Some Tips As We Enter 2024

Alright everybody, one last post as we enter year end. Lots of new people in here over the last couple weeks and I know I’ve discussed it many times and it is in the links along the top, but I want to go over some things and how to get the most out of this. There are few sections in every recap and this is how to best make use of it all.

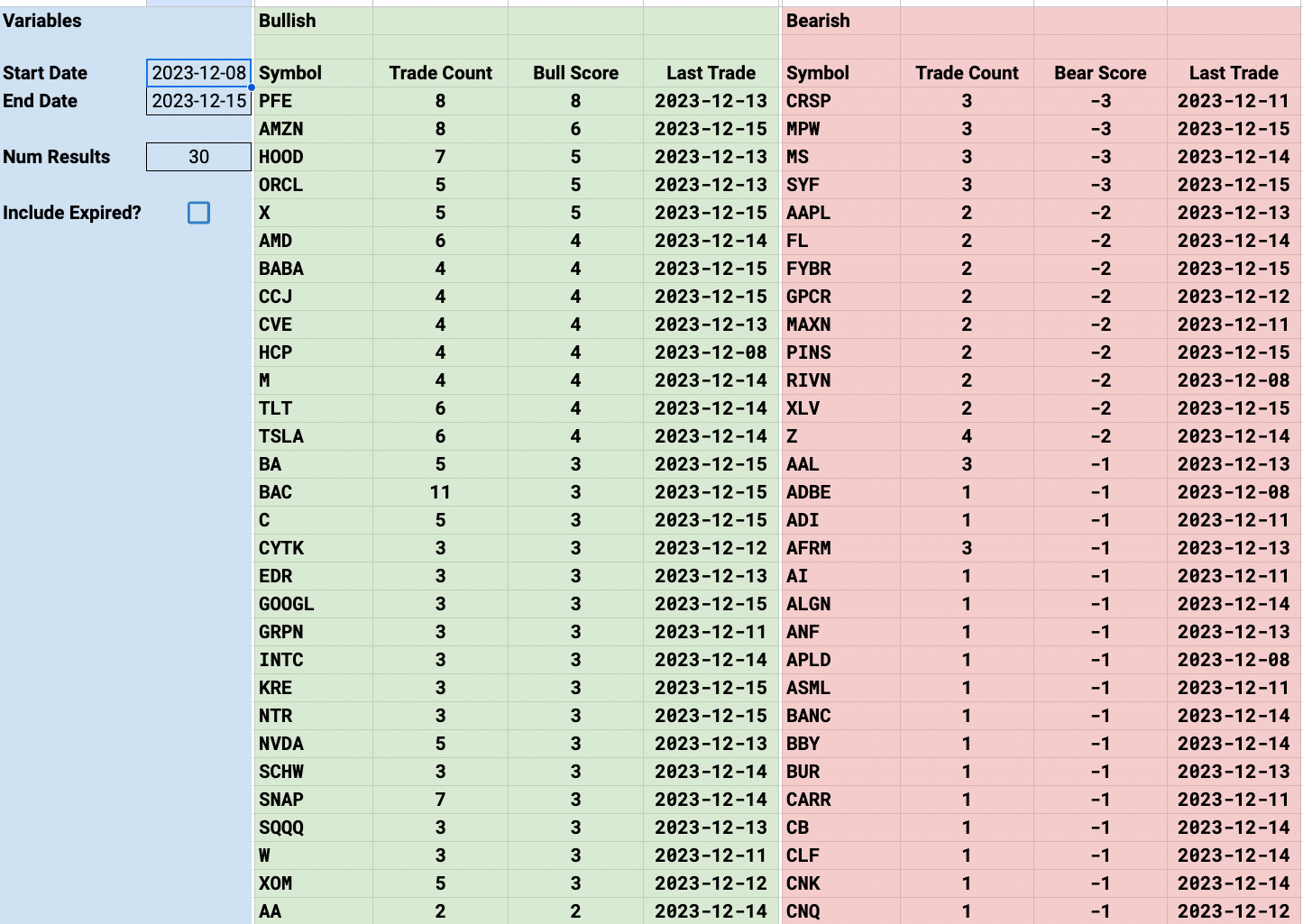

As you know everyday in the recaps there is a section of trends like below. I post the 1 week, 2 week, and 1 month trends. This is the 1 week trend from my final post of the year on 12-15. As you can see it encompasses the 12-8 to 12-15 dates. This is simply the total bullish/bearish activity I’ve logged in my database and should help you see where unusual sized trades are flowing. Simple enough, nothing groundbreaking here, but it’s just a way to visualize what is going on within all those tables I post everyday.

