Wrapping Up A Great 2023

With the final opex of 2023 now behind us, trading volumes will fall off dramatically over the last 9 sessions of the year. The market is closed next monday for Christmas Day. I’ve already begun work on a very long 2024 preview that I’m hoping to publish as soon as possible but I estimate worst case in 7-10 days. It’s going to be very long and include alot of insights, charts, levels, and options data on countless different names and sectors. It will be a great guide into the next 12 months but I also want it to cover everything I can think of so I am going to devote these next 2 weeks to getting it just perfect. That means no more recaps or live sessions for the final 2 weeks of the year.

I do not believe we will be missing much simply because volumes drop off so much because nobody is around and if nobody is around, the amount of institutional sized trades falls off immensely. I also think it is good for all of you to take a break from the grind of markets. Markets are nonstop and especially if you’re trading short term options it can take a toll on you mentally, socially, and ultimately physically. We’re up 7 weeks in a row to highs of the year, this really isn’t the worst time to just close your screens and take a 2 week vacation from this.

This was my first full year on here. The whole substack began from someone asking me last year to share my notes on options data, I had never even heard of this platform to be honest. Those who’ve been here the last 19 months know how much this has evolved. You can go back and look at the early recaps and compare their depth to what is coming to your inbox everyday today and it is night and day. I couldn’t have done it without alot of help from readers like Edwin, Shanya, and Danny at substack along the way. The three of them saw the potential and helped me make changes along the way turn this into what it is today.

I’m biased, but I don’t think there is anything out there that rivals this substack for traders at home. Before doing this I looked at all the options trading platforms out there. While each is nice in their own way, they focus too much on giving out all the data out there and they don’t really breakdown the oddest things and what you’re looking at in terms of flow and levels to play off of. I think the move to highlight 5 unusual trades a day in here really puts this in a different league where you’re getting actionable ideas with levels that other services do not offer. 5 days a week means you’re getting a deeper look at 100+ odd options trades a month. You all see how fast some of these names I highlight work out. Having done this a long time, I know what odd options action is and I know when it is notable, my parameters in place filter out all the noise. Combine that with the trends system in place and I think there isn’t a better offering out there for information on directionality. There are certainly people who write better deep dives, share more on financials, etc but in terms of data on what stocks are potentially going in what direction, I really think this is as good as it gets and as a trader that’s the most important thing. If there are changes you want implemented, drop me a note below I have some time now to consider things. If you think this is great, you can drop a note and say that too, I always love the feedback.

With that said, everybody who is here will never pay more than they’re paying at the current moment. Substack keeps your price forever from whatever you signed up at. For many of you from day 1 that’s as low as $19. So this part is more for the couple thousand who get the free preview everyday and never signed up. The next 2 weeks are the last 2 weeks to sign up with the current pricing, I’m raising the prices for the substack and the live part dramatically on January 1. The live part especially, there’s so many times people in there will tell you where I post a trade and within seconds its ripped higher. It’s just something even getting the recaps midday cannot capture if you are an active trader. I underpriced all these offerings from the beginning, I know alot of people say things and they’re full of it. I knew I had to prove myself to you all first and here we are 19 months later, through a bear market in 2022 and followed up with this run this year you’ve seen what I’ve shared along the way. I’ve posted every move I made this whole time and that has resulted in some dramatic outperformance.

