Q2 2023 Recap: I Outperformed The Nasdaq By 50%

I have alot to say, I’m going to go over the last year in here as we’ve just crossed 4 quarters. Then I’m going to go over what went right and what went wrong this quarter along with some charts for the next quarter.

Here are the previous Quarterly Recaps from when I began writing last June.

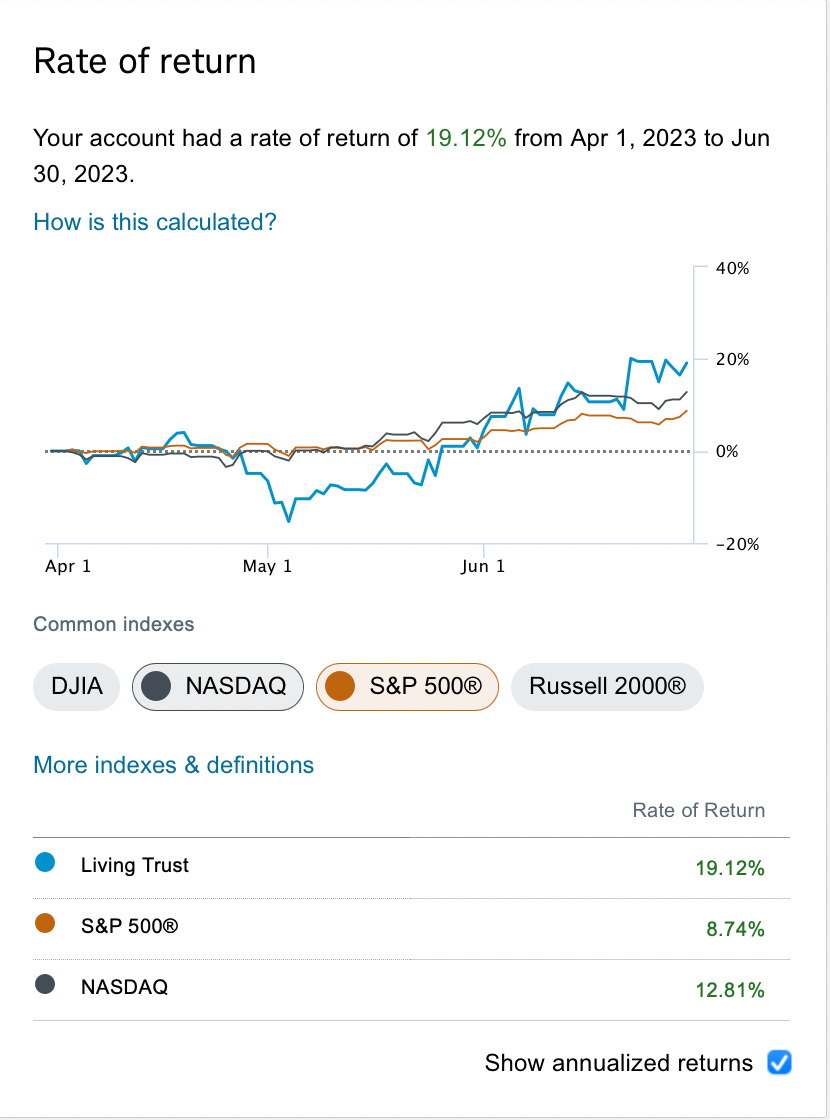

This was another fantastic quarter for me. I ended the quarter +19.12% vs the S&P up 8.74% and the Nasdaq up 12.81%. EVERYTHING WENT UP, EVERYDAY. I hate these quarters, everything just goes up and it is not fun. What’s fun is when the market is flat/down and you’re able to generate Alpha while everyone else is in panic mode. I was underperformed by a bit in late April as I tried to short the market a few times on technical breaks that did not work, but I kept tight stops in place and I recovered. One of the most important abilities you will develop over time as you hone your trading skills is the ability to be objective and cut positions for a loss and move on. You see so many people get burned because they stick to their thesis, you won’t ever see that with me, a trade needs to work almost immediately, and if it doesn’t, you were wrong, time to rip off that bandaid and move on.