Looking at the table above, you see lots of big names, naturally big names see more options action than smaller ones. That’s just the nature of the game, names like AMZN will see more flow than something smaller like CVE above, so when CVE has a bull score of 4 and AMZN has a bull score of 6, you should pay attention to CVE because that means the aggregate of bullish trades minus bearish trades is only 2 less trades than Amazon which sees a ton of action.

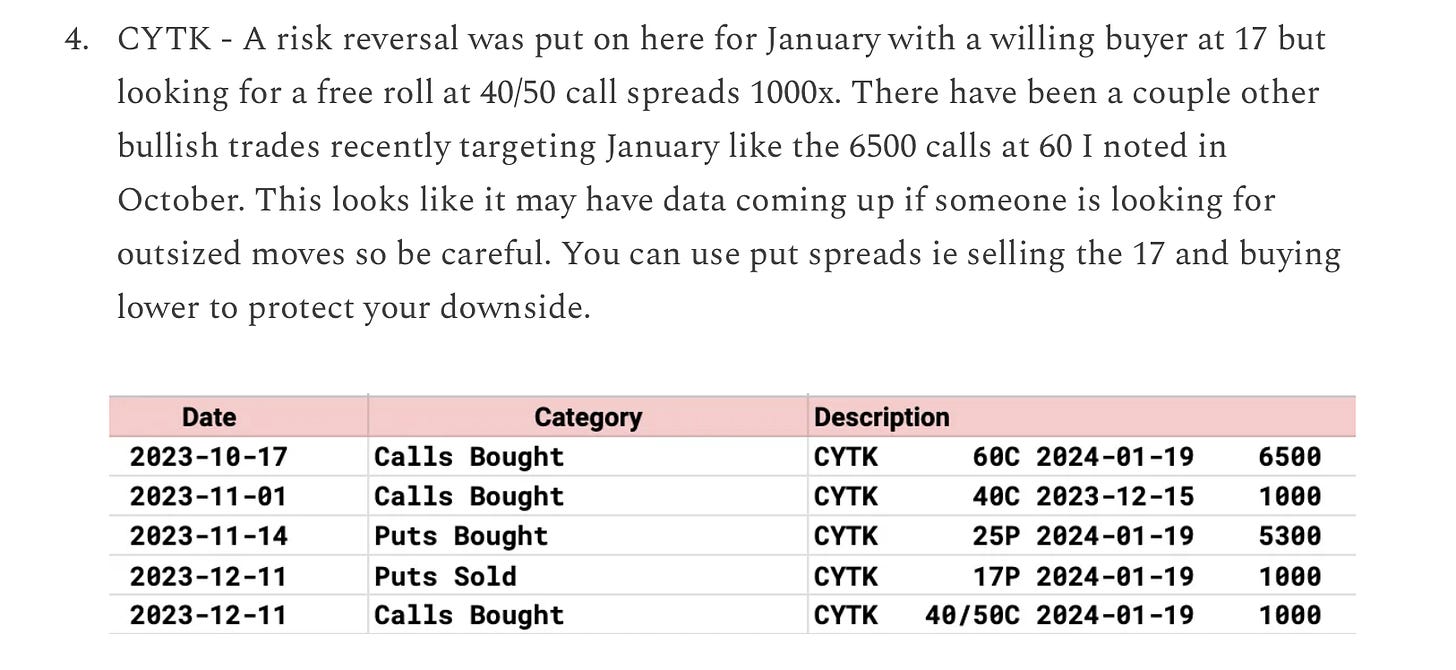

One you will notice above is CYTK, it had a short term bull score of 3. I highlighted it in the 12/11 Recap below. It had seen alot of unusual action and wasn’t really a name I knew anything about. For those not paying attention, CYTK went up 82% today. The player who bought those 6500 calls at $60 for January made millions today. Anyone in here could have played that and I know a few mentioned they did.

