Outperformance Begins With Being Directionally Right.

Monday morning, no market today, so I figured I’d put out a note on how I utilize the data I provide you all with. Obviously I post my entire book every monday along with all the trades I place daily as the week progresses, but I want to discuss how you should be utilizing the information I provide you with everyday. Let’s start with the table I include daily.

Just remember directional strength is the most important when you’re trading to the long side, so focusing on the strength and the levels is the single most important thing.

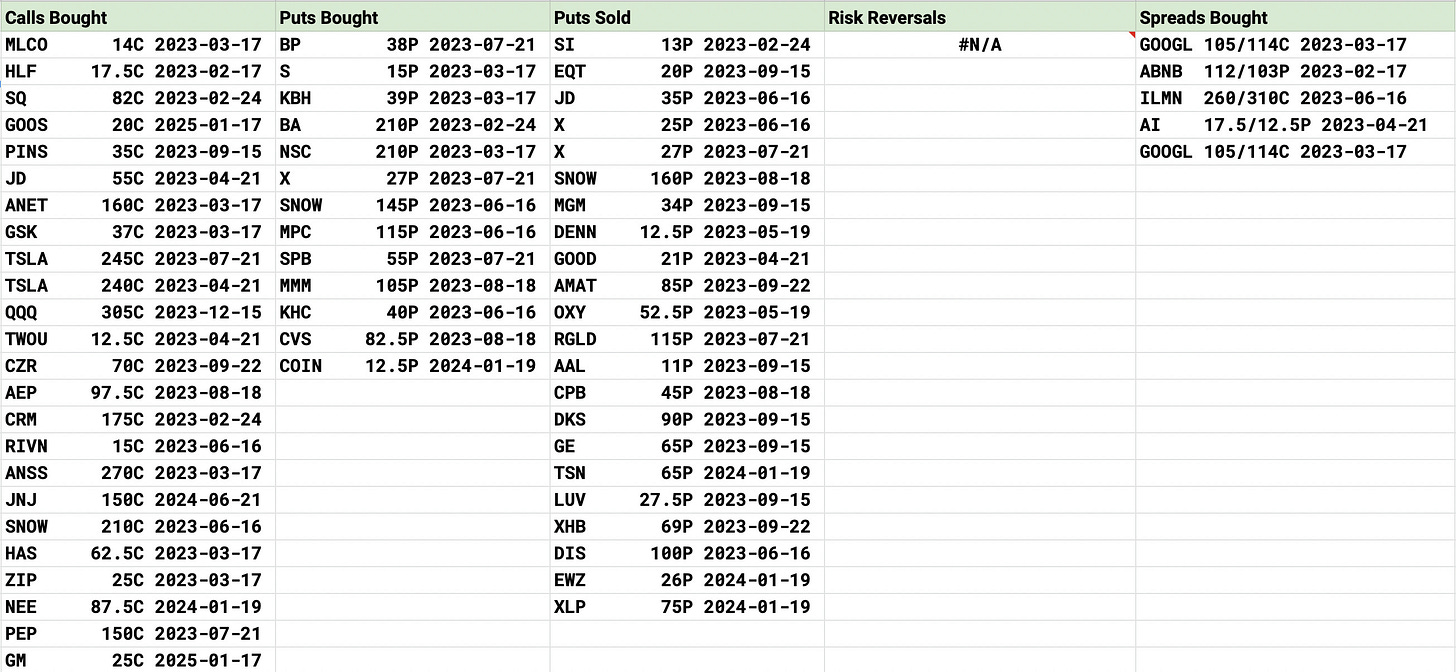

This is the unusual options activity from the 2/14 recap last week

When I post these daily, I’m giving you the institutional direction from the day. The calls and puts bought are many times hedges so it’s hard to look at those with much to gain from 1 day. The put sales are really more indicative of the levels institutes want to go long a name in serious size so I pay attention to that much more.