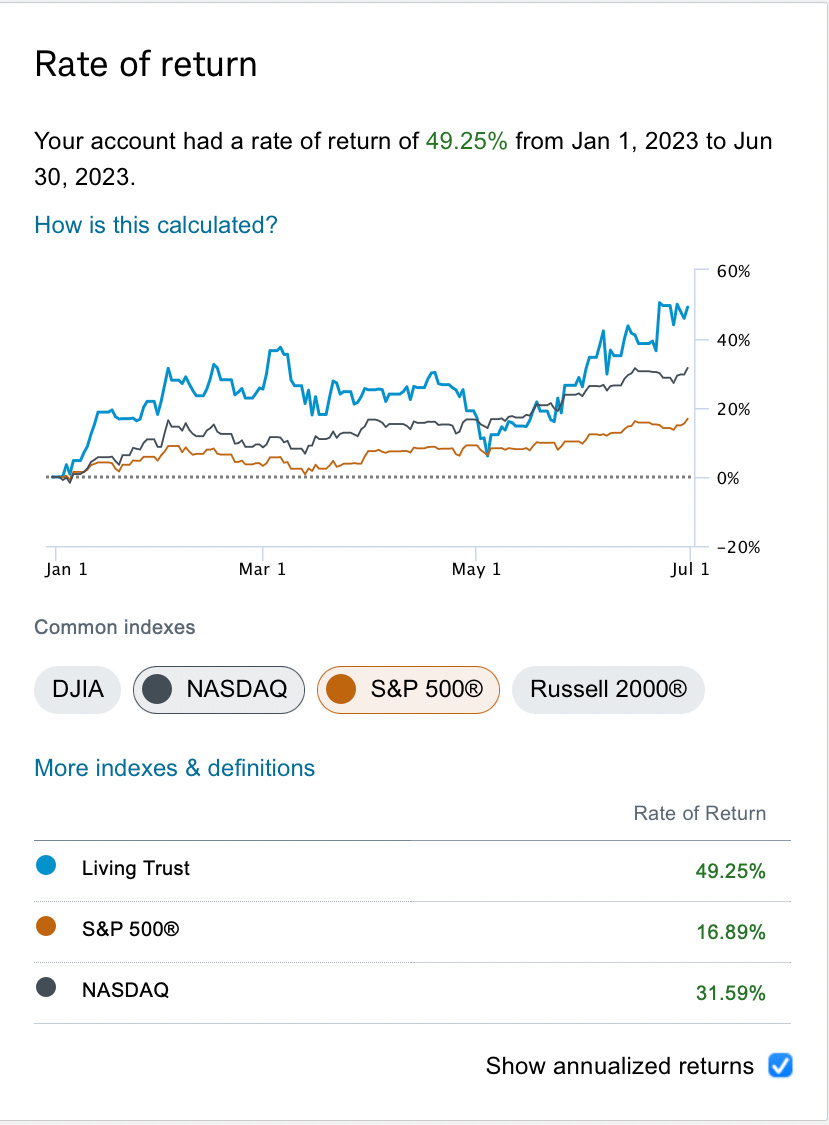

Year to date I am up 49.25% vs 31.59% for the Nasdaq and 16.89% for the S&P.

