I'm Taking Some Time Off

I wanted to write up something this morning going over why I’m taking a little break, reviewing the year I had in the market, and laying out some changes I have coming to this substack and the community discord in a couple weeks. I just longformed this starting at 4 am today and set the timer to send it so if there grammatical errors, mea culpa.

Why The Break

As you all know my dad has been in the hospital for just over 6 months now, from May 30th to be exact. We were told last night by the doctors that they expect him to pass away in the next day or two. Maybe we can eek out a few extra days but give or take this is it. He put up an incredible fight, but unfortunately this Merkel cell carcinoma was just a relentless adversary. I know most of us will lose our parents at some point in life, but my dad wasn’t just my parent, he was my best friend and idolized him. I can’t tell you how many days I’ve spent in a hospital the last 5 years, how many times I’ve heard that his cancer was in remission only to have another type pop up a few weeks later, and how many glimmers of hope we had the last 6 months that ended up being nothing. I cannot really put into words how much suffering I’ve witnessed these final few months but I’m just mentally exhausted and I really need some time off now. At least this coming week but possibly a little more.

The real issue is last year I took the last 2 weeks of the year off with how slow the market was in that timeframe and if I take say 10 days off now, I would return right into that period. I know the timing sucks. I could take the rest of the month off but I don’t want to let everyone down so what I’m going to do is post a link to my database and it will be open until the beginning of next year just in case I do.

The Year In Review

There’s not much to say, everyone that owned stocks did well this year. I really only made a handful of big trades, you saw all of them: AMZN,AAPL,FOUR, and IBIT were the big ones. I was so busy dealing with my dad all year I had to take longer term trades utilizing leverage if I wanted to outperform while not staring at my screens all afternoon. I really had no time, I’d do my work in the morning, share my recap and head to the hospital near daily for 6 months. I couldn’t hold short term positions because I just wasn’t around. I tried to look for names with repeat option flow and attack there. It wasn’t the approach I took in here all of 2022 and most of 2023 as I was trading daily and sharing what I was doing, but it worked and in the end that is all that mattered, here are the final results.

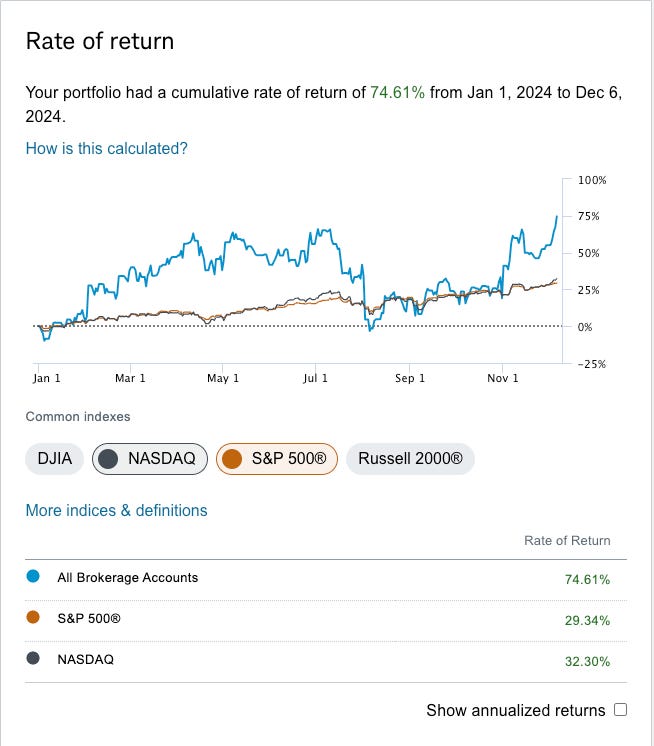

YTD I am up 74.6% vs 29.3% for the S&P and 32.3% for the Nasdaq. That big drawdown was of course right when Amazon collapsed this summer during their August ER.

