Amazon, It Isn't As Bad As It Seems

I will have an update at the bottom of this on my dad, but I plan on being back Monday. Today was Amazon’s earnings and I have a large position so I wanted to write up something because I know many of you do too. I’m writing this from my phone, so if there are some grammatical errors, forgive me. There is no wifi here so I couldn’t even work on my laptop if I had it.

Where do I begin? Let’s start with the reality of the situation which is Amazon is not anywhere near as bad as it appears today. I took a quick glance at Twitter and that’s the same cesspool of bad information it always has been. Let’s look at the recent peak to trough moves of the big 6”

MSFT - 468.35 to 390 afterhours this week

NVDA - 140.76 to 100 afterhours this week

GOOG - 193.31 to 165.86 last week

META - 542.81 to 442.65 last week

AAPL - 237.23 to to 213 today afterhours

AMZN - 201.20 to 169.50 today afterhours

or Drawdowns of

AAPL - 10.2%

GOOG - 14.2%

AMZN -15.75%

MSFT - 16.7%

META - 18.4%

NVDA - 29%

So in the scope of things, Amazon at 170.xx right now is in the middle of the pack in terms of recent drawdowns in large cap tech. It really hasn’t done anything that would be considered horrible.

So what went right today?

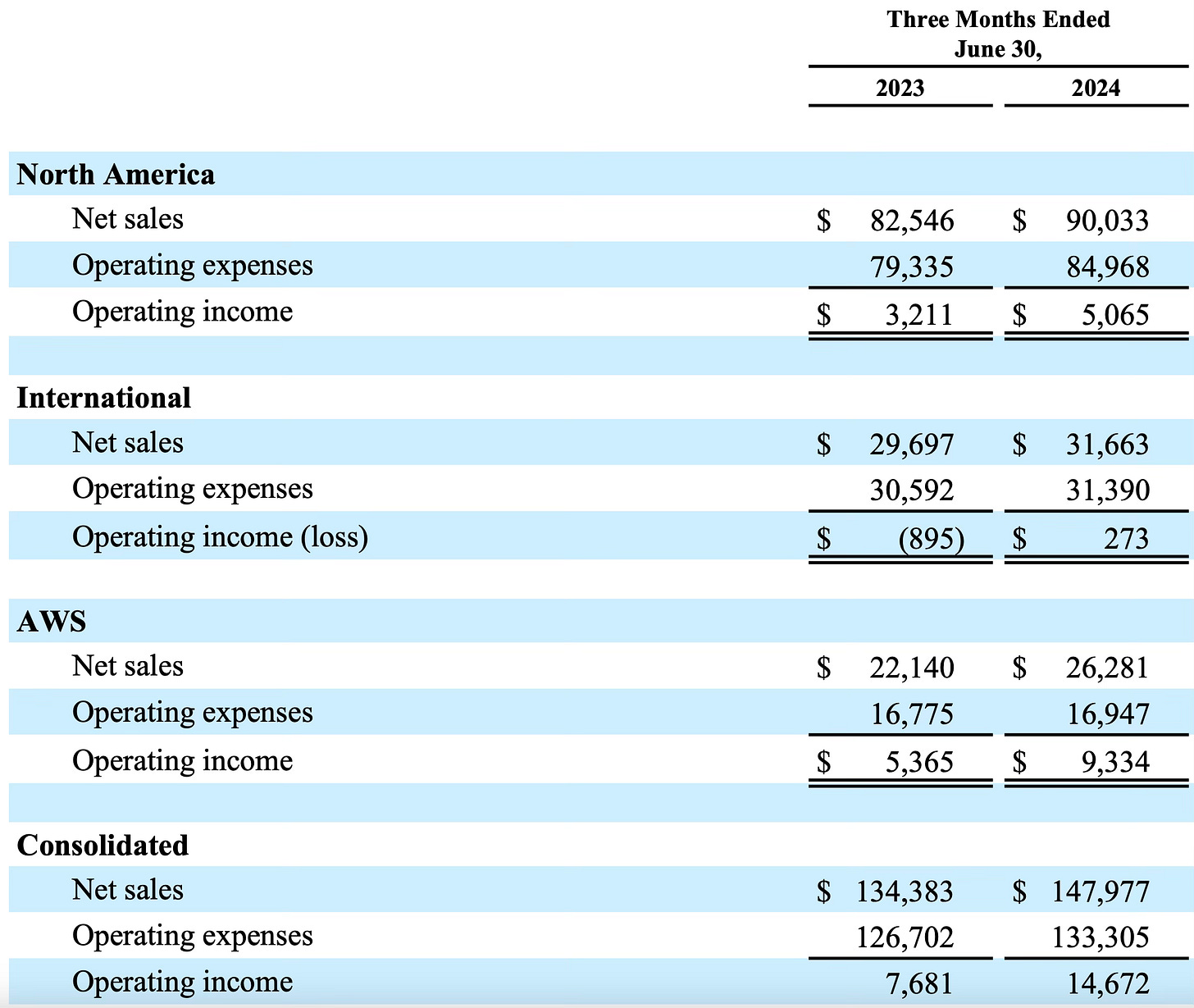

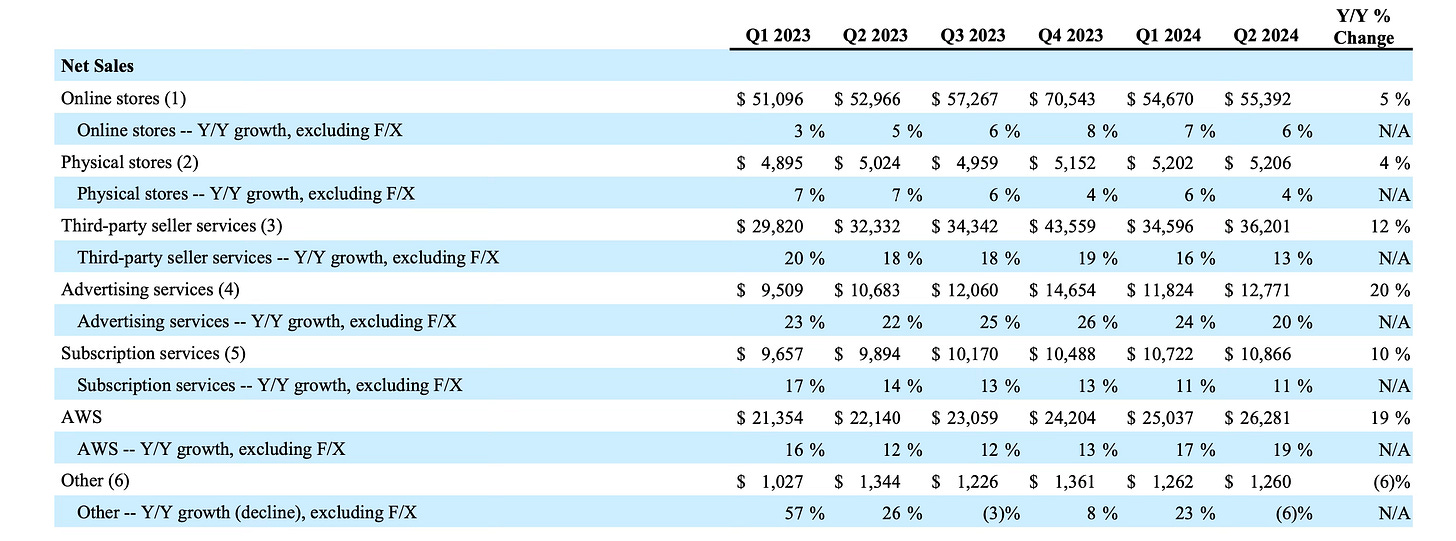

AWS was up 19% to $26.28B and at tremendous margins which led to $9.33B in operating income in the quarter. It’s funny watching the goal posts move, 2 quarters ago the panic was over how Amazon was worthless ex AWS and AWS was struggling to grow, now AWS is booming and all the analysts on tv find every excuse to explain why AWS isn’t that important. I don’t think I’ve ever seen a business change CEO’s and then post a record quarter the first quarter, but AWS did that at a $105B run rate, pretty remarkable in all honesty.

Amazon itself is posting some incredible figures, $14.67B in operating income in 1 quarter is tremendous for a company many said “made no money” just a few quarters ago. Amazon is really flexing its muscle as it turns up the switch to profitability. Even retail which many said wasn’t a profitable venture is now making $5.3B per quarter with international being positive for a second quarter in a row. This is what investors have waited forever to see.

