We Broke Trend, So What Now?

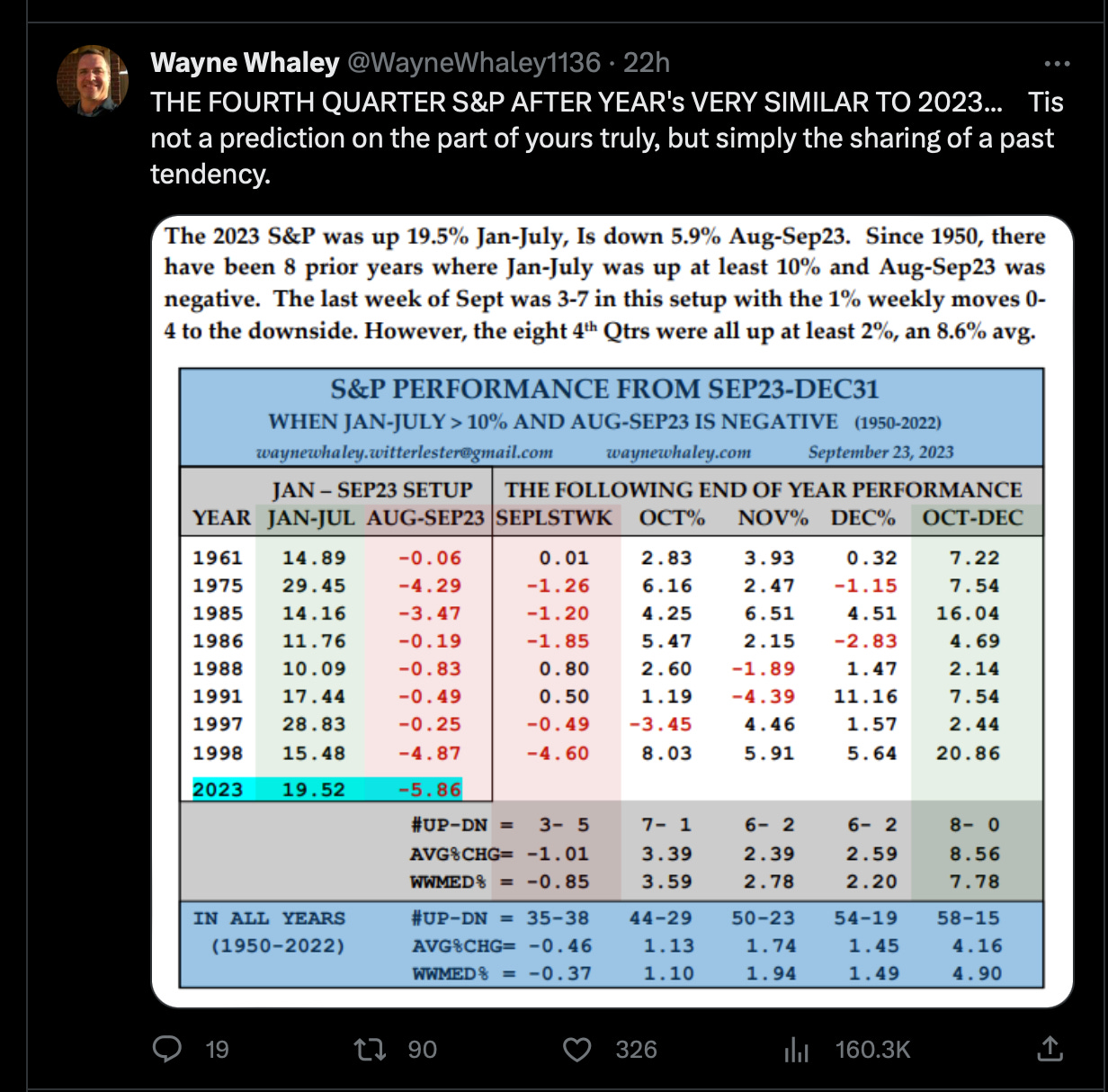

I’ve seen all these tweets this weekend about how bullish everything is and how things are perfectly normal, like this

or like this…

The reality is we broke a major trend, and when that happens, historically, it gets rough for a bit and we drift down to the 200 week, the green line, with this past March being the exception. Let’s take a closer look….

This below was the 2018 breakdown which led to the SPY going from 285 when it broke down to the mid 230’s in a few months…….

