The How & Why Of Leverage.

I got a lot of new readers yesterday and since substack doesn’t allow for an FAQ I felt I had to write this up. I got a few comments about the leverage that I am using and I do use quite a bit so I wanted to explain myself. First off, this whole country was built on leverage, without leverage a lot of things you see would never be possible. Without a mortgage most would never be able to buy a home. So it makes me chuckle when people are scared of leverage but have credit card debt or a mortgage. That too is leverage.

Can leverage be dangerous if you don’t know what you’re doing? Absolutely, and that is why I repeatedly say if you are interested in selling puts, you should use cash secured puts until you’ve gained more experience and are comfortable with leverage, for me, this is second nature because I’ve done it so long.

Now, do I utilize leverage at all times? Absolutely not, why am I using it at this moment with the market so overvalued? Because we’re in an uptrend, that’s it. That is why I say the importance of reading charts is the most important skillset in the market. It will keep you out of overplaying your hand in downtrends.

What do I mean?

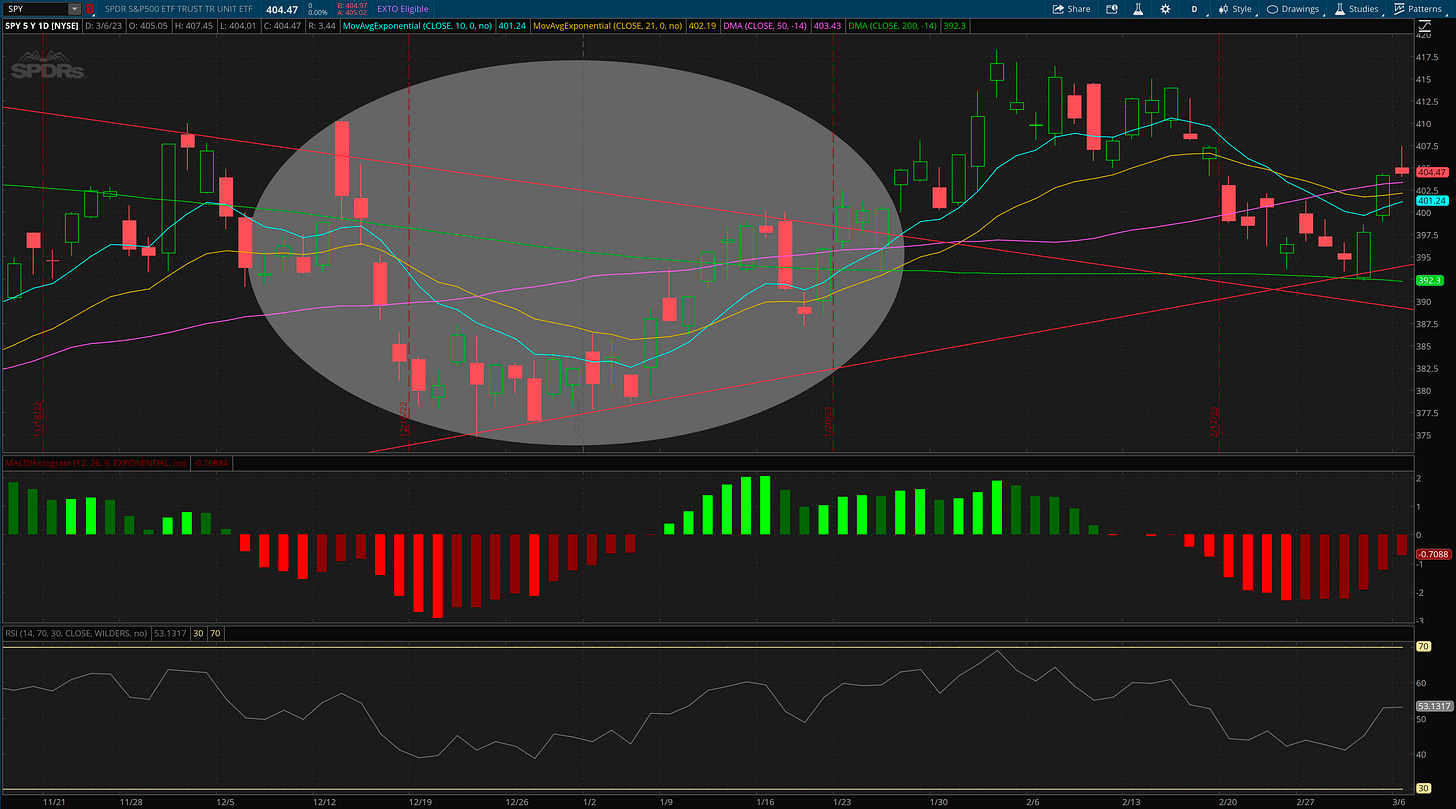

Here is a daily chart of the overall market, SPY, you can see the clearly defined downtrend, the upper red line, we were in from early last year at the highs all the way until early 2023 when we finally broke out of the downtrend.

If you zoom in closer you can see in October we put in that huge bullish engulfing candle which began a new uptrend. We are currently in that uptrend. Do you see how we came down in December and perfectly tested that uptrend and continued on until we broke out? We formed a higher low in December than we had in October, within the uptrend and then broke out into where we are today. All that in spite of all the awful economic data we have been seeing.

Now, when did I dial up the leverage? Looking at the chart above, I highlighted down below where we based right on the uptrend line. If you go back to my posts from that timeframe in December I constantly kept saying as long as the uptrend doesn’t break we are ok. We had test after test, but never a confirmed breakdown. That is when I said this is it, the market is going higher, it just didn’t want lower and I turned up the leverage nearly to the max in the most oversold names with option flows.