So where did Amazon go wrong today?

This management team sucks. They’re about as exciting as watching paint dry, but I’ve said that forever. You can be a brilliant human being, you be a savant at your speciality, but there is a gift of gab some people have where they can charm investors and on a scale of 1-10 Andy Jassy is a 0 in that regard. He just parrots the same lame talking points every time he gets to speak

“ we want to delight customers”

“customers are trading down on price”

“the equation will flip” regarding cloud percentage

There’s many more but Andy Jassy has now been CEO for 37 months and the stock is down a little over 3% in his tenure. I don’t care what anyone says, every CEO is measured simply by share price, how much they improved a business is irrelevant. Steve Ballmer improved Microsoft plenty but he will always be remembered for a disaster of a share price under his watch. Andy is a nice guy, he is a very good manager, but he isn’t the right CEO. There are so many levers he could excite investors about and he is just incapable of doing so. Things like self driving cars, Amazon has them and Tesla doesn’t, you won’t hear Andy discuss them. You won’t hear Andy say something to the extent of how big the retail TAM is, meanwhile you have guys like Elon Musk who just make up things regarding products and TAM and investors eat it up. Andy actually has real things to pump with and he is just such a square that he can’t even toss investors a bone.

Then we have Olsavsky the CFO, I’ve made my feelings known on him forever, it has now been 3 quarters since META announced their dividend and not once has he indicated any internal discussions on a dividend or buyback, it makes no sense whatsoever because both Google and Meta had significant moves on their dividend announcements. There is this other, Jeff Bezos, who holds 900m+ shares, hard to believe he doesn’t want say a .25 per quarter dividend. It would make him a ton of money annually, it would get the shares into a new class of investors, and the combination of a dividend and buyback, which literally every other megacap has, would buoy the stock. Of course that’s what companies who care about shareholders do, Amazon just prefers to do their own thing. It’s incredible because the market gives them plenty of respect because the minute they do announce that stuff, the stock will materially re-rate and it’s always a question of when will they do it.

In terms of business, here is what went wrong

3P only grew 13%, that was a big “deceleration”. A business this size still growing 13% is very impressive but the narratives change when 2 quarters ago you were at 19%. This is with 3P fees rising, did sellers leave? I find that hard to believe because Nike did in 2020 and their brand died since. Are consumers pulling back spend? It’s possible, or hear me out, maybe people just aren’t getting reckless and buying alot of stuff they don’t need? Imagine the horror because economists will get sad and start posting stats like “Americans have too much cash in their bank account” because it would be the worst thing for the economy is consumers weren’t living month to month and blowing every dollar they made. I think 13% growth when it’s a $36B per quarter business is tremendous. This is a very mature retail business, this isn’t some hot startup, 13% is very impressive when you look at the growth figures Costco,Walmart,Target put up at much smaller scale.

The ad business only grew 20%, this was actually not impressive to me, yes 20% is an impressive figure now matter how you spin it but Amazon is now 1.5 quarters into their Prime Video ad business and it is showing no impact anymore. Subscriptions are barely up so not many are paying that $2.99/mo and advertising is up 20% with it included, so that means retail ads are not as hot as they should be. Perhaps sellers are realizing they don’t have to pay the Amazon toll to get their product sold if they have solid brand recognition. Whatever it is, ads should be much stronger than 20%, but 20% is nothing to cry about when it’s nearly $13B a quarter. This is still firmly the world’s 3rd largest ad business but either Prime Video is a dud in terms of streaming hours or sellers are buying less ads, either way, something just isn’t right here even as right as it appears.

Capex, my god $17B+ in Capex, do you know how much that is? They said Q3 and Q4 would be higher. Obviously the bulk is going to a 35% margin AWS business but this is a ton of money. Andy Jassy is full speed ahead and oddly enough I trust him here because he is the man who built AWS. It’s hard for normal people to fathom how a company can spend basically $1.5B a week in Capex, but don’t you worry Amazon will find nonsense to blow it on, they discussed Kuiper extensively on today’s call, Amazon is now spending heavily on the satellite building business. That great business our Chairman Bezos thinks shareholders should fund for him because he doesn’t want to blow his own money doing so under Blue Origin.

Do we ever guide up? It seems like every quarter it’s the same nonsense of Amazon giving a bad guide, “resetting” expectations blah blah blah. Leaders lead from time to time, I’d have to check when we last guided up, but it feels like an eternity ago.

