June 8th, 2022 Recap (A Sample Of What You Get)

This will be the only free post I make

Notable trade on Sierra Wireless($SWIR) - A large player sold 20,000 December $17.50 puts and used the proceeds to purchase a $25/30 call spread 20,000x. An odd trade in a name with nearly no options activity. I followed this trade by selling $22.50 puts expiring next week looking to get long shares at a lower level.

Moves I Made Today In My Personal Account

- Overall Happy With The Day

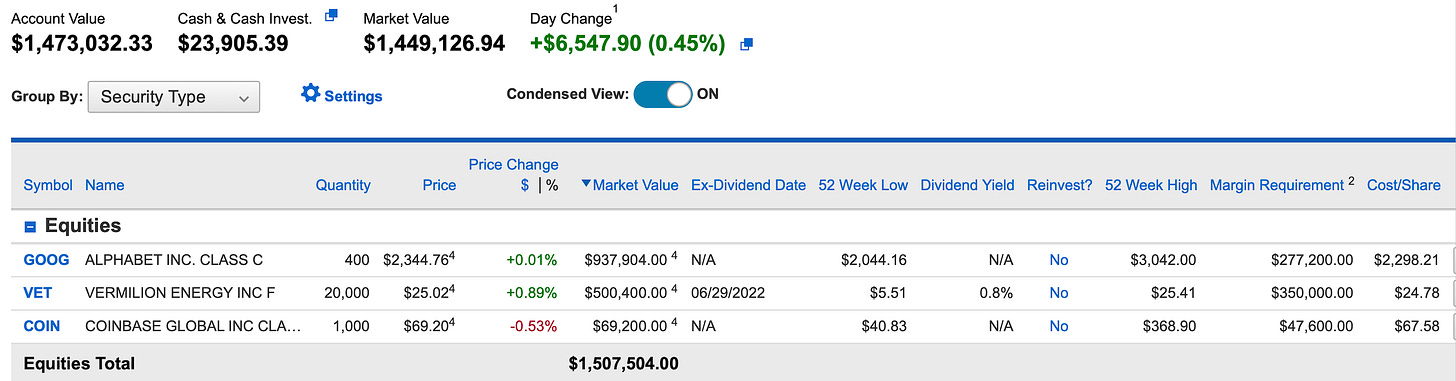

I ended the day up $6,547.90 while the overall market was red.

I took a stake in $VET at $24.77 purchasing 20,000 shares and sold an equal amount of $25 calls expiring next Friday vs the position for an average of .86. This is simply a technical trade on a very nice setup in a cheap energy name. This trade has potential to return a little over 4% in 7 market days if the stock closes over $25

I also sold 110 $VET $22.50 puts expiring next Friday for .21. Again this is a stock im looking for a move up in, the technical setup is right, I sold puts below to lower my average if it gets there.

I sold 20 $TTD $51 puts expiring Friday, its a big technical level for the stock and Im happy to get long there.