This is the Covid crash where the insane panic and vix topping 80 sent us well below the 200 week as the SPY went from 320 at the break to 220 in a month, but it was very short lived.

This was the breakdown last year as again we pulled back to the 200 week as the SPY broke down from 450 to below 360.

And here we have the current break of trend. March was interesting because the breakdowns were saved by 4 different monster earnings releases from mega caps. We have Microsoft, Meta, Apple, and Nvidia all reporting huge quarters and their massive moves saved all 4 of the individual breakdowns with a massive gap up, what is the catalyst to save us this time? If it’s earnings for big tech, that is a month away, so naturally it seems probable, based on the past, that we drift down to 420 at a minimum and a decent probability we move down below 400 to that green line.

For your book, I can’t answer because I don’t know your timeframe or objective. I know you shouldn’t be using any leverage right here. I know you also should be selling covered calls vs your positions and overall I just would not be using any short term calls here. Common and leaps are fine. Everytime we have a dip like this people always panic and bring up these parallels from other crashes, the reality is this is just part of stocks. Trends break, stocks go down for a little bit, but they always come back just pull up a chart of the market over the last 50 years. Look where the SPY is today vs the 1987 crash, the tech bubble bursting, the Great Recession,etc. Unless your retirement is imminent you don’t have much to worry about, they always save stocks.

Now that question is James, if you feel the market likely goes lower, why are you sitting in AMZN leaps right now?

The answer is because I have multiple ways of thinking about it.

