Q4 Recap. I Outperformed By Alot....Again

What’s going on everyone, it’s been a while since I wrote you all. We had a fantastic vacation to the Dominican Republic with family and friends that capped off a pretty great year for me. As great as the market was, I’d say the birth of my son in August was the highlight and then having my favorite team, the Astros, win the world series in October was just the cherry ontop of an unbelievable year for me. So now I’m back and next week will be back to normal with recaps everyday.

Before I get into this quarterly recap, and it’s going to be a long one, brace yourselves, I just want to say thank you to all of you who subscribe to this substack, I’ve never really gone over my strategy and musings with an audience before. I wasn’t really sure how this would go, but after so many of you asked me for it, in the 6 months I’ve done this, it’s gone quite well. I’ve met a ton of great people and more importantly I’ve been able to help so many alter their views on the market and to me that’s the most important thing. What the market has done the last 30 years through the era of cutting rates and te start of the internet may be something we never see again in terms of returns. The buy and hold strategies our parents succeeded with during the boom times of America, may not be there going forward and that’s where my strategy of following options flows and charts to sell premium could really shine going forward.

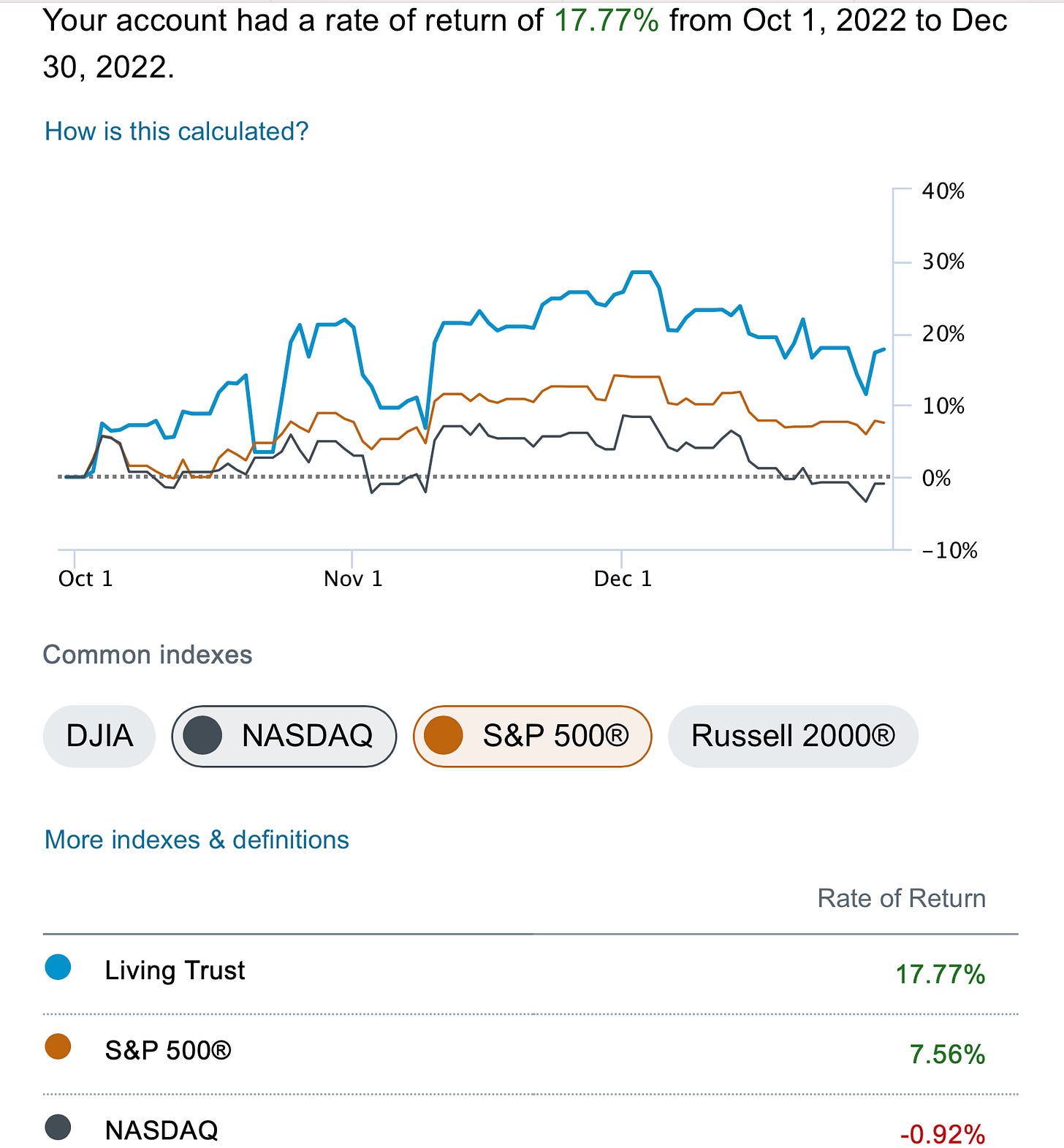

This particular quarter was another solid one for me. I returned closed to 18% vs 7.5% for the S&P while the Nasdaq was slightly negative. Obviously alot of the outperformance this quarter was due to Twitter and the closing of that deal in late August, but I also used the last few weeks of the quarter to position myself for 2023 by selling alot of January 2024 puts which went down hard at the end of the year as the market declined. Those will likely lead to some significant outperformance later in 2023.

