Q1 Recap

I always look forward to these quarter end recaps where I can talk about where we’ve been and where we’re going. I don’t even know where to begin with this market, this has been the easiest market I’ve ever dealt with for the last 5 months. After the covid crash, while it felt like we went straight up, the VIX was elevated and the moves were chaotic. This melt up that we’re in has been with the VIX mostly glued sub 15. For those who don’t understand what I mean, think of the VIX as a gauge of the daily moves in the market. The higher the VIX, the more hectic things get. We spent most of 2020-2022 with the VIX between 20-35. The VIX peaked at near 86 during the covid crash, the last 5 months it has been hovering mostly around 12-13. There has been zero fear, just a daily repricing of assets higher.

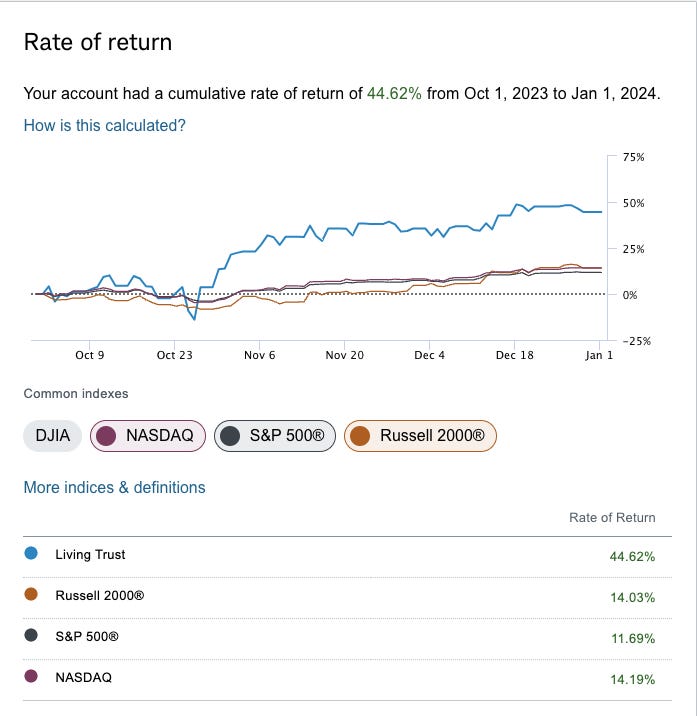

I can’t complain because I’ve made a ton of money and you likely did too. I thought last quarter was the best quarter I’ll ever have with a 44.6% return

Then this quarter happened and I returned 46.93%.

