Why I Went In Big On META

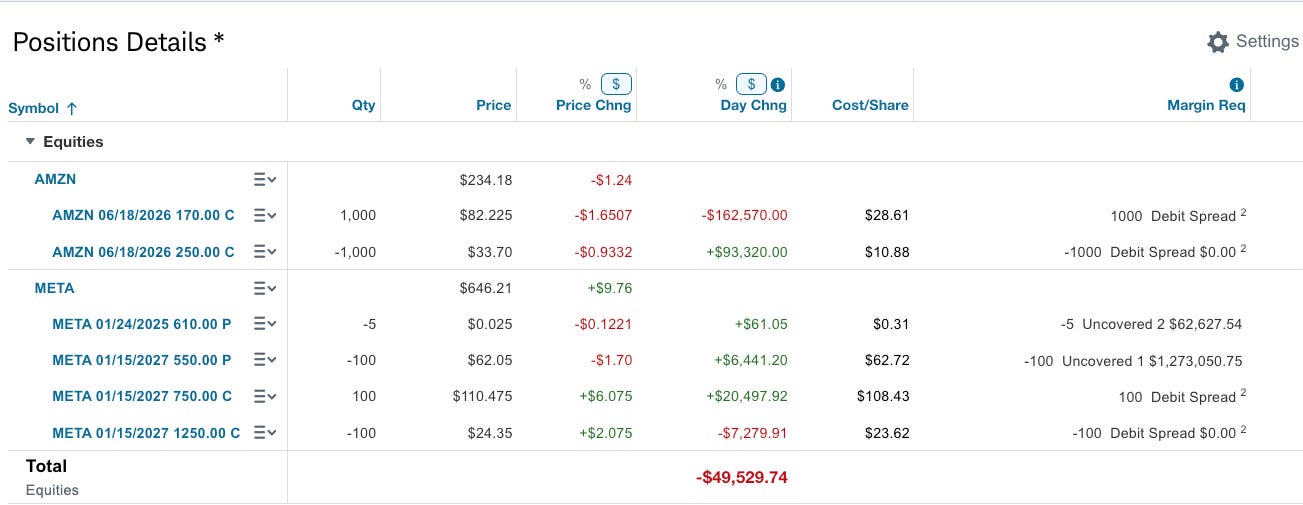

So let’s talk about my book for a moment, again I took that massive AMZN call spread below nearly 2 years ago in May 2023, Amazon was $117 and it is now officially a double, the call spread still has a ton of upside remaining as long as AMZN ends up over $250 in summer 2026. To say I’m in a good spot is an understatement, I need almost nothing here to make a fortune. The probabilities of success are definitely in my favor but anything could still happen so I don’t consider it a win, yet.

As you can see below I put on a massive risk reversal today in META. I sold 100 puts at 550 in January 2027 to buy 100 750/1250 call spreads. I originally put on 50 but the more I thought about it, I said I have to swing for this one. Why? The player who laid out nearly $100m today on those $1250 calls is looking for a sharp move soon, not necessarily $1250 but a sharp move and they can begin to cash in those calls. For me, the way I look at is had I just bought a 750/1250 call spread I would have paid around $85 per contract with upside to $500 per potentially. By adding the short puts, although it eats up a ton of my margin for now, I take the cost down from $85 per to nearly $20 per. The actual numbers for mine as you can see below were

750/1250 call spreads bought for 84.81

550 puts sold for 62.72

Total outlay 22.09 per contract

So here’s where I stand. META on a technical basis is about to have its highest weekly close ever, that is very bullish. I have that huge AMZN trade I will hopefully be closing at some point this year, I need to find my next big swing and its here. When I wrote up META as a best idea here on 11/30/24 I mentioned I thought they were the leader in the AI that would matter one day. I still believe that. This morning Zuckerberg dropped a pre earnings release that CAPEX would be higher than expected and usually the market hammered companies who said that, but META went green. It loved the news that capital was being allocated to the right spots. This is a Free Cash Flow monster, it generates all sorts of cash, the crash in 2022 was because nobody but Zuckerberg believed in the metaverse, this is different because everyone believes in AI and now Zuck is pushing in all his chips.

So what’s the downside here for me? Well worst case I have to take on 10,000 shares of META at a 550 basis and with the premium received 487.28 basis in 2027. Not a problem I will have plenty of cash once I close my AMZN trade but I’d say the likelihood of META being 487.28 then is probably under 5%. Either the market would have collapsed or something would have changed in the thesis. I would have closed well before then in either scenario so that isn’t a concern of mine.

So what’s the trade really cost me? Yes it ties up my margin but I’m risking $22 to potentially make $500 should I hold to expiry and META tops $1250. I probably wouldn’t even hold it that long, say META makes a sharp move to $750 or $800 this year, I could close the whole thing up for a huge gain. What are the catalysts? A potential stock split is near the top I’d say with META at $640, a 10:1 split would not shock me this quarter or next. This quarter is also 1 year since they initiated the dividend so I expect a hike coming this quarter. Then of course there is the actual business of META which is on fire and will see more AI synergies than most at this stage. Aside from all that, a potential TikTok ban although looking slim now, would be huge here. More than all that, Zuckerberg has seen what Trump did for Elon and Tesla and moved over to his team. He dined with Trump at Mar A Lago, he was there for the inauguration, he has come a long way from being the guy who banned Trump in 2020. The market is heavily rewarding the companies in Trump’s good graces, pretty much the entire Tesla pump was because of that, because nothing fundamental has changed there.

I’m up 13% in less than a month on a big book, I am going to take a shot here. I expect my AMZN trade to continue slowly heading towards its max value over 250 and with this I have a chance to basically return over 20x my total outlay at max gain. I don’t think $1,250 is insane for META, it would be over $2.5T for a company pumping out cash, buying back shares, and leading in AI. That is still well below where Apple, Microsoft, and Nvidia trade.

I liked the risk/reward and I’m a little crazy and I have a huge cushion with my Amazon trade. So that’s my explanation.

Appreciate the write up. I've had my eye on META since you mentioned it in November. Congratulations on your AMZN trade. You stuck with your thesis, and we know b/c you show us your book!

Thank you as always for the detailed write up, JB. Excellent insight into your thesis, along with the explanation to the cost breakdown. We’ve been talking about the potential for META for a while, so very glad to see you get into a trade in such a large way, with strong conviction. Hope you’ve had a great weekend man.