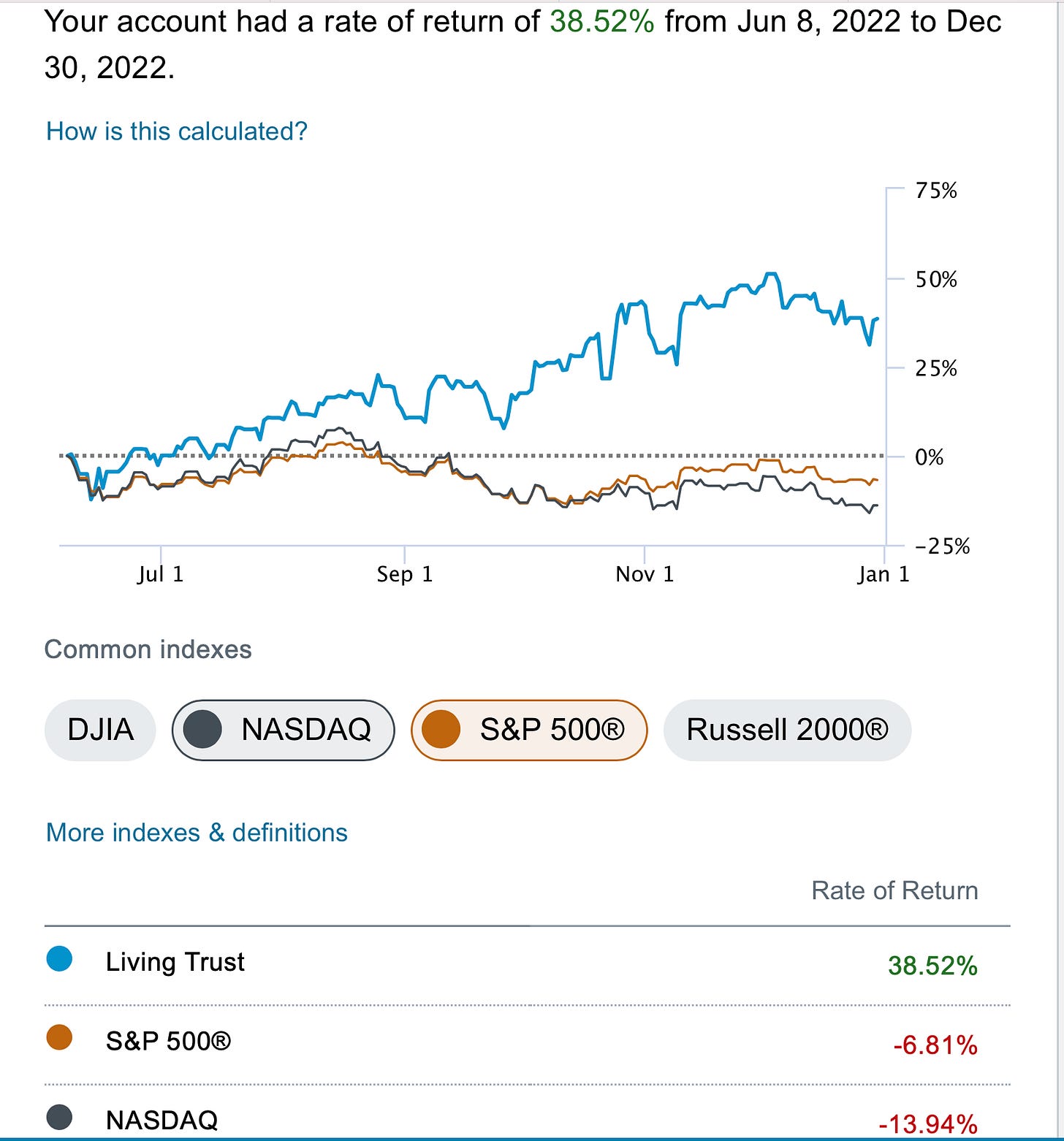

For the time being, from the onset of this substack on June 8th, I am up 38.52% vs the S&P being down 6.8% and the Nasdaq being down 13.94%. If you told me coming into this that I would outperform the Nasdaq by 53% while mostly trading names I would have told you that you were crazy. You have to remember I’m in my late 30’s this is really this first bear market we’ve encountered in a long time and although I was around in 2008, I certainly had nowhere near the capital I have today, so to navigate the worst market in years and come out of it with such a huge generation of alpha, I really can’t complain about anything.

What Am Looking For In 2023

Nothing. Alot of nothing, in my opinion we’re looking at a long period of zero or negative returns. Could the market go up? Sure as move later into 2023 and people start looking forward to a new president in 2024. I could see a rally, but overall I think you’re going to look back in 2-3 years and have pretty flat returns in real terms. Inflation will remain high, whatever returns we generate will be eroded by it. We all know the macro stuff, we know the earnings declines coming, so let’s skip that and look at some charts, since that is all that matters.

On the weekly, it is easy to see what’s going on. We have this vicious downtrend we’ve been in now for 15 months or so. The top and bottom of the channel are clearly defined. We reject the top and bounce off the bottom, until we get a trend break in either direction. The white line is the precovid level, we haven’t quite tested that yet while many of our leaders have gone well below it. If I was a betting man, I’d say we test that in this downtrend as we’ve formed a series of lower highs.

