I Just Hit My First 100 Bagger: The Importance Of Risk Reversals Explained.

Apologies again for yesterday, we got internet back late in the afternoon and I added trades to the database which you can access in the link I sent out yesterday. I will also have the best idea for this week posted tomorrow but today I wanted to go over a subject very near and dear to me. Trade Structure.

Yesterday with CPNG closing at $23, I closed up the first 100 bagger I’ve ever drawn up on this substack for my weekend best ideas. Still it probably isn’t the most profitable trade I’ve drawn up as 2 others are still open and going very well with alot of time left. We’re going to discuss it all in depth down below, actually we’re going to look at 3 examples of trades I drew up as best ideas: one that worked quickly, one that didn’t, and the one that went for a 100x return in 7 months to show you what happened to the trades because of simply using risk reversals vs long calls. Remember these weekend best ideas are usually longer term trade ideas.

This is a topic I mention alot but I feel isn’t discussed enough by most traders on fintwit. Actually I don’t know any who talk about it other than myself. The importance of designing your trade for the best possible outcome. I saw this tweet below from a trader yesterday who got caught up in that FFIE mess, this stock went from .04 to almost $4 in a week in classic twitter pump and dump fashion. I actually saw that I flagged some weird calls in the thursday recap because it was odd volume for the name. Anyhow, this trader was right on by buying puts when the stock was 3.60 and although the stock fell over 50% in 1 session, she still lost money, how is that possible? Vol crush. Had she simply utilized a bearish risk reversal selling calls higher to finance the put buys lower, she likely would have seen a nice profit.

Again there is alot that goes into trading options that just gets thrown out of the window when the markets are just going straight up like they have for seemingly the last 18 months. Everyone looks brilliant with their trades. Usually, this game is pretty difficult, and this player learned a hard lesson in how it isn’t as easy as simply being right on direction and then buying calls or puts. There are so many complex trades from butterflies to ratios to condors but I mostly try to keep it simple to not confuse you with crazy terminology. Luckily, my favorite trade, the bullish risk reversal, is quite simple to explain, you just sell puts lower to help finance calls higher.

This gets me to the point I always stress with you all that you absolutely need to utilize these when you want to long a stock. Think of it like being a chef and being given a great recipe but you end up putting your own twist that great recipe. You see the trades the big players make when I highlight them and you need to put your own spin on it. Why do you need to do this? To reduce your outlay as much as possible. I always discuss that it’s very important because what happens is you can be right on direction and still lose money if the vol crush occurs when you’re just slightly wrong on timing. When you add in that small wrinkle of throwing in a put sale to the trade, yes it ups your risk, yes it eats up margin, but it also dramatically increases profits in the event you’re right. If you’re wrong, worst case, you can buy what is hopefully a good stock, lower than it currently sits. If you notice I usually target a support level where I suggest selling the puts because all you can do with quality names is go long at at good levels.

Now we’ll look at the scenarios I outlined above. First let’s look at the trade that worked out recently and how because of the risk reversal it worked out far bigger than the trade of the big player involved. In the March 16, 2023 Best Idea I highlighted NEM, here is the Link

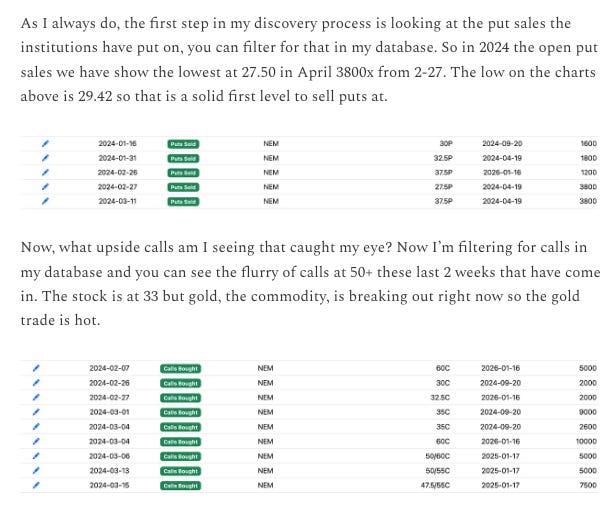

At the time, NEM was just under $34 and there were calls galore coming for January 2026 almost 50% out of the money along with aggressive put sales indicating buyers were willing to take shares nearby. Players were looking for a big move, you usually don’t see this much option flow in this name. Here was what I highlighted.

