Why Amazon Is A Generational Buy Right Now

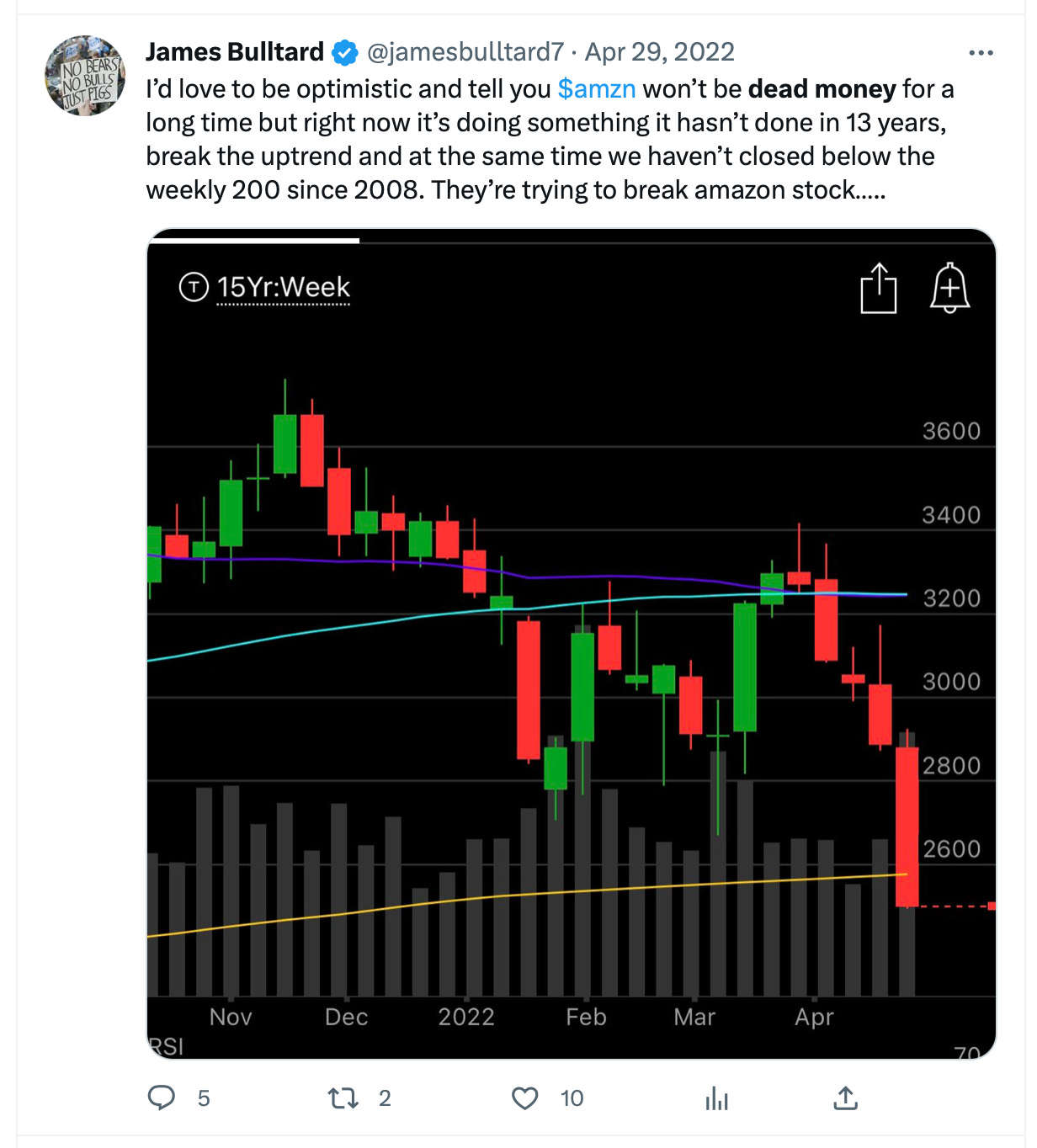

I wanted to do something a little different this morning. I wanted to do a deep dive, as meaningless as I think they are, into Amazon and why I think there is an opportunity to make ALOT of money in the coming years. As you know I was a staunch Amazon bull 2 years ago, obviously when the chart broke down last year, I moved aside, that was last april in this tweet below.

But now, the stars are aligning, the real concern now is only the overall market holding up. Amazon is ready to explode if it does. As you know I put on a very large risk reversal 2 days ago out in December 2025. Let me discuss a few points.

The stock is trading at pretty much pre covid levels, 116 now, as you can see below it was nearly 110 before Covid was a thing. So 3 years of growth and you’re paying not even 5% more today.

Do you know how much Amazon has grown since Covid? Q2 2020 was the first full quarter of Covid lockdowns. Everyone was stuck at home and ordering everything to the house. Amazon was the big winner. Sales zoomed and Amazon did $88.9B in revenue and while that was impressive, you can see below Amazon just did $127.4B in revenue this past q. So revenues are up 50% nearly from the start of covid, very impressive.

Of those revenues, the highest margin segments at Amazon are “services” those were $38.67B during Q2 2020 and today they’re $70.4B. So the highest margin segments are up nearly 100% and the stock is 5% higher.

The AWS slowdown is very overblown. AWS is now at $21.35B/Q which is up 100% from Q2 2020. Are companies optimizing spend? Sure. Does Amazon depend more on startups and small businesses than Microsoft, sure. The runway here is so massive and we’re still so early in the game, Morgan Stanley projects the cloud to grow significantly as you can see below to nearly a 4x by 2032. I think those projections are low still because of all this AI we’re discussing now and the workloads involved.

