How Are Others Using This Data?

One of the questions I get often is how to best utilize all this information. I obviously have my style, you see it everyday, others have built their own style, there really is no one size fits all answer. You just sort of find what you like in the options world and begin to go with it. Some trade weeklies, some sell puts for income, you have to find what suits your needs.

In this post I’m going to share how 6 different people in the community discord use all this information to trade their own way. You’ll have their usernames, well all but one, and I’m sure all are happy to answer any questions you may have should you want to inquire more. All of these people are in the live tier so I see them trading everyday and chose them because I see their success in that smaller group as they trade and discuss what they’re doing. In my opinion, they get the absolute most out of all this. Now if you’re not in the live group its fine, the recaps are more than enough time to put on trades since I send it out mid day, but the live tier exists, and its a small group of 115 now, for the purpose of accessing this all live and trading it with a group. It isn’t for everyone, you definitely have to be dedicated and have free time. I’m going to share my side of things first and then I’m going to share all the blurbs I asked them to send me. Hope this answers alot of your questions.

My Take

As I’ve said many times, I don’t think people need to be trading as much as they think to get the results they seek. You need a handful of trades, with conviction, and leverage, and you will outperform. Where does that conviction come from for me?

Out of the money call flow

high trend score

put sales

charts

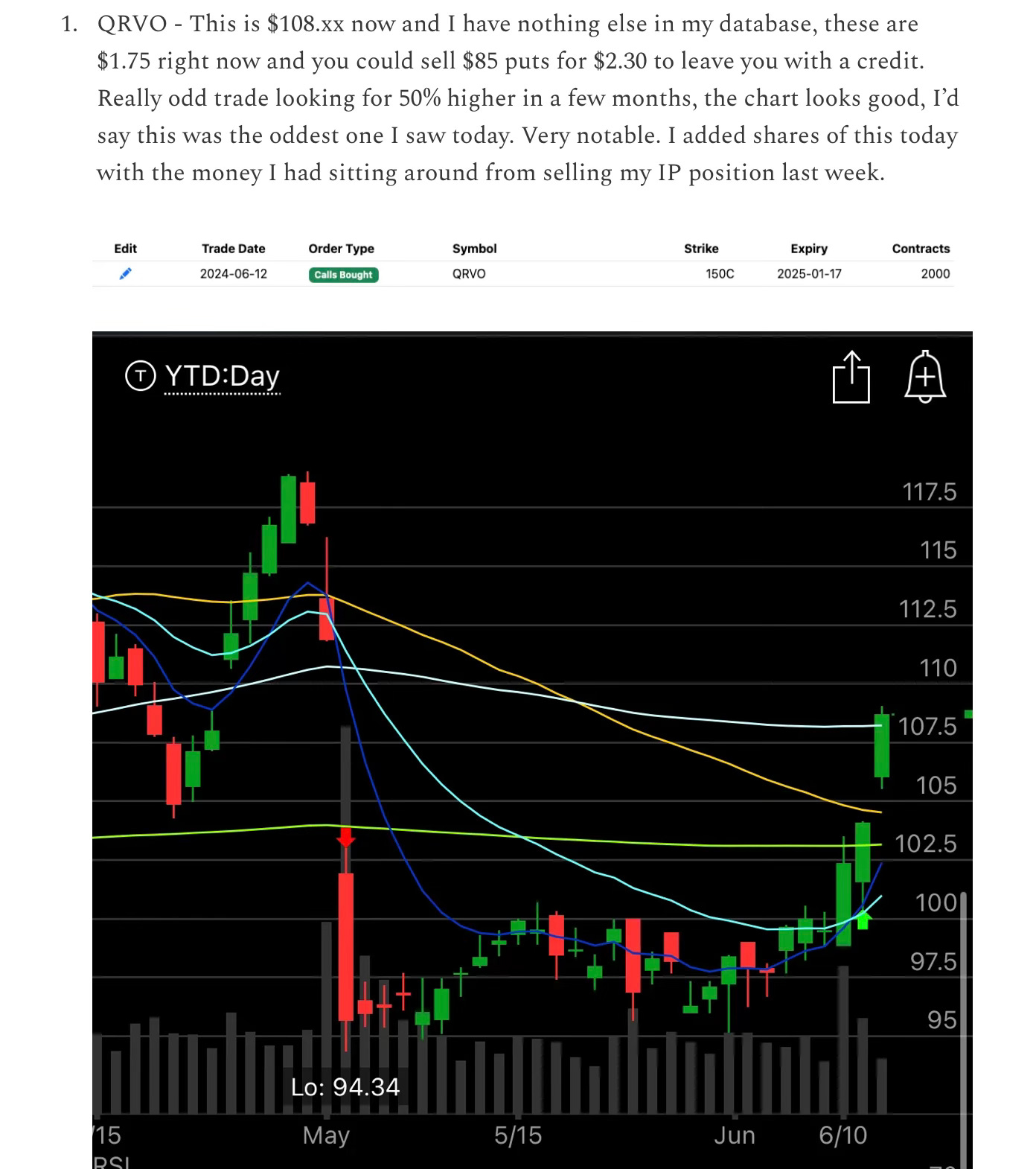

As I log the trades everyday, there are a few times a month where you see a trade that’s so out there that you just don’t even ask questions and buy. In the June 12 recap here I said the below about QRVO and that I was adding it

What’s out there for me? A name with little to no option flow combined with an OTM calls assuming it’s not a biotech. That is the holy grail for me. Now, the problem is I can’t really put size on a name like this because I just can’t sleep well with it, but I can swing say 1-3% on it. Here, the stock was $108 and they were buying $150 calls in January 6 months out. I didn’t even know this name, but I knew that trade was just nuts because I had no other trades on the name. I quickly glanced at the chart and a chart you have to remember is just a visualization of buying and selling. If a stock is being bought, the chart will be a nice setup, if it isn’t, then it won’t, simple enough. So with those 2 things in mind, I stated that I bought shares. Here we are less than a month later and QRVO closed yesterday at $118.75. Now I sold my shares a couple weeks later for a gain to focus on my Apple calls, but the point is the same, the trade worked because the oddest trades in all this data do so at a high clip. Will QRVO go to 150? I don’t know, but I know directionally buying shares the day those calls came in led to a 10% gain in a month, that is a big gain on common.

