Why I Bought Bitcoin This Week

I had a lot of emails the last few days after mentioning that I took a stake in IBIT so I haven’t really had much time to sit down and write out my thoughts on it but I do today and I figure this is easier than replying to every single email.

What Is IBIT?

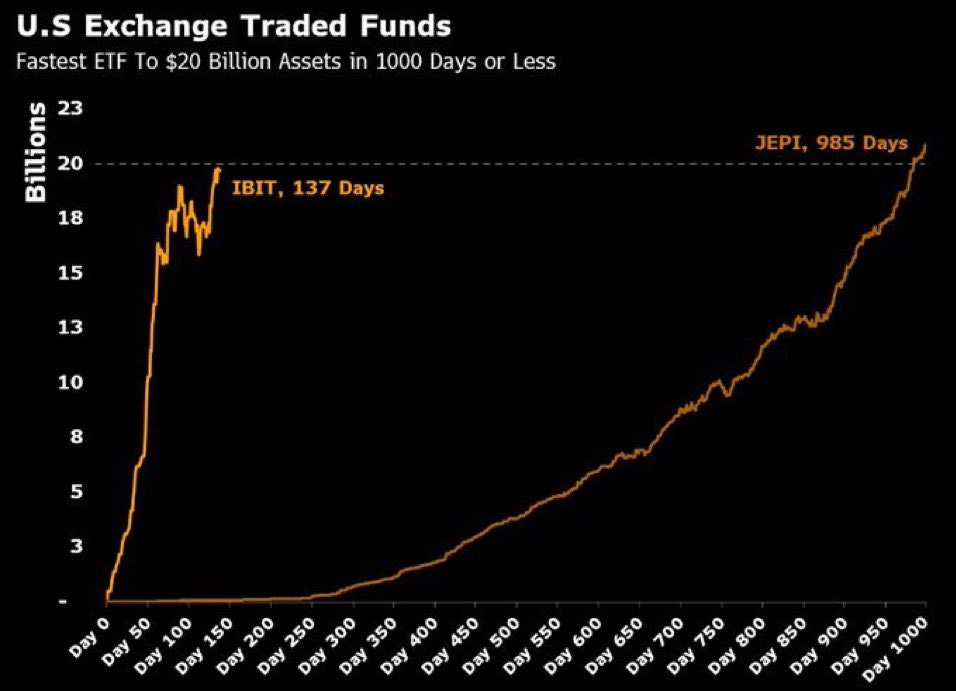

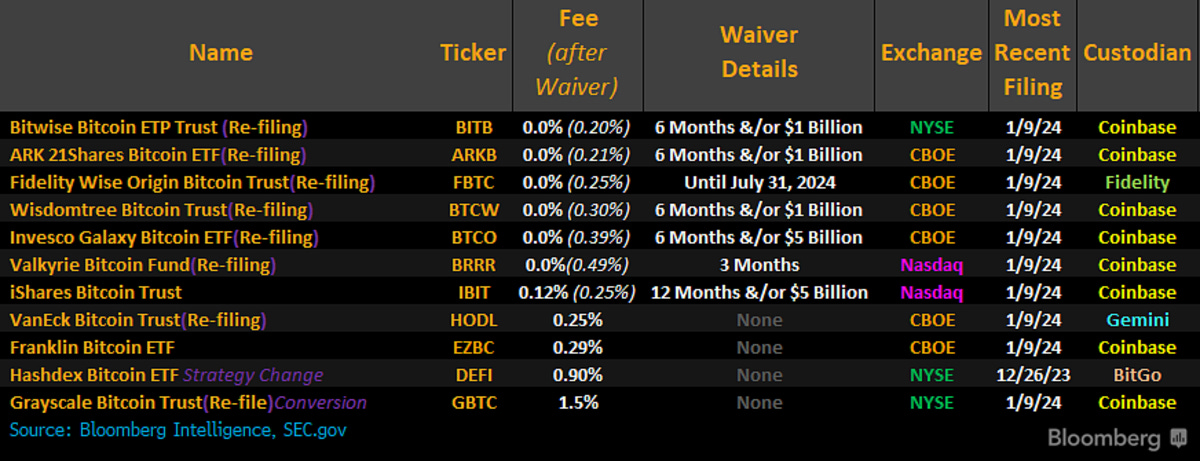

In January 2024, Bitcoin ETF’s were approved. This was a big deal because it validated the thesis of bitcoin. There was always this fear that bitcoin would be banned, deemed illegal, whatever. Since it was launched, IBIT was the fastest ETF ever to achieve $20B in AUM, by a mile, that is how much demand there was for an easier way to buy bitcoin from investors.