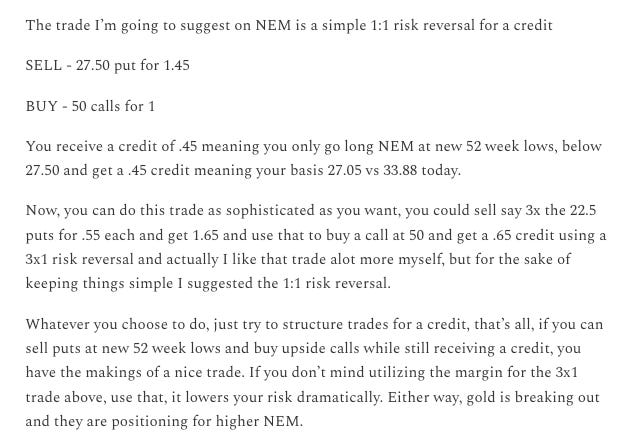

So I looked at all those $50+ call spreads for January 2025 and noticed straight long calls at $50 were $1. The problem with buying calls that far OTM is if you’re wrong just by a hair they get crushed and you can be down 20-30% quick. So I drew up a 1:1 risk reversal selling puts at 27.50 because the chart and option flow aligned with the put sales I was seeing above. If the stock was going to $50+, I figured a conservative 20% lower put sale would suffice in terms of risk to go long. The trade below ended up being for a credit, yes, it was put on not only for free, but you were paid .45 in total so the trade cost you absolutely nothing upfront. That was my structure. Let’s say you were right on direction, but not completely ie it moved from 34 to 42 you would have lost money on the long calls. With this structure, as long as NEM was over 27.50 in January, worst case you pocketed .45/share and moved on. If it was below 27.50 you would be buying shares at 27.05 which I felt was a solid value with the stock at 34.

What’s happened since? NEM closed yesterday at $43.74 up 30% since that post in 2 months and the trade above, it has gone perfectly. The puts sold at 27.50 for 1.45 are now .25, you’ve gained over 80% on those, and can close them up if you wanted to ease your margin requirements. The calls at 50 are now 2.95. Had you straight bought calls your profit would be the long calls going from 1 to 2.95 which is fantastic, a triple in 2 months is incredible. Instead, by using the risk reversal you’re getting $2.95 at the moment on calls that you were paid to take. You spent $0 out of pocket, so if you close up the trade now you made a fortune percentage wise because you’re walking away with $2.95 for the calls + $1.20 per share profit on the short puts for a trade that cost you nothing.

Now lets look at one that hasn’t worked yet, MTCH, which I highlighted on 4/6 here

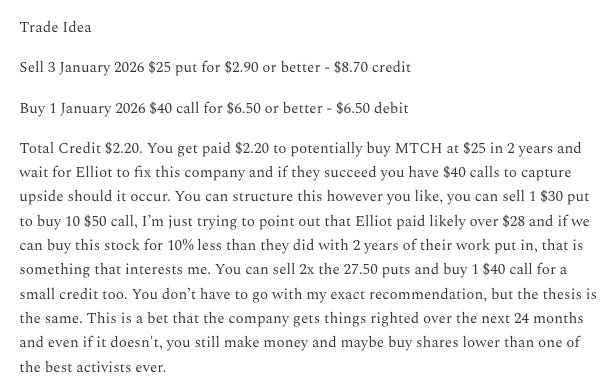

MTCH, I suggested an unbalanced risk reversal because I couldn’t find a 1:1 that worked out and I wanted to also receive a credit but buy the stock at bargain levels because it was acting horribly. The reason I was comfortable doing this aggressive 3:1 ratio was because an activist, Elliott Management, who I hold in high regard, was long the stock well above the $25 level mentioned below. At the time MTCH was 33.50/share and today it is nearly $31/share which is a 7% loss on common since. At the moment, the stock is nowhere near the $25 level where the puts were sold so I’m not worried about assignment. The stock would need to fall another 20% before that risk.

Now those puts in January 2026 that I suggested selling for 2.90, they’re currently 2.75 because although the stock is down, the IV crush has sent the short puts profitable! The long puts have gone from 6.50 to 4.55 for a sizable loss on those, but again, the loss right now is simply a paper loss. I got paid to put this trade on because of how I structured it. At the end of the day as long as MTCH stays over 25 this trade works. I see no reason it won’t with an activist holding a $1B position from higher and making changes. Elliott doesn’t lose often look at there with PINS and SU recently. The trade works even if MTCH falls another near 20% and ends at 25.02 in 2026.

