Gaining An Edge: Anatomy Of My Large Trade

I wanted to start this off with a little commentary on a different topic before I get into my best ideas. Yes I said ideas because the market does appear to be rolling over short term and I don’t want to post just 1 idea this week because I don’t like the short term picture but at the end of this I have a list of 15 quality names that have had nice earnings reactions and are now drift higher candidates for the quarter ahead instead.

Option Flows

We are now 3 weeks into earnings season. As I’ve said many times playing earnings is a complete crapshoot that I do not recommend unless you have some serious conviction. Typically you know my stance that I prefer for names to report, see how they report, and then trade into the strength after. Some of the names with bullish option flow in size like AMZN,JPM,INTC, and SCHW worked out greatly, others like PayPal and UBER did not. I then see comments where people are blaming the options flow or wanting to backtest old recaps. By all means, go for it. You think unusual options flows are going to hit at a high percentage? I’m literally breaking down millions of options trades placed daily through some very aggressive parameters and highlighting the absolute oddest ones. The point is I’m looking for some crazy trades. You’re missing the point of it all if you think they’re going to work at a very high clip. They’re more to help find an overall direction in names seeing repeated positioning. Like how you see the trends finding many before they move up. The actual odd lots may not work like in that 100,000 contract buy in BVN, but the equity itself did rise 15% in 4 weeks. The options flows are 1 additional layer in your discovery process, they’re NOT a guaranteed winning trade. If they were a guarantee then we would have alot more funds out there beating the market every year than we do.

The reality is this, as I always say, within that data you get everyday the puts sold are the only column where we know exactly what they are, levels funds are looking to go long in a worst case scenario. Even if they’re long puts and they add short puts to make a trade a spread, that is still the level they would close the short at. So we know puts sold, those are the spots someone with alot of money wants to go long. With the calls bought and puts bought, the truth is we just don’t know what those trades are. Take that BLK trade I noted this week. Who knows what that was, it wasn’t serious size maybe $100k but when someone buys far OTM calls like that on a stock that typically doesn’t move, you have to take not. With others someone could be short $100m of PYPL stock and they could theoretically buy $5m of calls to hedge that trade. They could be long $500m of PYPL and buy 10,000 puts to hedge that. I post all those trades and maintain my database simply trying to model data to get a little edge that is all. Have you ever seen me buying size short term calls? Hell no, I’m not a gambler, I’m very calculated in every move I make, even the Amazon leaps I had I was too conservative in that by buying December 2025 in the money calls, but that’s me, I’m very conservative even as aggressive as it looks on the surface.

In the case of my large Amazon trade I had 3 things line up: I had the most options flow out of any name in my database, I had a chart setup that was looking perfect back in May which allowed me a massive cushion on my entry by earnings, and lastly I had what I consider maybe the deepest understanding of Amazon relative to any company in the market and a belief that it was mispriced dramatically within the market.

