Trade Of The Week: Make 25% This Week On A Cheap, Activist Backed Name

As we begin a new week, looking back over the last nearly quarter, I have posted 14 of these best ideas and 13 have expired worthless, while 1, Google, expired slightly in the money for a 93% success rate.

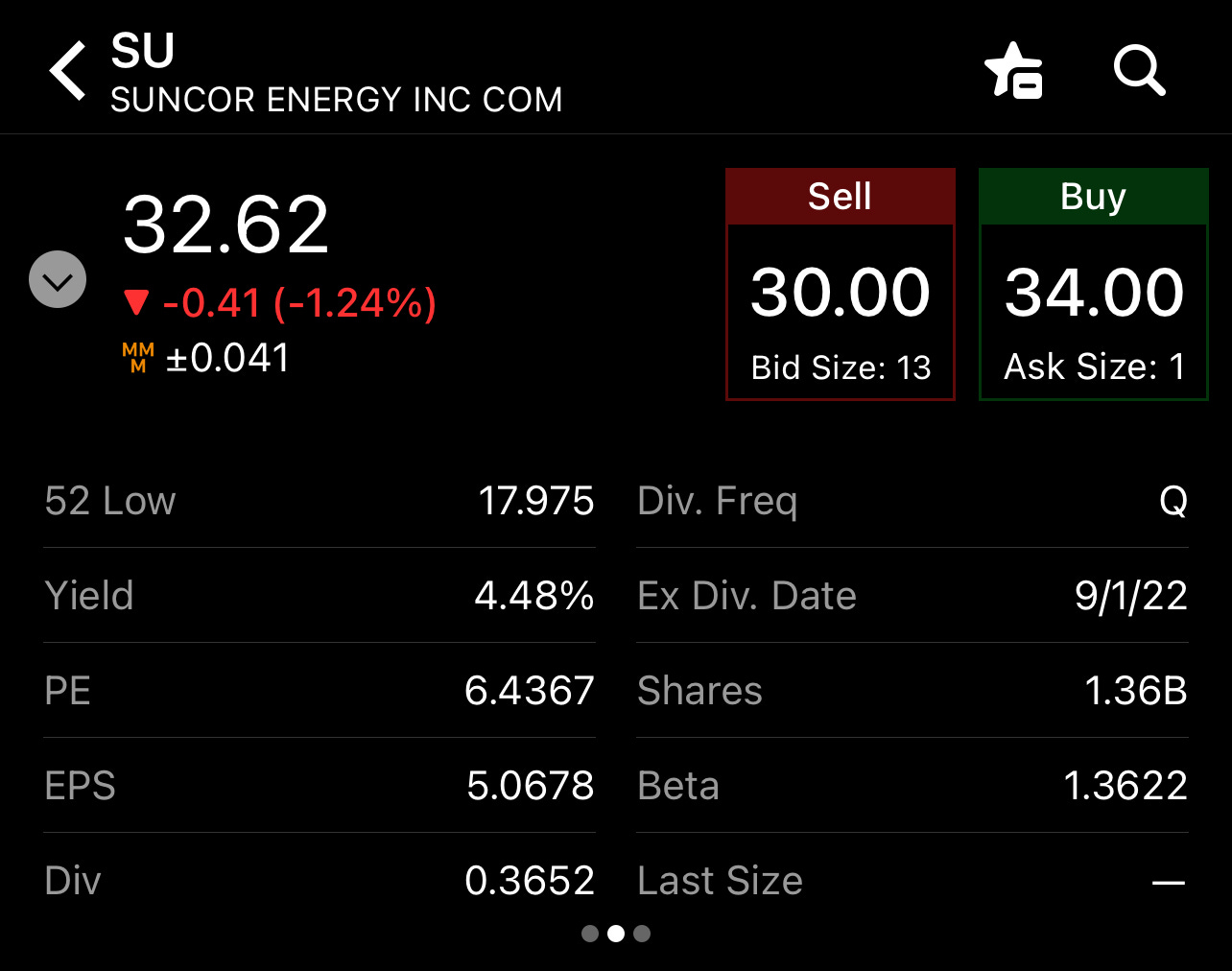

This trade is a special one because it not only gives us the opportunity to make 25% on our risk, but because this name pays a dividend in a few days, it allows me to be more aggressive than I usually would be because I don’t mind being assigned shares this week.