Why Was IBIT A Big Deal?

I first bought bitcoin at around $1000 in 2016/17 I forgot, I first heard about bitcoin in 2013 or so and I never thought much of it. It was sort of this thing people used to do illegal stuff ie buy drugs, buy missiles on silk road, etc. It was a little complex to buy bitcoin itself and when Coinbase made it easy, I jumped in. Actually at the time, you could buy it on a credit card for a while and I loved that. I was racking up point and buying this asset that just kept going up.

Coinbase really made the experience not fun. There were so many outages, there was no customer service to contact by phone like most brokerages and then the cold storage. What a nightmare that was. If you wanted to secure your bitcoin you had to put it in cold storage on Coinbase and it involved basically needing to write down this super long code and then making sure your family knew where it was in case you died. Imagine telling your wife hey look if I die,I put a big amount of money in Bitcoin, you need to log into Coinbase and pull it out of the cold storage, here is this 100 digit code that you’ll never remember so make sure you never lose this. Also it takes a couple days for the cold storage to release the funds into the account.

Pretty crazy right but that was an easier option than putting it onto something like a Trezor and having it at home where who knows what happens to it.

So now having the ability to buy bitcoin without the hassle of cold storage or these crappy brokerages or fear of your family not knowing what to do in the event you die, that is all gone with the ETF launches.

So Why Buy IBIT Now?

I’ve been watching it for a few months after launch, I wanted to see which ETF gained the most traction and naturally it was the BlackRock one. In the past GBTC existed, but the fees were ridiculous and I just ignored it. It was still a mistake because GBTC was an incredible vehicle. Today though things are changing rapidly. The economic data we’re seeing is just awful, last week Chicago PMI was at Depression levels, we have a fed that likely has to cut rates soon even though they shouldn’t, which is just going to send inflation raging, and finally we have 2 presidential candidates that are going to be in a race to see who can give the people the most stuff to win the 2024 election. Basically, the same thesis Bitcoin has always had, that central banks will continue to devalue your currency and you need to be in this asset that has a fixed supply.