My point of all this is anyone can trade options, but my goal on here is to not only help you understand how to read the options flow looking for the right direction, but to also help you learn how to set up every trade in a manner that works even should the actual trade not go as planned. That’s literally the definition of “options” since you have multiple potential outcomes not just 1 which most have when they usually go long a call or long a put.

Now for the big one. The CPNG best idea I suggested a couple months back going for 100x return from mid November when I suggested it until today when it expired here

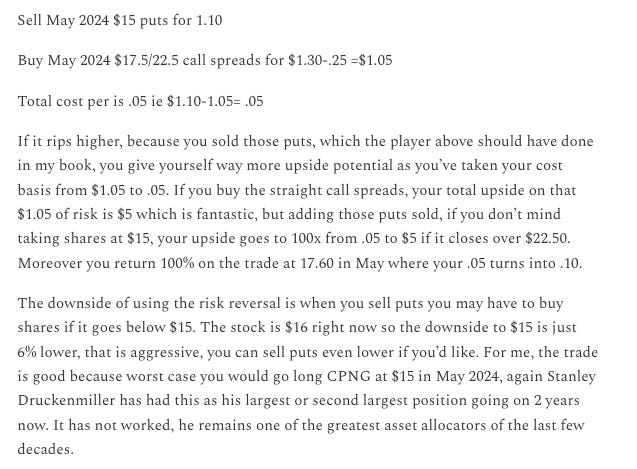

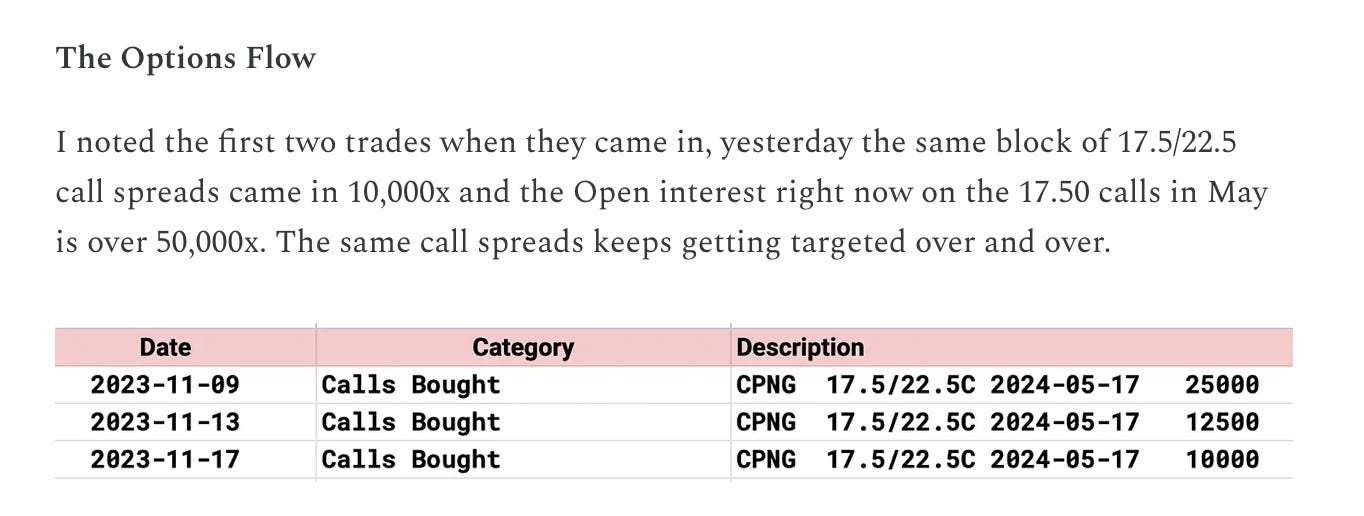

Coupang was seeing call buying galore targeting yesterday’s 5/17 expiry back in November. As you can see in the link above, almost 50,000 call spreads were bought expiring yesterday that went for full value over 22.50. Coupang closed yesterday at $23, pretty remarkable if you remember these bets were placed with Coupang at $16.xx. The stock went up nearly 50% since November far outpacing the market, those call buys were on the money with serious size nearly $5M worth at the time which turned into almost $25M now.