I always do my best to highlight what I deem the 5 oddest trades in a given session, and the table I post is usually over 100 odd lots as per my parameters but the reality is there are over just too many names everyday and I can’t give you a write up on every single one.

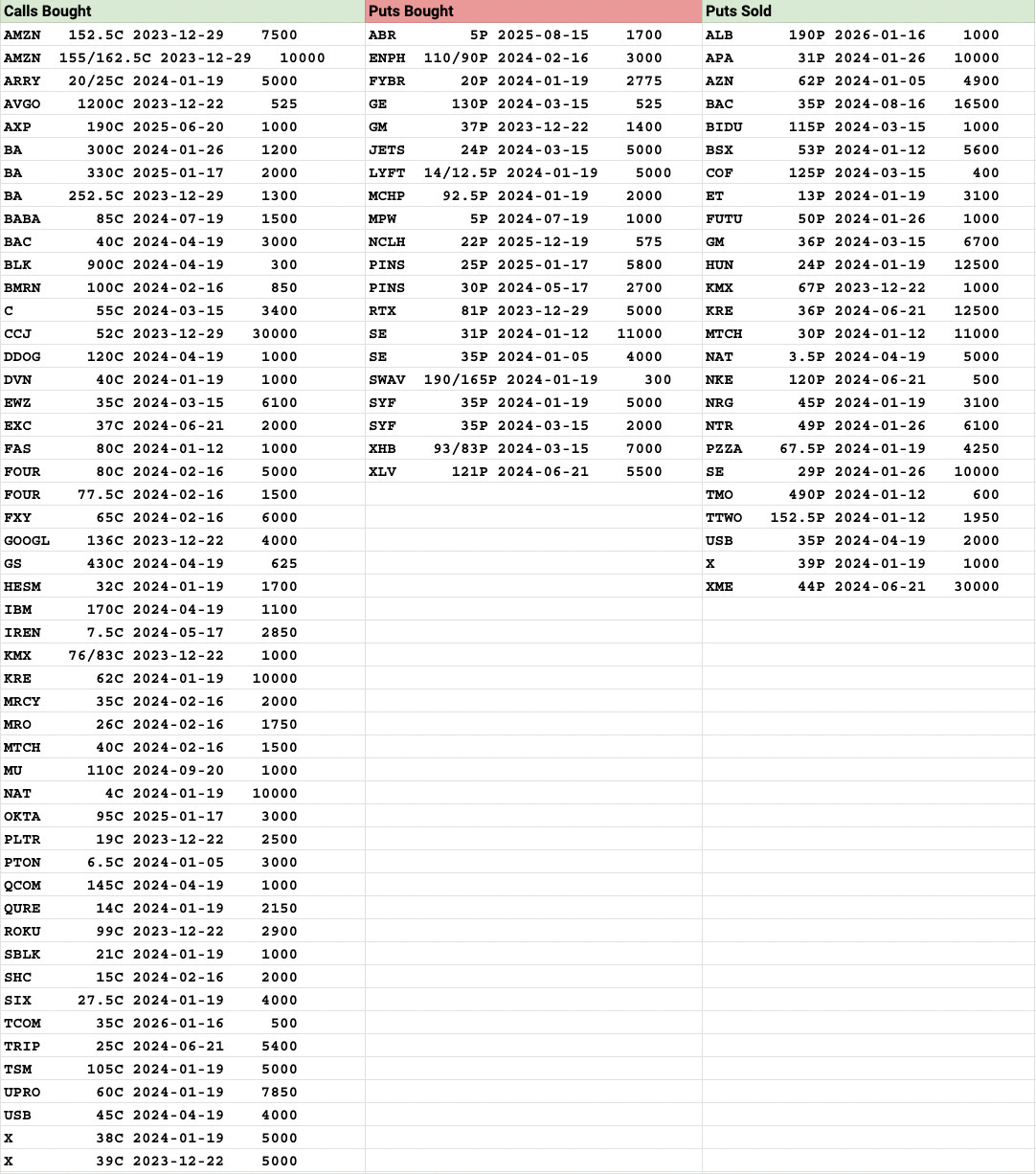

Here is the table from 12-15 the last recap I wrote, there wasn’t much action into OPEX but aside from the odd calls on X below which was bought out just 1 day later, the main thing to take from this is just the levels big money is placing bets at. For me the column on the far right is the most important, the puts sold, that’s where funds are showing you the levels they’re willing to long a name. Look at KMX, I highlighted that one because of the short term risk reversal they put on. Those $67 puts they sold in size for last week worked perfectly and expired worthless because that is the point someone was willing to go long the name and it never got there.