Now let’s say its a larger cap name that sees more than 1 trade here and there, the trends in the daily recaps I share daily give me an idea of what names are seeing repeat bullish trades. That lets me look at those charts and make my move. Like last year when I added my Amazon leaps in size, that was by far the hottest name at the time and I went for it. Apple recently was seeing repeat bullish out of the money calls and put sales at the money, so I went for it and it has worked. Again these option flows are simply the sum of the parts of what big money is doing after lots of strategy sessions. So although scattered between the trades are many hedges, the majority are not. In this case having multiple trades going in one direction is enough for me to take a shot, that is what the trends section daily was designed to show us. If I’m comfortable with the ticker the size I take is bigger. Does it always work? No not at all, look at how the PayPal flow came in hot a few weeks back out in 2026, and then Apple killed them with their announcement at their event. Those call buyers were very wrong on very big dollars, could they be right by 2026? Yea there is still hope, but they deployed alot of capital and were wrong for the moment because of Apple.

Take this week’s best idea yesterday, I mentioned all the put sales, put sellers to me are the smartest people in the market, they know what levels they want to go long at and when they sell puts, I want to pay extra attention. They are wrong but at a much smaller clip. In the daily recaps, the put sold column is a barometer to me of what level do institutions want to get long at. If you’re seeing put sales at the money then a name is likely ok to go long.

Hope that answered how I look at things., that is how I use this data to guide me in how I pick what I want to be involved in. Before my big Amazon leap trade I was managing multiple positions and what I’d do was sit down at night look over the table I share and look through charts to find the setups I found most interesting. It was time consuming, alot of people who quit here send me messages that it’s too much data or too much time is required. My rebuttal is nothing in life worth doing is going to be easy. If it were easy, then everyone would be a successful trader. The reality is this stuff takes time, you have to scan for setups, see them, draw up levels to execute trades at and go with it. I definitely try to ease your burden of doing that with the 5 trades I highlight everyday, but the reality is finding success at anything is time consuming.