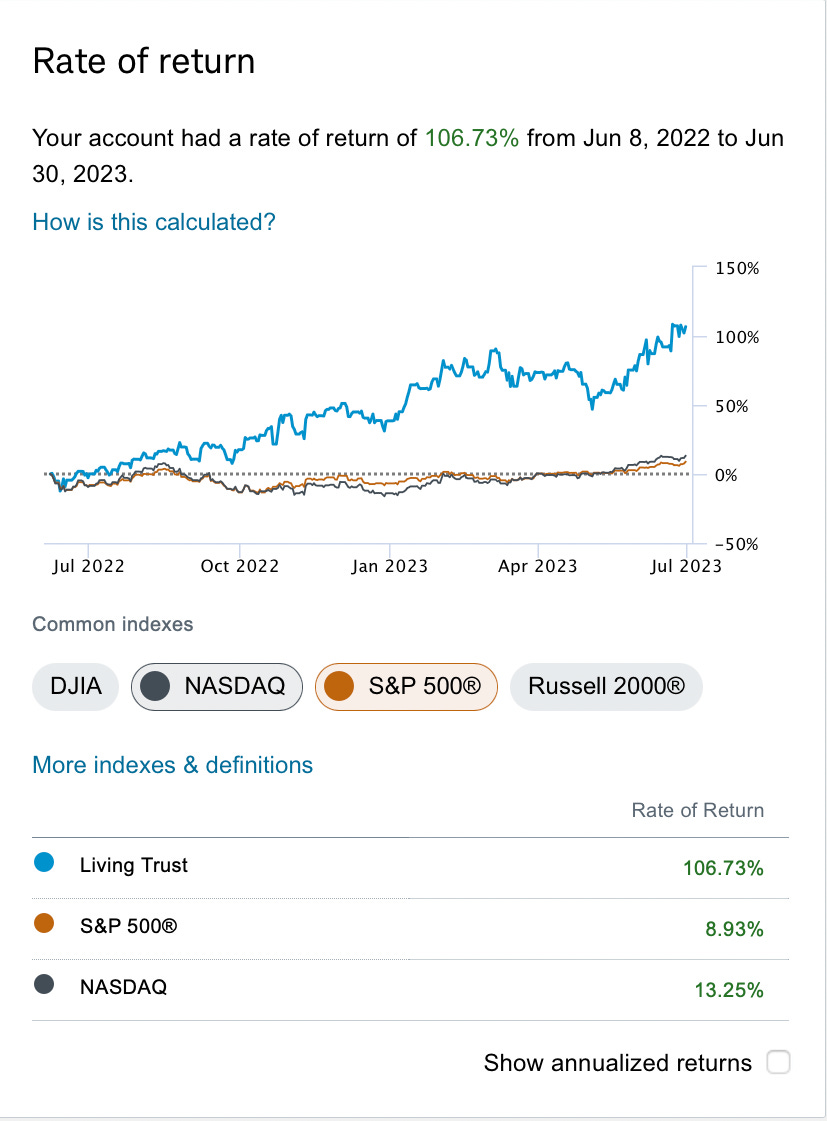

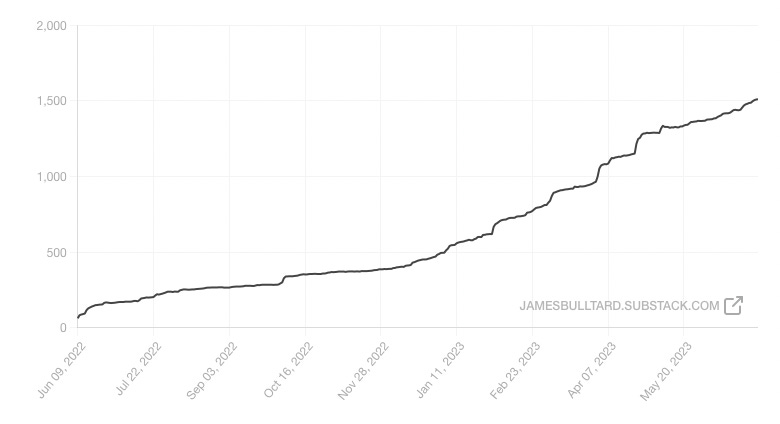

The worst part about quarters/years like we’re having is you get all these people who start posting their year to date gains and kindly ignore that hideous 9 month period we went through last year where the market died. I’d like to see more of them posting 12 month returns because you have all those obnoxious people who post things like “Tesla is up 150% YTD look at my brokerage”, while ignoring the fact that if you zoom out 12 months Tesla is up single digits. I did not forget what we went through, here are my returns from the last 12 months. I began writing this Substack on June 8th, 2022 and in that timeframe I am up 106.73% as you can see below. Even the mighty Nasdaq is only up 13.25% in that timeframe.

I’ve now outperformed the market by 12x over the last 12 months.

You all who were here last year remember I completely avoided all the pain last year and outperformed by always positioning myself in pockets of strength. How did I do that? The same charts and option flows we go over everyday here. The importance of following the money and understanding there will always be things that are going up even in weak markets, that is the goal of all I do with this data. The true test of someone’s ability is how do they perform when things aren’t going perfectly as they are right now. In today’s environment a monkey could make money, that doesn’t take skill.

As for this quarter was alot of good, but there was alot of bad and I’m going to go over it all.

The Good

The Amazon trade worked perfectly. When I said I wanted to take a break from trading 6 weeks ago, it was a confluence of things. Between taking my dad to his radiation treatements daily and being unable to watch 20-30 positions as I normally held and overall just being burnt out from all the work involved with charting every night, answering these substack emails, etc I just wanted to step back and not focus on the day to day stuff until I had time. I chose Amazon to park my money because it was about to have the proverbial “golden cross” where the 50 crosses the 200 day and it was the top trending name in my database and it happened to be the name I knew best. A perfect storm for me to buy some leaps and take a break. What I wasn’t planning on was a near 35% return on this trade in 6 weeks, but it happened even though the stock was only up around 13%. The power over leverage

I knew to quit selling puts as the VIX dropped. I stayed disciplined. I do not believe in selling puts on margin when the VIX is this low. The options pricing is based on the VIX and 15 or lower, you’re asking for a big headache when vol spikes, the VIX is 13.xx now. So, I didn’t let temptation get to me and I’ve stuck to my guns, no put selling until the VIX normalizes somewhat to the 18-20 range, it’s great this timeframe coincided with my break, but even if I wasn’t on a break, I’d have to shift to a cash secured approach in this tape. If I ended this year right here at +49% I would not cry about. So taking a break from selling puts isn’t silly to me at this point.

The Bad

How many times did I try to short the market and fail? Alot. We had 4 breakdowns of the October trend this quarter and I got short every single one, not a single one worked as each one was met with a gap up thanks to a megacap tech stock report. In order Microsoft,Meta,Apple, and Nvidia reported on all 4 of those gap downs which resulted in massive gap ups and reclaiming the trend. Here was a tweet I made about it. Truly, I have never seen anything like that, the first thing you’re taught about when it is time to short is on a trend break, but this market, was something else.

