Amazon Q2 Earnings Recap.....What A Quarter

As most of you who have been here long enough know, I have been sitting in this Amazon trade for nearly 3 months now. I entered my big position on May 16th and I wrote this piece below on May 18th. The stock was $116 or so and the rest is history.

Why Amazon Is A Generational Buy Right Now

Last week I followed it up with my preview of Amazon going into earnings.

Amazon just closed the after hours session over $140 after nearly touching $143. That was a very big 10% move adding nearly $140B in market cap.

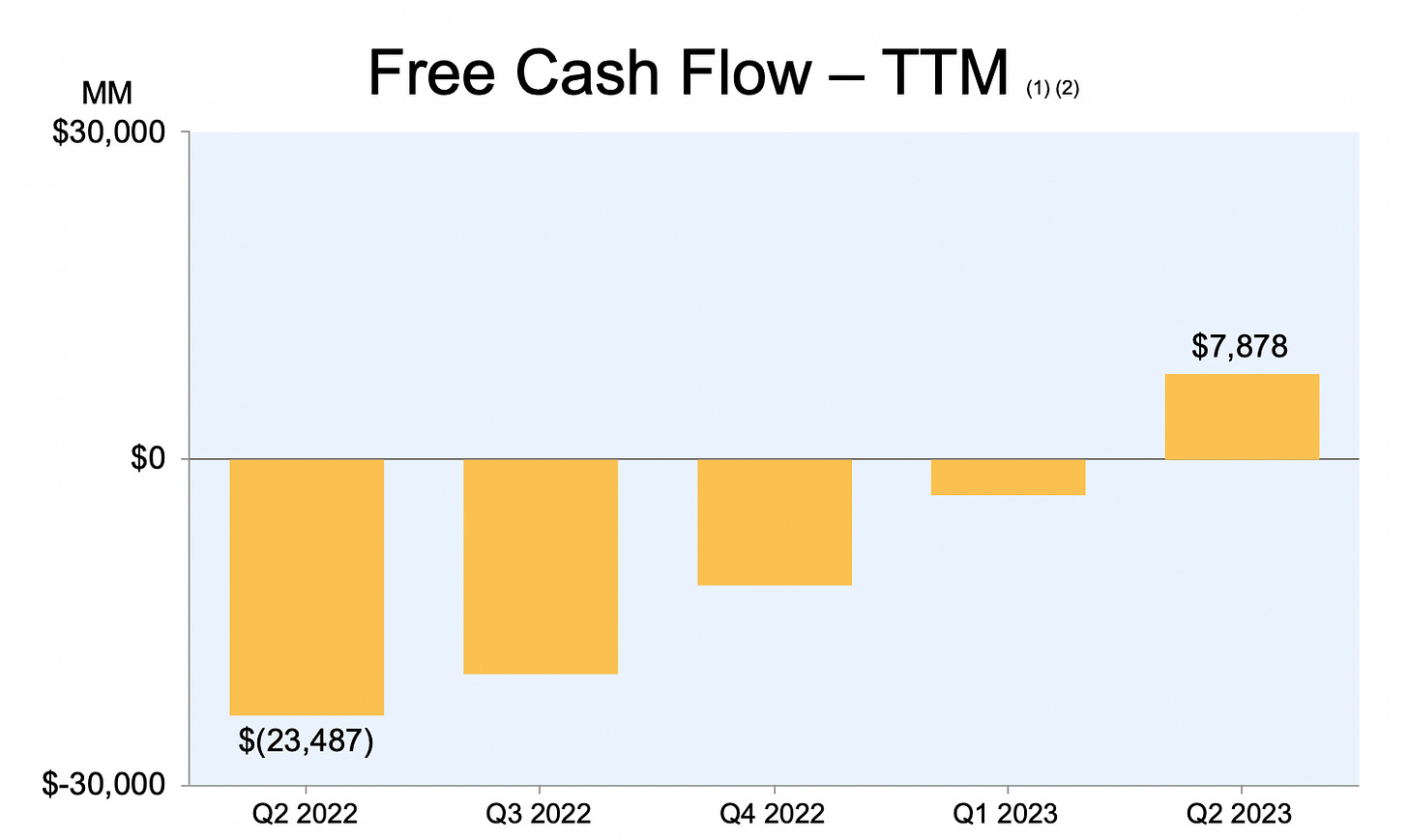

As you all know, I never wavered in my belief of what was coming. Today that belief was vindicated with the best quarter Amazon has seen in years. FCF returned on a TTM basis, capex was trimmed dramatically, and retail margins perked back up significantly. The long forgotten name we know as Amazon finally has life again. What began as a technical trade right before the 50 crossed the 200 back in May became a hold as I just saw no opportunity greater than this to deploy a sizable amount of capital. While a name like META or NVDA may be up more in that 3 month timeframe, Amazon is the name I’m most comfortable with because I know it inside out.