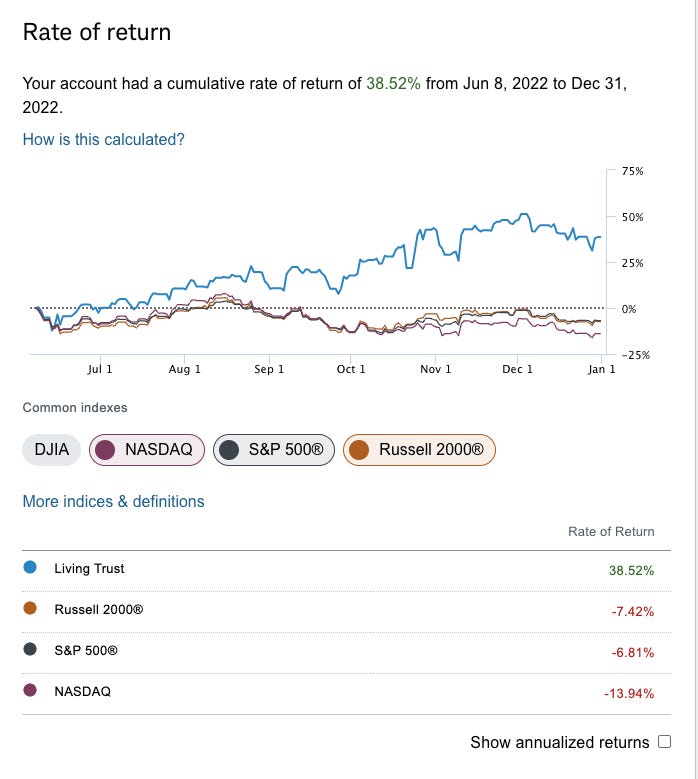

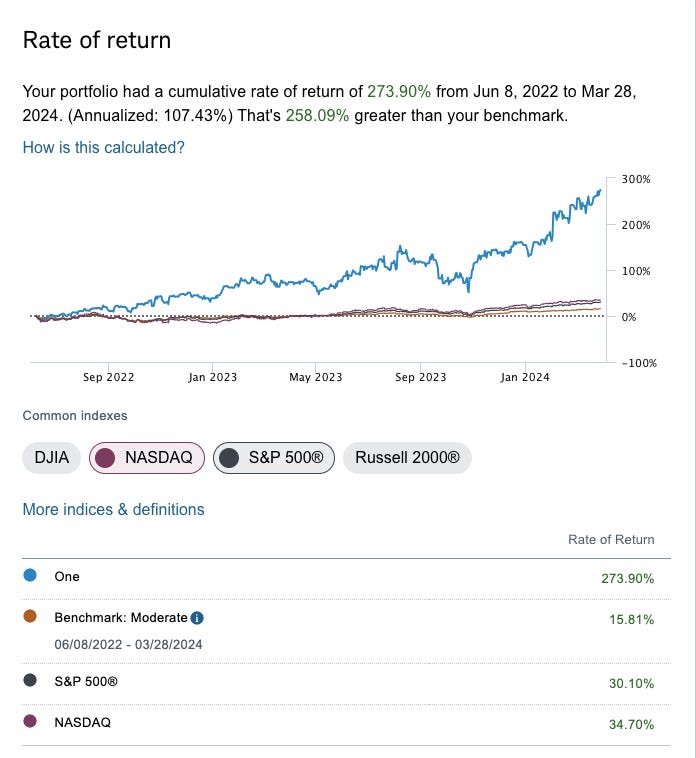

I don’t think I can put into words what these sort of returns mean. Look, I expect to outperform the market every year, but I expect it to be challenging. Take 2022 when I began this publication June 8th of that year, that was in the middle of a very rough period, the market was down 7% the rest of the year, tech stocks were down 14% and I still managed a 38.5% return. That was fun, we didn’t go up every day,I felt accomplished. My job is to find pockets of strength in the market and execute on them, I did that. It wasn’t easy at all.