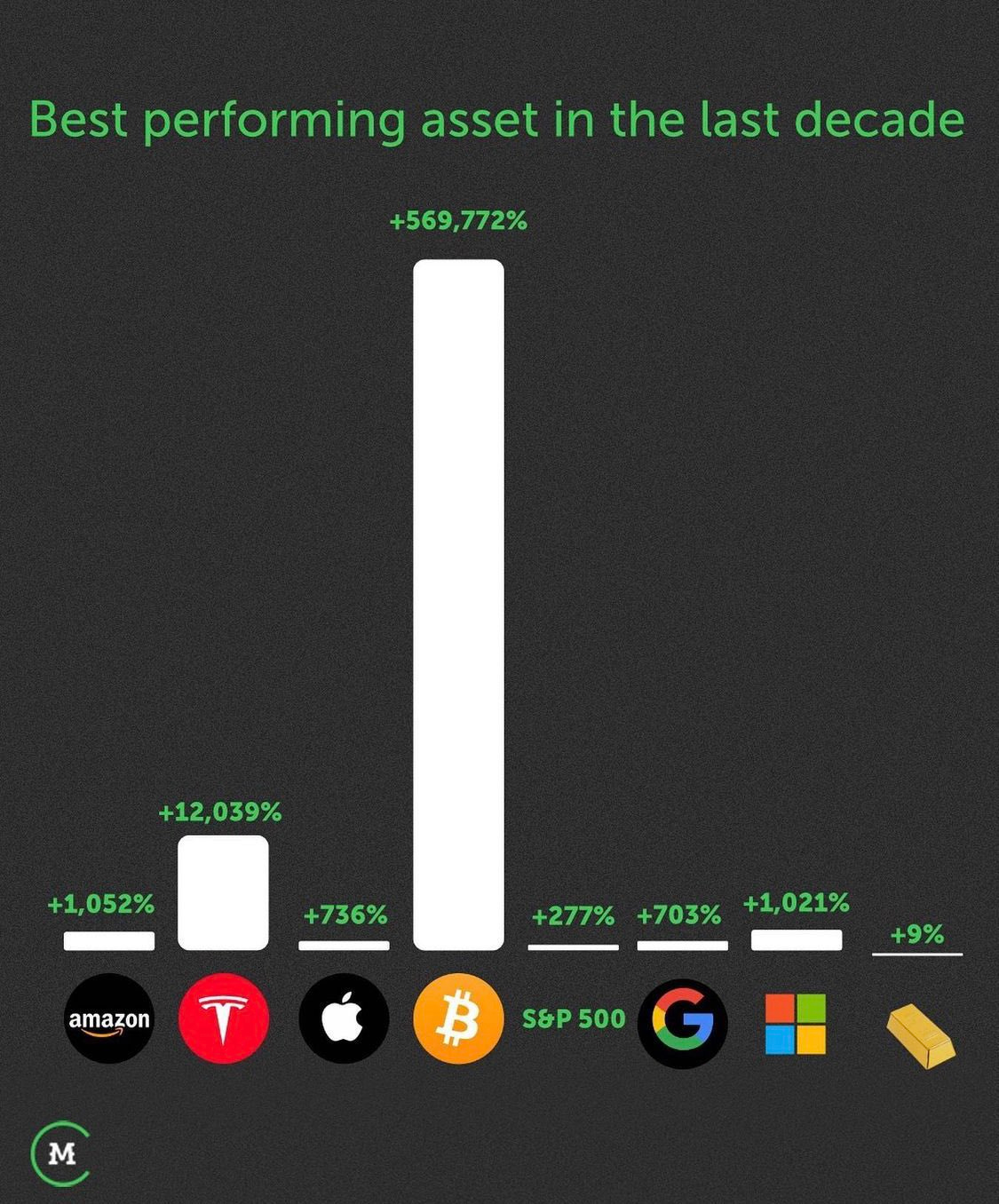

It’s funny looking back today with Bitcoin at $68,000 how many thought it was a bubble as an asset, I personally don’t agree with alot of the things many use it for, but hey, lots of people do bad stuff with US dollars too. I personally don’t see it as a currency, Bitcoin is just a scarce asset with a total supply of 21M. As more and more decide they want to allocate capital to it, the reality is there isn’t enough and it will go up which is why it is the best performing asset of the last decade, by a mile.

What’s My Plan With It?

Another reason I never held actual bitcoin the last few years was because I always like to generate income on a position I hold. With my big Amazon leap position I have short calls vs it. I feel like every position you hold is a sell at some level and you can just sell calls there and generate income while you wait. I’m hopeful at some point, soon, that IBIT will launch options and I can begin to sell far OTM calls on my position. If you hold physical bitcoin, you can’t sell calls vs it so that was a reason I avoided it, but it turned out to be silly because the thing is up 70x from when I first bought it 6-7 years ago.

What’s The Bull Case On Bitcoin?

Simply, the fixed supply. When you look at something like gold, there’s no fixed supply. As the price rises like it has recently, supply increases as more mine for it because they can sell for a higher price. Bitcoin is literally the opposite, it just went through a halving where the daily supply was cut in half to 450 bitcoins per day and in another few years it will go down to 225 and then lower every time there is a halving. It requires ever more energy to mine these bitcoins so unless the price goes up the miners have no incentive to mine for them. It sounds complex, but simply put, math is math and you can’t fake it. Can demand for bitcoin go down? Sure, but I see no reason for that as it is the only crypto that is truly decentralized with no single entity behind it. That is why there will never be another bitcoin.

You have to think about how lucky we are in America where as awful as our government is, you can still trust your money in banks here. There are many foreign countries where you cannot. I am very familiar with this in Lebanon where my family is from. The banks literally just stole all the citizens money over the last 4 years. No matter how much money you had, the banks just took everyone’s money and today you can only withdraw a few hundred dollars a month of your money. Your life savings are gone. Aside from that our currency completely crumbled from 1500 to the dollar all the way over 100,000 at one point. We weren’t alone in the last decade you’ve seen Argentina, Venezuela, countless others deal with failed currencies.