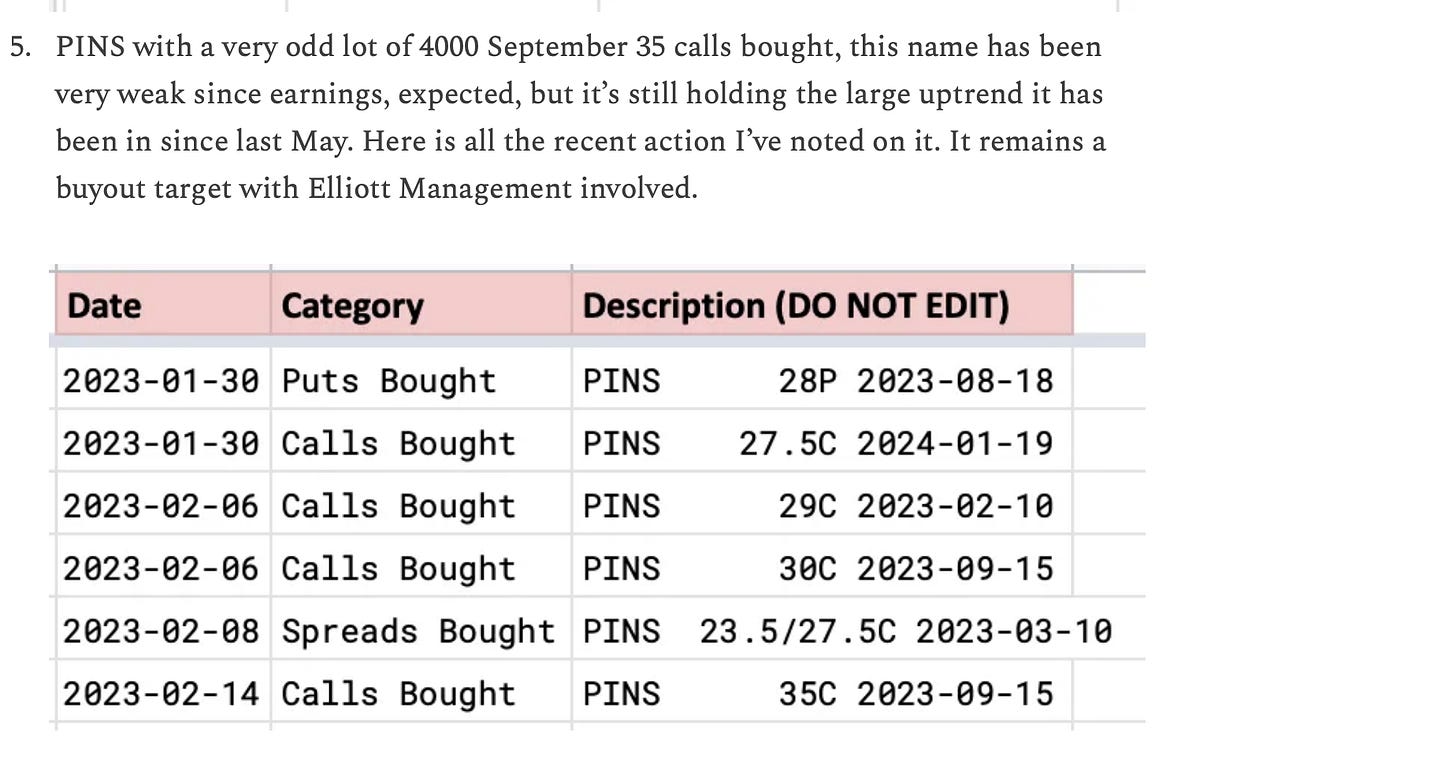

Everyday as you notice I post my best handful of trades daily along with the data I’m seeing in the database I’m tracking like this PINS note from that day

