We Broke Trend Yesterday, What Now.

I’m going to make this post public, I think it’s important enough that you can share it with whoever you want. Yesterday was an ugly session. Whether it was the threat of a potential war, rate uncertainty, or whatever narrative they wanted to run with, none of that matters, what does matter is that we broke trend. Investors tend to focus too much on the “Why” and that isn’t as important as understanding that something changed and making the appropriate changes to survive this period. Take a look at the chart below.

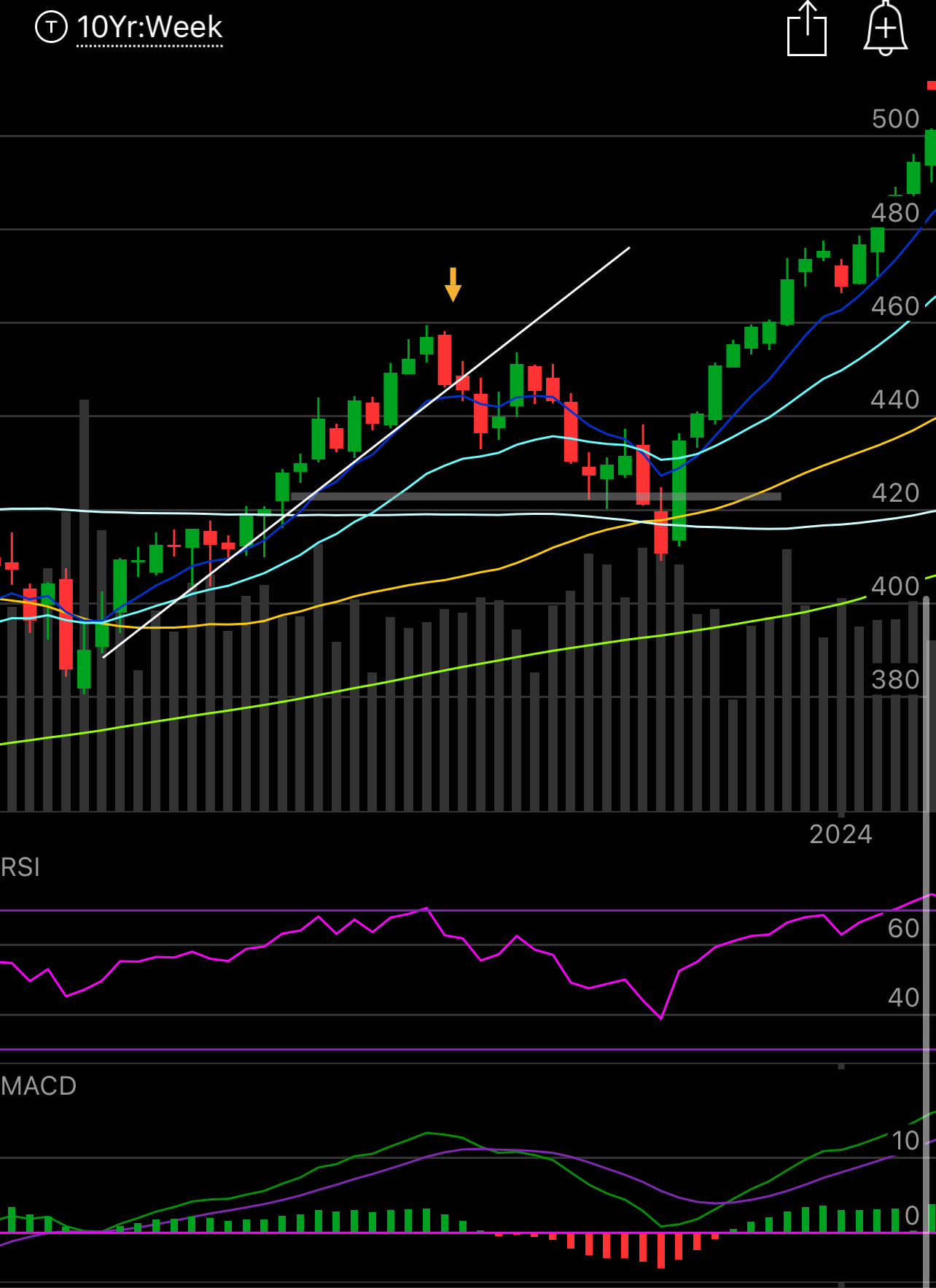

You see that perfect uptrend we’ve been in for 6 months, that now has been violated. You notice how the MACD is about to cross and flip negative for the first time in months too? Everyone is always in a panic about “when” the market corrects and I always tell you here that markets do not just correct. You have plenty of time to see what’s going on and make adjustments. In this case, the market has been sending warning signals all week. I’ve pointed to losing the 21 ema as big deal when we first did it 7 sessions back with that big bearish engulfing candle. Of course we snapped back in the next few sessions but the weakness persisted and you can see inside the oval I drew where the 8 ema(dark blue) finally crossed the 21 ema(light blue) yesterday which signaled an 8/21 crossover. You will also note that while we tested below the 50 day(yellow line) we bounced and held it.