3rd party sales is Amazon’s main business and that is booming. I know its cliche to say AWS is Amazon and retail sucks. While 1P retail is a pretty horrible business, the 3P segment is the greatest retail business in the world and it just did $29.82B in fees collected in Q1 when it did $18.2B in Q2 of 2020 in the first full covid quarter. Remember now, these are just total fees collected, not revenue. Yesterday we saw Target post revenue up $118M yoy, Amazon, due to the way they report 3P figures, their retail sales were up well over $10b in Q1, yes, 100x what Target grew year over year. This business is dramatically misrepresented by nearly everyone who discusses Amazon

Advertising is very high margin, we know that from META and GOOG. Amazon is now doing over $9.5B in Q1 in advertising. In Q2 2020 we don’t know the advertising number because it was still stuff in under “other” but that number was $4.2B. Today it’s $9.5B and Amazon has another $1b in “other” still. So it’s safe to assume Amazon’s ad business has nearly tripled since covid. That makes sense because Amazon ads are the highest converting in the world at over 10%. Google and Meta ads convert at closer to 1%, when people come to Amazon they’re looking to buy something, thus it’s easier to market to them directly knowing their purchase history.

Subscriptions are booming. This was $6B/Q in Q2 2020, it’s $9.6B now. Obviously prices have risen at prime. More ring doorbells are out, Amazon is making a big push into fitness with it’s halo, Audible is the leading audiobook platform, and again this is just another very high margin segment that has seen over 50% growth in the past 3 years.

Free Cash Flow is improving, last Q showed a massive yoy increase in the TTM FCF. The optimization of the business is under way. They reduced headcount by over 100,000 and after 2 years of seemingly no direction, they appear to have seen the light. Everything is going in the right direction now.

Free Cash Flow is about to explode. You can see below that Amazon was only generating about $2.17 in FCF the year before Covid. Then the heavy investment cycle began and FCF went to the backburner. Well FCF will be back this year and it should grow massively in the next few years. Almost 5x where it was in 2019 by 2027 and those estimates are probably conservative considering Amazon is now in the easy part of the game which is trimming the fat and making it work.

The Charts

The Monthly appears to be near a major point where the MACD goes green for the first time in years and leads to a prolonged period of strength. Again the overall market needs to hold up, and that is more my big concern, but this is a very constructive look.

The weekly chart below shows a name that finally came up over many of the moving averages that were in it’s way early on. You can see a clearly defined higher low in early 2023 and the stock really doesn’t have resistance until the mid 120’s. Again, assuming the overall market can hold up. Once Amazon can clear that 200 Weekly in the mid 130’s it has blue skies above.

The daily does concern me a tad as it’s reaching overbought levels with another gap up this morning after good Walmart results. Stocks tend to return to the moving averages if they become too dislocated. Short term, it very well could cool off a little.

On the otherhand it could stay extended. Here is NVDA which was overbought in late January and has continued forth. What’s funny here is everyone is piling into NVDA as the AI play. Amazon has been in AI longer than anyone, they’ve been using LLM’s for years. Amazon is just very bad at hyping things. As you notice most earnings calls have the investor relations guy leading them until this past Q where the CEO came on. That is why most companies have the CEO run calls so he can get his message across, slowly Amazon is getting this concept after nearly 5 years of shareholder failure.

The Options Flow

While there are many more trades than this in my database, I’m only going to look at the ones placed in the last month and a half. Amazon is still the most bullish name in my database over the last 3 months and that divergence seems close to playing out. What you will see below is the large amount of January 2025 calls opened. These are giving the company time to get it together and make that pronounced move. Yesterday that ITM put sale I noted below at 135 in September was an interesting way to play another $20 of upside.

How I’m Playing It

As you all know I mentioned putting on the risk reversal I did the other day. Why use that? By selling the $90 puts in December 2025 and buying the $100 calls in December 2025, I am basically looking at a cost basis of $25/share. That is because the calls were $36.50 and the puts I sold were $10.50. Therefore at anything over $125/share by December 2025, I am in the money. Now, if Amazon is below $90/share I would either have to take shares there or close for a loss. I don’t see Amazon at $90 by December 2025 because that’s where it was in 2017 and that would be a catastrophic failure. On the other side by using these leaps 2.5 years out, doing some math off the top of my head, there are around 130 weeks until expiry? If I just sell weekly covered calls for .20/week I can get the total cost of the trade back by expiry. You all know I go into every trade thinking of every scenario.

At this juncture, with Amazon basically saying the biggest part of the capex is behind them, with the focus on generating FCF now, and pessimism nearly at it’s peak on how AWS is going to struggle, how the consumer isn’t going to spend, and with the charts aligning. I do think this is the time to take a large stake in Amazon. Could the debt ceiling or a recession ruin everything? Sure. Again, this trade might fluctuate day to day, week to week, but I am confident that I can reduce .20/week off my basis consistently and have the trade on for nearly free in time. In the short term, markets will do what they do, but I have a hard time seeing Amazon stay flat for another 3 years, after the last 5 where they did nothing. This really does appear to be their time to shine and I think they will.

I got this out this morning because I won’t be around the next 2 days. My father is a lung transplant recipient, and one of the side effects of all the medication he is taking is that he is prone to cancer. He now has his 3rd bout with skin cancer in the last 2 years. Fortunately it hasn’t spread, but he will be in the hospital all day prepping and then having surgery. My mother is too old to be there with him, so I will be there all day today and most of the day tomorrow until he’s sent home. That is why I will be out the next 2 days.

I hope your father feels better. Thank you for your knowledge. Best of Irish luck to you.

Thank you for the insights on Amazon. Our prayers are with your father on a successful transplant and recovery!