How Do You Utilize This Data?

I had nothing to post this morning so I thought I’d go for a community discussion and share some things and get some feedback on how to improve on my end and show you some of the things other members are sharing. For those of you haven’t utilized the discord, when you become a paying member a welcome email came to your inbox, inside it is a link to the community discord, if you haven’t, you should join it, there’s hundreds of great people there sharing lots of great content. Within that, there is the general chat where most of us are all the time but on the side there are multiple other channels for others to share their musings

The current trades channel is an interesting one because alot of people post trades they’re placing and you can get ideas from other smart people on what they’re doing. The reason this is a great place is when you have that many smart people sharing their ideas, who loses? At worst it gives you a new concept to think about.

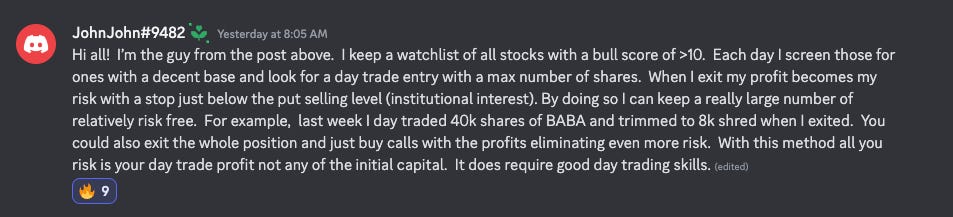

Yesterday there was a member who posted how he liked to utilize the data. This was the first post before he went into depth on how he uses various moving averages to help guide him, but this post was interesting because it made me step back and think about my own usage of the data.

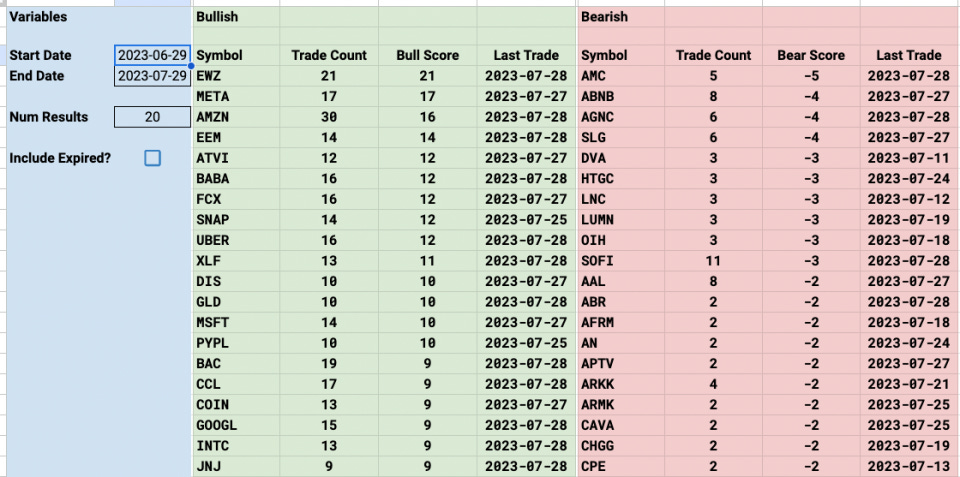

He basically took the the longer timeframe of the trends section I share everyday and came up with his own system where he focuses on the top trending names and swing trades them intraday. Now think about that, it makes sense. If a name is seeing repeated bullish flow over longer timeframes, you probably want to be in that name. Here are the top trending names of the past month and most are up ALOT. Granted the market is up alot too, but these names below had some of the biggest movers.

His personal approach was just focusing on the top trending names but with shares, a bit similar to my personal approach which is focusing on top trending names but via selling puts. This whole system was designed by me to catch what names are bullish/bearish so I can sell puts into strength and avoid names of weakness.

There was another member a while back who said he liked to focus on the names seeing weekly calls/ week out calls and waiting for the calls to fall dramatically 50% or more and then jumping into those. That’s another way to utilize the data of knowing when short term things are seeing a ton of action and focusing on them specifically.

The point is there are so many ways to use this data every week, there is no right answer, but what is so interesting when you combine all these people inside the discord you are taking all these intelligent people, and combining all their various knowledge and skillsets to learn new ways to look at and think about things. Utilize it, the greatest resource in life is not just access to smart people, but watching them in action. Everyone in that discord is friendly and outgoing, you’d have a hard time finding someone who wouldn’t explain to you what it is they do exactly with regards to the market.

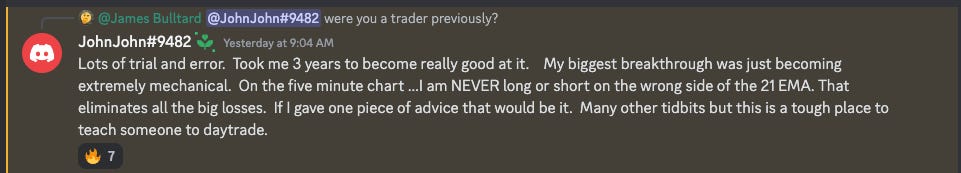

I always get questions on how to think about things and I truly think the best answer is to watch everyone else and ask questions, then try to develop your own system. My own system you see everyday came from years of trial and error, just like the guy above said the exact same about his method. He said it took him 3 years to get to that point.

What I’m trying to say is trading/investing is hard, there isn’t 1 right answer on how to trade. I’ve been trading 20+ years. When I began playing with the market I was a teenager and I was horrible I could never seemingly enter a trade properly. If you want to know how long ago that was, I was getting advice on Yahoo Message Boards. Anyhow, it was a place where I learned early on there were other driving factors to the market besides fundamentals. It’s taken me nearly 3 decades since to perfect my method, and everyday is still a learning process where you make small tweaks and you move forward with your approach. So don’t get discouraged if it’s not going as planned right away. There’s a whole room of people, many professional traders amongst all the other finance professionals, who are willing to help you if you just share what it is that is or isn’t working with your current trading. Use that. I wish I had that when I was younger. It would have taken a steep learning curve and shortened it.

You have the most critical part of trading down, the data showing what is being bought and sold on a daily basis shows up in your inbox everyday, once you can combine that information with a better approach on entering/exiting trades, you have all you need to win at this game. It’s about tailoring it to your needs. We don’t all share the same balances and goals. A person with a large account may want to sell puts into the pockets of strength, a person with a smaller account may want to buy calls, another may want to buy shares. That’s fine, in the end they all seek the same thing, wanting to know what stocks are going to go up in the short term. Therefore it’s great to interact on the topic and see how different people are doing different things with the same end goal in mind.

Comment below on what it is you do exactly and if there’s more you want from me regarding the data and how it is shared everyday. Is there something I could do to better the delivery? Is there something more you want me to add to the recaps. Adding the trades of interest 2 weeks ago has been a big help a lot of people told me, that’s a great thing sharing 5 chart setups and their option flows everyday so that seems to be a great addition. Is there anything else you seek?

Enjoy the rest of your weekend and I will see you tomorrow.

I’ll start posting some of my trades in the discord as I take them. Typically it will be a day trade trimmed to a swing trade position. You have to make your own trades... DON’T just try to copy or you will by nature have late entries and exits and not the same results. I just want to relay something I’m doing that is working well that perhaps others can model in their own trades.

Inspiring and resourceful James! Thankful for following you and knowing this community.