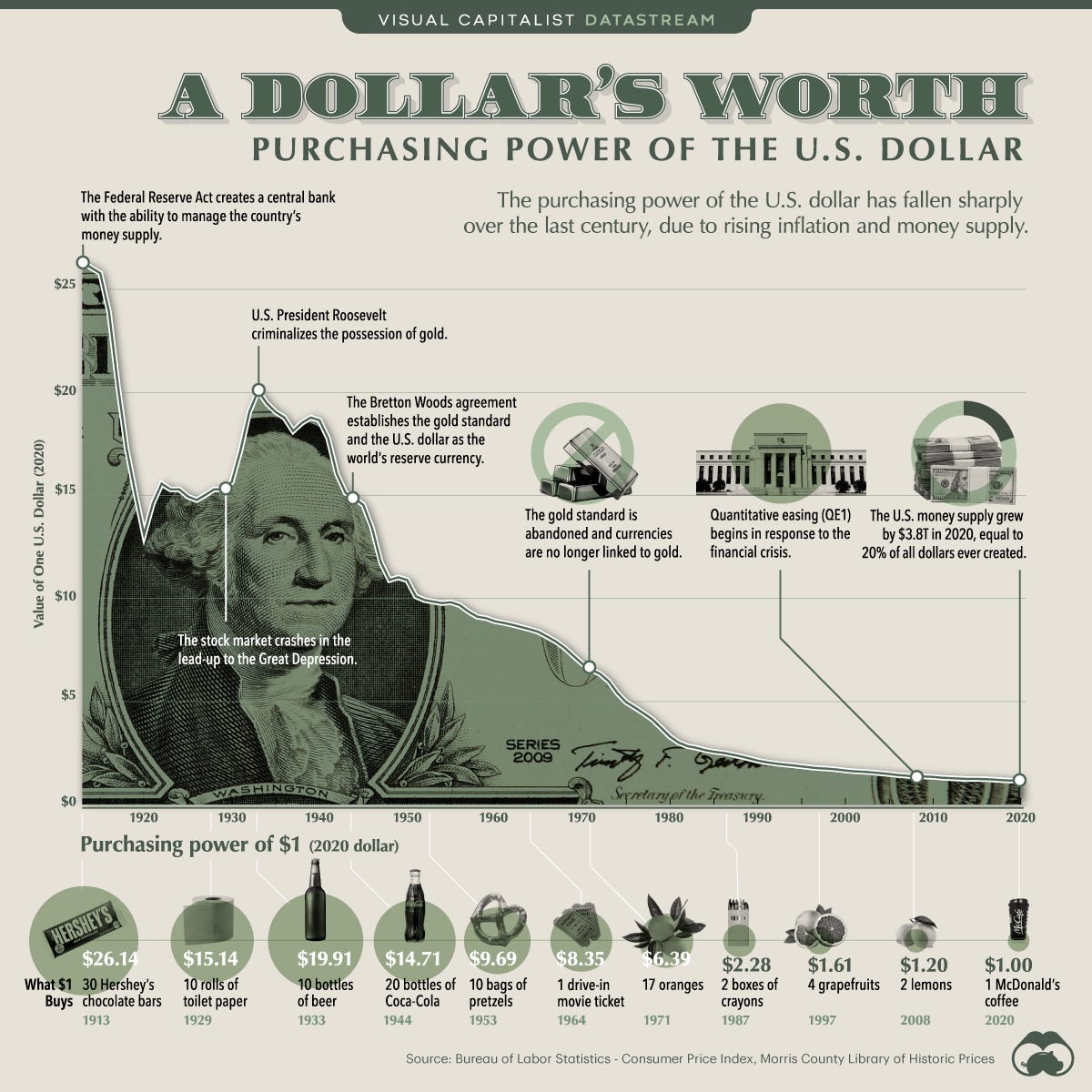

Even the dollar we’ve all seen this famous chart below. The dollar has been in full decline forever, the only way to be ahead is to buy assets whether it be stocks, real estate, art, whatever. You definitely cannot just sit on dollars and win.

So Why Will Money Move To Bitcoin?