As far as charts go, I’ve said before, in the history of markets, nobody was ever caught up in a market selloff by selling when things broke below key moving averages. You have to learn the moving averages are truth, accept it, and use them. Some like the 50 or the 200, me, I like the 21 ema. It is a medium term trend. It’s just not possible, think about it, to have a market breakdown with the trend staying in tact. If the market breaks below the 21 ema, that is your sign this short term trend is broken and something is brewing. If you always lighten up when that happens, you will never be caught in a downturn. I wrote extensively on the topic in April the day the market broke down and we followed through with a decent selloff. If you’re disciplined and stick to this 1 basic premise, you will never, ever get caught up in a market selloff. You know to adjust, if you have to hold for tax purposes you can start selling covered calls or buying puts, whatever you choose to generate income in a market that is in decline. That piece is below.

Bottom line, just keep it simple, so many of you message me with all our positions and the reality is you just don’t need that many. Just pick a handful of names, pick your spots and place bets it if you’re trading. Now if you’re investing that is a whole different thing and you can diversify all you want. When it comes to trading I think less is more always.

Now for the people in the discord who I think you should listen to their takes on what works for them are below. If you’re not in there, the discord link is in the welcome email you got when you subscribed, if it didn’t work, I will include a link all the way at the bottom of this post. Please join it, there’s 815 people in there now and it’s as good of a finance community you will find anywhere.

J2004

JBs service has opened my eyes to many different methods of placing trades - call spreads, risk reversals, strangles, straddles, etc. JB’s service provides a few distinct advantages over any others which gives us an edge in the market: option flow, Substack information, and hearing from the many contributors covering a wide range of topics and sectors.

The option flow, the way he culls the data, and the way the data is presented in the database is huge. JB has an innate ability to scan and find the best option flows on the market. This is very different from your standard ‘unusual options’ books, services, etc. Due to JB’s background, he picks out the big buys that stand out as institutional buying or other real market players. One of the things I find most important - JB knows how to read the scans and can pick out what the options moves are - did someone really just sell/buy/roll a position? JB will tell us what he sees and what he thinks the whale’s strategy may be. There’s many examples online where other services call out an options move and it’s not a buy, it’s a sell, or vice versa (one in particular with someone incorrectly logging JB’s own trade, being called out and having screenshots provided to him yet still failed to acknowledge his error).

The different strategies he talks about in the Substack are excellent tools to get one thinking about ways to place a trade. Using things like call spreads, reversals, selling puts on names with bullish flow not only lowers the cost, enabling me to purchase more of the contracts I’m looking at, allows me the ability to take on more risk, and ultimately follow the big money/institutional buyers. I tend to stick with names I know and have experience with trading (AAPL AMZN AVGO META GS LLY etc) but I do trade other names as they come into the Live channel. Generally I’ll look at where the big buys I’m interested came in, identify a method to play - r/r, spread - and then price my put sell a support level lower than the whales position. Reason I go below is because I have to assume the institutional buyer can easily assume more risk than me and/or may not care to be assigned the shares at his put sell price due to their larger funds compared to my portfolio. I can’t get assigned 10000 shares of AVGO, haha. Using these strategies allows me to put on larger trade with less capital risk and there’s really no need to risk more unnecessarily. With call spreads, I don’t have a problem capping my gains with a call sell that’s close my my bought strike - I’m generally conservative and begin taking profits around 20%, so knowing that about myself, I am risking less but still getting the results I’d get from naked calls. This has also helped from a psychological standpoint - through lowering my capital risk, I’ve been able to stay in positions longer than I would have had I been in naked calls. Another method I like to use are looking for credit plays. If I can manipulate the dates of a r/r or spread and turn my trade into a credit, I view it as a win/win. (See JB’s AAPL r/r from a month or two ago - genius play that paid out huge). I’ve been a member of JBs service for almost one year and my YTD gains are +82%, my 1 year return is +118%.

This service is 100% responsible for these returns - I cannot emphasize enough how using the different strategies to lower capital risk or get a credit play, have enhanced my trading.