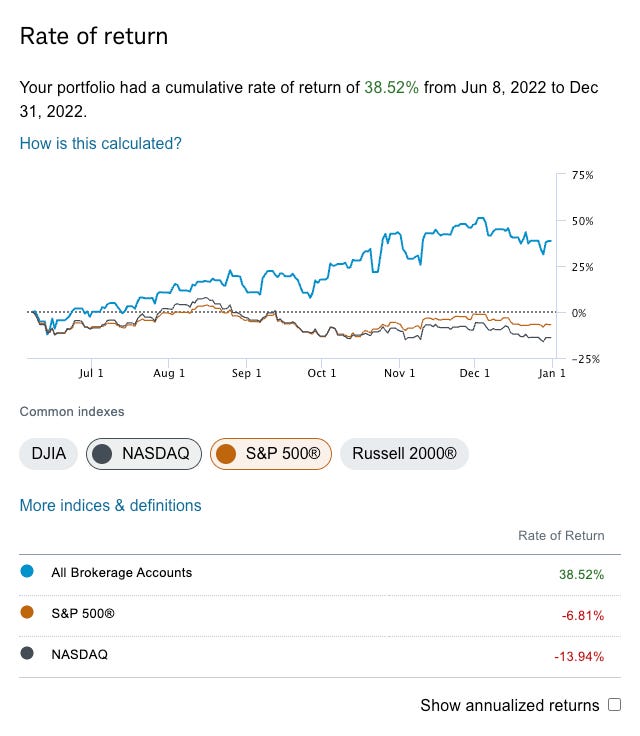

Since the time I begin writing this substack and sharing all I do on June 8th, 2022 I am up 344.33% vs 52.21% for the S&P and 63.12% for the Nasdaq.

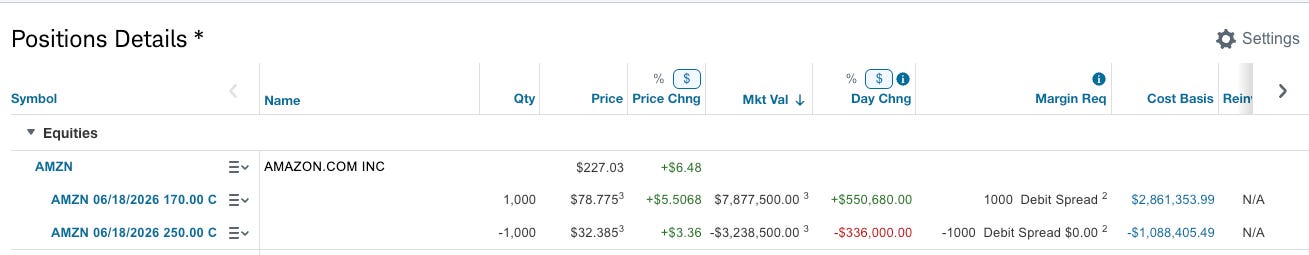

Should I have been up more this year? Yea probably but I’m extremely conservative, it has its pros and cons. Take my big Amazon trade below, I turned my $170 leaps bought in early 2024 into a call spread as Amazon rose, when Amazon crashed to $155 in August I looked like a genius but now that it has rallied, it has crippled my total return to a degree. The calls I sold for $13 are now $33 almost and are down huge technically but the reality is I capped that trade and now the max return on that trade is the spread $250-$170 which is $80 + the premium $13 so $93 total. The trade currently sits at $46.39 meaning I have alot to go until the max value of $80 is achieved simply if Amazon rises from $227 today to $250 by June 2026 on 1000 calls which is 100,000 shares. So yes, I am in an incredible spot right now where if I do nothing for another year and Amazon just rises 10%, I will make a fortune on a massive position. If you have these leaps and have not sold calls vs them I highly suggest you do even higher than I did at say $300 and try to recap some of your cost basis if you think you’ll be in the trade that long. I had always targeted $250 or so being my exit point because the max fibonacci extension off lows is there at 255 so getting $13 in premium for me was a $263 exit as I expect Amazon to stall around that 255 level when it gets there.

