Q1 Recap: I Returned 26% & I'm Disappointed In Myself.

This is a quarterly recap post, I will have my best ideas and charts for this week in tomorrow’s post.

Great Quarter but the headline wasn’t a typo, I returned 26% this a quarter and I feel like I failed. Who didn’t make money this quarter? This past week was insane, the whole quarter was surreal, it felt like everyone was rushing to get long every tech stock before the quarter ended for a little window dressing. The panic buying was nonstop the last few sessions and we ended the quarter on a strong note.

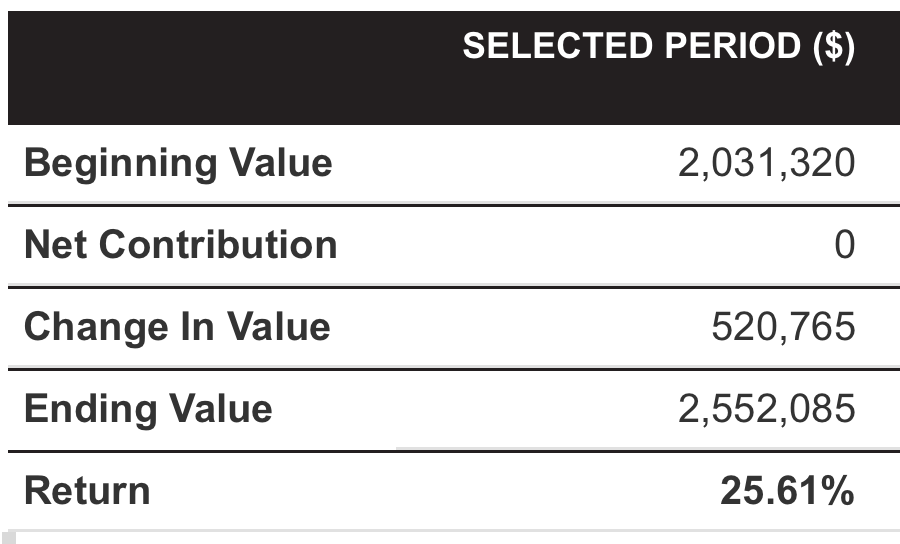

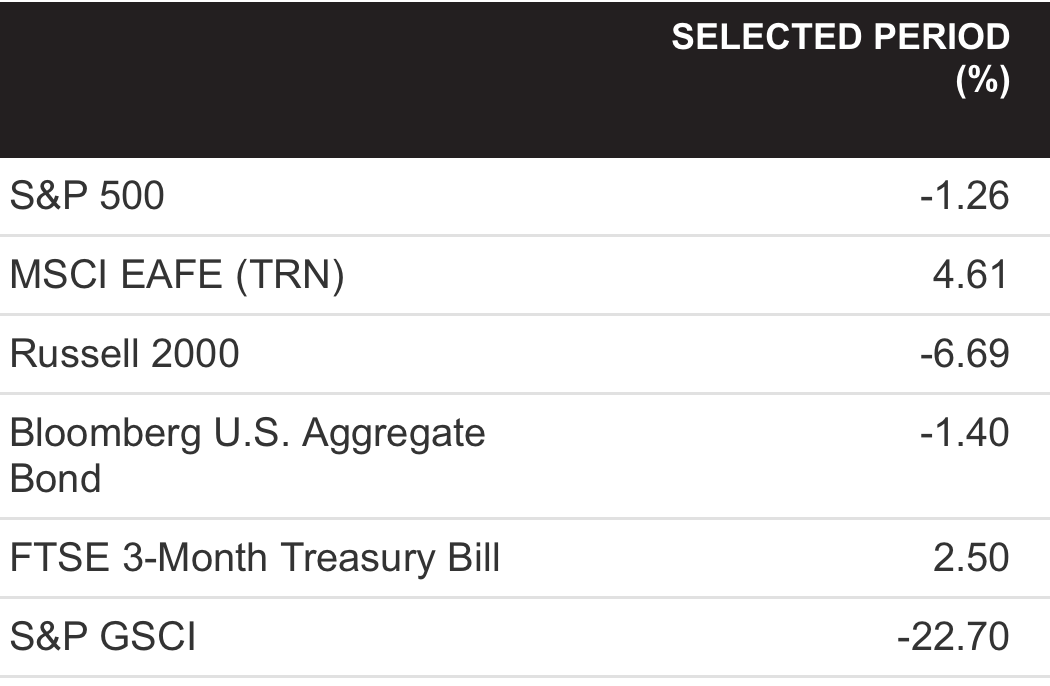

For the quarter I closed up 25.6% vs 5.96% for my benchmark, the S&P 500. This is a great result don’t get me wrong.My only 2 other recaps have shown similar results since I began chronicling this journey last June.