My sizing may have seemed crazy then, and you probably thought I was a lunatic holding into the print today but for those who’ve been around this substack long enough, you know that when I have conviction, I go for it. That is why I always tell you to have a trading book that differs from your investing book. Your trading book has to be where you get reckless if you feel the urge, you can’t second guess yourself trying to be conservative. Whether it’s going all in Twitter last September and ignoring all of Elon Musk’s nonsense about getting out of the Twitter deal or this current Amazon trade. When you have have conviction and that conviction is backed by charts and option flows, you have the perfect recipe to make alot of money.

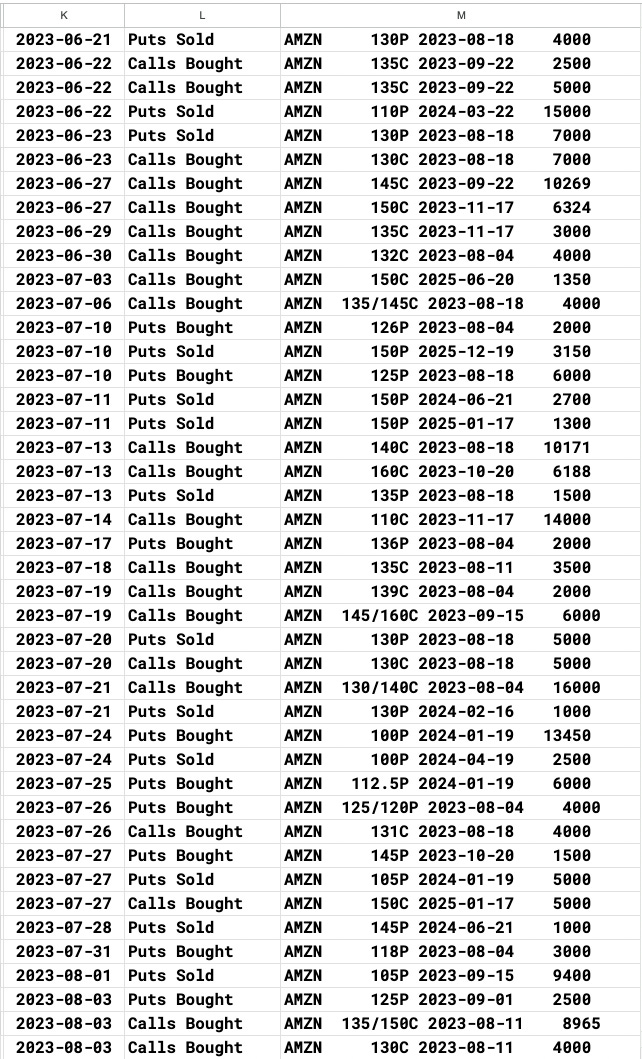

With Amazon it started with all the option flows that you see in my database. It doesn’t matter what longer term timeframe you pick, Amazon dominated the open options flow heading into today. The short term numbers were skewed because so many puts were bought recently, likely as hedges but look at this