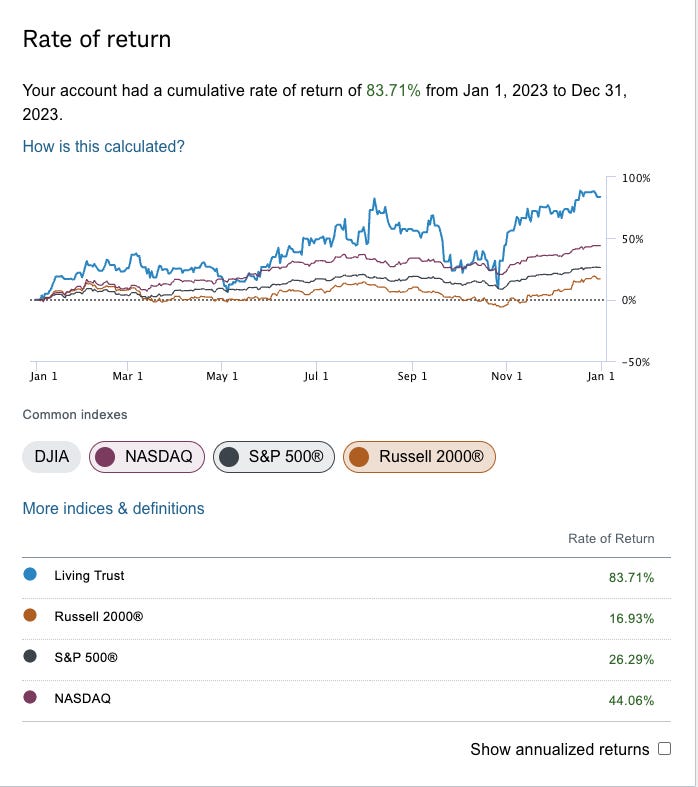

Then 2023 happened and we began to just slowly melt up and in May of 2023, I realized it was pointless wasting time going through individual names because the slow melt was beginning and I just levered long Amazon because I felt it was probably 100% or so undervalued and my options database showed it to have by far the most bullish activity so I went all in. 2023 ended with an 84% return for me vs 26% for the market but again, this wasn’t really an accomplishment everything went up, me a little more because of leverage, anyone with a pulse did well last year.

I don’t expect it to be just putting on a little leverage and watching my net worth go up every week, but that’s what 2024 has been, a continuation of 2023. Below is a weekly chart of the SPY this year, not even a blip to this point.

This isn’t really fun. There is no challenge. There is no skill required to operate in a market like this. You have amateur “growth” investors on Twitter who were on the verge of committing suicide in 2022 trolling fund managers on Twitter. The notion of managing risk just doesn’t exist at this point anymore. The market has always been a casino, but today with the fed injecting liquidity combined with the rise of options trading it has basically become a fire truck shooting gasoline at a raging house fire.

What lies ahead? As I mentioned yesterday, some weird stuff is going on with commodities, they’re signaling the complete opposite of what the fed is telling us. They’re saying inflation is surging. We just closed yesterday with the XLE at its highest monthly close in a decade, the XLB(materials) closed at all time highs, gold closed at all time highs, financials closed at all time highs. You get the point, EVERYTHING WENT UP. Crypto went nuts this quarter with Bitcoin topping $70,000 and somehow being a laggard as all these other junk coins like Jeo Boden, a meme coin of our president was up 160,000% last month.

My plan? I’m staying the course, I put on my large Amazon trade last May and forgot about everything else. It has worked very well and I’ve outperformed the market dramatically since. I rolled it up once along the way to my current positioning which is my call calendar using the June 2026 170 calls and I’m short 900 of the January 2025 $240 calls and 400 of the June 2025 260 calls vs my position.

The 170 calls are $10 in the money now, they were $30 out of the money when I put the trade on, while it is easy to say “why don’t you just roll up to catch more upside” the answer is this trade is up enormously and at this point taxes are a major consideration for me. I don’t think there is any point of worrying about the rest of the market because outside of NVDA, no megacap is going to see growth like AMZN this year. Look at the list below post by Brand Muchen yesterday.

With 74% EPS growth this year and a PEG of .5 I don’t think you could find a better positioned megacap than Amazon and assuming they just execute this year, which I don’t doubt they will, the stock should be much higher by the time I can cash in some of these for a long term capital gain. Realistically, if I didn’t want to place another trade until June 2026 there is I’d say a greater than 50% chance Amazon is north of $300 and those $170 calls that I paid $28 for are over $130 a piece. The math is easy: By end of 2026 Amazon should have $300b in cash + $120B of FCF. That’s easily a $3T+ company which would put it at $300/share. Of course, that is why I’m so leveraged to this trade, I didn’t just pick a name out of a hat. Math always wins in the end, as Tesla investors are finding out today.

Yea yea, of course I had to throw in a Tesla barb, come on, its me and I’m patting myself on the back, do you know how hard it was to fight the hordes the last few years Tweeting how overvalued Tesla was and now seeing it be 60% off 2021 highs amidst everything going up? I don’t waste time shorting stocks because it is significantly easier for me to find something that will go up with all the options flow coming in daily.