On a monthly basis, the SPY just put in a bearish engulfing candle, that is not bullish in any way. This goes together with my thinking of next year being rough early on and positioning for it.

On a quarterly basis, the MACD flipped negative for the first time in a very long time, well over a decade, it takes time for technical damage like that to resolve hence my stance on a prolonged period of nominal returns, for the buy and hold types.

The channel I highlighted above is critical because it’s going to be stiff support and resistance, look at this tweet I made months back about the dollar topping out because it hit the top of the channel. The dollar is down 10% since and has continued to weaken. Simply put, the dollar hit a point where a tidal wave of sellers stepped in.

The channels and moving averages are invisible to the average investor but they do so much more than anyone can ever imagine. I still run into fund managers, financial advisors, etc who think this stuff is nonsense, and as it turns out, what was nonsense was all their returns during a decade of fed easing. The market is the most complex game on earth and everyone thought for years you could just buy and hold any asset and it just went up. That era is over, the new era is going to be a different one where you’re going to have to be more of a stock picker and more of a premium seller if you’re going to outperform and I think many have not realized that yet. I see the same rhetoric I saw last year. Just buy Amazon,Google, Microsoft, etc because they’re “cheap” and while I do agree there, I think just because an equity is cheap, it doesn’t have to go up. The technical damage is done and now, you have to plan on making money in a volatile market that will likely, overall, be flat to down.