Now the max gain that player above had was great, they went from $1.05 to $5 for a full profit on the trade, but had that player just thrown in the short puts I suggested, the profit percentage would have been significantly larger because their outlay would have gone from $1.05 per contract to $0 and they would have gotten paid a nickel per contract so had the trade not worked as planned, they still would have profited a little or gone long Coupang at value levels.This was one of the best trades I’ve ever seen, it’s so hard to make a call on a name like CPNG rising 50% in 7 months and layout serious dollars to do it. Have you noticed the best trades of all the ones I highlight are when these players repeatedly hit far out of the money calls with time?

There were 2 that I highlighted in the last year that have gone for immense profits

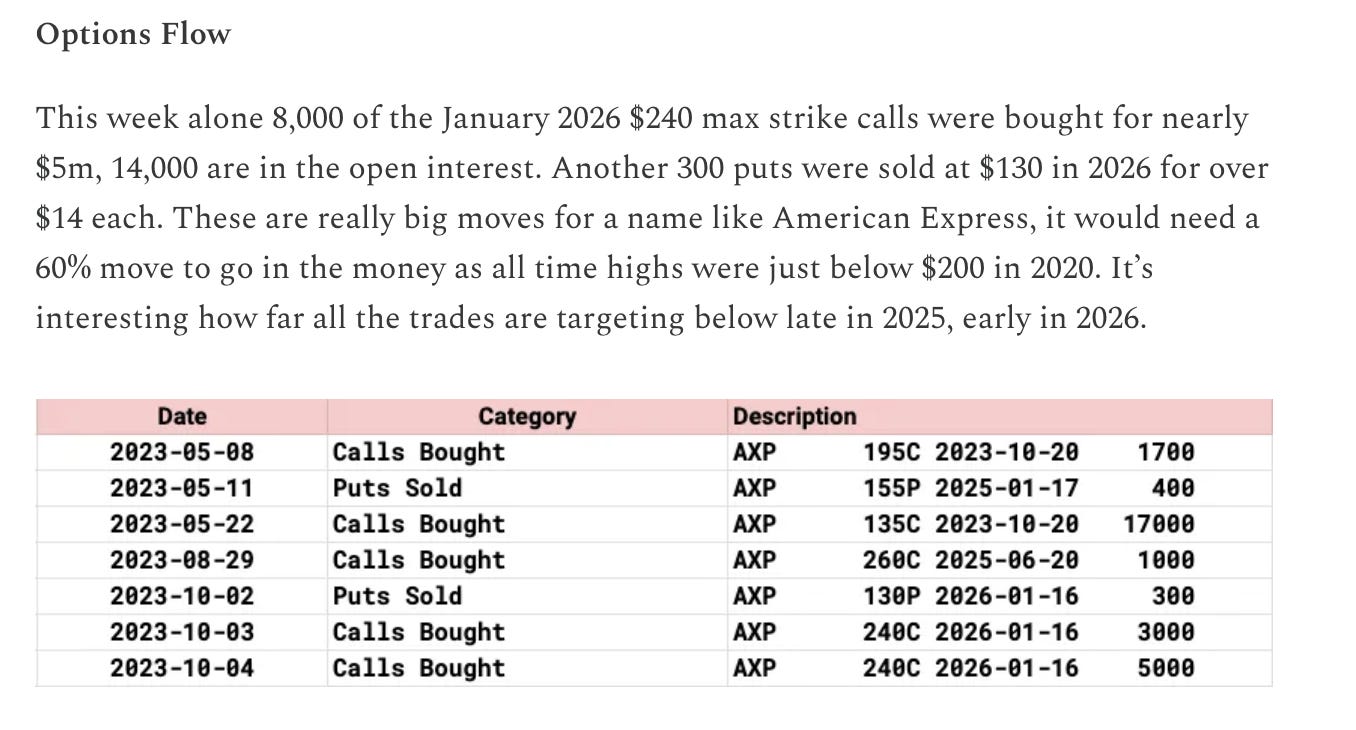

AXP - I drew this up as a best idea on 10/7 last here. Look at how they were buying January 2026 $240 calls when American Express was under 150. It is $242 today.