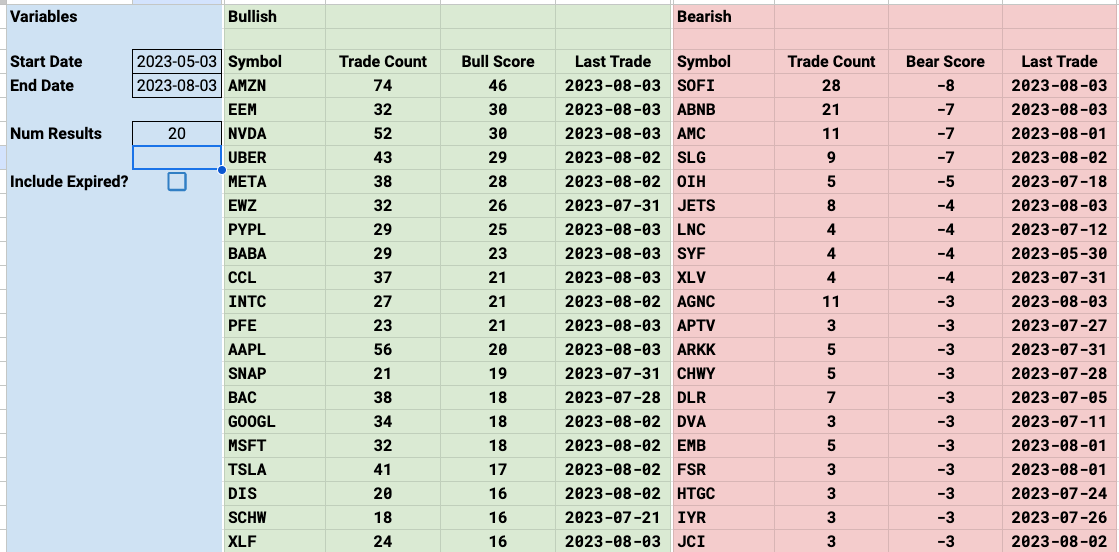

3 Month Timeframe

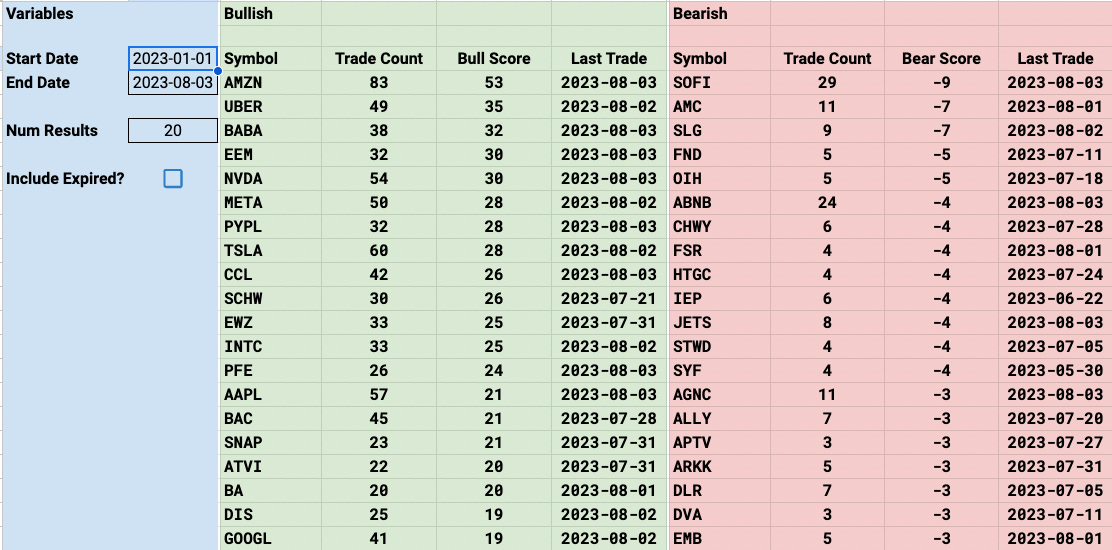

Year To Date Timeframe

Of all the trades still open from January, Amazon has 50% higher bull score than any other name. I had noted 68 bullish trades and 15 bearish trades.