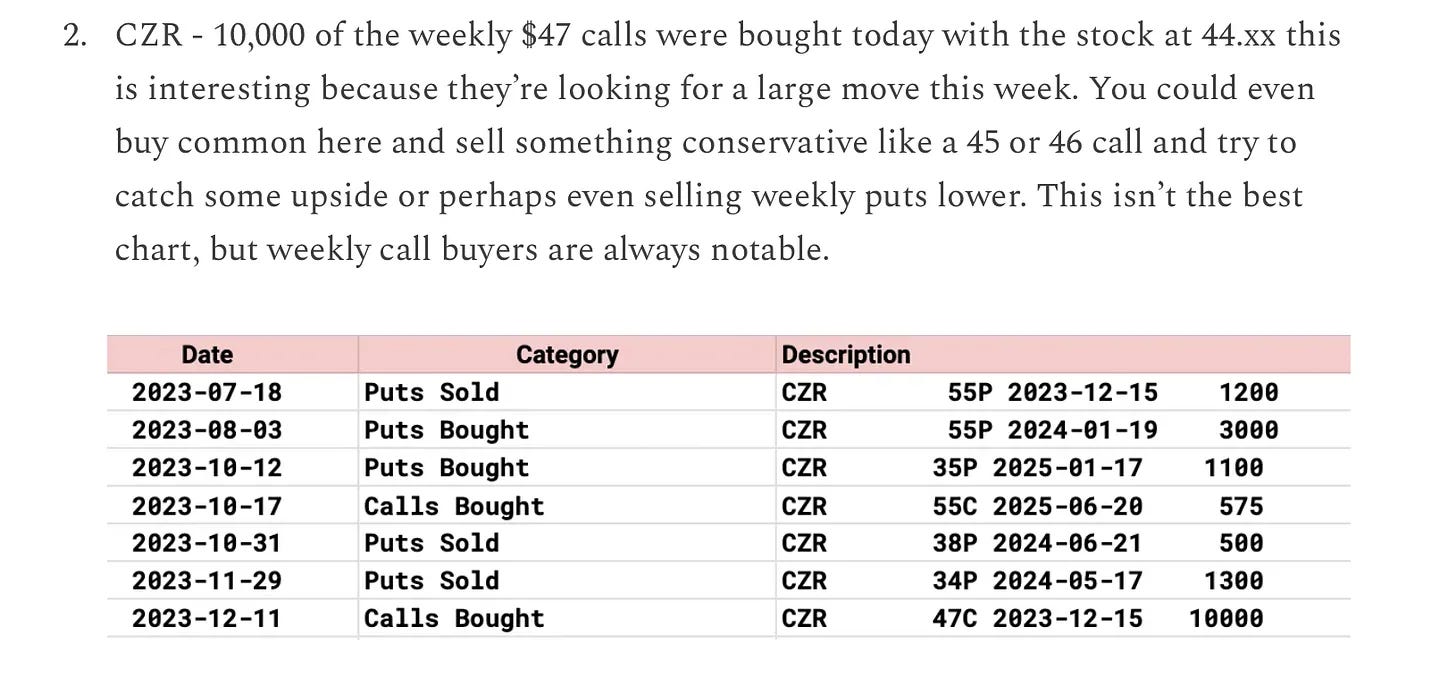

Another important thing to look at is the dates. Trades with closer expirations are significantly more notable in what you need to focus on. Take that CZR trade I highlighted recently on 12-11 expiring 4 days later……

CZR ended up popping 20% in 2 session right before that expiry and that player cashed in a fortune.

Calls vs Common?

I get this question all the time on whether one should use calls or common. Personally I’m more a fan of selling puts when I think name is going up because it minimizes risk. The answer of calls vs common is really more on your risk tolerance. I never suggest weekly calls, the risk of your money going to $0 is too high. If you swing commons you can be wrong and you won’t see your trade go to $0. So for me, I think the right way is look at the direction of options data in conjunction with charts and make a determination on which direction you want to play first, then I would suggest using common just for the sake of safety. Leverage in the short term is a dangerous game and you have to survive, there will always be other trades, but not if you blowup. So ensuring you don’t let 1 single short term trade ruin your trading book is very critical. There are countless ways to work out of a trade that does go against you with common. You can sell covered calls until it turns around if it’s a quality name. You can simply wait for it to go up or you can cut it for a loss. Either way, the likelihood of a total loss is far lower with commons.

The reason that I wanted to send this out is because I’ve had a few discussions with people who have returned 100%+ this year and I just want you all to understand that stocks went straight up most of this year. Everyone long looked smart in 2023, all those people are back to posting their YTD gains, not many want to discuss their 2 year returns. As you saw in 2022 for those who were here, there were still plenty of opportunities to make money long and short things and the options flows highlighted plenty, but the key to doing well at this game is simply not blowing up. Avoid the leverage, avoid short term options and you will survive. Years like 2023 make everyone get a bit complacent with their strategy and it feels like you cannot lose money buying calls but I’m telling you this year was simply markets reverting to 2021 levels. We’ve done nothing in almost 3 years, the moves going forward won’t be as easy to come by and the likelihood of short term calls working will fall significantly, using common is the safest way to approach this. We have an edge in here with the options data and trends, but we have no control on how finicky the market can be, so enjoy the good times, and don’t get frustrated with the bad ones, but your top priority needs to be avoiding blowing up.