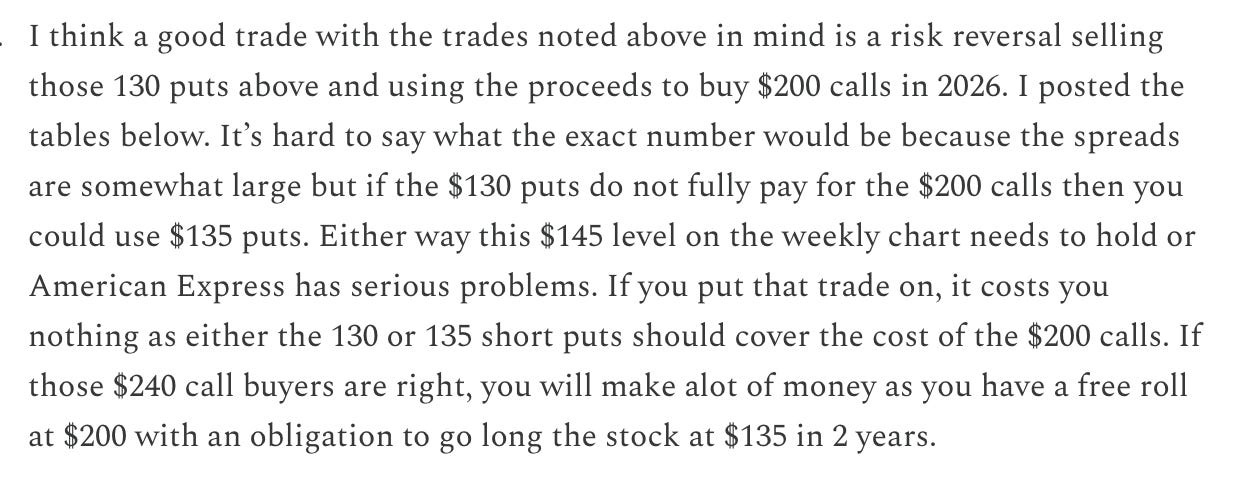

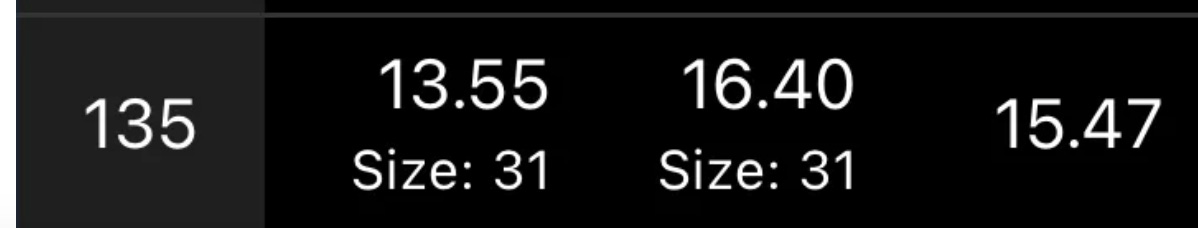

and here was the trade I drew up for American Express below, a 135/200 risk reversal in January 2026 which at the time would have landed you a small credit of around $2. Today those $200 calls below are $65.50 so yes you would have a 5x simply by buying calls back when I wrote this with another 2 years to go, those 240 calls are still in the open interest, but with the risk reversal in place you went with a trade that cost you $0 out of pocket and paid you to take the risk to a massive profit.

