We Broke The Year Long Downtrend Today

Yesterday when I said the price action was bullish, this is what I meant. We did the same “V” up again today. They continue to buy every micro dip daily and for the first time in over a year, we closed above the downtrend we’ve been in.

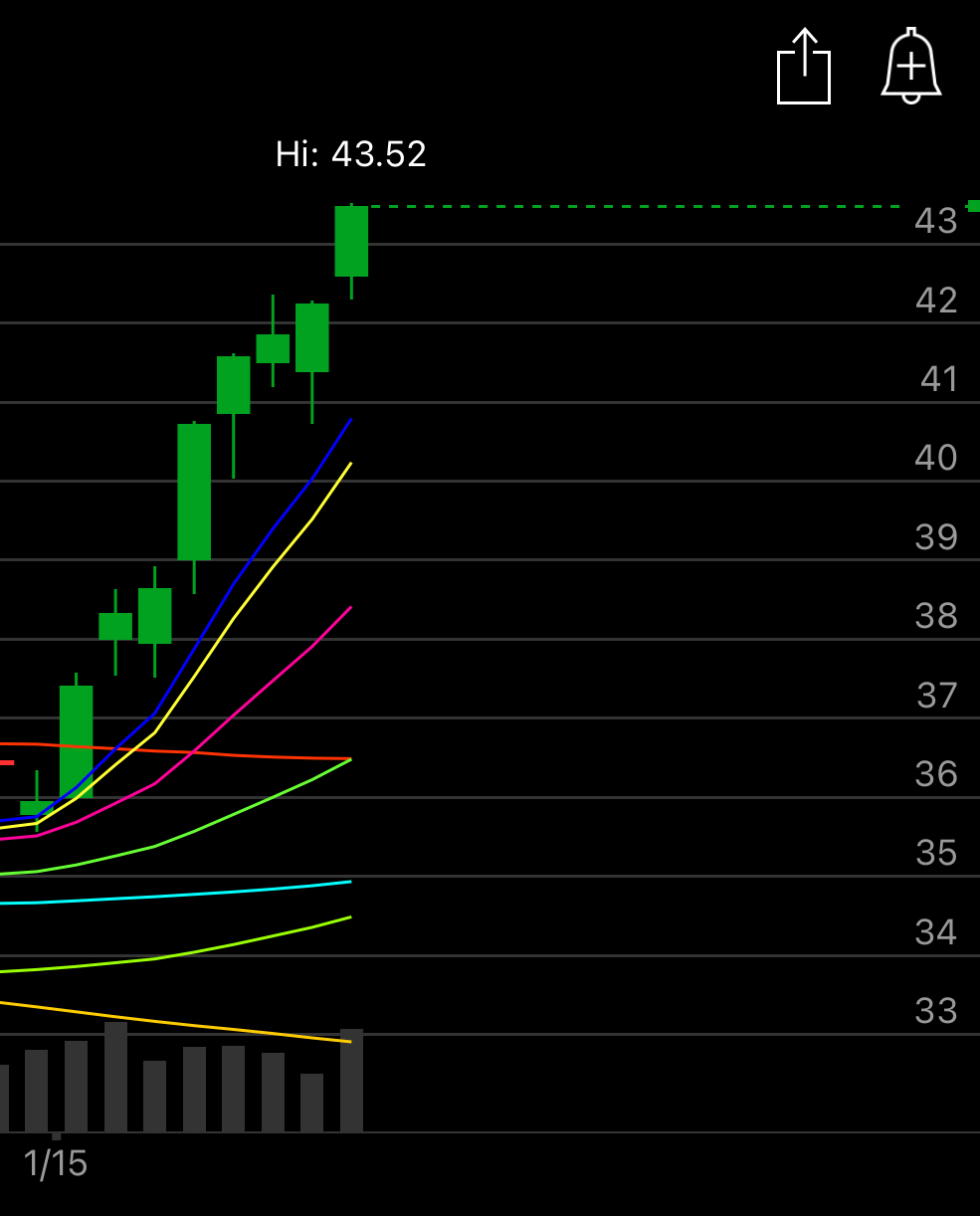

Here is the daily candle, we gapped over the downtrend, tested it and then continue on to close at highs. This is incredible to watch and exactly why I closed my put hedges yesterday, you can’t fight this kind of strength just because you believe something. That is the fatal flaw most investors make, they hold on too long because of their “beliefs”. Those who survive and thrive at this game have no emotions. You have to be able to rip the cord when something isn’t feeling right and like I said yesterday the price action was getting to be unbelievably bullish and none of the macro stuff seemed to matter.