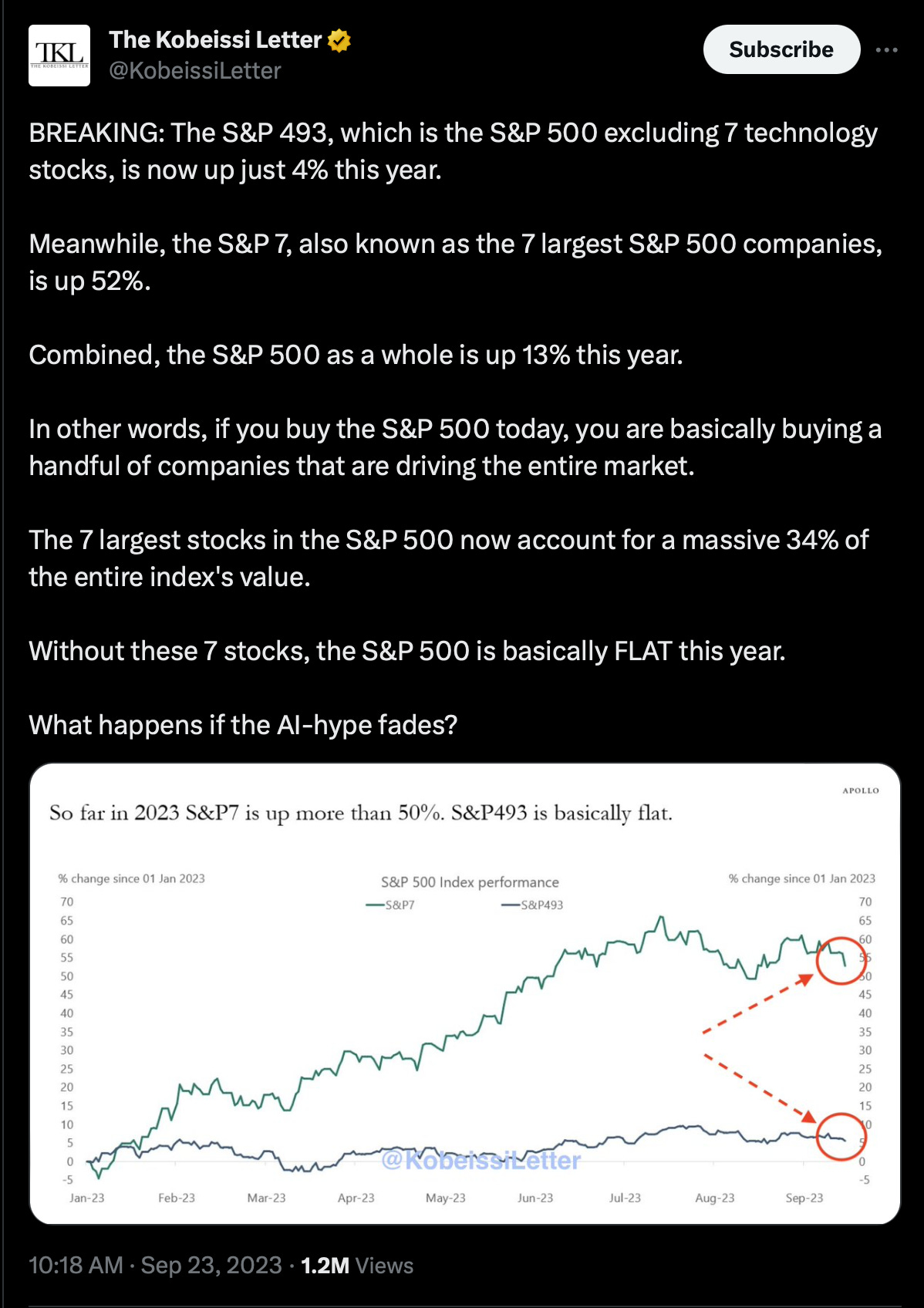

First off our market is completely driven by megacap tech, I’ve said it before but the tweet below highlights it even more. The 7 largest stocks make up 34% of the S&P. That is Apple,Microsoft, Google,Amazon,Nvidia,Meta, and Tesla.

As the tweet below highlights, the market ex those companies is up just 4%. Last year when those companies were smashed, the entire market was too. What am I getting at? The rest of the market really doesn’t matter, as big tech goes, so does everything else.

Back to Amazon, why them? Because of the big 4, they are the only one that is displaying real growth at scale with Operating Income up 131%. If you include the rest, only NVDA was better at 218% and you’ve seen the move that stock had.

Operating Income last quarter YOY

Apple was negative

Microsoft was +18%,

Google was up 11%

Meta was up 12%

Tesla was was negative

Nvidia was up 218%

So now Amazon awaits its lawsuit from the FTC which will be a giant nothing, the FTC has gone after Microsoft and Google and accomplished nothing, this will be more of the same. The lawsuit is expected to be revealed this week. Then there is the AWS slowdown which on the surface seems like an issue, but it’s not when you look at how this massive business nearly doubled in 3 years. Then finally, you have all the question marks regarding fuel and labor inflation that weighed on Amazon last year and nobody knows how those will reflect going forward. When there are question marks, the market throws a fit.