Just remember when you’re selling premium, there are 3 ways to win a trade. If it goes up, you win, if it stays flat, you win, and if it goes down, but not enough to hit your level, you win. Think about that, when you’re long a stock, the only way to win is it goes up. If you’re short a stock, it has to go down for you to succeed. When you’re selling premium, it doesn’t matter what happens, what matters is, are you right on the level you’re selling puts at. So learning how to identify those levels looking at various timeframes is very important. Is my strategy for everyone? No it’s not, you need to have a decent bit of capital to make it worthwhile, but I hope the last 6 months have shown you that it is a viable strategy when properly utilized.

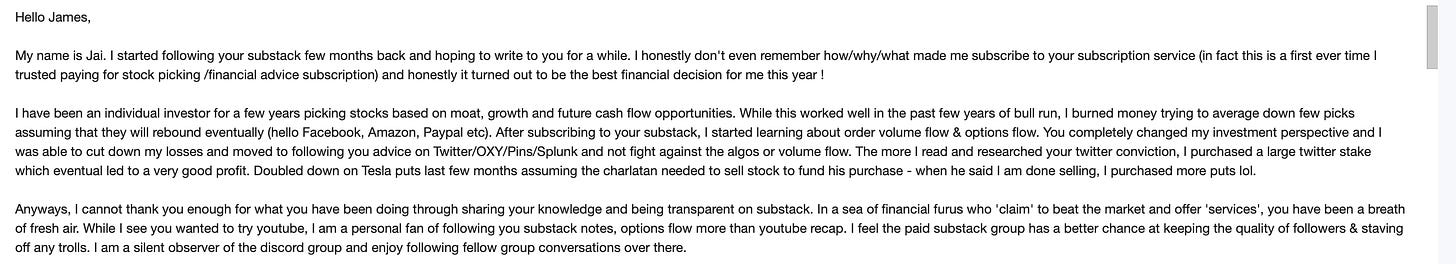

As for feedback from you all, I don’t get it often, although I do want to hear what you want more of and less of, but I got a couple emails this week from a few guys in here I wanted to share because it really made me feel good about the progress we’re making in here. A big part of why I started this in June was the amount of misinformation I saw going around was staggering. You had all these “gurus” just sending everyone to slaughter with all these growth stock calls as rates were rising and so many were burned. Then there was the whole buy and hold crowd who really had no idea how the market really works behind the scenes but they continued to be vocal and I said I’m going to show everyone how the game really works and it has nothing to do with any balance sheets or income statements. A simple horizontal line on a chart can show you more than you ever could learn from hours of reading financials. Is big money buying a particular name, yes or no, that is entire game.

With that said these emails really brought me more joy than you can imagine. It’s a satisfying feeling knowing that the hours of work putting together the daily recaps are paying off. Maybe not enough to buy a $13m jet like Meet Kevin telling people to buy Tesla everyday on youtube, but maybe I can get there someday ha!

So if you do ever feel like writing me, I do read them and I do reply.

That is my recap, I didn’t want to make it too long, enjoy your New Year’s eve and again I can’t thank you enough for trusting me to guide you through these tough markets. Just remember the charts and flows tell the truth, you can either accept that reality and ride the wave to alpha generation, or you can stick to fundamentals and your beliefs and get run over when stocks stop going up everyday.

I’m going to link a video recap with some year end charts, charts that interest me and my positioning as of yesterday into 2023. I’m going to make a big push in 2023 to post 2 videos a day to youtube one premarket and one post market where I take requests from those on the substack. So if you haven’t followed me there, here is the link.

Hi James,

Although it's been nearly half a year, congratulations on becoming a father.

I've missed your recaps since you stopped writing before Christmas. Glad you're back!

Didn't realize your YouTube channel was active. I had been checking it, but when it went silent while you continued your other work, I thought you had decided not to make videos. I'm putting it back on my list.

I appreciate the sincerity in your comments. It's nice to see how much you get out of interacting with your audience.

Thanks for all you do and best wishes for the coming year.

-- Russ