Another great benefit of JBs service is the group of regular contributors we have in the rooms. The vast knowledge across so many sectors gives an edge no other service can provide. Through talking with JB and other contributors I’m able to get a real time assessment on a trade I’m looking at and solicit other ideas from those more experienced than me. Oftentimes I’ll find myself in the same trade with a few other members which I find to be very beneficial - I now have others to bounce my theories off, rid myself of my own confirmation bias, and have someone else tracking the trade - when we are all in a similar or same trade, members are good about throwing out updates to their position size, rolls, buys/sells, etc.

BTCapital

Okay let me try and articulate this: “I use James’ option service as a primary way for me to gauge market trends for both popular large cap stocks and more obscure stocks that tend to be parasitic or beneficiaries in broader market trends. My trading portfolio is currently about 15% in Bulltard type stocks but a large chunk (70%) is in mega caps that are buttressed by incredible cash flow and option flow (AAPL AMZN META from largest to smallest). To me these are safer bets and we’ve seen unrelenting option flow in both calls and sold puts in these names so it makes more sense to me from a risk management perspective to play it safe in the big names. I occasionally play weekly option buys from this flow but these are always so risky I’m not going to bother with commenting on those too much. The live section is really beneficial for getting this data quick and swinging calls if you want to do that with weeklies. The medium to longer term Bulltard names though I really try to squeeze a little extra juice out of. I keep the risk moderate: never more than 20% total and never more than 5% in options in these names. Risk reversals and selling puts is a good strategy on these but I do it less often and prefer blatantly following the calls, stock, or buy writes. This is a personal preference and not meant to be a contrarian way to play these. The process for me is simple: is this babe obscure? How does the chart look? What is the sector? I answer these questions quickly and then usually buy and ask more questions later. Why are big players buying calls on a name with no options volume? If it’s good enough for an institution to buy 1000 calls on some random junk, it’s good enough for me. Home builders had somewhat of a blow off back in June; JELD BECN AZEK were 3 bizarre tickers we highlighted and you could’ve played it with calls, stock, sold puts, etc. In my experience, taking profit quickly is your friend, even if the whale you followed has options with time.

One key thing I do with these obscure tickers is cross reference with a few filters: M&A? Insider buying? How’s the chart look? Niche market? Potential catalysts? Is this sector running hot? You get the idea but if one or two of these is a good signal I usually just go for it. Having a 60% win rate on these names is beyond exceptional for returns if you’re scoring 100% on calls, it’s why I try to keep the basket broad and not so concentrated too. GTLB is a recent name that I played and the chart looked BAD. So why did I buy? Software was in the trash, GTLB has the GOOGL put and the someone bought 50% OTM calls for October. I followed and bought some 25% OTM calls as well and sure enough the flow overrides the bad chart. Its surge has brought it back above all the MAs and guess what? There’s even more flow and M&A chat so there’s more meat on the bone. Not all of them turn out this way so you have to remind yourself if not concentrating too much in these names. All those home builder stocks I mentioned? They’re in the gutter now. So what I have gotten recently? Crypto names and REITs for now are looking hot; great flow, good charts. I’m somewhat consolidated at the moment but I chalk that up to a bunch of vacation I’m taking, it’s been kind of slow. To conclude I really just try to keep it simple: what has flow? How’s the chart? Buy and ask more questions. I bounce ideas off a lot of people in various parts of the discord and that’s another important aspect, in my opinion. None of us all trade the same but all of these variables tell a story and it’s very helpful for other smart people to proofread your story before you start trading your hard-earned money. Patience is very important in these obscure names.”

RP89

James’ service has been the single most valuable tool I use for my personal trading and has completely shifted how I view the stock market. Reading the option flow that James posts tells me the story of where the market is going - highly paid professionals spend hundreds of hours vetting each of these options trades before they are placed, and we just get to see where the money is moving after all that work is done. An example of how I’ve used the flow is the US Steel acquisition last year - when the market was having a tough time in late Q3 I had a thesis that $X was going to sell for a major premium and the flow data kept validating this thought. The incessant flows validated my own beliefs and gave me confidence to continuously increase my position, resulting in a 225% performance in 2023 with a lot of credit going towards this buyout. Now in July 2024, the $AAPL flows have been non-stop for 2 months and convinced me to simplify my approach and allocate heavily there, resulting in outperformance yet again. In addition to the “what to buy and why,” James’ roadmap on when to go to cash or hedge profitable positions is very very important for inevitable market downturns. James is also very gracious with his time and particularly helpful with any questions I’ve ever had. The discord is my default place to be during market hours. Running of the Bulltards has altered any preconceived notions I had about how markets work, and more importantly has significantly altered my family’s quality of life. I believe that anybody who actively trades should subscribe and couldn’t possibly recommend it more strongly.

