Trade Of The Week, Easy 14% Return In 1 Month Following A Legendary Activist Investor.

I want to preface this by saying tomorrow I will have my preview of this week’s earnings and how I will play everything but in this post I wanted to discuss the trade of the week only. This is a pretty rare opportunity in that the market is giving is gift wrapping us a layup so to speak. How?

Well, thursday was a disaster of an ER for Snapchat. What a horrible company. They promised 50% growth for years, literally

Of course everyone saw the awful numbers from Snapchat. We saw the massive operating loss, the negative FCF, and the 13% revenue growth which didn’t even get close to anywhere near the 50% target Spiegel laid out. So what happened? For the 3rd time in 3 months, Snapchat killed all the ad names. It’s amazing how this company Snapchat is seen as such a barometer of everything else. This company sucks, flat out, there is nothing more to say. It is well behind TikTok and Instagram in terms of engagement, it doesn’t target a key demographic like Pinterest(women) but rather kids with no purchasing power. To say it would be the first places advertisers would go to cut their ad spend in a crunch is an understatement. What are conversion rates on SNAP? They’re nowhere near the 10% industry leading ads at Amazon, and certainly nowhere near even the sub 2% conversions Facebook and Google were getting pre IDFA changes. To say ads on Snapchat are useless is putting it kindly.

With all that said, we saw Google lose 6% yesterday, Facebook lost nearly 8%, Pinterest was down 18%, nearly every social media name was destroyed because SNAP lost close to 40%. A bit overdone to me, but that’s how markets work. What exactly were investors expecting when Snapchat is run by a sleazy CEO who not only gave a complete lie on his guide of 50% growth for years, but he turned around and sold millions up millions of shares after telling investors the best was yet to come. The stock is down almost 90% since. Then take last quarter where he waited a couple weeks AFTER earnings to revise his guide down for SNAP which sent all ad names reeling again. I really don’t understand the markets affinity for this company or this CEO, both are awful and read through to nothing other than the fact in bad times advertisers don’t want to waste money marketing to kids.

Trade Of The Week

There’s 2 in here on the same name, so pay attention.

We’re going back into the well on Pinterest, even though the chart broke down yesterday, what? Why would I do that? Because it was an irrational move and it only occured because of Snapchat and we have the backing of one of the best activist investors of all time Paul Singer, who is far better than Warren Buffett if you want my honest opinion, but the majority of fintwit wouldn’t even know who he was.

Paul runs Elliot Management and they just disclosed a huge 9% stake in Pinterest earlier this month which sent the shares rocketing up to nearly $22. They currently sit a hair over $18. From a fundamental standpoint Pinterest is a very good business, this is nothing like Snapchat. You can start with 80% gross margins and $400M of EBITDA. They also have $2.5 billion in cash. User growth is slowing and with 450m users thats not good, hence the move down, but these users are very very very valuable. Why? Because the majority are women and women are the head of household ie responsible for the spending. These users are worth significantly more than pre teens who make up most of Snapchats base. Paul Singer sees something here and he was in Twitter as an activist before the huge run last year, I got into Gigamon years back because of his activism, to say he gets things done is an understatement. Read about his past where he seized an Argentian Navy Boat, the guy doesn’t waste time or mess around.

The 2 trades I like, one for this week and one for the next month.

Let’s start with August 19th. I like selling the Pinterest 14/12 put spread for .25. In this trade you will risk $1.75, technically $2 but bc you’re receiving .25 the risk is $1.75 and you need Pinterest to be over $14 by August 19th. Now why this level? For starters its well below what Paul Singer purchased at, the fundamentals don’t even support it being that low and secondly, it gives you room with earnings coming up. This trade would return 14.2% in under a month