All that nonstop put selling and call buying I’ve noted for weeks finally paid off. It was just such a large amount of bullish activity, it was hard to ignore what I was seeing. Moreover some of the trades I noted were hundreds of millions of dollars, funds were positioning into Amazon in size and why not? The rest of the megacaps had already run hard enough. This is just what I had open in the last 2 months, you can see the overwhelming amount of sizable bullish activity.

The fact remains that the options market remains the first place you will see activity when something material is coming. One trade here and there doesn’t mean much, but when you have 83 trades and 68 are bullish over a multi month period, you probably should take note of that.

So now what?

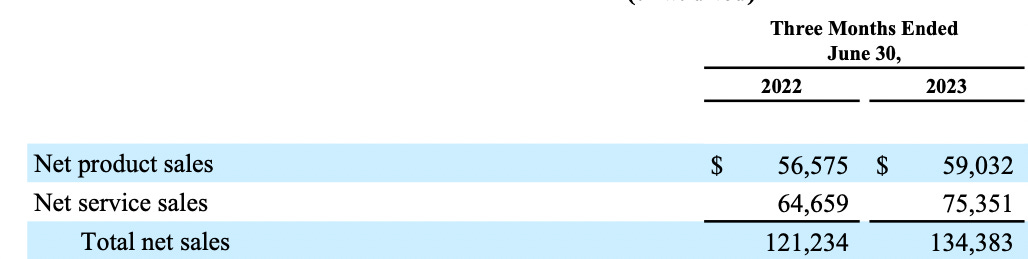

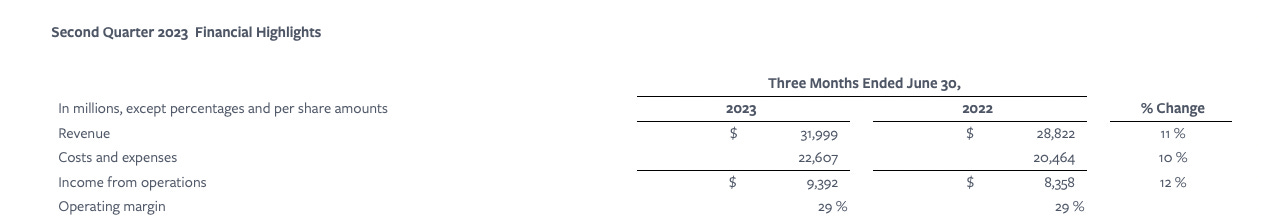

Amazon just showed the world it is back. They beat income estimates by nearly 100%. You have the same analysts and tv talking heads who have no idea what they’re discussing saying the numbers were so so, they should learn how to read financials. Even Jim Cramer, who I think is awful, took notice how great these numbers were. Take out that 1P business and the grocery stores, how did the numbers look?

I see a services business that just did $75B in revenue and grew 16.5%. Everyone is fawning over Apple doing $21b in services revenue, who cares, it is double the market cap of Amazon and just posted its 3rd straight quarter of negative revenue, that isn’t impressive at 30x earnings.

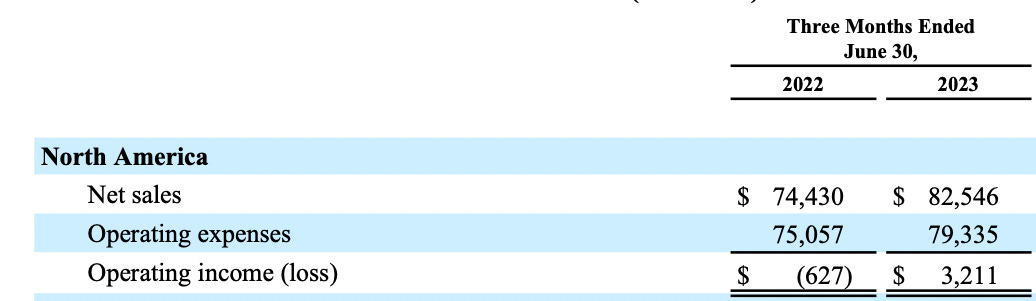

What else went right? The consumer is weak narrative, that’s dead in North America where Amazon grew its numbers 11% and operating income exploded.