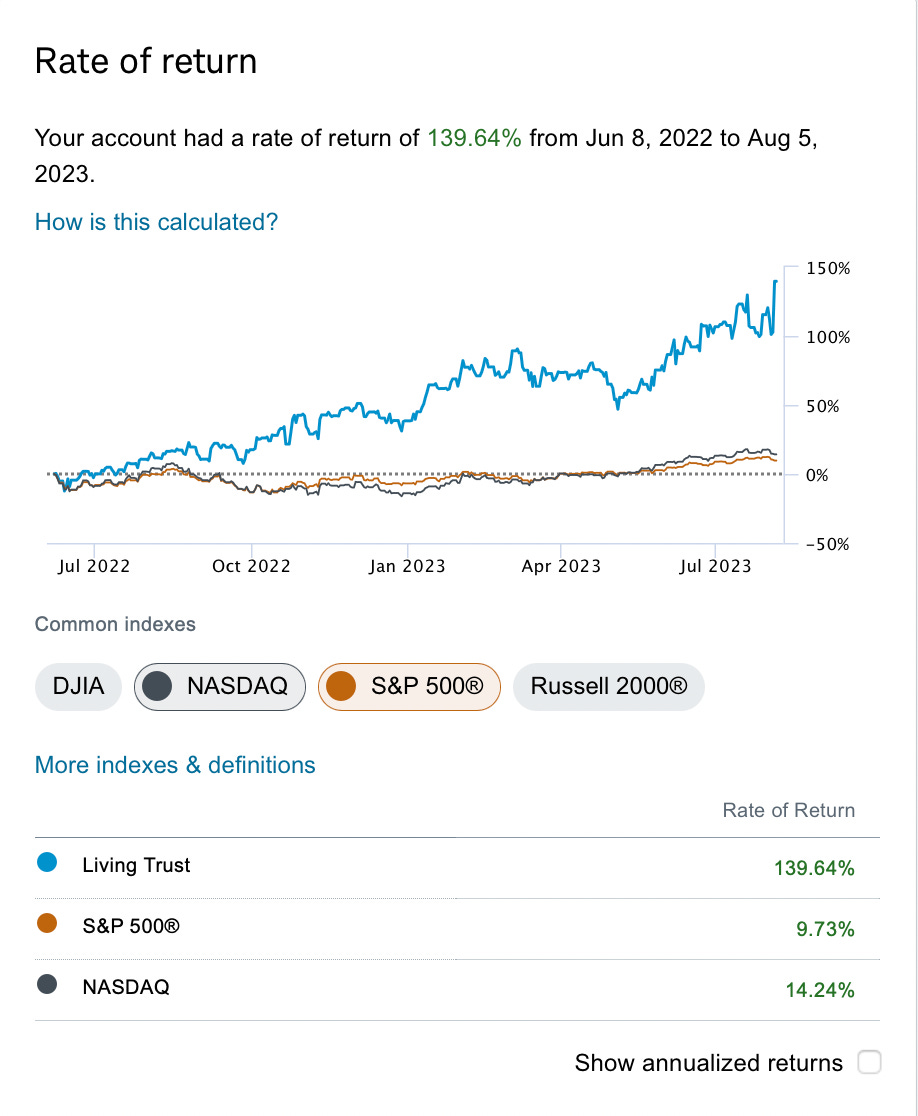

Those were my main reasons for closing all my positions in May and going all in. Again, you all know exactly what I hold. I don’t post spreadsheets. I’ve been writing this substack for 14 months now, June 8th, 2022. Since that time, I’ve posted everything I’ve done and you see it all the same day I do it. Since that time I am now up 140% and the market which is only up 9.7% in the same timeframe with the Nasdaq up 14.2%. The one thing you see with me is I’m always positioned in strength. This game isn’t rocket science, there’s always a pocket of strength somewhere and for me, I believe the options flows hold where you will find it.

You see all those sharp moves up and down, that’s how a trading account moves, when you make really aggressive bets using leverage, which I do. That’s going to happen. Again this is simply my trading book and in my case it was cash I had leftover after I bought a home last year. It wasn’t money I needed for my investments, it wasn’t money I needed for anything else and simply put it was where I was planning on being aggressive in generating returns. That’s it. The reason I say this is because lots of you always ask me about how to think about allocating percentages and how to think about risk profiles and portfolio beta and my answer is always the same, stop.

Those are all things for your portfolio. I too have a portfolio and I add to it every week, I have UTMA accounts for my kids, I add to those every week, and the reality is I don’t care what the market does this week or next month or the next 10 years. I have a long time to go before I need that money. That is my situation. I retired young and I am probably 30+ years away from needing my long only book for anything. Which is why I’ve said my situation isn’t yours and I can’t advise you on how you think or trade, you have to separate your play money from the money you need and then think like a business owner. Your trading book is a business, business owners get aggressive, they invest all their time and money into building something, isn’t that the goal with your trading? To build some sort of income generating business? My trading book could go to zero and my life wouldn’t change(it would suck believe me) but I don’t really think about it in the context of anything more than as long as we’re in an uptrend I will push it and when we’re in a downtrend I will pullback.

You saw last quarter, the market broke down 4 times and I was first to short things when I thought we were going the other way. It didn’t work out and was part of those drawdowns you see above, but the point is I just let the charts guide me, I don’t really have a bias in either direction so I seemingly mostly position right into things because I don’t have a macro view, I know better now that none of that stuff matters, and whatever people think matters will show up in the charts where we see all the buying and selling actually occurring. Sprinkle in some options flows and to me that is my “edge” on finding direction within the market.

Take the current Amazon trade I’ve been in for 3 months. When I first discussed entering it May here Link the chart setup, particularly the higher lows and breaking the downtrend on a longer timeframe were a big part of my thesis

Then I mentioned my particular notes on all the unusual calls being bought at that time. You can see those ITM $135 puts sold when the stock was $115 then, you can see the multiple 2025 call spreads opened back then, I could see that they were really positioned for a much large move higher over the longer term. Now remember Amazon isn’t a heavily shorted name, so to me, these weren’t hedges.

All that combined chart + option flow led to my saying the risk was worth the reward in terms of going all in finally, and you all know what happened next. That trade has no culminated in a 7 figure gain which by itself was up 18.2% Friday at the close.

Here are the lot details of that trade. I kept averaging up for a few days.

This trade wasn’t easy, Amazon had some many fakeouts along the way. Even as the trade was unfolding alot of you kept asking me “don’t you see the put buys today on AMZN” and I would always tell you that was just 1 trade in a series of many and the overall data is showing tremendously more buying than selling. You can’t really be emotional about this stuff, if you are, you have entirely too much risk on. There were so many days I lost over $100k in a session holding this trade, but I’m long 600 leaps, that is 60,000 shares so of course on down days you’re going to get hit. You have to believe in yourself, believe in what you’re seeing in the charts/options, and just size to where you’re comfortable with a loss and have a plan B in mind. I always laid mine out on how I could sell short calls vs my position and get all my potential losses back in time.

Now it all worked out and I am in an unbelievable position going forward. Amazon is probably the market leader now after that quarter it posted, it should definitely drift higher if the market holds up and what I joked about potentially being a once in a lifetime trade looks like a much higher probability today of actually being just that. There are also many ways to generate income off this position as I hold it and I will be showing you all that in the coming weeks after I let it run a little from here. I can basically turn Amazon into a dividend stock with huge weekly income using short calendars and the dividend only crowd would lose their mind if they knew you could actually generate alot of income on high quality stocks, weekly even, without having to buy lemons.

Best Ideas - 15 Strong Names That Should Outperform In The Quarter Ahead