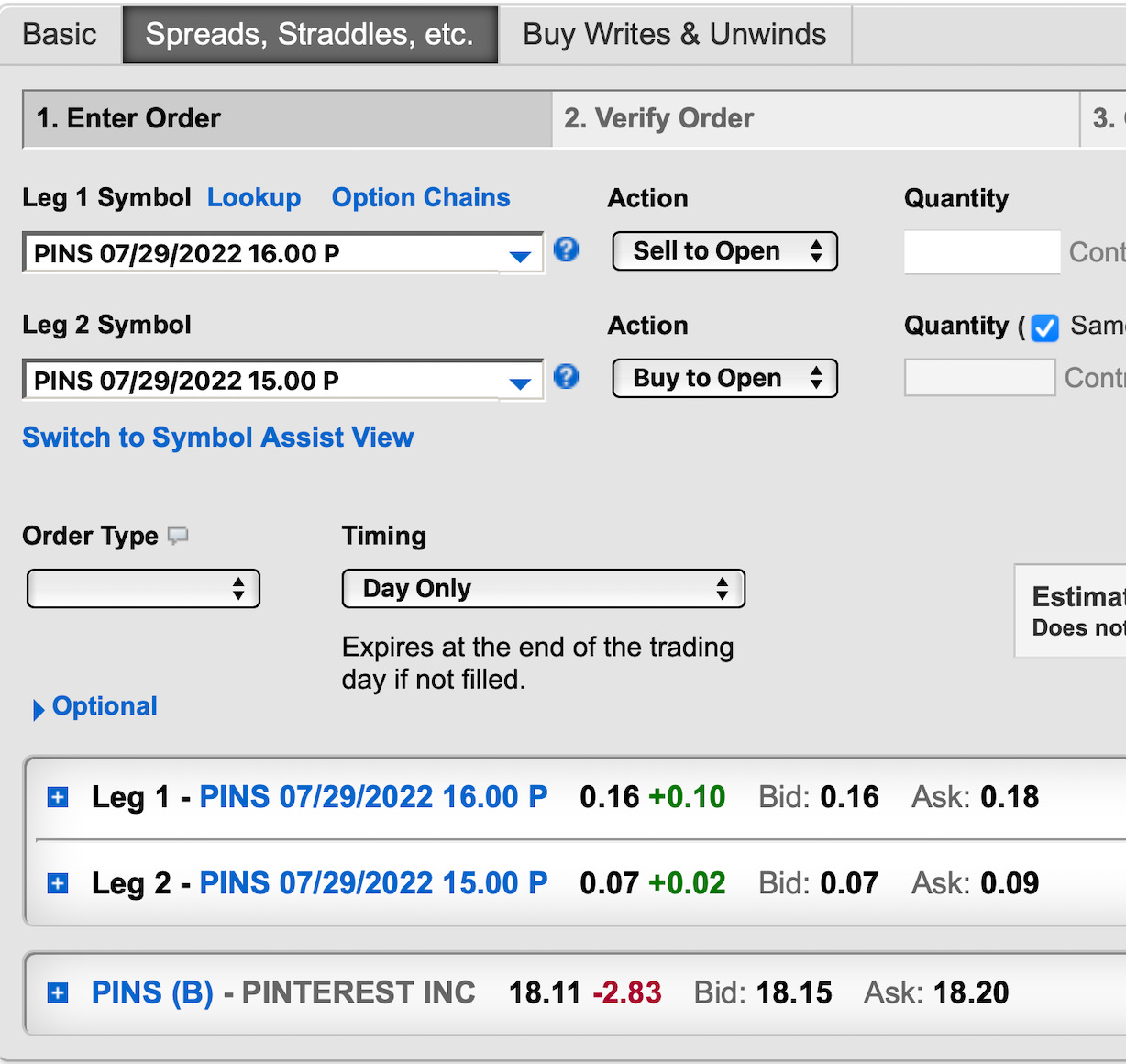

The second play would be shorter term and have higher risk, not because of Pinterest but because Google and Facebook report this week. Pinterest reports on August 1. If you have a stronger stomach, the 16/15 put spread for this coming week would return .09 on .91 of risk leaving you with a 10% return or a purchase of shares with a $15.91 basis, either is tremendous. I will be taking both of these. I think friday’s move was absurd and unjustified.

Let’s look at the chart, now this is where charts get tricky, you can see the recent uptrend we were in and how it broke friday, but friday was an exogenous event, Snapchat dying is not something you can take seriously because it doesn’t materially affect Pinterest and if it did an activist like Mr Singer wouldn’t have gotten involved. Ask yourself how many activists are in SNAP? None

If you look closer, the last time we broke below the trendline, the next day Elliot disclosed their stake. So I wouldn’t expect this name to stay down too long. What concerns me this week is from my post yesterday, Google is technically looking awful. Facebook has alot of questions to answer this week as well, those will read through to Pinterest, that’s why Im saying, give yourself a little room and if you get shares at $15.91 that’s a big win going forward and we can sell some aggressive covered calls into earnings the following week as they will be juiced up.

Anyways, I hope you all have a great weekend and I will have my earnings week preview up tomorrow!

Thanks a lot for the post and hope you’re doing good! ❤️

I was wondering if it’s a good idea to sell $103 covered calls (breakeven price of $109.5) for 7/29 against my GOOGL shares purchased at an average cost basis of $108. Another idea is to sell $115 covered calls (as you suggested in your latest vid). Do you’ve a preference depending on max premium to collect?

Fair to say this Pins trade worked after today. Thanks for the post. Learned a lot already after reading my first article