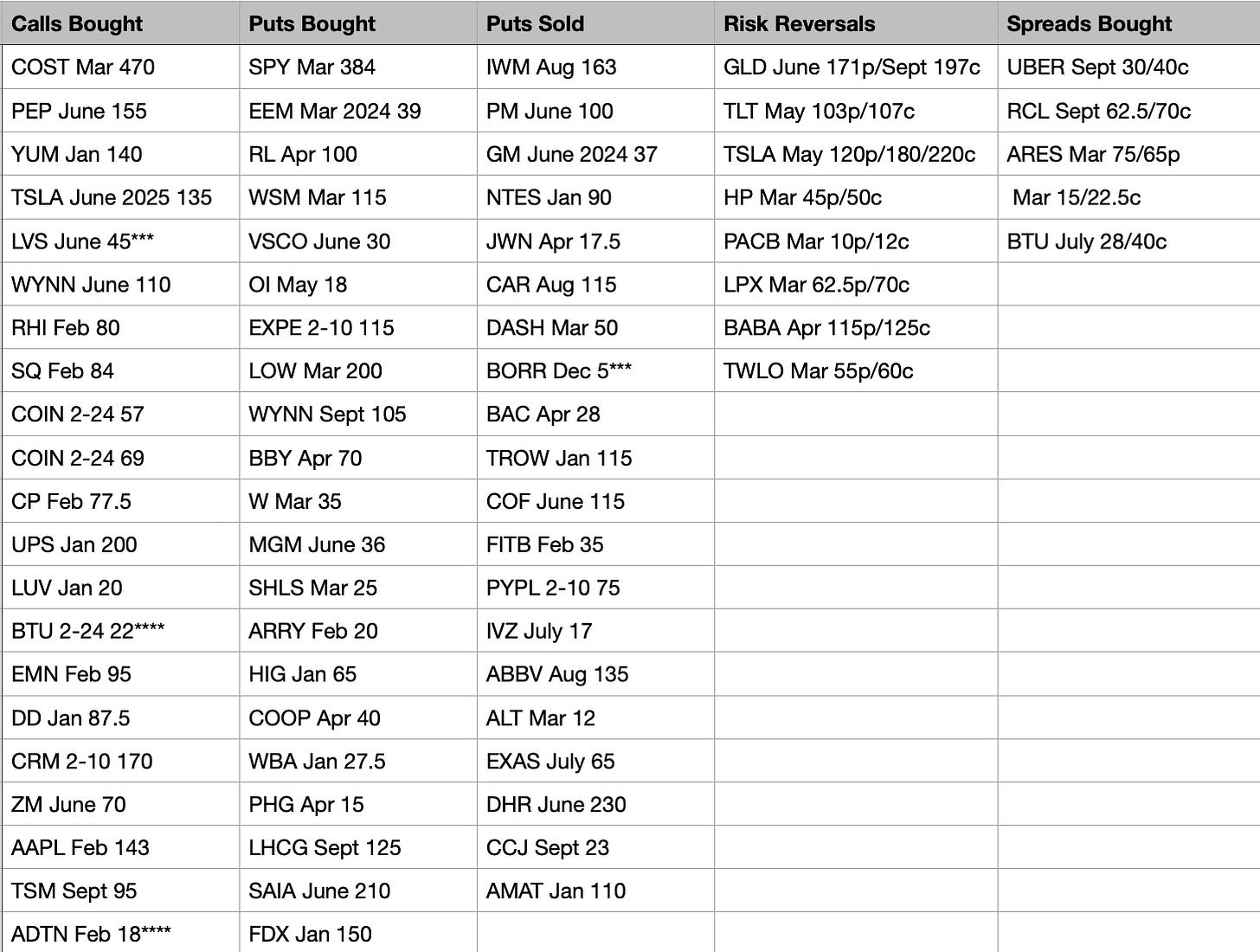

Today’s Unusual Options Activity & What Stood Out

Before I get into today’s recap, some of you might remember this, but in one of my recaps last week I mentioned JXN having an odd lot of Jan 2024 calls bought at 40 one day. I followed it by selling puts lower, but I looked today and it’s been up everday since. It made me laugh, check this out below. Just goes to show you how important it is to follow the flow of money.