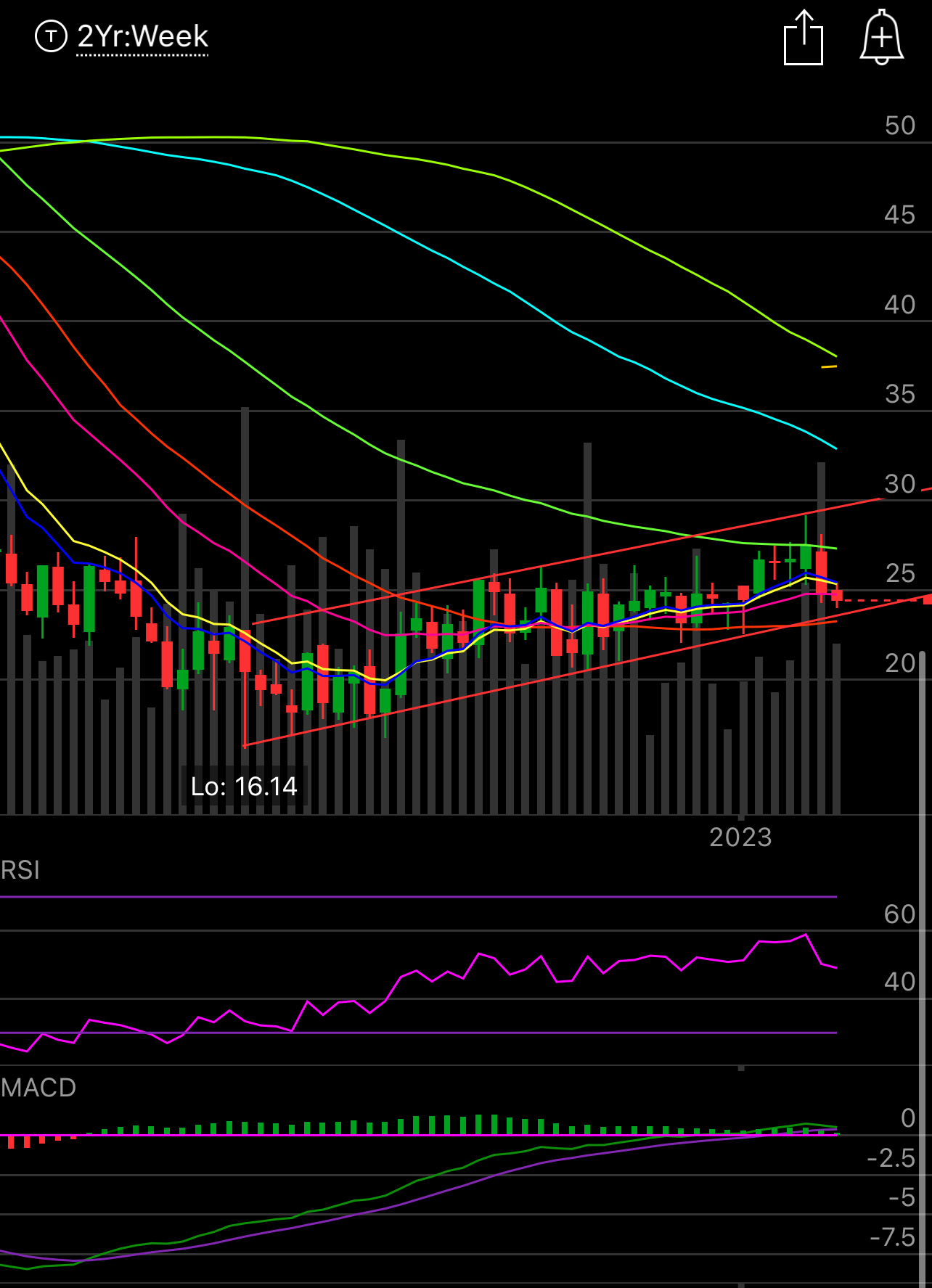

You see how there are 6 unusual sized bullish trades in that 14 day period. That is significant bullish demand. It isn’t just 1 trade. With that data in mind I pull up a chart, here is a weekly of PINS where you can see a clearly defined channel. I know what levels to be wary of if the chart breaks down from that channel.

Now as you notice the 52 week low is 16.14. What puts am I short? The 20 and 17.50 puts for 2024 which with the premiums received would place me in the name with a cost basis of 17.91 and 15.42. Why are those levels so important? Because for starters I’m not trying to go long the stock, I’m trying to make money without being put the equity, that is all. Now if I had to get long the stock, the levels I sold puts at are very cheap, hence why Elliott Management took their stake around them, I can take shares and sell covered calls down there, or if the equity comes down I can roll out my short puts to a further date and lower strike. Bottom line at that valuation, the risk is low. This isn’t me take PINS at 80 in 2021 and selling puts at even 50. It’s me selling puts at a rock bottom valuation with support from an activist along with directional support of institutional call buying looking for higher levels.

Get where I’m going with this?