Lack of shareholder return, we’ve discussed this alot, there are 6 mega caps, 5 do buybacks and dividends, one does neither. Amazon is about as shareholder unfriendly a company as exists. They don’t care, I’ve accepted it. The shares today are lower than they were in August 2020. Obviously the stock got ahead of itself during covid, but this is a company posting records every quarter and management is just seeing the multiple compress because the market has no faith in their ability to excite people. Can you blame them? Amazon is generating a ton of cash, but so are the other big 5 companies. The others are reducing share counts, paying dividends, and you don’t have to wait for every 3 months to hear what new narrative is going to be an anchor on the stock.

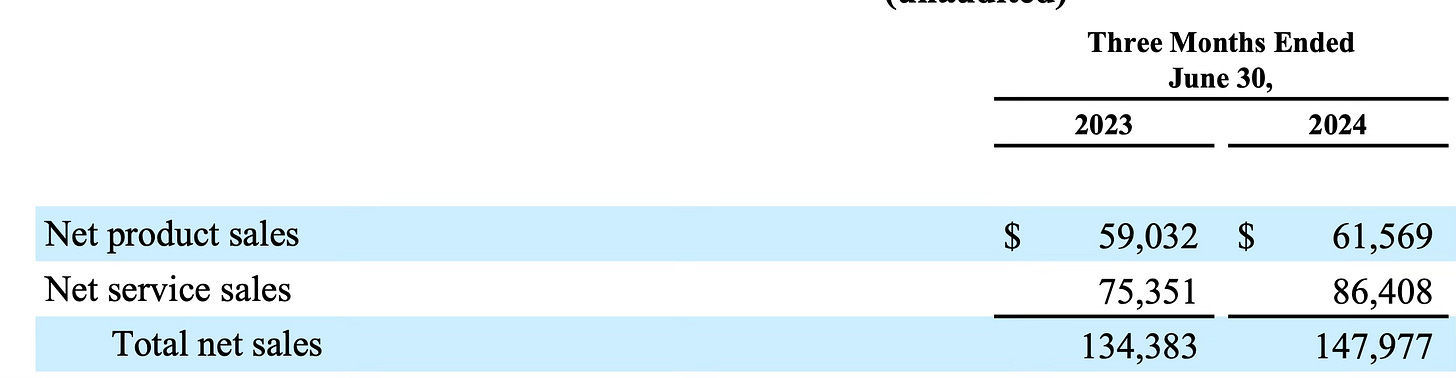

With Amazon it’s always something new, if it’s not AWS, it’s ads, if it’s not ads, it’s margins, etc. Simply put they have too many moving parts and they can never seem to get those parts to work at the same time. Look how long the Amazon earnings release is vs Apple which is simply 3 pages. Amazon is just too complex for their own good at this point, they need to stop breaking out all these segments, go to services and just discuss this below. Services are the only segment that matters and those are now 58.4% of Amazon’s business. That is so impressive but you’d never know it unless you broke out a calculator. This was the slowest growth of services at 14.6% year over year, but still very impressive when the number is $86.4B

Overall, I don’t see any analysts lowering targets tomorrow, you might get those analysts who lower the price from $230 to $220 or something but nobody is going materially lower. This company is doing very well, investors are just sick of their nonsense. There are recession fears, but they’re going to be there every quarter till the end of time now. Amazon is sitting right near the 200 day now, a break of that would not be ideal, for the moment we are breaking the 8 month moving average for the first time since I entered my trade. It’s obviously August 1 so there is a long time for it to recover, but the bad technicals just seem more of an overall tech thing than Amazon specific. As I posted above, the drawdown from peak to trough is nothing egregious, and the company is a 2H company where all their best numbers come in the back half. The guide wasn’t exciting considering they have Prime Day data, but they did guide for between $11.5 and $15B in Q3 income, look this company is making alot of money now, this thing is trading as cheap as it ever has on forward earnings, the premium it once had is still there, but it is far smaller than it used to be.