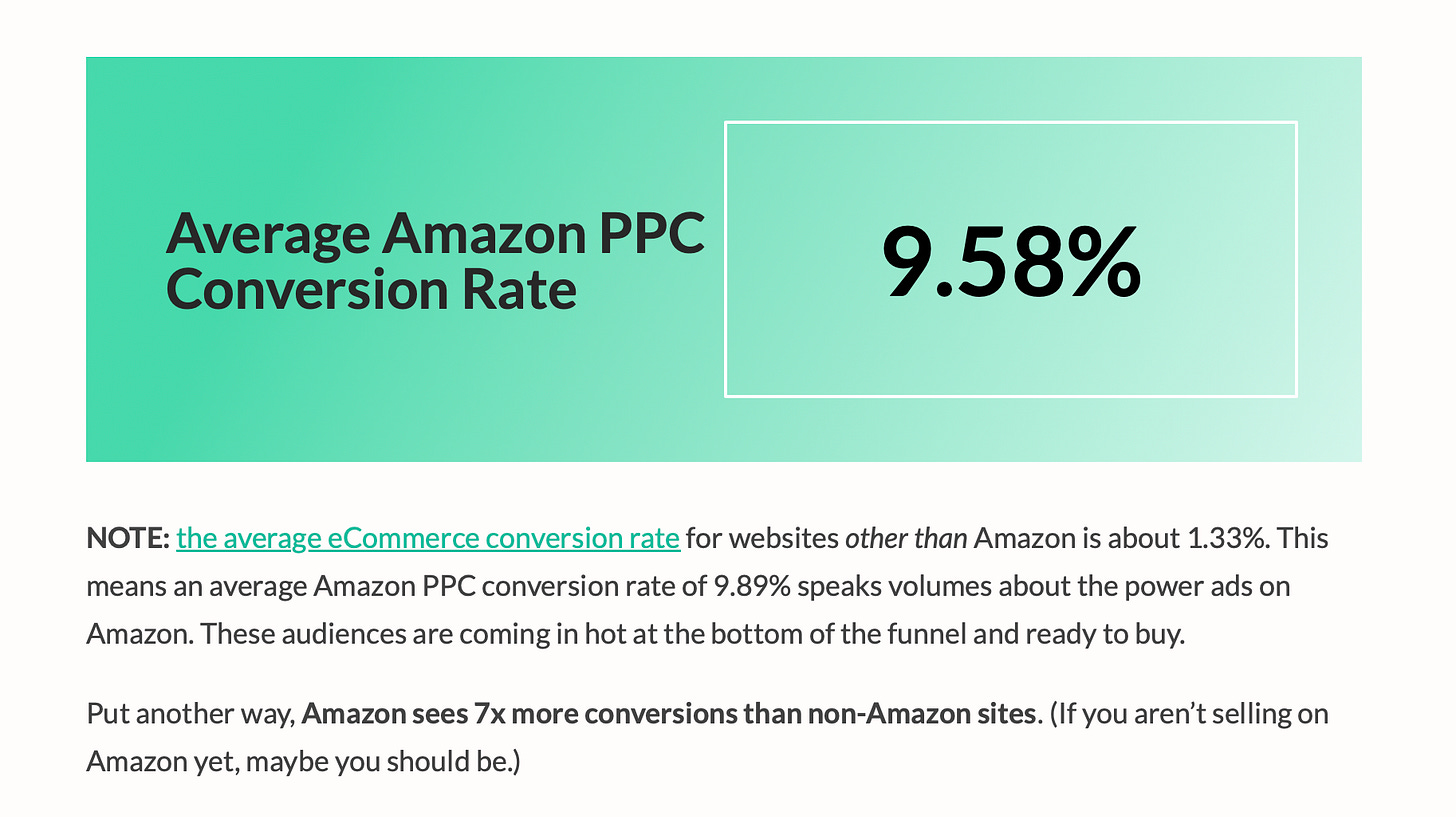

None of those worry me at all because of the astronomical growth of advertising. Most analysts really still don’t get that advertising is the main business at Amazon but they will soon. If we really are heading into a recession, we always hear ad budgets will be cut, that may be for Google and Meta, it won’t be here. These ads actually work. As you can see below, Amazon ads convert at near 10% while the average conversion rates for other sites is 1.33%.

That is just due to where Amazon is in the sales funnel and they’re flexing their dominance even more by adding advertising to their prime video starting in 2024. Historically as a business Amazon has turned every cost center into a profit center over time and this is just 1 more venture for them. The amount of EBIT it will add should be substantial over time as advertising is incredibly high margin. META is an $800b/company of $31.5B in advertising last quarter. Amazon did $10.7B so its safe to say at the moment Amazon advertising is probably worth $250-300B by itself considering it is growing twice as fast as Meta is.

No other megacap has its biggest profit drivers growing double digits like this and Amazon has 2 of them with AWS and Advertising. So while there is legitimate concern at Apple, Microsoft, and Google about where the meaningful growth will come from, there isn’t any of that at Amazon. The question for Amazon remains the same its been for years, when will THEY decide to show profitability, and if last quarter was any indication, the time is now. Until they show some consistency here, it can’t break off from the rest of the market, so my guess is next quarter if it shows another 100%+ operating income beat, the market will finally respect their return to glory.

With all that said, why have I stuck in the trade. Well for starters it expires all the way out in 2026 which is an eternity from now. Markets will gyrate plenty between now and then. Secondly, the equity is so undervalued and the options flow is all so bullish, I can’t risk some news dropping out of nowhere and I miss a substantial move. Thirdly, I can sell calls vs my position and reduce my basis, so moves down don’t really concern me. Lastly, aside from a very modest break even on the leaps, there are tax considerations and while you may view it as me giving away money, I don’t because I already have a very large taxable gain this year and if the trade goes south on me in the next 3 months, great I will offset some of those gains with a loss by trimming some of these.

The bottom line is Amazon has always been the most intriguing company to me, for starters most retail investors don’t understand it, but Amazon wants it that way. Amazon has been like a dormant volcano the last few years, building up for this monster move, when it comes I don’t know, but it is coming. You don’t spend all this Capex and R&D without an incredible return in the end. It just doesn’t happen. So while the market may be set for a potential move down, I am not in panic mode because some companies can still grow in these periods and as we saw last quarter, this is one of the ones that is doing it.

man, I like the way think and put it on paper!!

Good stuff as always