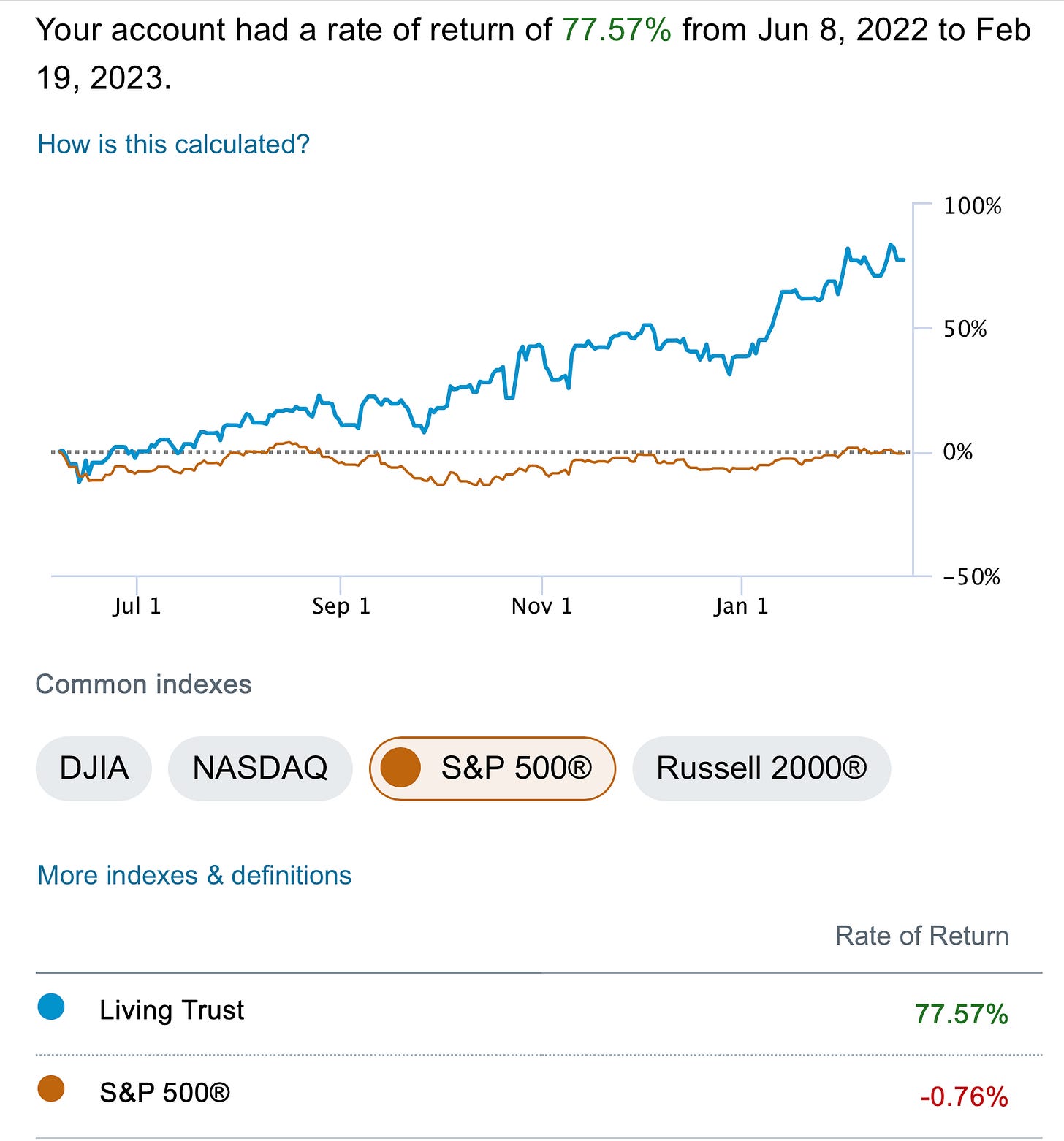

When I started this documentation of my process last June, it has been a straight move up, I’m now up close to 80% vs the S&P in that timeframe as you can see below.

People who don’t understand my thought process don’t get what I’m doing. I’m simply looking for directionally strong names and I’m selling puts into that strength at lower levels that’s all. Typically I do use shorter timeframes, but as I stated, around Christmas, I didn’t like the markets valuation and I tried to zoom out 12 months with the notion of a flat or down market I would still post 50%+ returns due to the leverage I was using. Even now, we are almost 2 months into the year and I’m up 4x what the market return is.