Today’s Recap

LVS had 25,000 calls bought at $45 in June, huge vol, esp for ITM calls

BTU saw calls bought for 2/24 at 22 and a large call spread bought for July at 28/40

ADTN saw a weird lot of calls bought at $18 in Feb, a name that doesn’t see much

BORR saw a weird block of puts sold at $5 in Dec, very little action here

CCJ Sept 23 puts sold in huge size, I followed these.

TWLO interesting risk reversal selling March 55 puts to buy 60 calls, coming into this year I told you this was my favorite position for an activist and it’s up almost 40% in a month.

UBER another name that has seen nonstop bullish flows for weeks with a large September 30/40 call spread bought today.

TSLA with a large risk reversal put on today selling 120 puts in May to finance a 180/220 call spread, interesting because not much capital risked for a monster return.

What Did I Do Today?

I outperformed by alot, why wouldn’t a levered put seller do so. More interesting was the weakness in the Russell and my outperformance while mostly focusing on the IWM since that was the index that was already broken out. How the SPY closes tomorrow will be of great interest to many and we have PCE in the morning which could just as easily send us back lower. This minefield of datapoints isn’t close to ending.

Trades I Put On Today

CCJ Jan 2024 23 puts for 1.65

NOW Jan 2024 350 puts for 25.20

VZ 1/27 40 puts

VZ 1/27 39.50 puts

That’s all I added today, you all still have my book from monday for the rest of what I have. CCJ was a name that I’ve liked for some time, it continues to see bullish flows repeatedly and I followed the September puts sold in size today. NOW had a great quarter and you all know my belief in Post Earnings Drift so I sold puts far lower there. VZ I’m trying to build a position to sell covered calls on. This is a name that does nothing but pays a monster yield and I can sell covered calls on it to amplify that return to likely over 20%/year.

This is going to be my last post for the week, I’m on a vacation with my family, so no weekend best idea, as I said last week, it’s best to not gamble during earnings season and with all the big players reporting next week and Jay Powell speaking it is best you take tomorrow as a chance to lighten up wherever you feel necessary because the following week has ALOT of potential for some crazy moves for those not interested.

Since I won’t be around this weekend, I’ll post this now, before today I was up 16.76% this year vs 4.71% for the S&P and 8.17% for the Nasdaq. After today I’m nearing a 20% January, that is absolutely outrageous for someone selling puts. It’s one thing if you’re buying calls but I always said my goal is 1%/week, not 20% in 4 weeks, but I can’t complain, it’s been a great start to the year.

I’m proud to say that from the time I began to write this last June, the market is still red and I am very green up 62% vs an S&P down 2.5%. When I set out to do this, part of it was to show people the real “fundamentals” of the market with charts and option flows but moreso to document what I’ve done for years which is outperform the market handily using a combination of charts, option flows, and premium selling. You always get people saying, “ if it’s so easy why doesn’t everyone do it” and my answer is I don’t know nor do I care. I do it and that’s all matters. I’m not about showing past results but showing what I’m currently doing and I did it during one of the toughest stretches we’ve faced. I’ve handily kicked the markets ass since last June when this started and I posted every trade along the way. So for those of you who’ve been here from the beginning, thank you for sticking around, I hope you’ve learned a thing or two. I really am interested in hearing below from those of you who’ve been here a long time, how are your returns from day 1 last year on June 8th? I’m genuinely curious how you’re doing, leave a comment below.

Here is to hopefully a great rest of the year!

PS - if we fall tomorrow on PCE I didn’t jinx us, we’ve just been straight up for 5 days, it’s ok if we have a breather.

Enjoy your weekends and I will see you monday :)

Great post today - thanks as always James and enjoy the trip/weekend.

Hey James! Great post today. I'm still holding onto a SPY 400/390p hedge so I'm down a bit but here's my performance since joining and beginning trading with you (12/22/22):

Net Liquidated Value w/Hedge 2.32%

Net Liquidated Value w/o Hedge 3.53%

Total Cash Returns (assuming all positions expire without assignment) with Hedge 11.74%

Total Cash Returns w/o Hedge 19%

Keep in mind I'm basically only doing CSP's with a small cash balance. I'm really happy with all the advice you give on the substack, discord and your calls are always awesome. Not decided what to do with the hedge with Powell coming up and a minefield of data points.

Keep doing the great work!