I’ve posted in the past that every market correction begins with a trend break. Really, look at these charts below and tell me what you think.

Here was late summer 2023 when when we broke trend in late summer and what followed was a multi week sell off.

Here was the 2022 sell off, same thing an uptrend broke.

Here was the Covid Crash in 2020, you will notice even there the minute the chart broke, the chaos was beginning, if you look at a daily chart you can see to the day when the market told you something was brewing and to lighten up.

and lastly here is the 2018 market sell off

So what do you get from all these charts? Should be simple, uptrends break means things go down for a little bit. Charts are just buying and selling visualized and when a trend breaks, it is letting you know something just isn’t right for the time being. The market is speaking to you, the problem is many don’t listen and that’s when you get hurt. Of course if you look a year or 2 out from all those selloffs above, we are much higher every time so if you’re buying the dip just know the weakness will persist but you will likely be fine in time. After all markets are designed to go up.

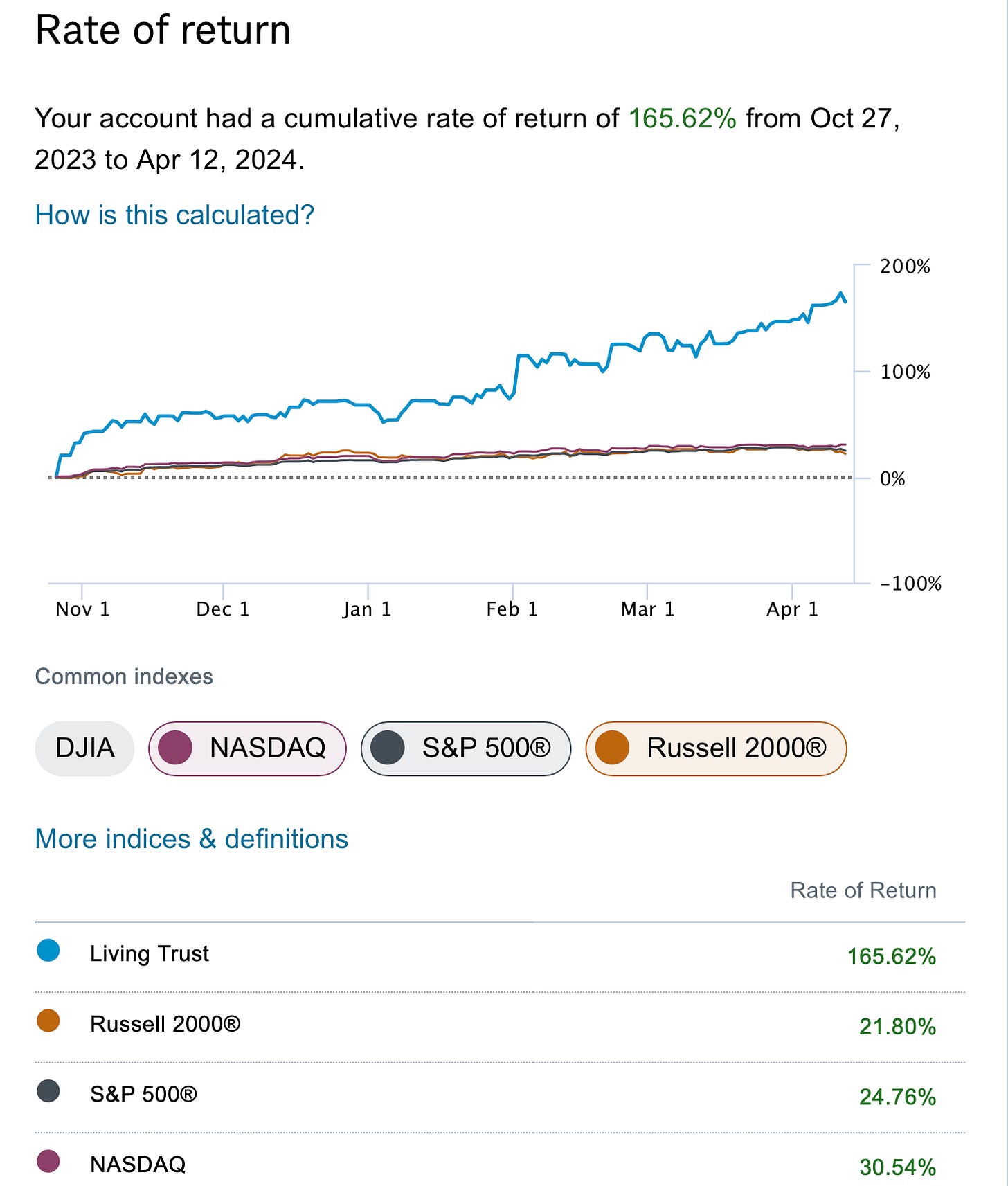

As for right now, we’ve been straight up for 6 months, how much are you up in that timeframe? This all began the day after Amazon’s print in late October 2023, I’m up 166% vs the market up 25%. This move has been insane, there really isn’t another word for what has gone on. I know I’ve never returned 166% in 7 months ever, but it happens if you’re levered into a name like Amazon and it goes from $119 to $186+ in that timeframe. If you want to go to cash, nobody is going to fault you, I just wouldn’t recommend it. I would suggest what I’ve said all week, remove leverage, close up short term calls and maybe sell covered calls on names you don’t mind being called away. That’s it, panicking is silly as things are going to be ok.

The funny thing is if you look at RSP below, that is the equal weight SPY you will notice it looks much worse than the SPY.

Why? Because the SPY is so heavily concentrated in those 6 megacaps that make all the money so the panic is happening deeper under the surface and breadth is narrowing. What sane person is selling these big names printing money faster than anyone in history because of a potential war or rates staying elevated. Those 6 win in a higher rate environment because they have all the cash. If anything people will hide in those eventually and I always hear people say its “crowded” well Apple was crowded from 2014 on and it’s still up nearly 9x in that timeframe, really, look below.