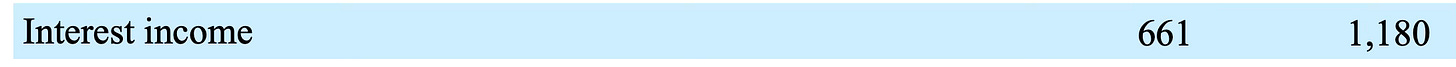

While it feels like Amazon is this massive laggard, that is the stock, the actual business, they’re operating as well as they ever have in terms of bottom line and without any financial engineering or shareholder returns with a slew of question marks it still maintains a valuation near $1.8T. The market narratives are constantly changing. Yesterday we were up big on the fed, today we were down big on recession fears, tonight Israel was attacked, will that lead to a bigger war. It’s just part of being in the market, we’ve all known big tech was dead money for a while when the Nasdaq broke down a couple weeks back. All the mega caps have give or take moved down the same amount, Amazon isn’t really materially worse than any of the rest. At some point we will go back to buying big tech only, and all these will go up. There is nothing to sell on any of these reports. The other day Microsoft sold off because Azure grew 29% vs 31% expected and 2 days later it was back at highs, these companies are generating serious cash flow and I’ll tell you something, rates being cut even 2% isn’t going to change the trajectory of these junk small caps. Amazon made $1B in interest on their cash this Q, actually $1.2B. Do you know how many decent sized companies do not generate $1.2B a quarter in income? Amazon made about what Starbucks does in a quarter just in interest on their cash……

Overall I wouldn’t panic, if you’re holding calls, it sucks, that’s why you have to give yourself as much time as possible. Stocks don’t always move when you want them to move, eventually math works, short term, the charts have been telling us to avoid tech and we’ve talked about that for weeks here, I think in a better environment Amazon wouldn’t have been crushed today, but so is life, my June 2026 calls will be hit, but I’m not closing them yet so I’m not concerned. I still think at a minimum this is a $2.5T company which would be $240 a share and with AWS re-accelerating everyone who thinks that is all Amazon has shouldn’t be lowering their targets. I still think retail is the gem at Amazon and while it was a bit slower, it is still growing double digits, not really my idea of “slowing down”. Markets are markets, narratives change quick, 6 weeks back NVDA was a buy every dip, now it’s down 30% and it can’t find buyers, consider megacap tech is basically all we have, I can’t envision a world where buyers don’t come back eventually.

Alot of you have been emailing me about my dad, I appreciate all the emails, its a bit hard to reply to them all, so I’ll give a quick update.We’ve been in the ICU for a few days,I’m learning about alot of stuff I’d never heard of, right now is blood gas is too high. The plan was to intubate him Wednesday because he was struggling to breathe without a bipap for more than a few minutes but yesterday he was able to go a little bit longer without the bipap and they said as long as he can tolerate that we won’t need to intubate him. He still has water in his lungs and now pneumonia for the 2nd time in 2 months. I’m learning alot about cancer through this journey and it seems most pass away from complications and not the actual cancer. Either way every day he’s around is a win in my book and I’m glad to spend these few days with him because they really haven’t been great days. We’re still on intubation watch which means they dont let you eat because they want your stomach empty but if he can get through this the next couple days, we can get out of the ICU and back to a normal hospital room to deal with his other issues including his cancer returning less than a month after it went into remission. I was told I need to be realistic about the situation from the doctor but I don’t really believe in that sort of stuff my dad is tough he beat the odds on pulmonary fibrosis, a lung transplant and this cancer has gone in remission a few times already. I think he has a good bit of time left if we can get a few breaks, maybe I’m in denial, maybe I’m optimistic, but I’m not going to give up until its over. We just need him to get strong enough to where they can begin the first chemo he did that worked with no side effects. Because the first one had no side effects when the cancer came back he opted for a different one he was told would have side effects but thinking how bad could it be, the second chemo he did rocked his world. If he can get through these issues he has now, and get strong enough over the next 3-4 week timeframe they’re giving us, and if the cancer doesn’t spread wildly during that period, we can start chemo again and possibly escape again. Cancer is the worst, especially this Merkel cell, it’s just relentless, he’s had other cancers since his lung transplant, but this particular one has gone into remission 3x this year and come back every time. It’s been a long journey for us as a family the last 10 years with these last 2 months being the most trying, but I’m still hoping for the best outcome.

Sorry again for being out this week and I plan on being back Monday either way, I just wanted to get this note out tonight after Amazon reported.

Thank you.

Just amazing you typed all this on your phone on a day like today.

Thank you, James. Your mother and father are lucky to have a son like you.