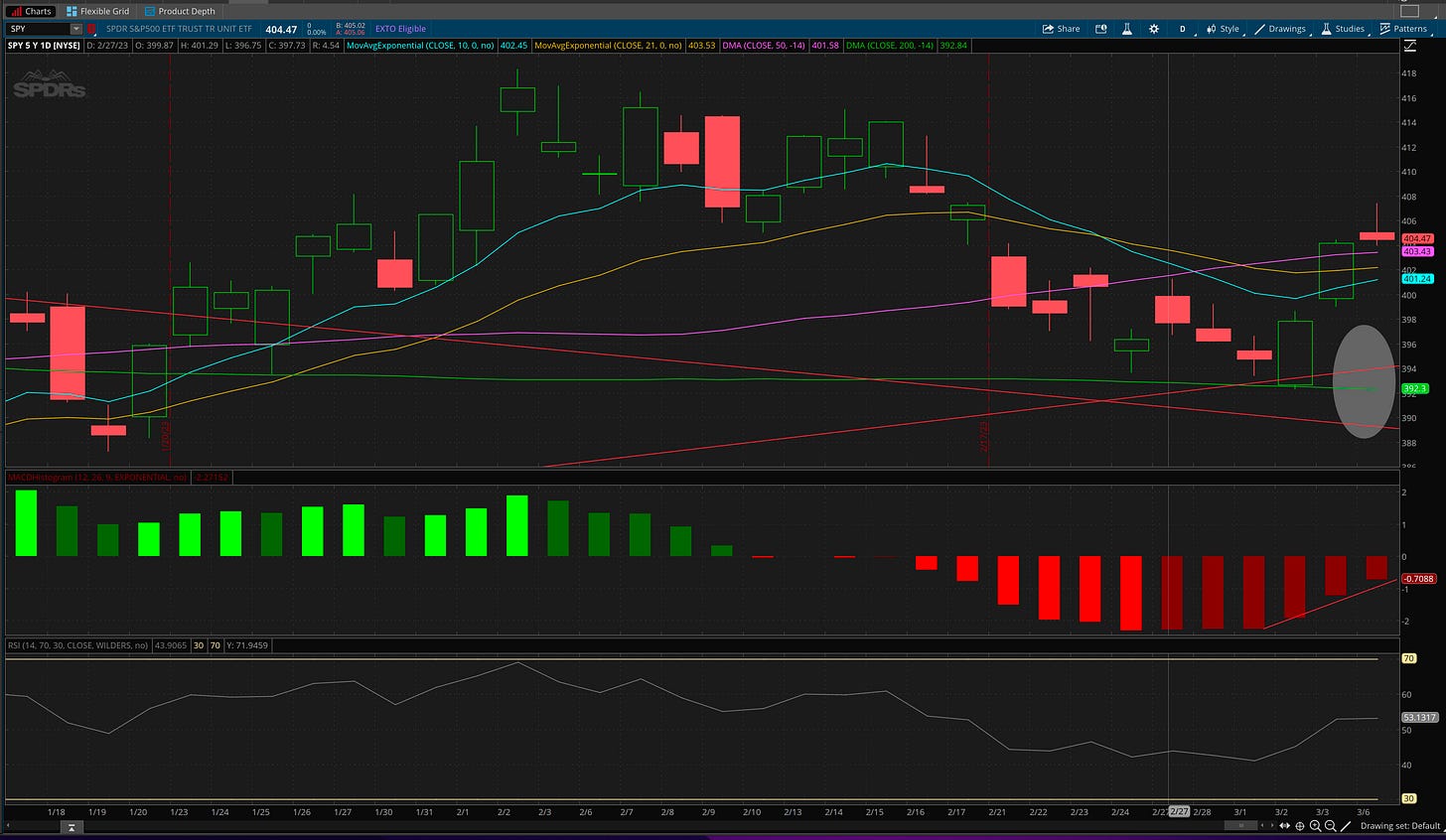

So what about now? Well simply put until we break that downtrend, I’m going to be full speed ahead. The minute that uptrend breaks I will lighten up, it is that simple. Markets move in waves and when the going is good, as a trader, you have to press it and when we enter a downtrend you take your foot off the gas. You see the circle I highlighted below? We have 2 big levels just below us. Around 395 currently on the SPY you have the uptrend we’ve been in since October, a break below that would be a big warning sign to lighten up, then we have the downtrend line from last years downtrend below it. A break and close below both would be time to massively lighten up on the leverage.

So to answer the question on how I use leverage. When we’re in a clearly defined uptrend, I press it, hard. The minute that uptrend breaks, I lighten up dramatically. The biggest mistake investors make is trading weakness. I don’t waste time with that. I trade directionally strong names based on option flows and in strong markets I go harder. When the market is no longer in an uptrend you simply tone down the leverage as you saw last year, these downtrends are periods of overall weakness, but even within those there will be names that do well and the institutional options data I post daily should be a guide in finding those pockets of strength.

So to my point I had questions asking “what about covid” so pulled up a chart of the era, you can see the uptrend I drew from the late 2018 crash. You see how that red line shows us in an uptrend the whole time and the minute that uptrend broke that was your warning sign to get out of longs and either sit on the sidelines or go short, many did not listen, they ignored what the charts were telling them. This is why I say charts tell a story.