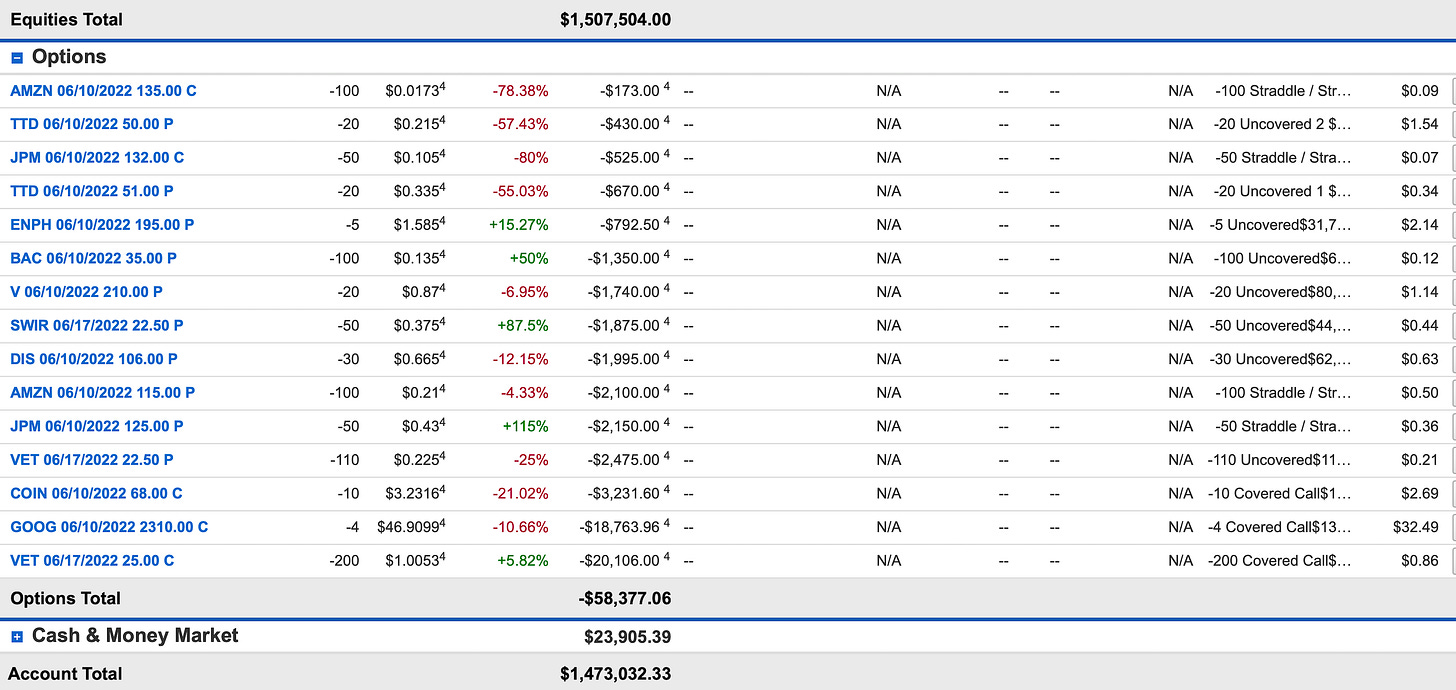

These are all the options positions I have open at the moment. As you can see from the graphic above, I am long only 3 positions right now. $GOOG at $2298.21 and you can see I sold $2,310 calls for $32.49 which would have me called away at $2,342.49 for a nice 2% gain on the week, if not, Im still long Google but at a basis of $2,265. Coinbase is the same deal I got long last week at $67.58 and I sold calls at $68 this week for $2.69 which would get me out of the trade at $70.69 a gain of nearly 5% for the week.