Looking back where this place began in summer 2022, I was just trying to share my musings during a market crash and how to still find pockets of strength in times of weakness. I still think that period was my best work ever just because I was up almost 40% during that timeframe in 2022 when the market continued red. A year like 2023 and 2024, everyone made money, it didn’t take any skill so to speak to do well. Everything went up, but those same guys posting how they’re up 300% in 2024 were crying in 2022 down 70% because all these growth names they’re in were getting slaughtered. In here though I shifted heavily to the Twitter buyout because of the option flow, I read the legal docs and made the determination Elon would be forced to buy Twitter and placed my bets. That was my first big trade gone well and a big part of why this place grew so quickly.

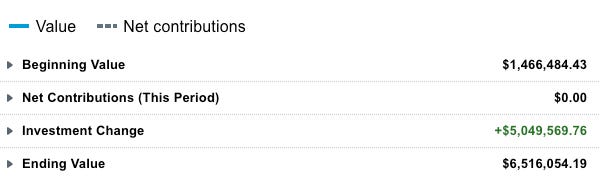

As you can see below from my Schwab account, I have not added 1 dollar to my book since this began. I haven’t had to take any out for taxes yet, but I may need to this April we will see. This was all supposed to be the money I was aggressive with and I did just that. I always told you all to keep your trading book separate from your investments because you want to be free to be a little reckless in how you size things up. I would never go all in with my investments but here I pressed it with leverage where I saw fit with Twitter and Amazon and you can see that a handful of trades was all it took to have some huge gains. Alot of you have similar account sizes to what I began with 2.5 years ago, here is your proof that a couple big bets can get you where you want to be.

I don’t know if I will sell anything into year end, I don’t have any losers to harvest although I could do something like close all my Amazon short calls for a massive loss, sell some Apple gains into it so my gains are offset and then reduce some of my Amazon leaps, but I’m really not sure yet. So I can’t tell you how my book will look when I come back but I may do some tax harvesting as there really aren’t any losers that I hold just some short calls that are down big and I can use them in my favor.

Changes Coming Next Year

The 1 change I’m making to the substack/discord is something that will not impact anyone who is currently subscribed, it will only impact new subscribers.

Starting late December all new subscribers after that will pay a significantly higher price but will have access to the live portion of the discord. Why am I doing this? Well substack refuses to offer tiers for whatever reason even though I’ve asked for it many times. They only allow 1 monthly payment option. A lot of you want to be in the live part of the discord but don’t want to pay for a full year till you try it. The problem for me was always having to manually add/remove people in there so it was a 1 year at a time thing. A member of the community built a discord bot that is tied to my substack and people will then be able to subscribe and automatically be added/removed from the 2 live channels. So even if you’re subscribed now and want to pay for the live part monthly, you will be able to you’d just cancel and change your subscription. If you’re interested in just the recaps, if you sign up before January 1, you will have them, after that you would have to just pay more for access to the recaps + the live discussion. So again, nothing is changing for all of you who are subscribed, you won’t pay more and you will still get exactly what you get now. If you signed up 2 years ago you will pay that same rate you signed up for, nobody will pay more if they don’t want to.

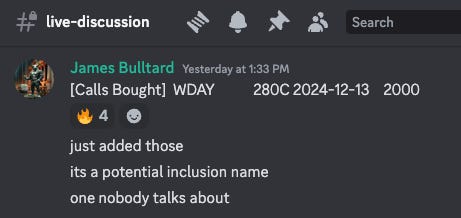

A lot of you ask me if the live part is worth it? Take yesterday for instance I send out the recap everyday mid day for those who want to daytrade off the data. Still even after I wrap up if I see something interesting as I’m logging the trades, I will note it for the live group. These WDAY calls came in at 2:33 EST for next friday, I mentioned that I added those to the database and they stood out because that was a potential inclusion name. Sure enough afterhours, it was included in the S&P and those calls are up 500%+ now.