Operating cash flow was +74% to $61.8B

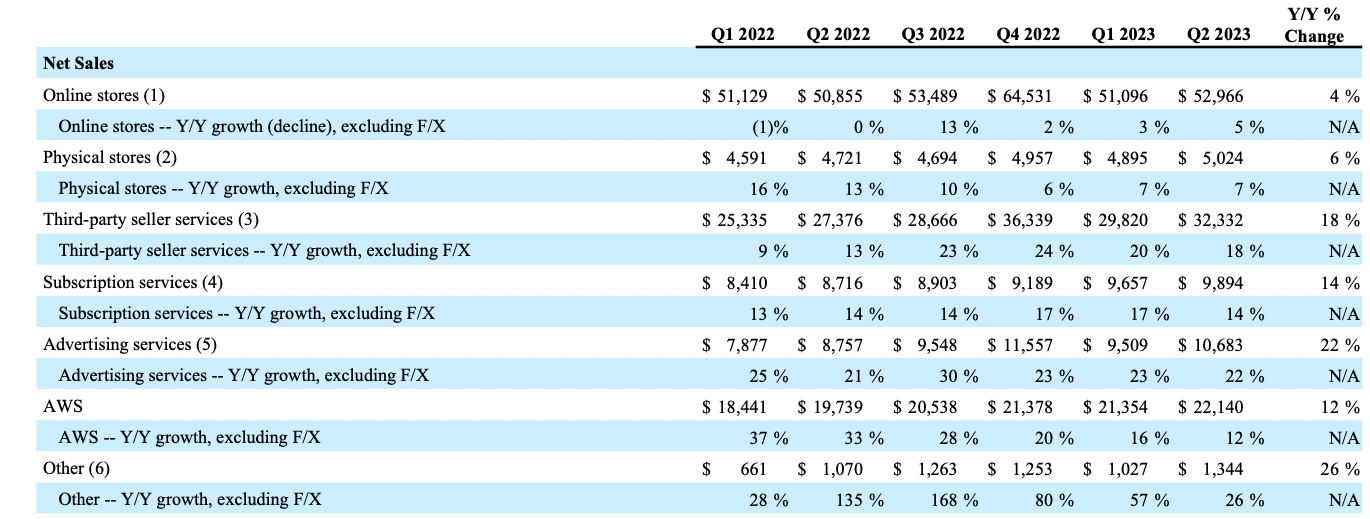

How about the segments individually? The 4 most important segments all grew double digits, at massive scale. Even subscriptions grew 14% on nearly $10B of revenue in just 1 quarter. These numbers are mind boggling.

3P + 18%

Advertising +22%

AWS + 12%

Subscriptions +14%

3P

Amazon grew it’s 3P business by $5B YOY, remember that’s fees collected, so it grew the GMV by $12-15B somewhere in that range, that is alot of sales growth for a supposed “weak consumer”. Amazon is taking share from everyone else and it starts with shipping times. Sure Shopify,Temu,etc are nice alternatives, but if you want to get your product in under a week, and in many cases in just a few hours, there is only 1 Amazon and that alone will make Lina Khan’s life very difficult when she tries to present how Amazon harms consumers and should be broken up. It’s near impossible to say these ultra fast shipping times Amazon can now achieve aren’t making customers lives significantly better and if you remember my very first thread on Twitter in 2021, my thesis then was that eventually the shipping speeds would make it very hard for Shopify to compete, and as we saw a few months back, Shopify exited the logistics business. They just waved the white flag and moved on. Speaking of Shopify was down 5% today, it’s getting difficult for them to compete with Amazon when consumers are only interested in how fast does my item come.

AWS

This surprised and grew by 12%, many feared single digits were coming. One of the things that has stood out to me for weeks has been this nonsense the media keeps pushing about how Amazon is in a distant 3rd place on generative AI. Who cares? Bard and Chat GPT are surface layer things, they aren’t they whole AI race. Moreover, Selipsky told Bloomberg a few weeks back “Altavista led search in 1997 too” when asked about how far AWS was behind. We are so early in this game and its asinine to think AWS won’t be a major player. The pie is so big, many will win, and most importantly Amazon said today they’re seeing customers coming back to build more on AWS. So that backlog is going to play out going forward.