The Trade

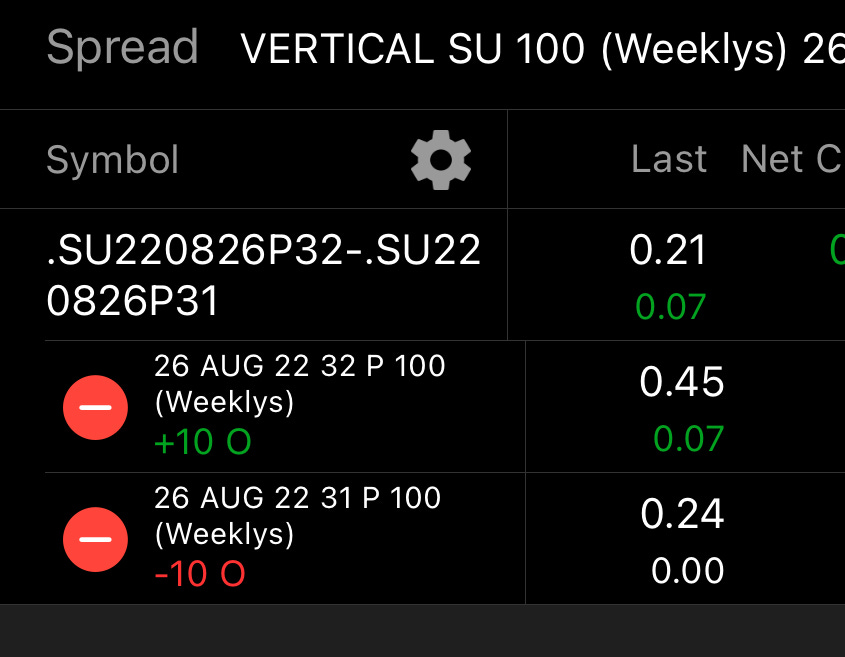

Suncor(SU), as you know I purchased shares last week at $31.60 and sold a $32 covered call and got called away on friday. It was a great a trade. This week I’m circling back to it but via short put spreads. I like the 32/31 put spread for .21. The stock is currently at $32.62 and we will attempt to buy it for nearly 3% less. This trade risks $.79 for a potential return of $.21. If assigned shares $31.79 is a great price.

The Why

As I stated above $31.79 is a great price to go long because it is at the 200 DMA. As you can see below the chart is setting up and basing nicely along the 200. Best of all, the stock goes ex-div next week on 9/1 so even if you’re assigned shares at $31.79 you have the opportunity to sell covered calls on a cheap stock next week AND collect a dividend, a little double dip.

Activism

Let’s discuss Elliott Management and their involvement. This is my favorite activist fund, led by Paul Singer. Recently he has gotten involved with Pinterest & Paypal with the shares rallying hard after. Suncor recently had their CEO Mark Little mutually agree to step down, this was due to Elliott Management and 3 days ago Elliott got the new board members it wanted put in place.

Fundamentals

The name is cheap well under 10x earnings, the yield is near 4.5%, you can see what the activist sees. Net income was up 360% on the recent call. They gave plans to divest assets and return capital to shareholders. All things you want to see.

Options Activity

Last week there was a large buy of September $33 calls, over 10,000 of them. On August 15th someone sold nearly 5,000 September 9th $26 puts. In early August there was another large buy of January $37 calls.

Recap

Cheap name, nice dividend, goes ex-dividend soon, activist involved and a nice chart setup. When you’re selling put spreads that ticks just about every box imaginable for one to sell put spreads aggressively. Again the hope is your short put spread expires worthless and you don’t even get shares but if you get assigned shares at around $31.79 here and hold 1 more week, you will get ALOT more off your cost basis via a covered call next week along with the dividend putting your basis likely below $31.

The Overall market looks weak, I’ve noted the bearish divergences I’m seeing. I’ve noted the RSI turning south and the multiple rejections at the 200. I don’t see much upside particularly at the moment, could that hurt SU going forward, sure, but this name is not egregiously overvalued where it would be slammed in a downturn and it’s a name I’m comfortable being long because of that valuation. You can aggressively sell calls on it until you’re called away if you do end up stuck with some shares.

I made this post free, feeling generous, new baby on the way this week, but if you do enjoy this please be sure to subscribe. I post recaps everyday of all the unusual options activity, charts, and what trades I am putting on.