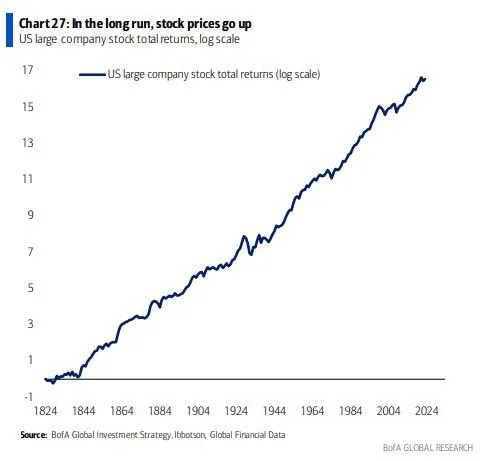

Also I don’t waste much time trying to short stocks mostly because of the chart below. Stocks are designed to go up, why waste time trying to fight gravity? Just find the pockets of strength and focus on those I find is a much easier strategy than trying to be a hero.

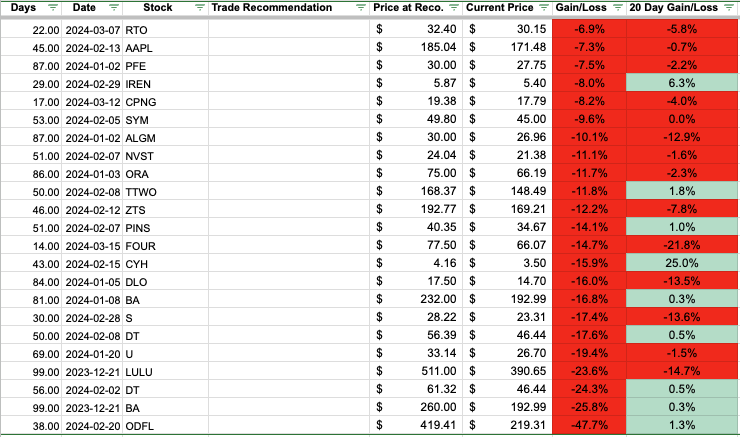

Speaking of option flow, here are the end results of the trades I highlighted this Quarter:

Here are the gainers

Here are the losers

First off, thanks to Luckmaster for putting this together we can have a visual of all these trades I highlight daily. Secondly, ODFL is not down 48% it just split and is up, so removing that, these don’t look too bad. The final tally of trades I highlighted are

16 had double digit losses

63 had double digit gains

Again these are gains on common. The column on the far left is days from when I highlighted the trades based off the options flow I post. That first graphic, look how many names are up over 18% from when I highlighted them.

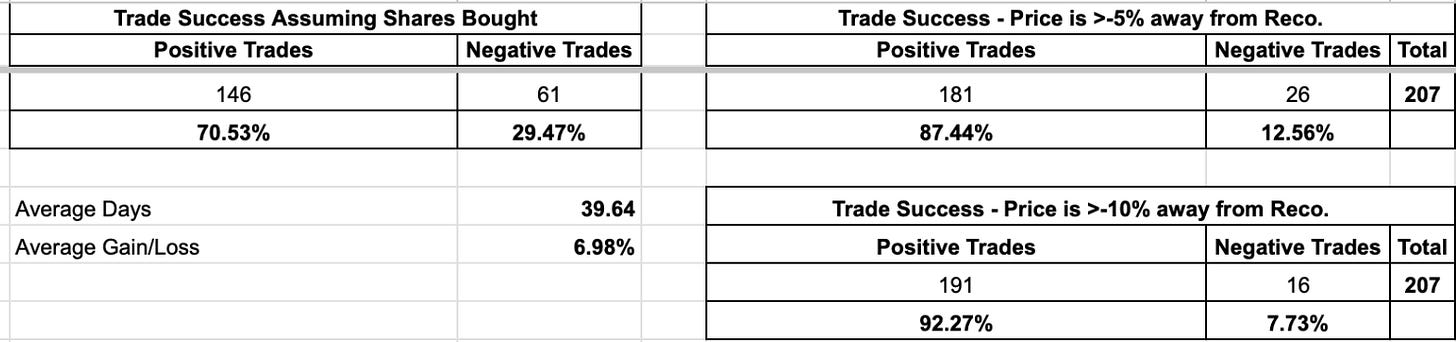

Overall, here was the final data. 70% of trades worked if you just bought common, 87% worked if you sold puts 5% away and 3 weeks out and 92% worked if you sold puts 10% lower and 3 weeks out.