Advertising

$10.7B in Q2 which isn’t even a big quarter. Prime Day has just passed and is the biggest advertising day of the year, Ads could post $12B+ in Q3 with that. Google as a whole did $58B this past Q, Amazon is doing nearly 20% of what Google does in advertising and they are so early in the game. Google just grew ads 4% and Amazon was +22%

META is only doing 3x the ads of Amazon and that’s the whole business at META. Amazon has countless other tentacles doing various things and it is barely worth 50% more than META. Also, Amazon ads grew 2x as fast as META this past Q. Amazon is effectively breaking up the advertising duopoly of Google/META with more effective ads than anyone else has when it comes to products.

Subscriptions

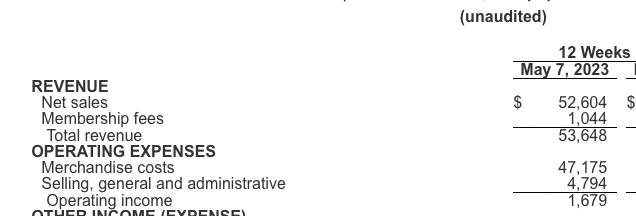

$9.9B in the quarter up 14%. Again COSTCO is a $250B company that basically sells products for breakeven just to sell memberships, and those memberships total a hair over $1B per quarter, Amazon has memberships totaling $10b per quarter. What is that worth if Costco is a $250b co?

The bottom line is Amazon has turned a massive corner right now, it sounds crazy that a company worth over $1T for so long has negative FCF but here we are and the TTM FCF is finally back to positive. The question is what can stop Amazon now? Seemingly nothing as long as they don’t get in their own way with destructive spend.

Now that Amazon has gapped up, depending where it closes tomorrow, it could have its first weekly close over the 200 DMA in 15+ months. That is the yellow line you see below that has been stiff resistance for over a month now. That now becomes support and Amazon should in theory outperform the names like Apple and Microsoft in the coming quarter because those should drift in the other direction. If the market pullback, great, Amazon and Google should lead after their reports. Names move in cycles and for now, it is Amazon’s turn to breakout and drift. Tomorrow morning you will see a flurry of upgrades and analysts changing their estimates, this name is so under owned, you’re going to see many new participants entering. It’s not everyday a dormant monster comes back to life.