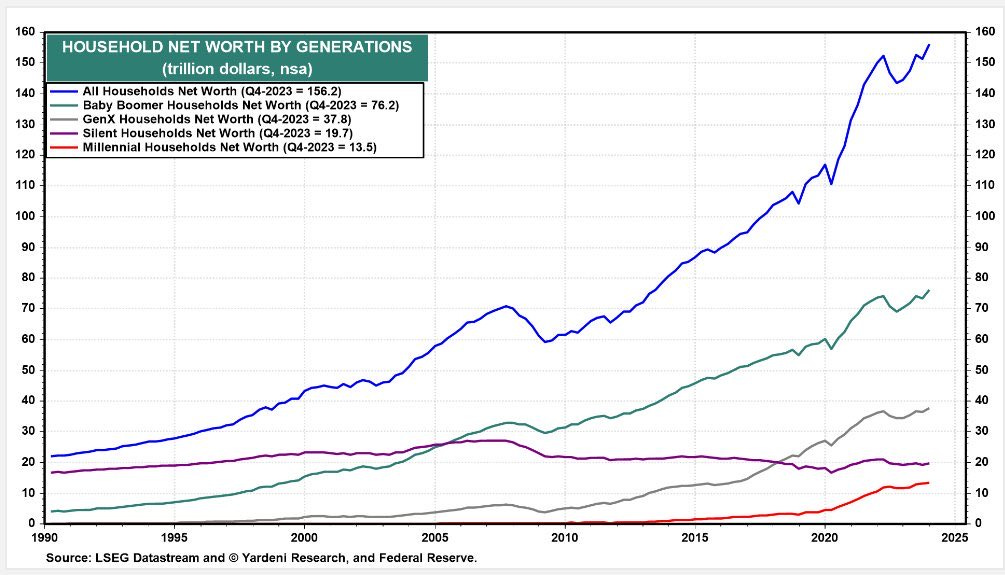

Ease of purchase. We now have an easy way to buy this asset that never existed. Think of how much money sits in assets aside from Stocks like Real Estate, Artwork, Classic Cars,etc. We’re about to undergo the biggest wealth transfer in history from the boomers to their kids, those kids will be the ones diversifying from dad’s farm or mom’s artwork to the bitcoin. It won’t be tomorrow but it is a huge shift. Rev Cap on Twitter posted this chart today showing how much wealth in trillions the boomers will be passing along. $80T, the entire value of bitcoin today is just over $1T. Then add in the foreign wealth and you can see how far bitcoin can go.

Friday I was at the hospital with my dad and I saw this on TV. Advisors don’t like Bitcoin, great, they will one day, that’s a bull case by itself. I love how Charlie Munger, may he rest in peace, hated bitcoin with a passion before he died but he somehow thought Alibaba was a legitimate company worth investing in. He lost fortunes on that trade and Alibaba is the real fraud because the CCP ended that company with one swift move, nothing can end bitcoin like that. Yes I know they say Quantum computing can but that is nowhere near fruition. Bitcoin is hated by many because they can’t control it, plain and simple. Jamie Dimon, Warren Buffett, Bill Gates the list goes on and on, they’ve been wrong but their hubris is too great to admit it. So I think it is a mega bull case that advisors as a whole don’t like it today, when they do like it, and finally recommend buying it, it will be much higher.