Teton Capital

So I run a fund that is about half my own $. Am generalist and can and do invest in everything and go long and short. Technically SPY is the benchmark but the goal is just to make money in absolute terms across all environments, although of course I try to outperform SPY and QQQ each quarter. Your service has been so useful and it's gotten to the point where if the options flow isn't there, I won't take the trade, it's just not worth it. Recently I took AAPL and C and those were fantastic. I want to see a repeated drumbeat of flow on a name and particularly put sales. This has kept me out of trouble more times than I can count, particularly in energy where it seems most traders are never not bullish because they love the sector too much, but the flow is honest. But I have to use discretion and don't just take every trade. For example, PYPL was very tempting with all the flow it had, but I hate payments as a sector, so I gravitate towards names and industries I can understand, even if it means I miss good trades. Of course, there's been luck and I will do the occassional discretionary trade. E.g., BVN / FTDR / MOD. I trade commons or sell puts. I never buy calls. I probably should utilize risk reversals more but this is just what has worked for me; I use a lot of leverage on commons and for me that's enough risk since I run very concentrated. Concentration obviously works both ways but for me it keeps the bar high / it's harder for a lower quality name to make it into my book if I can only have a few bets and I get sloppy when I have too many positions.

Judah Rhodie

Value of the substack to me is two fold - (1) scraped options data that is filtered based upon size and unusual trades (2) James’s options expertise on how to structure trades and his thoughts on trades more generally. James is very risk averse and is prudent in in way he structures things like risk reversals to minimize capital outlay and to increase the probability of wins in different market scenarios. I use the service to (1) follow whale option flow (2) follow flow in stocks where I wouldn’t normally buy options but I want to see the option flow (e.g. shipping and (3) follow public option flow for strange and unusual trades which could be insiders being naughty but where I have no exposure to any legal risk because I am just following market data.

Anon

Im not sharing my name bc I dont want people to dm me when Im on discord im focused on trading and dont want distractions. I trade weeklies exclusively with short puts and shares. The ppl in the live room can likely guess who this is, I spend my time waiting for weekly live trades to come through to analyze. 2 weeks ago Roku calls came expiring that week I swung commons for a few points and sold puts boom big win. With weekly option data I instantly swing commons only and sell covered calls below target call buys. My objective is to mostly hold a position and have shares called away friday. I swing a small book of 456k now, I was at 165k when I began last thanksgiving with the live people. I had used other rooms but alerts weren’t enough for me, I wanted more commentary from a community and this has been super for me. I learned alot about the function of markets and cut my time reading filings and listening to earnings calls to zero. I had a doctor dm me about a name I was asking about in the biotech channel and he gave me a deep answer to why a name I was curious about wouldn’t work bc he knew the space well telling me to lower my expectations. Another time I reached out to a knowledgable sounding person in the trade channel who worked at a cool startup who told me in depth why I should buy ARM when it was sub $100 and I regrettably didn’t add enough. Its a great group to talk markets with. What I love most abt jb is you sense he cares enough to send out emergency posts when he needs to calm the group down that is something I haven’t seen around different rooms. There was the amazon emergency post or the emergency post when the market was seeing a break of the 21 day in April, those were calming and markets have recovered since.

In Conclusion

You don’t even have to play with options to utilize this data, even if you buy commons, you want to buy the right name going in the right direction, right? You have to decide what your goal is. Is it generating income selling puts? Is it long term capital appreciation with leaps? Is it day to day trading with options.

That is the goal and following trends, following the bets of big money, and buying strong charts has always been about as big an edge as a market participant can get. If you’re not in the live tier, the “current trades” tab in the discord is full of people posting what they’re buying and selling everyday, use that. Bounce ideas with those people. There’s so many channels in the discord covering every topic you can think of, find whatever you seek and someone will be there to help you. Access to all these people who are so knowledgable in so many various spaces is something you should utilize and shouldn’t let go to waste.