The reality is names get crowded because they are the best. People overthink things, they always want to sound smart and find a gem or be contrarians and they’re ignoring the reality that these 6 big companies are just seeing cash pile up on their balance sheet weekly. Those companies can buyback shares into perpetuity. You can buy these growth names all you want but take a company like Amazon that many said “doesn’t make money” they’re now sitting on more in annual interest from their cash pile than most of these growth names generate. A name like Apple or Google could see headwinds from whatever and still print so much cash and buyback so much stock that the equity can continue higher for years on end. To say these names are unstoppable is an understatement.

I won’t bore you with the chart I’ve posted multiple times, but we’ve been straight up for 200 years. Whatever is coming, as long as you’re not reckless with short term trades or leverage, you will be ok. You just have to understand that when you’re in an uptrend like we were just in, it is fine to press things. When that trend breaks you have to accept reality and adjust your book. Could this all change? It is possible. We could have just had a false breakdown. If we reclaim that trend above then things would be ok. For me, anytime the market or a specific name is holding about the 21 ema that is your short term signal that it is ok to remain long, below that caution is warranted. Earnings season is here and how these companies report and guide will be more important. We need to wait for the megacaps in 2 weeks to potentially save this market. This coming week we have no companies of major importance reporting so it is an opportunity for markets to be weak. Then 5 of the big 6 report the following week.

If your timeframe is 12 months or more away, things will likely be ok. They’re probably ok in 6 months even, we’re heading into an election and I imagine Joe Biden would prefer things be at all time highs into that. We are just facing the reality suddenly that there could be a major war in the Middle East and everyone front running the rate cuts was wrong. We’ve gone from 7 cuts in early January to potentially 0. I know some banks are still in the camp we do 2-3 this year, even our President said we will cut soon. I don’t see how that’s possible, but I’m not even going to pretend that I care what happens. All that matters to me is the price action and right now it’s telling you to watch out. That’s it.

Have a great weekend and I will see you Monday.

Well done! Very sensible post. Be cautious, but don't panic! It's like driving in the sunshine, and it suddenly starts to rain.

I had been wondering about AMZN's response to earnings. In the past few earnings, it hadn't run up in advance but jumped on the announcement. This time, it started to run up in advance, and I wondered of it would sell off "on the news." But since it's come back a bit, and since the market is likely not to be frothy before earnings, perhaps it will be another normal reaction.