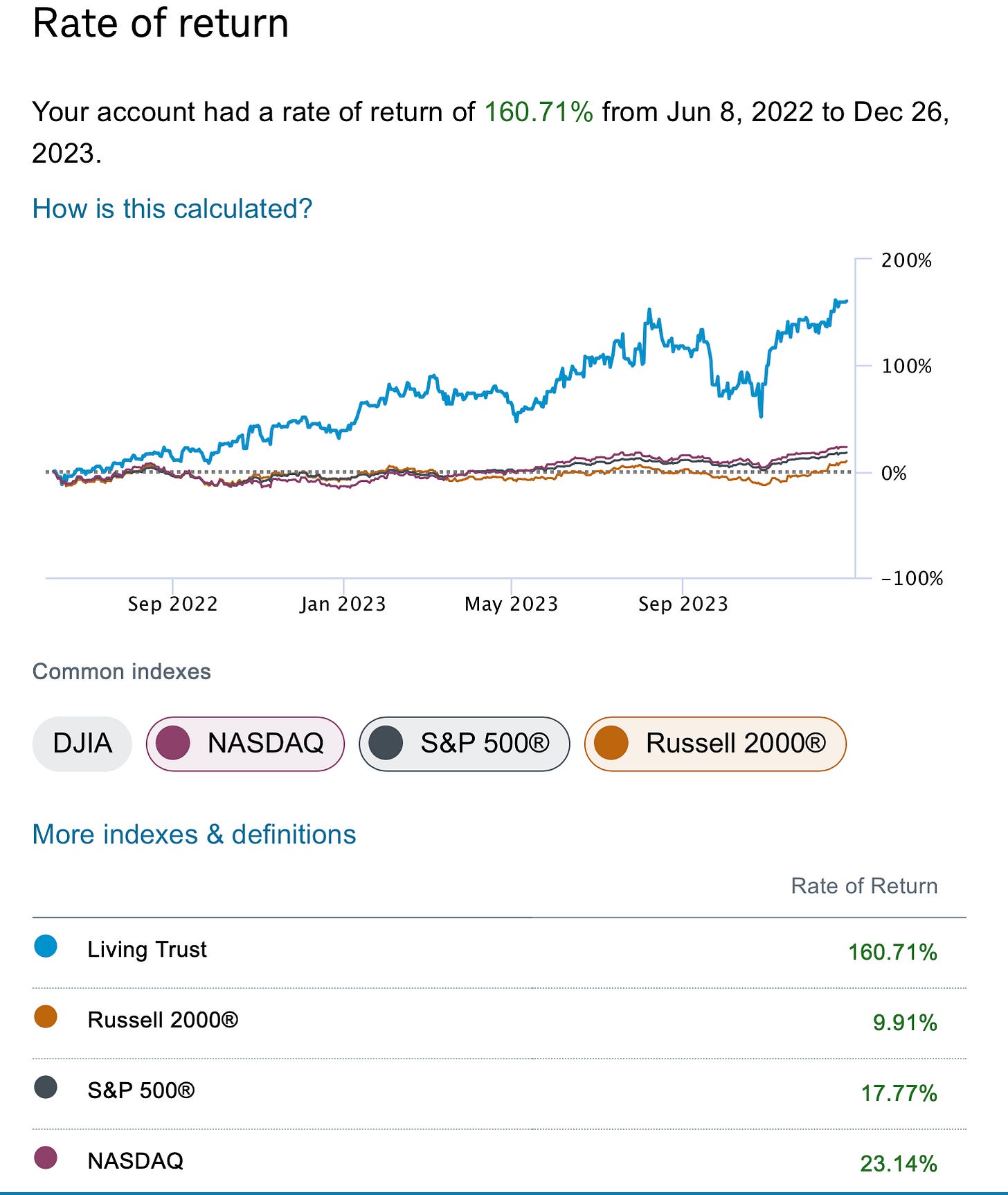

Step back, look at your 2 year stats, are you happy with them counting 2022? How would you handle the next market selloff when it comes? Look at the drawdowns I’ve gone through below from the time I began writing this substack last June. It hasn’t been smooth sailing, but I’ve always adjusted on the dips and I’m now up 160% in the last 19 months.

If you have some strategies for using the data in your own manner, share them below in the comments. I know everyone has their own style and in the end there are so many ways to make this work, there really isn’t one right answer. My focus in here has always been on helping people see where big bets are going to help gauge direction and I want to make sure we’re all on the same page on how to best utilize this all heading into the new year. As I’ve said many times, I do believe the community discord is maybe the best corner of trading around on the internet and you should be in there asking questions/sharing your trades because the more people picking at your strategy, the more you will refine it and improve, its never a finished product. Just my two cents.

I hope you have a great end to the year with 2 sessions left and I will be back to a normal posting schedule on Monday with the recaps.

Lastly if you’re on a free trial now, I asked substack & unfortunately when I raise prices on January 1 you would pay the new price unless you actually signed up before then, so just letting you know because I don’t want to upset anyone. Again this has no effect on people who are currently signed up, it would only be for people who sign up after January 1. Existing members have the price they signed up at originally forever.

Great recap. Happy new year man.

Thanks for this very helpful. Am I correct that this info is on the discord? Or do you issue regular posts on Substack? Thanks