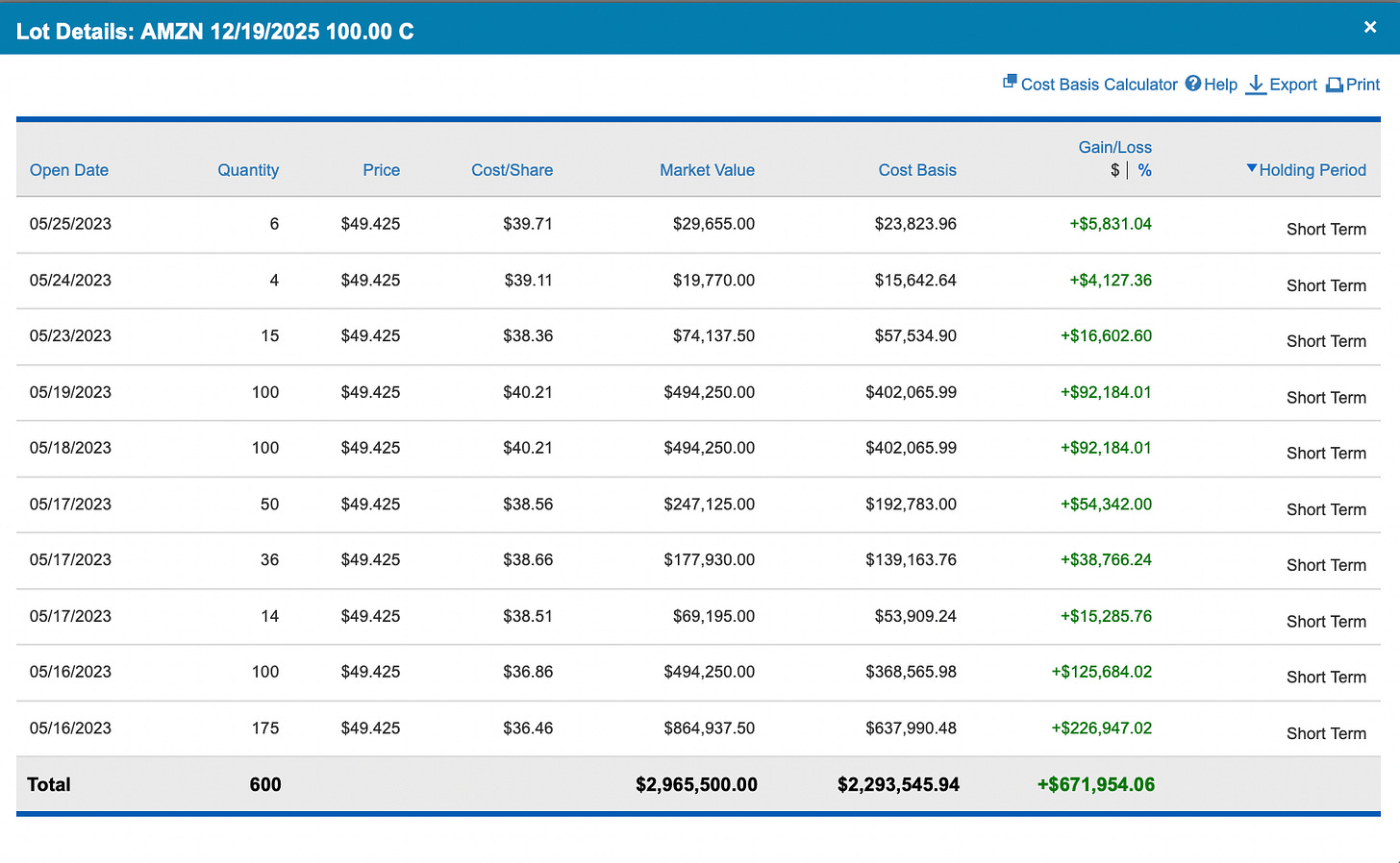

As for me? My 2025 leaps are now officially in the money from what I paid back in May. Here are my lot details. I’m in a great spot, in a couple weeks after it settles down I can begin to sell weekly calls vs my leaps and lower my basis to $0 over the next 2 years and hold all the way through to where I think the leaps go from $38 to $150+.

Either way if I play my cards right I can get my entire cost basis back slowly. Think 120+ weeks to expiry and all I need to do is get .30/week back via short calls to have that trade be a free roll. Many options, but the bottom line tomorrow morning I will be up nearly 60% on those leaps from May meaning my entire account will be up somewhere in that vicinity in 3 months. The need to rush back and do something else is just not there for me, if I see an opportunity I will take it but I am taking my kids on a vacation for the next few weeks tomorrow and honestly, I’m nearing a 200% total return on a big book from day 1 of starting this substack on June 8th last year. I pressed it at the right times and I don’t see the need to do much here, I’m in a good spot where this particular trade should carry forth until Q3 reports and I can make a decision there.

I know many of you followed me on this trade and I’m sure you’re happy tonight. It’s always exciting to see your thesis play out.

I hope you all have a great day tomorrow, I hope you forgive me, but I’m taking the day off. I write to you all every single day, some days twice, and I won't miss a day even on our upcoming vacation, I’ve made plans to wrap up at the same time I always have. Tomorrow though, I want a day off to enjoy what should be a very substantial gain for myself. I think you all will be ok without 1 day of option flows, you’ve already received over 400+ this week, surely there’s something in there somewhere you can attack the market with.

Congrats again to all who held bravely into the print.

Excellent work!

Hi James,

Congrats you are like an oracle! When you say “I can begin to sell weekly calls vs my leaps” do you intend to do a call calendar selling weekly short term calls at the same strike as the LEAPS or at different strikes?