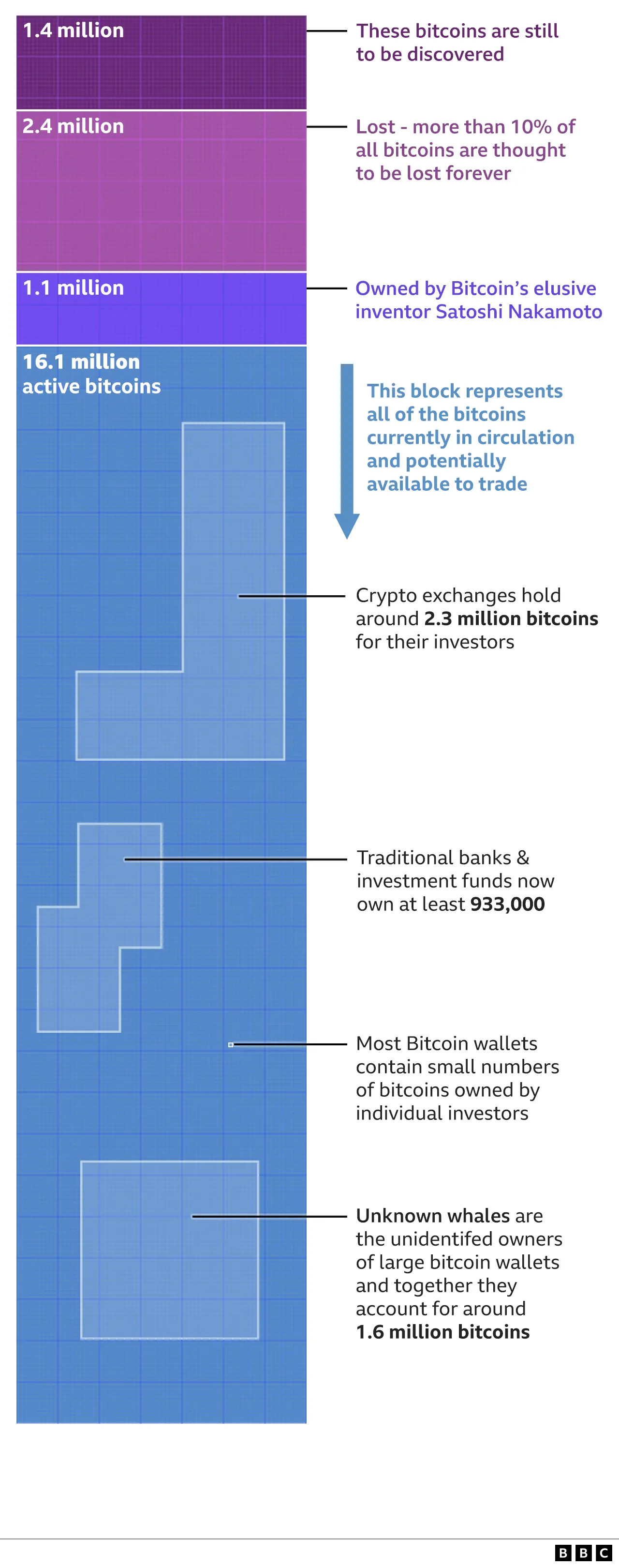

For now though, think of it like this, the whole world has a population of 8 billion people and 21 million bitcoins exist. Of those, estimates are millions are lost forever, that is based off data from wallets where bitcoins have not moved in years. Again every bitcoin can be seen so you know where last one is, you can’t do that with dollars

So the same way we have 6 stocks that pretty much everyone buys, we have 1 legitimate crypto that is a store of value. The others all do various things, but they aren’t stores of value like bitcoin with a fixed supply. What happen when you have 8 billion people and a real float of say 17-18 million bitcoin with alot of early holders who are never selling while you have banks across the world now buying it and countries getting in on this today with places like El Salvador just buying as much as they can

You have public companies buying up bitcoin with the latest being Square recently saying 10% of profits were going to be going into Bitcoin but look below as of today you have over 10% of the total float held by entities that likely won’t be selling any time soon. Add in 1 million in the Satoshi Wallet which have never moved and the millions lost and you’re looking at a very small pie for the rest of the world.

I don’t know how high bitcoin goes, I definitely think if it ever sees those pie in the sky $10M+ estimates some give that we are embroiled in some chaos and the world is breaking down so pray that doesn’t happen but I don’t see any reason why it cannot go materially higher from this $68k level today. The adoption phase is just beginning with these ETF barely being a few months old. I took a sizable stake last week, no, not larger than my Amazon position, nowhere close, but in general I’ve waited to see which ETF would emerge as the leader, it is IBIT. I’m not really concerned what it does day to day, I just know that no matter who wins the election here in November, the spending coming is going to be massive and that will lead to a move higher on bitcoin. Along the way who knows what companies and countries begin to add bitcoin to their balance sheet. I still think it is very early in the adoption of Bitcoin and today’s price means there is less risk than when it was even $500 and you were really gambling. Today, big players are allocating capitol to it meaning it has been significantly de-risked.

In general I think everyone should have a tiny allocation at worst to bitcoin, it is an asymmetrical bet. If it works, you’re going to be thankful you have some, and if it doesn’t work, that small risk didn’t ruin you. Now thanks to the various ETF that exist, it has never been easier to make that allocation. Here is a list of Bitcoin ETF if you are interested, I researched them all and chose IBIT for my needs, you may find another one suits your goals.

Very nice write up James

The cold storage cracked me up. I actually have a few Bitcoin on a Ledger in cold storage with my seed phrase in a safety deposit box. If I die my family will think I’m nuts. If shit hits the fan I do think it makes sense to own some actual bitcoin. Future adds will be to ETFs (I agree with making money off options).

Hey James, welcome aboard, we are happy you are here!