I took some pretty substantial losses on BABA and JD calls. There was a point in this quarter where those two were the top trending names. As you know I’ve always hated China stocks, but I believe in the system I’ve built. I believe in following the flow of money but unfortunately it does not always work out. I took some pretty substantial losses in these 2 tickers as the continued to move lower. Remove the losses from the China trade and my short selling, who knows I’m probably up 40% this quarter.

In Closing

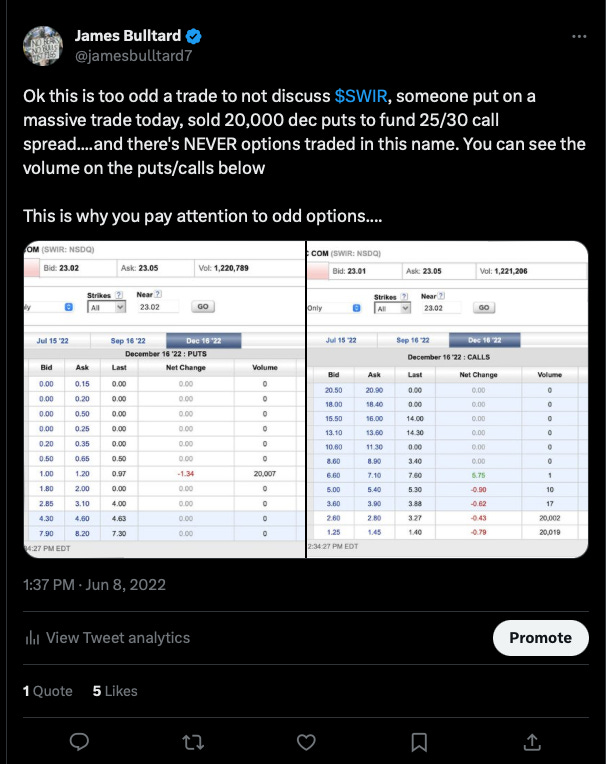

This Substack over the last 12 months has become a big part of my life. What began as me blogging about 1 unusual trade a year ago has turned into something so much more. I’ve met so many interesting people, made countless friends along the way. This whole thing began with 1 tweet that nobody even noticed, only 5 people liked it!

Last week I crossed into the top 25 paid financial substacks. Can you believe it? In 1 year this silly little blog of my daily notes has turned into a viable business of its own. I couldn’t have done it without all of you, especially those who have stuck around. This week I crossed my 1500th subscriber, it’s been surreal to watch grow daily.

I’m biased but I do believe my system works, and the amount of people who have stuck around clearly says that it does. Following the money isn’t some new thing. I may have a different spin on it but the basic premise is not new. Not only have I employed it myself for years, but the purpose of writing this substack was to document it all for the non believers. How many unusual trades worked out just this week alone? Yesterday those Apple calls I noted Thursday ended up going for a 10x in 1 day. It was unreal. Not only does my daily table show you everything a person needs to study for the next day, but I think I do a very good job of highlighting the oddest of those trades every day. I’ve done this so long that I know when something is weird and needs to be noted. We’re now over 1 year into this project. The results speak for themselves alot of you have even outperformed me because you’re far more aggressive than I am. That’s great to see. I just want to be a cheat sheet for you all, but you still have to do the work on your end figuring out how to best utilize that data.

All these guys on Twitter post excel spreadsheets of positions and results, I post straight from my brokerage everyday. Being honest is a big part of why I think I’ve found so much success on here. I don’t bs you because what benefit does that serve? If I lie you’re not going to do well and you’re going to move on. I suppose others think there is an endless supply of new people, and that’s probably true but I want people to be happy with what they’re receiving and stick around. Just the community alone in the discord that has been built up over the last year is amazing. There is so much brainpower in there. All of you are Traders,Engineers, Doctors, Lawyers, Startup Founders etc and wow when you put that many smart people together, it’s amazing to see the great ideas that are bounced around in there. That alone has been such a fun part of this experience.

The bottom line is there’s always a process behind success. You watch these great football coaches like Nick Saban and he always mentions his process in every interview he does. I constantly discuss my process. I post the charts, the option flows, and how I combine those to come to a decision before a trade is executed. It’s like that parable in the Bible about teaching a man to fish, my objective isn’t for you to copy me, it’s to learn how to do this on your own. There may come a time where I’m not around, who knows what happens. I’ve shown you where to access the data, you see what I use to model the data, and now you know how to read a chart now and why that is so important. You combine those three things and you have a major leg up in terms of attempting to generate alpha. If you had to do this on your own, you should be able to by now, and that was my whole objective from the beginning, educating people on how the process works. You can’t make people believe you unless you actually show them what you’re doing.

I've really improved my premium sales since following you. Thanks for all your work and congrats on the success!

The only blog I read daily. Congrats please give us another 5 yrs!