So to answer your question of is the live part worth it, yes, the general discord is an amazing community with 1000+ people and lots of channels to discuss things. The live part is what it is, the people in there are just a more focused group of traders who are actively trading the data as I share it. You get my thoughts and their thoughts and if that doesn’t help you earn more than the cost then I don’t know what to say other than you probably need a new hobby. It’s not for everyone its very high paced but I’m trying to make it as accessible as I can for those who want it next year. So that option will be made available sometime later this year probably in the last week of 2024 as we get ready for 2025.

This has been a great year in the market, don’t press things here. RSI is max overbought, every name is at 52 week highs, just relax, there will always be new opportunities. If ever there was a time to take a break, this is it. Take some time off, I do think it won’t be this easy forever and heading into the inauguration would be a perfect time for a little volatility. Of course stocks will continue going up over the long run, they’ve done so decade after decade for a very long time.

As for this place, I could never have dreamed of having an internet community of this size ever, I’ve made alot of good friends along the way and it has been alot of fun. I don’t know alot of adults who actively look forward to going to work everyday, but I do. I get to do what I love and chat with alot of cool people everyday, it’s a dream really. I think those of you who’ve been here long enough see the real order of markets now. Most of the news coming will be seen in option flow, the key is understanding what you’re looking at in terms of levels to play off of but you don’t have to spend hours on end researching companies and their financials. When it is time, the big bettors who have done all that work for you will more often than not let you know what direction is coming.

Have a great end to your year, enjoy your Christmas/Kwanza/Festivus/whatever you celebrate. Will a few weeks off without data be hard? Yes and no, the end of the year is just slow anyways. Go enjoy some time off with your family, cherish the time with them and there will be plenty more money to be made in the weeks and months ahead. I feel bad about taking time so much off but I can’t help the timing of what is happening with my dad right before an already slow time of year in general.

James,

I'm sorry to hear that time with your dad is coming to a close. I lost my dad to a heart attack when I was 16. Like you, he was my best friend. Having come out the other side of that loss, I've got a few bits of unsolicited advice if you'd like them.

Losing someone that was foundational to your life will bring you into a deep season of grieving. That grief is more than likely going to be very different then anything else you've gone through. The things that carried you through hard times in the past, like faith, self-improvement, focusing on work, meditation, prayer...you name it. Those things are still important to lean on, but you'll come to realize there is no fix this time. There's nothing you can "overcome" with that kind of loss.

That's not to mean there isn't a great life to be had after losing your dad. But it is meant that if you are prone to a personality that might approach your grief as something you will "rise above". You can save yourself years of pain by realizing something very important.

Your grief is a reflection of how deeply you loved someone. You'll want to fill that hole and soften that grief because it's painful. But, for me, grief was the one experience I just had to sit with for a long time. Carrying it with me while it was heavy. But then, as time passed and as I was ready, grief got lighter. I could start moving about in my life again. Almost carving out a new life without someone I loved deeply. Then more time passed and grief was something I didn't so much carry anymore, but was more like a tattoo. Always there, wearing it, but didn't have weight anymore.

In that process, I was never once "in control" of where I was in that grieving. It was more like floating down a river for a season of life. Letting it take me where and when I needed to heal. As we all love to feel in control, the process of surrendering can be difficult.

As always, taking care of yourself. Don't isolate. Be surrounded by loving relationships and continuing to have purpose in life are absolute fundamentals during difficult times. Your dad clearly has left a profound legacy for you and your family. How lucky are we to have had someone to love so much that nothing can replace them? That legacy your dad has built in you will never leave you and only continue to grow within you. You'll continue to see reflections of his gifts to you in the people you care for.

Wish you and your family all the best.

Hey James, my condolences. I can feel with you and I got a deja vu about my own father one year ago. clearly not cool.

One question regarding the link you shared here, it works, but it seems that the option flow of the day is not updating. It always falls back to the 6th Dec. is it just me or is there a bug?