Q4 2022 Recap - I Beat The Market By 10%

Q3 2022 Recap - I Beat The Market By 26%

So why was this quarter a failure? While this quarter was great and I’m thrilled to have done so well, the reason I consider this quarter a failure is because this was about as easy a quarter as you could ever ask for and EVERYONE did well. I went through alot of trouble when I could have just been long the QQQ or Amazon. While the S&P lagged due to oil and banks, the Nasdaq was on fire and closed up 20%. These quarters annoy me because as a put seller, when everything just goes vertical you are just playing a slow and steady game. Worse, you have to hear how great everyone is doing, from the same people who were puking their guts out last year as the market was on a slide. The call buyers are all making hundreds of percent per trade again. Quarters like we just had are silly because the one trade every single person is in, long megacap tech, was the move. That’s fine, they had their fun, but no, the Nasdaq will not rise at 20% every quarter, but I will continue to outperform especially when markets go flat or red again, by staying the course and following trends.

Stepping back to June 8th of last year when I began documeting this all I am now up 74.29% vs the S&P at -1.26%. Crazy right? The numbers are below up 76% vs the market over the course of a pretty tough year. It’s just a testament to my objective trading which is to avoid weakness and try my best to be in only strong names as they trend. Earnings season is coming up soon and I will have a new batch of trending names to trade after that.

Where Did I Go Wrong This Quarter?

I was on point about closing up leverage when we broke that uptrend and just remaining neutral until we picked a direction, that was pretty much all of March, where I made my mistake was sliding into MANU when I was up 35% for the quarter looking to hide in a buyout name during the turbulence. I ended up losing $120k real quick while the megacaps turned around. Evenso, I still outperformed with that mistake that would’ve been a crushing blow to anyone else. I was up so much when I put that trade on that even botching it short term, didn’t really end up affecting me.