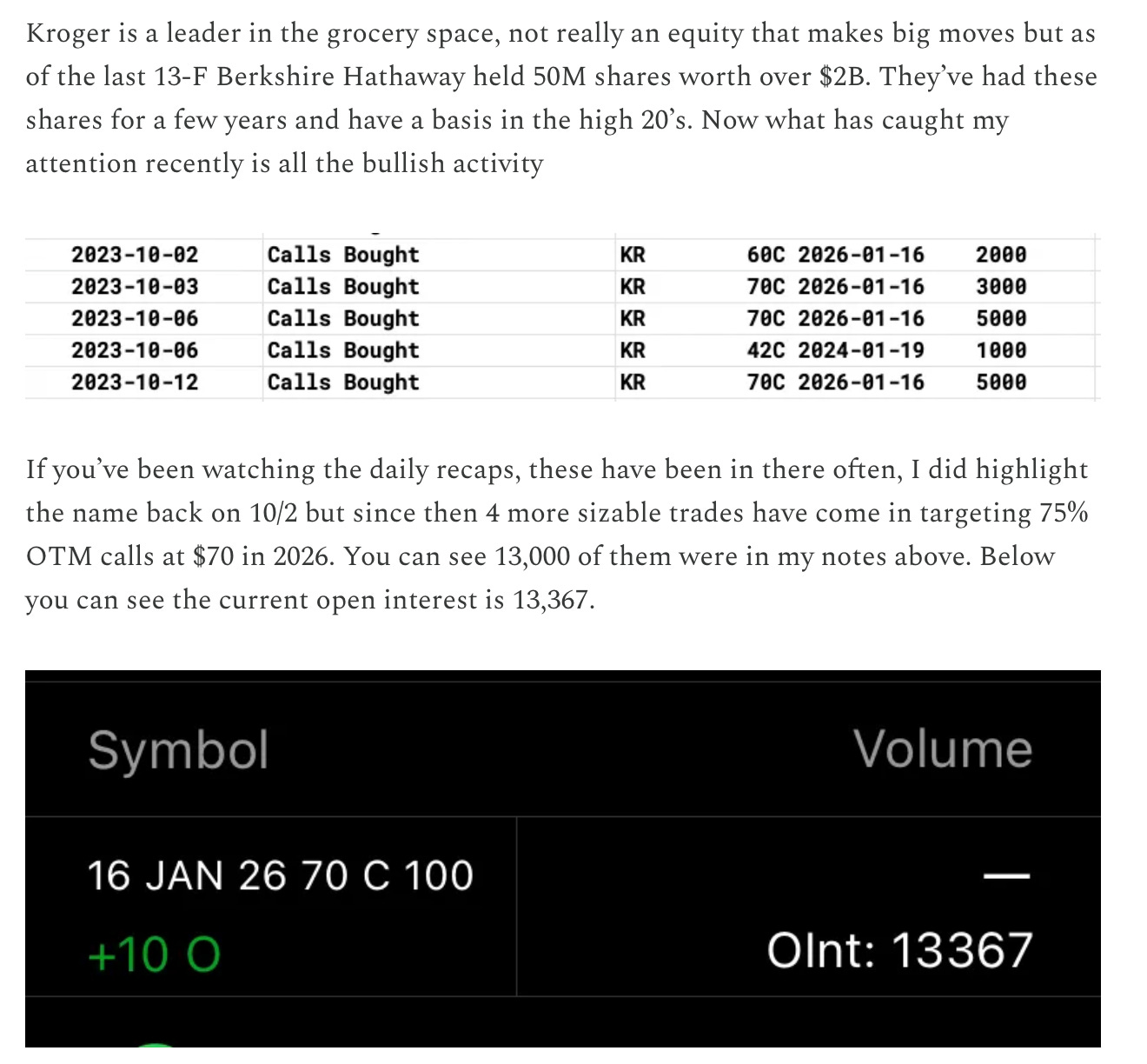

KR - On 10/15 last year I wrote up Kroger as a best idea Here

and here was the trade I suggested. Those KR calls haven’t even doubled even with the sharp move higher in a low IV grocery name, but the short puts have now plunged almost 70% sending this trade very profitable in the now 8 months since with another 18 months to go.

Just remember there are so many ways to utilize options, I have my own system, not every single trade matters. I think you see with me that I try to capture bigger moves in better names. I’ve built my process through years of trial and error and now you see the results, I’m able to consistently find these names just based on option flow and charts. You see my trade ideas daily, do I mention balance sheets often? The reality is equities are simply trading instruments, do most go up over time? Of course as long as they aren’t junk, that’s what stocks are designed to do, but what moves them on a short term basis is the simple flow of money and my goal is to try to find and highlight that everyday.

Over time you too will develop your own system. The only way is practice and losing money, no successful trader was great right away. You have to take some losses to see what does and doesn’t work for you. I know lots of great traders in the discord who discuss their own process trading this data and it is always interesting to hear how they utilize it in their own manner. Listen to them, they’re saving you alot of trouble. Ask them questions, they’re brilliant and friendly people. Utilize the community because it is a great resource these days and the reality is that there is not one style that is right for everyone. You can try so many different methods and find what suits you and your goals best.

As for me, you see my method and it took alot of tweaking on my end it to get here today. The main goal is simple: to use option flow for a guide on a direction and combine that with charts and moving averages to help guide how and where to structure trades in my favor. As I said at the top, this game isn’t easy, if anyone tells you it is, they’re lying. The only way to give yourself an edge is to utilize all the data available regarding option flow and to constantly sharpen your skillset trading wise to the point where you feel you’ve developed a system that works for you and your objectives.

Have a great day and I will see you tomorrow morning.

Excellent write up congrats on the 100bagger!

So mad I got shook out of the cpng trade 🤦♂️