers CYH and IREN, nothing notable there. The other 11 were real companies that just underperformed and the bullish call buyers/put sellers were wrong. Just highlights that occasionally, that can happen. Of those I still think some are very good companies for the longer term like ZTS,PINS,TTWO,U,S, and BA.

Unity I know in particular I wrote up as a best idea and I dug up that post, below, it was $33.14 at the time, but the trade I suggested was selling puts way lower at $25. It is still $26 now and it would take another 20% lower to get to your $21.55 basis I suggested, that is why I always highlight the put sales, I was dead wrong on this one and yet, the trade still is technically working.

And this was starting off with the year end recap I sent out on 12/21 here were the results of the best ideas I highlighted for 2024, this was simply just shares bought.

6 have so far beaten the market in 2024, 1 is inline and 3 have underperformed with 2 being negative. The 2 underperformers were Boeing and LuluLemon. Boeing has been a disaster, there is no other word for it, seemingly weekly now something is going wrong with one of their planes and it is a shame, one of the great American companies and truly 1 of 2 companies in the world making commercial planes failing like this repeatedly is a bigger deal than we hear about. It is down 30% this year in a raging bull market. Pathetic. LULU has put together a rough year as well and the breakout was a false one, I was wrong to this point, nothing more to say.

DASH has been the best performer up almost 30% from my recommendation followed by UBER and MNDY in the 20%+ gainers. LRCX has seen a big gain in the semi boom we’ve seen followed by AMZN and WYNN rounding out my outperformers beating the 7%+ the market has returned so far. Home Depot was inline and TMobile has been positive but a laggard since its breakout.

What was the point of all this?

The point was to highlight different ways of using the data to your benefit. This is what Luckmaster is doing with this and it is working. There is another member in the Discord, JohnJohn9482 and he used the daily trends table I share to see what he wants to dabble in short term using those as a barometer of names with trades and then he finds charts he likes within those and trades them.

Overall I decided to write this post because last night someone made a comment in the Discord that stood out to me

What BT said resonates with me because time is the most valuable commodity in the world. The whole point of this substack was to build something that hopefully people find useful in their trading journey while simplifying their lives. The daily recaps, the community, they’re all just tools to hopefully deliver Alpha in the end. That’s it, there is no other point to this. If I don’t deliver Alpha, nobody would read what I have to say. I share my data and insights and different people have done different things with it, that is always nice to see the creativity and intuition at play. There is no 1 size fits all rule with this stuff, I’m simply highlighting big bets I see daily and trying my best to give you my input on what I think I’m seeing.

So lastly thanks for always reading these recaps. Will every quarter be as easy as this one? No not at all, in fact I really do think we’re in for a little bumpy patch here for a few weeks before earnings, but stick to the process. Take the names seeing option flow, take the names with good charts, sell puts lower and let good names come to your levels. Anyone can buy calls, anyone can buy puts, but learning how to sell puts at key spots and having a good stock come to you is something that will benefit you when markets stop going up everyday. Learning how to put on options trades where you get paid a credit to do so the way I highlight is just another layer in getting a deeper grasp on how this game is played the right way where you minimize risk and maximize reward.

Now to the best idea for this week and another one of those Bulltard get paid to put on a crazy options trade ideas….