Really, zoom in and look at a daily chart of the period. Aside from all the warnings we got from news sources about the chaos unfolding in China, look below, the first time the daily chart closed below that uptrend, that was it. It was over, the algos that run the market were about to turn on it and the wave of selling was about to begin.

So the point I’m trying to make is this, almost never do crashes come out of nowhere. Yes you can have events like 9/11 where the markets have to close, and that’s why I said do not use leverage like me, I could move some cash over from my long term holdings and tide me over until the market settled down and normalized. Even the covid crash look above it was 3 weeks long.

When markets are about to go lower, the chart has sent you a warning sign long before in 99% of dips. Yes another 9/11 type event could happen, but no, I do not manage my trading book on the .00000001% chance a 1 day event could destroy markets. If you are scared of that, cash secured is the way to go. For me, a normal decline in the market will start with a breakdown of an uptrend, at which point I will heavily reduce my exposure. Look how cautious I am as is? I’ve said I’m short 2024 puts vs my normal quarter to quarter allocation simply because I think the market is dramatically overvalued. I think stocks should be much lower, but we are in an uptrend so I respect price and trade accordingly.

Executives lie, analysts lie, what never lies is price action. Your stock is either being bought or sold, the how or why doesn’t matter, what does is, are you on the right side?

Reading this one again. Simplicity and clarity laid out, sticking to it and not arguing with yourself (i.e. drive on "hope") is the key to success here. Great post James.