My point is this, I don’t want you to follow my trades exactly, I post my book every week simply to show you what I’m doing and how I think about things that is all. I’ve done this for a very long time at a very high level and I know how to manage my margin, you likely do not, it’s a trial and error process you will have to learn and get comfortable with. It isn’t something I can teach you, all I can tell you is my parameters which are that I try to maintain near 20% margin when times are about to get choppy like right now.

So to summarize it, I was replying to someone who asked a question yesterday in the comments on how I think about margin. I think of it like this. Pretend you’re buying a home, you see a home for sale for $1m but you want to throw your hat in the ring. You put in an offer at $600k, you know you’re not getting that home today, but that offer is open. 6 months pass and the homeowner has lowered his price to $800k but you’re still at $600k. The likelihood you get that home is very low, much like my far OTM put sales, but in the event I am put the shares it is at an absurd valuation.

So the process for me on selling puts is something like this

Follow the options flows and build up data on direction

Find a name that has seen repeated bullish activity, note the levels

Utilize charts to see what levels to go long at

Look at financials briefly to determine a valuations

Sell puts at a silly valuation

Wait for time to happen

See why I use leverage? I’m leveraging into all silly valuations on good equities. As you’ll notice, I never sell puts on Teladoc or Roku or some meme stuff. It’s always on high quality names with valuation support at a minimum. Around Christmas I tweeted Twilio was half cash

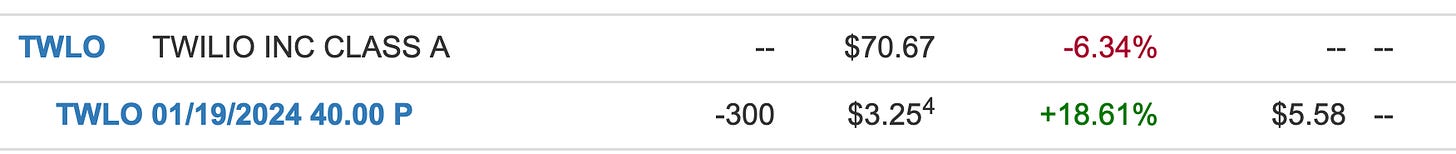

It is up 75% since. The options flows were all bullish as the time, the fundamentals lined up and I knew what a good valuation for the name was so I heavily sold puts to get long at 40 and with the premium received I would be long at 34.42. I knew that no matter what happened at 34.42 it was a steal.

Here we are 2 months later and the stock is now $70 and although those puts were slammed +19% yesterday and threw off my short term performance, I’m holding because there is another near $100,000 to be had in this trade for me if I hold another 11 months and let the decay happen. Which is why I tell you constantly to ignore short term day to day fluctuations and focus more on the risk of the trade actually going wrong.

As I stated early in the year, I figured with the longer term short puts most of my outperformance would come in the second half as the decay kicked into overdrive, but shockingly this quarter has been incredible. That wasn’t supposed to be the case. I do expect to have some really rough days in the coming weeks simply because I’m levered up on the short puts and the market looks like it wants a bit lower, as you can see with TWLO above, 1 day can send your puts up 20%, but as I stated, I’m focused on the long term here and that is that Twilio will not see sub 40 this year and I still believe an activist gets involved before June there.

Anyways, just wanted to give you a little insight into how I utilize the data I post daily in my own way and how you can use it in your own direction.

Don't want to Jinx it (which i probably will but whatever) but I think i'm finally getting the hang of this option selling thing and not throwing cash at the leveraged index ETFs and/or degen earnings plays and just hoping for the best. I made my first real killing as an option seller last week selling CROX puts. I know it's not a name that you trade but I've been watching it and I feel pretty comfortable with the action to be able to finally get some skin in the game. I love the idea of buying puts lower at a level that you would be comfortable going long at and just rinse repeat. I don't know why it took me this long to finally practice what you preach but now it's all I want to do. You the man

Very nice explanation and post. Thanks.

Is there any chance you could make the database of unusual option trades available to subscribers so that we could look up stocks we are interested in?