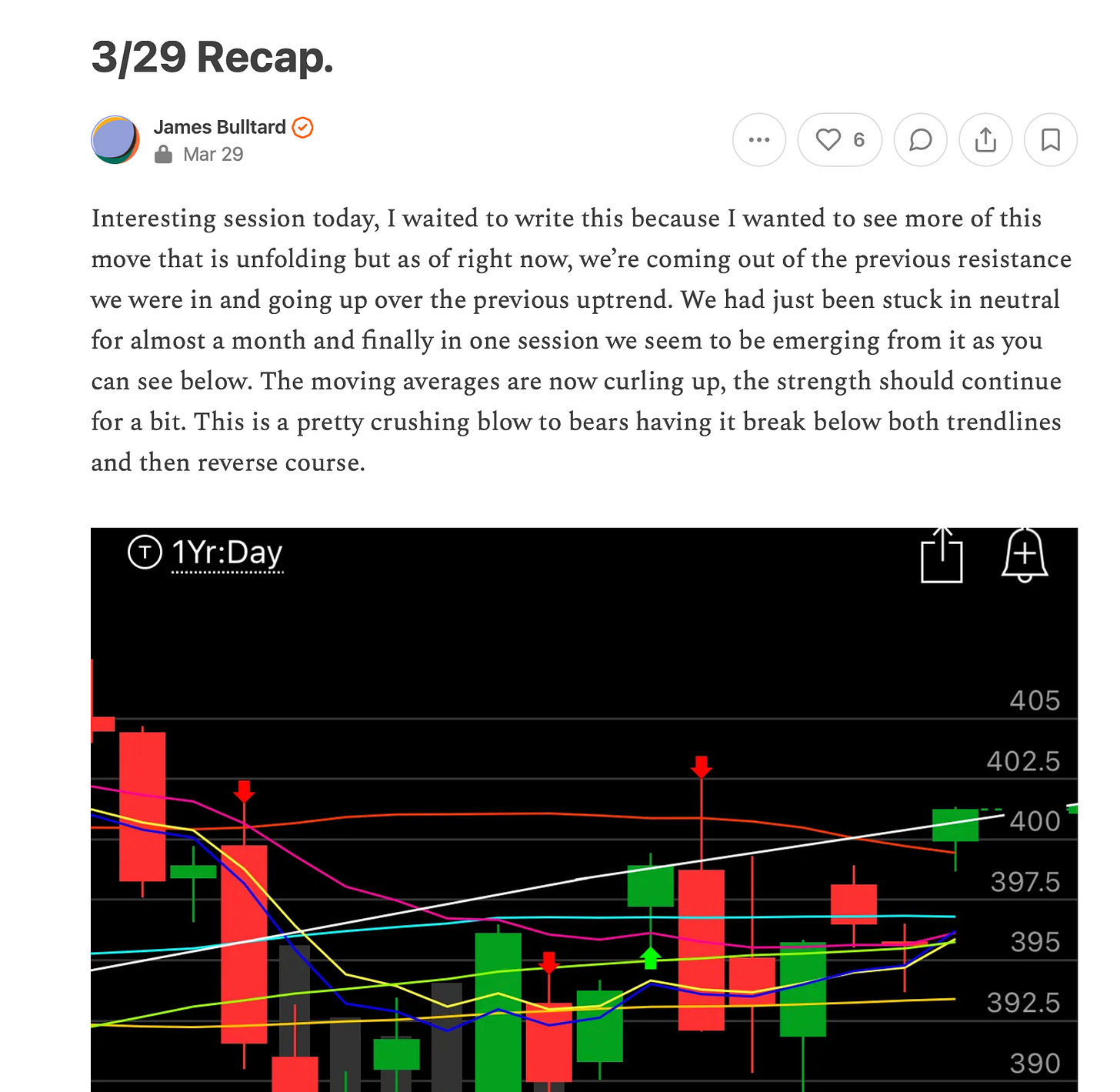

The recap on 3/29,below, I said we were emerging out of the zone we were in and strength would continue. These trends are real, I hope you’re all seeing it now with every recap I post. There is a time to buy, a time to sell, and a time to do nothing. Those times are all dependent on the little lines on a screen and the computers that do the trading.

What Went Right This Quarter?