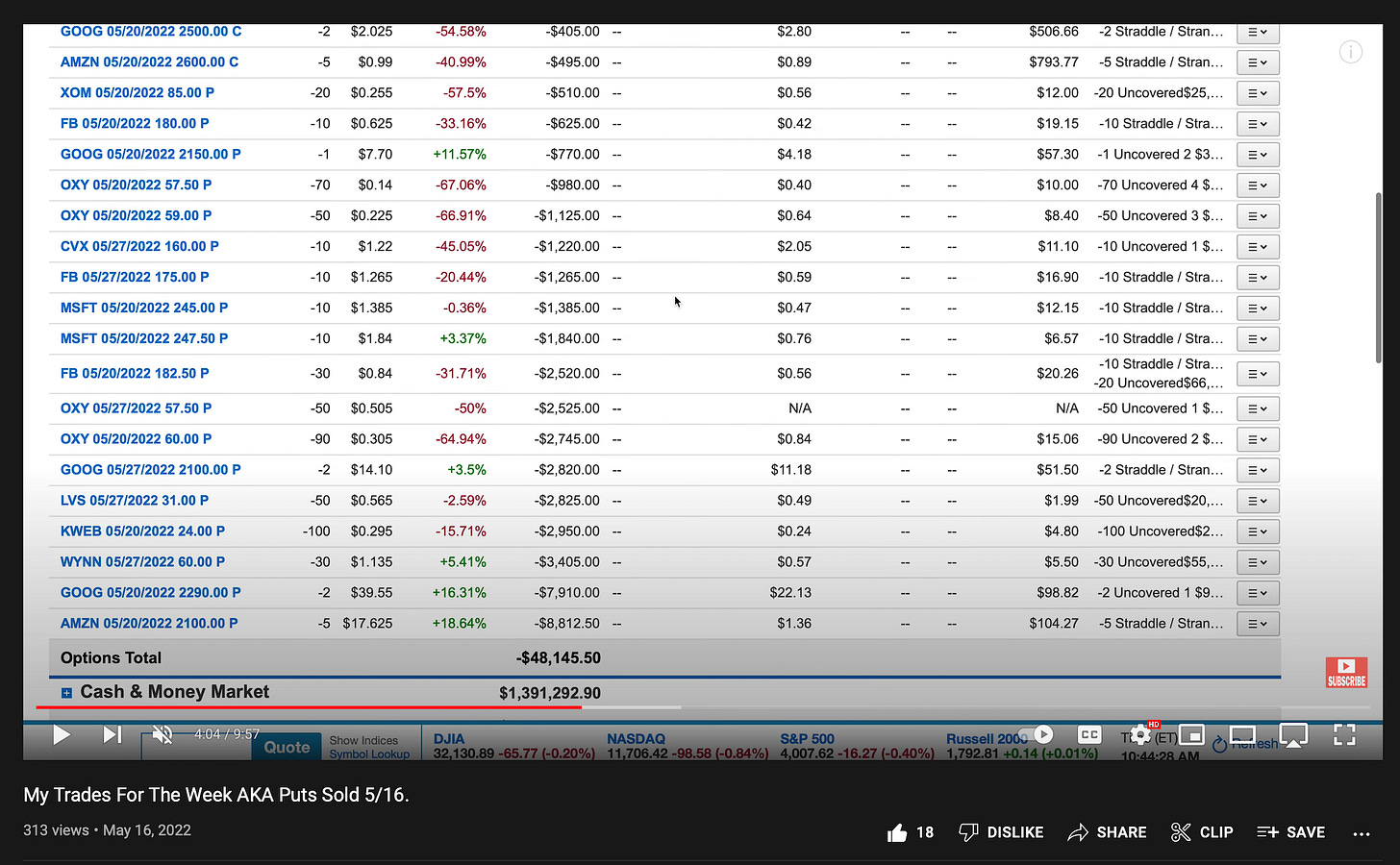

As you can see above my current balance is $1,473,032.33 if you go back to the first time I posted my portfolio on YouTube, the video posted on May 16th titled “ My Trades For the Week AKA Puts Sold 5/16” you can see clearly my balance was $1,391,292.90. Since then I am up $81,739.43 in a little under a month that’s just under 6%. The $SPY closed $400.09 on 5/16 and yesterday it closed at $411.22 so in that timeframe I outperformed the market by 100%. That is why I do what I do in terms of making the market come to me.

Other News Of Note Today

Dave Clark, Amazon WW CEO who recently “resigned” just became CEO of Flexport, a pretty substantial downgrade which implies he may not have resigned on his own will

Netflix rumored to buy Roku, I think this is a made up rumor much like the Amazon for Peloton rumors, no way does ROKU sell at these low levels, this reeks of desperation from a fund long ROKU

China stocks are all ripping on the support the Chinese government is giving the equities, the bottom for Chinese names appears to be in

Mortgage Demand falls to the lowest level in 22 years amid rising rates and slowing home sales, but this was to be expected, this was the goal of the fed.

All eyes on CPI Friday morning, will give us direction on the coming weeks.

Jobless claims as well tomorrow and a huge ECB meeting so be careful overnight holding longs

Favorite Chart For Today: $VET

The reason $VET is chosen for today is look at this setup. You can see the consolidation its been in since March and it finally broke out. Look at the MACD, the RSI, everything looks spectacular, now I didn’t want to get too aggressive with a name that’s run like this so I sold puts along with the shares I purchased I sold very aggressive covered calls bc I never want to be married to anything and this is just a very juicy setup for now.

What software do you use for technical analysis?

and

What is the best way to learn technical analysis?

Thank you all the videos. Love your work.

Could you do a follow up on LUMN?