We Broke Trend. It Is Time To De-Risk

I know I usually don’t write a recap on friday’s but this was too important to not discuss so Im getting one out there. Yesterday after I published my recap very early to remind you all that there was still time on your end to decide how you wanted to position yourself into this morning I got smacked around, I took a pretty big hit on my balance.. We all know the payroll number was this morning and I had mentioned all week that this would be a make or break session. We were toying with that uptrend line for days and I thought the session today we would either move away from it or finally breakdown. What I didn’t expect was a vicious selloff late thursday that would send us below that trendline.

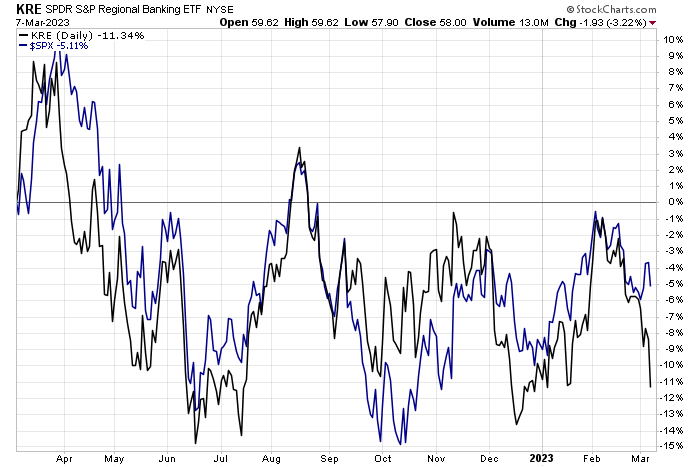

That red arrow below was when I began compiling everything for yesterday’s recap and we sold off 2% in a matter of hours AFTER that. The contagion from the SIVB fallout was nasty, you even had things like Bank of America down 6% in a session and that name doesn’t even move like that. That unusual put buying I had mentioned in small banks on wednesday’s recap ended up being a disaster in the making for stocks.

Why Now?

WE BROKE TREND. That’s it, late yesterday for the first time since this uptrend began, we broke it.As I’ve been saying for sometime, the market moves in phases, there is a proper time to lever up, and there’s a proper time to remove all leverage. Hedging is a waste of time in my opinion because you don’t hedge in uptrends, it rarely works as trends are strong and don’t care about short term fluctuations.

Late yesterday you can see below that we finally violated that trendline. We had tested it so many times on the way up, but yesterday was finally time to test lower. This signals a change is coming. Yesterday was also a 93% down day I believe? It was over 90% I know, but that usually is not a good sign.

If you step back and take a look at the year long downtrend we exited recently, you will see that the first test above the downtrend failed, it trapped alot of buyers, reversed lower, based and then finally broke out as you can see below.

Here is a closer look, but that first test signaled a changing of trends, we remained strong, and eventually a couple weeks later, we finally broke out.

This, in my opinion, is the same scenario, but in the opposite direction. Maybe today is a monster green day in the market on a payroll number everyone loves and the bulls buy everything, maybe we sell off hard, whatever happens, the more times you test a trendline, eventually the floodgates open. I would say the probability of a large selloff has increased dramatically. A close back under the original downtrend we began in November 2021, that downsloping red line below, would signal a time to remove all risk in my opinion.

