I Added A New Position This Afternoon

I don’t add things often, but I always discuss it in depth when I do, so now that I had some time this afternoon to overlook the newly opened option chain on IBIT, I took a long dated position and wanted to discuss how I’m going to use leverage and short call options to amplify a long bitcoin trade.

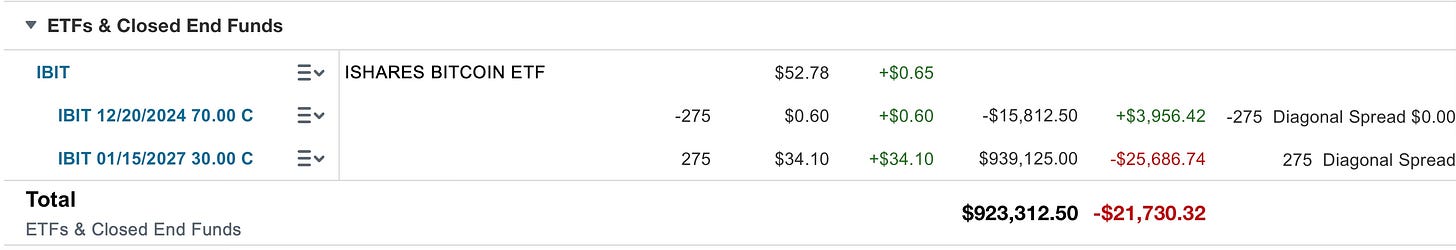

I first mentioned taking an IBIT stake back in early June in this post here at the time I was long IBIT but the lack of options on it kept me from staying in. I hate not being able to generate a return on a position via short calls. Even my AMZN leaps, I’m using short 250 leaps vs them effectively allowing me to generate income as I wait. Today was the first chance anyone has had to use options on IBIT so here is what I did. You can always check the volume when I say I did something and you will see them there. I utilized a 30/70 call calendar/diagonal/whatever you wish to call it. I took a leverage position via leaps and am using short calls on a monthly basis to generate an income/reduce my cost basis.

In this case here, I added all the long January 2027 $30 calls for a cost basis of around $35, I was on my phone at the hospital visiting my dad as I was trying to fill it and didn’t get the best fill but you try filling 275 calls on your phone with bad reception on a mobile app, it isn’t easy so paying up a couple pennies to finish the trade was fine with me. I also managed to sell the December $70 calls for .70 so instantly my cost basis on the trade is 34.30 or so.

That means over $64.30 on IBIT I am in the money. I have till January 2027 and I am in the camp Bitcoin is materially higher by then so my goal is to sell 30% or so out of the money calls on a monthly basis, get cash back and be long. If bitcoin happens to run over 30% in a month, I can close up the whole trade for a profit. You’ll notice I utilize these sorts of trades constantly when I go long like with WYNN a couple weeks back and that one blew up in my face as WYNN race 20% in a week and I had to close the whole trade for a win, smaller than I wanted. It’s my attempt at being conservative yet aggressive. Again, that is the purpose of options, to give you options.

What’s the worst case here? IBIT goes under $30 by Jan 2027. I lose all my money minus the short calls I’ve sold along the way. I don’t see that happening personally but anything could happen, bitcoin has been the best performing asset the majority of years over the last decade and now with all the options, the governments buying, Saylor adding, etc it seems fairly one sided buying on an asset in fixed supply.

Why the leaps vs shares? Leverage. I laid out a little under $1M and bought 275 calls which is 27,500 shares, the same amount of shares would have had me around 18,500 shares. So I was able to get 50% more shares just simply using deep in the money calls which right now are $23 in the money and I paid a $12 premium on top of that for 27 months of time.

I could have used $40-50 calls but again it is a large position and I want to be as conservative as possible, this isn’t me risking $20k on calls, I’m risking quite a bit so I have to be calculated in how I maneuver here. If I can get .70 a month over the next 27 months I get back nearly $19 from my $35 basis, meaning my basis is now $30 + $16 or $46. Is IBIT going to be $7 lower in 2.5 years than it is today? Anything is possible, but I wouldn’t bet on it.

So that’s my thesis, sorry for getting this out late, I just got home 20 minutes ago and wrote it up as quick as I can, you didn’t miss much if you tag along tomorrow. You are welcome to be more aggressive than I was, but try to think about the trade the same way I did. Look at short calls you can sell out of the money and think how you can work your way backwards should the trade go against you.

Love the thesis, appreciate the in-depth explanation (as always), and I can confidently say I speak on behalf of all those who get these that you never owe any "sorry"...what you offer all of us goes above and beyond what you have to offer - and what anyone else would share... so, thank you very much! Have a wonderful evening and good luck on all the trades (even though you don't need any haha

Great note today on $IBIT - really like your thought process on the trade, James! Wish I had the money to follow your trade idea here. Here’s hoping your next trade is a profitable one.