You can say whatever you want about bull market and everything up, but I’ve done really well in the middle of a bear market too. I’ve got a unique approach when it comes to options, but it works. The proof is in the data and now I’ve got 22 months of posts, there’s 600+ of them in archives, and every trade I’ve ever noted or taken is in there. From the inception of this substack I am now up 273.9% vs a Nasdaq up 34%.

The reason I outperform regardless of market up or market down is because I have a process and I stick to what I’m seeing within the options data and position myself in the right names over and over. There is always something that is being bought and I keep an open mind to what that is and focus on that.

Building this community has been fun. You spend your life managing money and honestly, it isn’t fulfilling. No matter how much money you make, you sometimes ask what your purpose is in life. I’ve spent the past decade watching doctor after doctor perform lifesaving work on my dad. From his lung transplant to multiple battles with cancer, these doctors really change the world because they impact families. Me, I just click buttons, nothing too special. Nobody really sees what you do. Being able to explain more about my process to thousands of people online and hearing their feedback on how they’ve implemented it and improved their skillset or their trading ability to better their lives is something you can’t explain until you’ve felt it.

When I began doing this in 2022, I didn’t think this would ever become a full time job. I was just at home and bored and began to put my musings into writing. Today it really has become a full time commitment, there’s 700 people in the discord alone and almost 3000 get my daily emails. This is beyond anything I ever imagined. The reach you have with the internet is honestly insane. I’ve made so many friends on here along the way and I’m always happy to hear your stories about how you are getting better. At the end of the day, when people set out to do something, they do it because they see a need for it. For me, I felt like in the middle of the 2022 market decline there were too many people posting on Twitter who just didn’t understand how markets work, I still feel that way btw. These people really thought deep dives on financials mattered to making stocks go up but the reality is they don’t and once charts broke down and option flow was very bearish, we were set for a decline. My goal was to explain how markets moved and what moved them. I think you’re seeing now more than ever that so many of these little options trades catch moves before they happen and if you implement your own twist on it the way I do by taking my knowledge of more complex options strategies like risk reversals and deploying them at key chart levels, your edge in the market rises dramatically.

I know some will say if you have a process that works why share it? I say why not? It’s not like it harms me in any way to have more people understand how to trade properly. How is me sharing my process any different from anyone who thinks writing an 8,000 word deep dive on a stock matters? That is their process and this mine, if someone implements whatever my approach is to a ticker I’m not in, it doesn’t affect me. What do I care? I’m just sharing my approach of how to look at the options flow and place a trade based on a chart, this isn’t some patented thing, it is just the end result of years of trial and error. If it didn’t work, you all wouldn’t be here, but it does.

Long term investors often get this arrogance that charts don’t matter, option flow doesn’t matter, etc. The reality is over time, everything goes up, it doesn’t take a genius to tell you that buying quality names you will make money over time, again that is what stocks were designed to do. My objective is to outperform the SPY. To leverage up at the right time, to delever when charts break. If you can’t do it, then what are you wasting all this time for? In my case, the time spent doing this the last 22 months was worth it when you beat the market by nearly 10x over that time frame.

I will have a best idea post for you all tomorrow, enjoy the day off.

James, you’re a superstar. Much respect.

Great recap! I agree, it doesn't feel too rewarding to beat the game while it's on easy mode, but seeing abundant increases in net worth is something I can get used to in the meantime. Looking forward to see more of what 2024 has to offer and what we can do with it. Cheers!