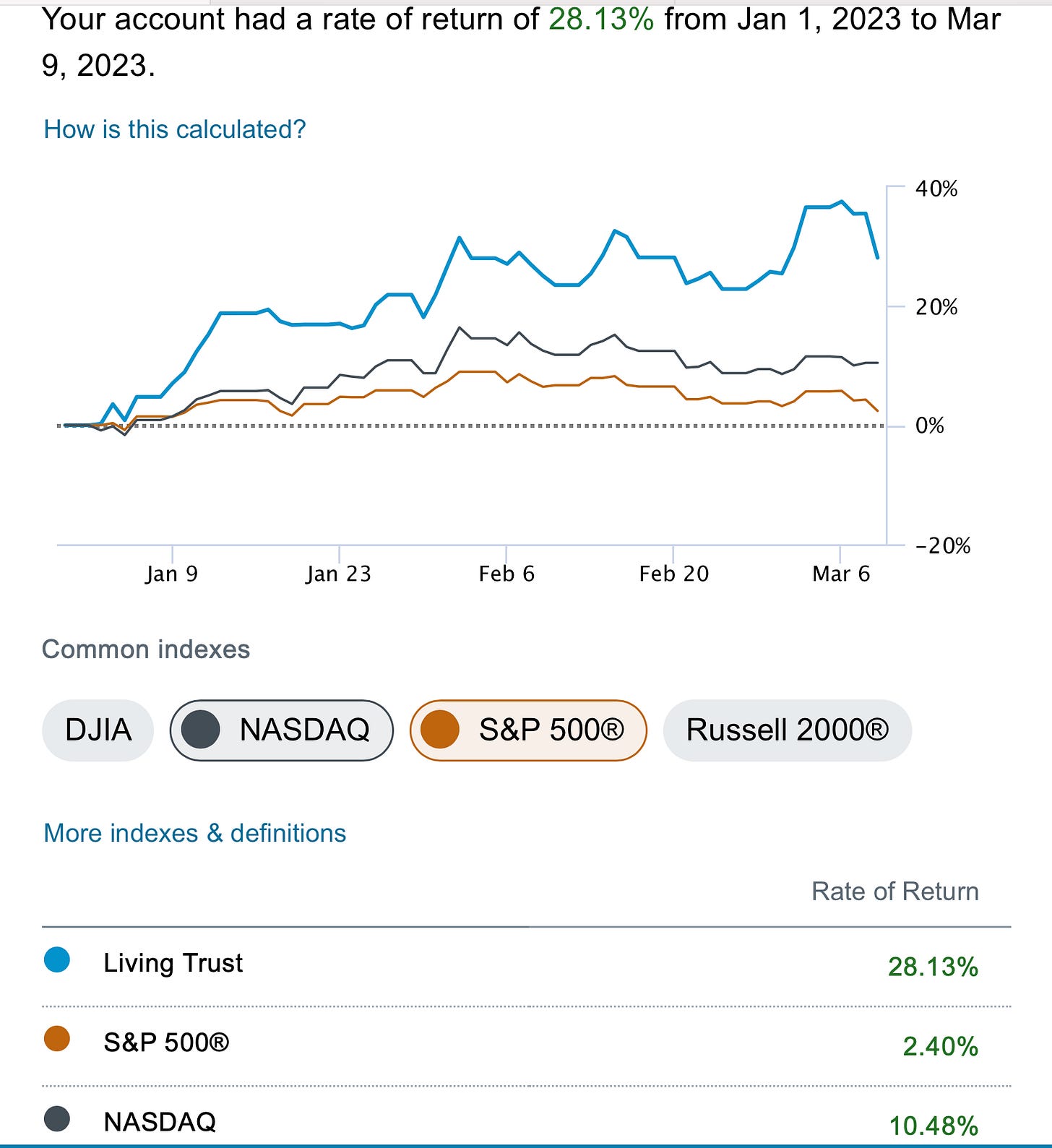

So now what? I didn’t want to but late yesterday I took off alot of risk. The stuff that would be hardest hit, tech. Do I think anything is wrong there? Long term, no, but I wasn’t a long term investor, I was a levered short term trader and it worked out phenomenally for us all in here over that entire uptrend and coming into this year, never once did I think I would be up 37% the other day or 28% as of this morning, that leaves me up 14x the market this year as you can see below.

So the leverage did what it was supposed to do, help me outperform. Now though, it’s time to close out the rest of the positions you’re uncomfortable with in my book, take the first quarter as a win and watch things unfold and wait for the market to find a new base. A mistake investors make is always having to do something. The reality is you don’t have to, you have to catch trends and ride those, that is all.

So decide how you want to play this today, but for me, it involves accepting that my first quarter has been better than I ever imagined, lightening up dramatically, and seeing what comes next. Something is wrong with our markets, the KRE just crashed 8% in a session, that is not normal, if you remember the chart I shared the other day before that dump, the market tends to follow regional banks. It certainly did yesterday, there seems to be something bigger going on with the banks and all of us have done well enough so far into 2023 that even if we never placed another trade this year, we would be ok. If you told me I’d end 2023 up 28% I wouldn’t cry about it.

Bottom Line

Let’s allow the dust to settle the next few sessions and see how the charts and flows are looking then. There is a time to be bullish, we just had a tremendous 6 months, and there is a time to be bearish, a non biased person would say that began yesterday.

Have a great day and I will see you over the weekend with my best best idea and charts for the week ahead.

Thanks a lot for this, i derisked and i am waiting what will happen. Still up 20% YTD and I feel it is a good win for me since i am just learning how to sell puts. Over performing QQQ and SPY feels good. I closed the positions bit too late during Friday but without you signaling break down of the market i would be still holding so thanks a lot :) Have a nice weekend

Thanks!