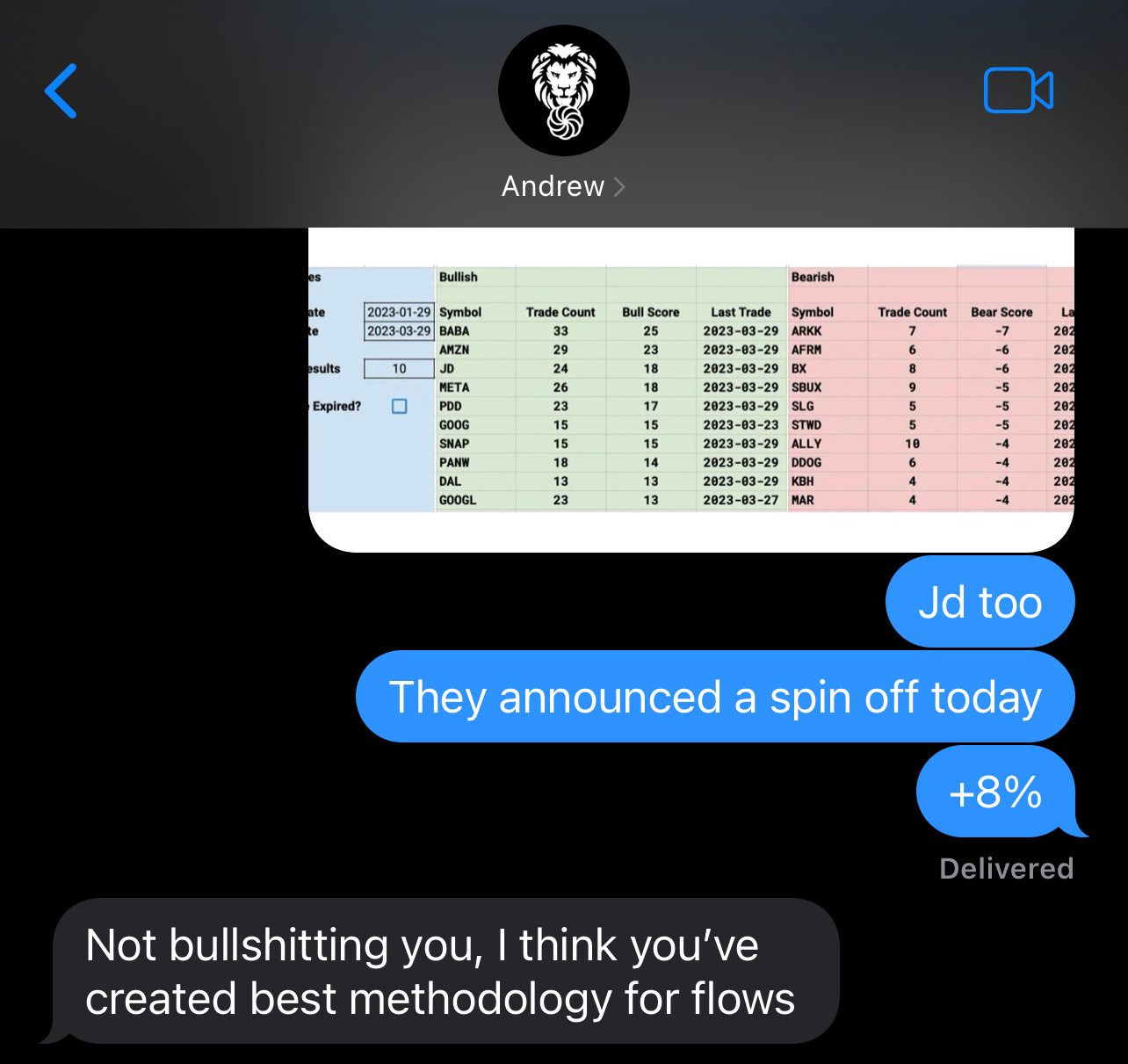

Trading wise alot. You don’t return 26% in a quarter on accident. I levered up properly and it paid off. I’m constantly trying to improve my trading and this quarter was a big step in that direction with the help of Edwin building out a way for me to organize all the unusual options flow I note daily. I’ve been able to build up trends and share those with you all. I’m now nearly 4,000 databased trades into this project but the trends are developing before our eyes and we’re able to see many moves developing before they happen. Inertia builds in one direction as insitutions load up options and regardless of what the equity does in the short term, eventually, names catch up with the flow of money. Look at the best ideas that have really exploded this past quarter whether it was Palo Alto a few weeks back or JD this past week. Even things like BABA rallying 30% this week a few days after my tweet weren’t a coincidence.

They were me lining up the unusual options data I was scanning for and overlaying it with charts for another layer of confirmation. I’m just slowly learning what to do with these trends and perhaps selling puts into divergences like I do isn’t the right solution for maximizing returns. It keeps me from catching the big move, all I can do is more trial and error. I can’t believe I’ve been doing this so long and I never once thought to input all the information into a database and model it the way I am now. I know going forward this will be a very powerful tool, actually I don’t know anyone doing what I’m doing anywhere in this regard. It’s my own style with my own inputs and so far the results have been encouraging. Even my good friend Andrew who did the live trading session with me 2 weeks back has done this for a very long time and he was very impressed with what the data has been able to spot as he’s been the only person who has had access to my data as a beta tester for what I’m trying to have built out. He gave me quite the vote of confidence on it’s proficiency and he is a very tough guy to impress.

Going Forward

I’ve been at this 10 months now and when I started I was obviously a random guy on twitter with a random name. Those of you who trusted me early have been rewarded with the same $19/mo price you had on day 1. That’s the beauty of substack, the price you sign up at is your price forever. Those who paid $29/mo after that are still paying that amount even as I’ve raised prices multiple times since, but whatever price you paid when you signed up, that’s what you will pay forever.

So once again I am raising my prices, dramatically this time, but it won’t go into effect until next Sunday morning so if you’re on the fence you have a week to decide if you want to join now at the current pricing or it will cost alot more.

Why am I raising prices? Because when I started last year, I couldn’t charge anything until I proved what I was capable of. I’d say 10 months through a really rough time in the market where I outperformed by 76% is worthy of far more than I charge. I think I’ve proven myself at this point and have a product that pays for itself many times over.

This substack has grown into far more than I ever imagined when I began. I couldn’t have done it without all of you who believed in me early on. When I started last year, it was a simple recap of the day’s unusual options flow. Today it’s a daily recap of the market with unusual options flows, trends, best ideas and charts on the weekends, my book, access to a community discord with a couple hundrd members and it’s just become so much more than I ever imagined. Along the way I’ve taken feedback from you all and added things you all wanted like the Discord. The community in the discord has really become a fun one, I’ve never really had a group of anonymous friends who share the same interests as me, but it’s just become a great place to spend time. There are so many intelligent people from so many backgrounds in there from Doctors,Lawyers, Engineers,Startup Founders, etc it’s just this melting pot of intelligent people all in the pursuit of the same goal, alpha generation. What a cool place to spend time that has become.

Here’s to a great Q2 and continued growth for all of us.

I've been with this substack for some time now and imo it's a great tool to leverage for trading, as well as learning. I've been in many rooms, including the power trading room, to Sam's room during covid. Those charge 5 to 7x more....Nothing beats the knowledge transfer that occurs with Bulltard. He's one of the best charter I've come across if not the best. Also his order flow has been top notch. It's obvious Bulltard is a professional and I can't imagine anyone getting a better bang for their buck if they're interested in trading.

Great post! I’m up 59.56% in Q1. Took an extra ride with calls (mostly spreads in a.o. META) and I tend to trade around TSLA since I follow the company and their deliveries etc very closely. Thanks for sharing your insights and keep up the good work!! 👍👊