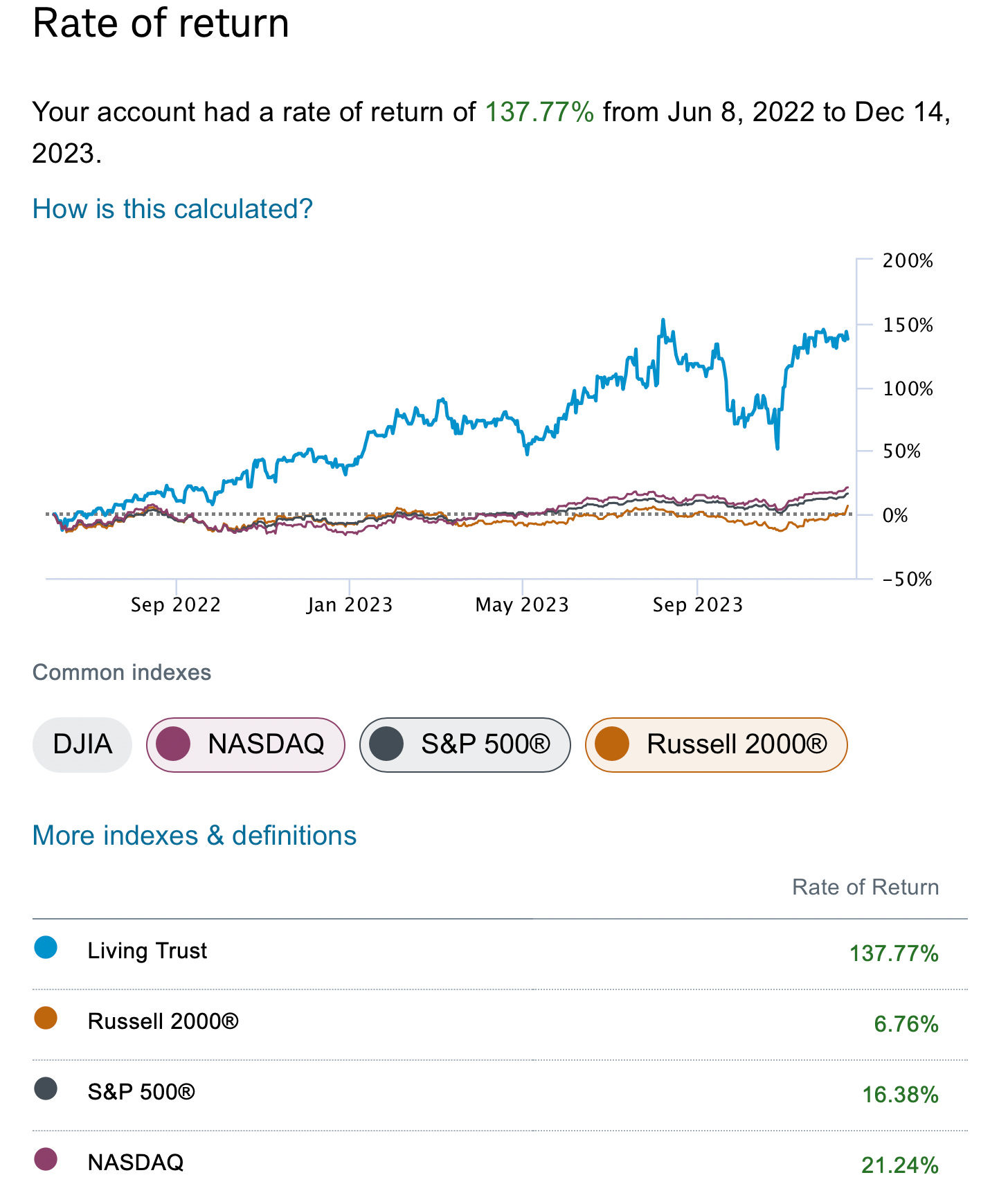

While everyone mostly did great this year, those of you were here late last year know how brutal that market was and how hard it was to outperform when everything was going down daily and we did it here. Everyone is sharing their YTD gains but nobody wants to discuss last year. I began writing this all on June 8th last year and from that time I’ve outperformed the market by 7x even through some steep drawdowns. The nature of utilizing the leverage I do means there will be steep drawdowns along the way, but even this year, I stuck to my guns knowing the option flow was backing a move higher on my large Amazon position and here below are the final results of the last 19 months, not even counting yesterday because I’m up so early and Schwab hasn’t even updated yet.

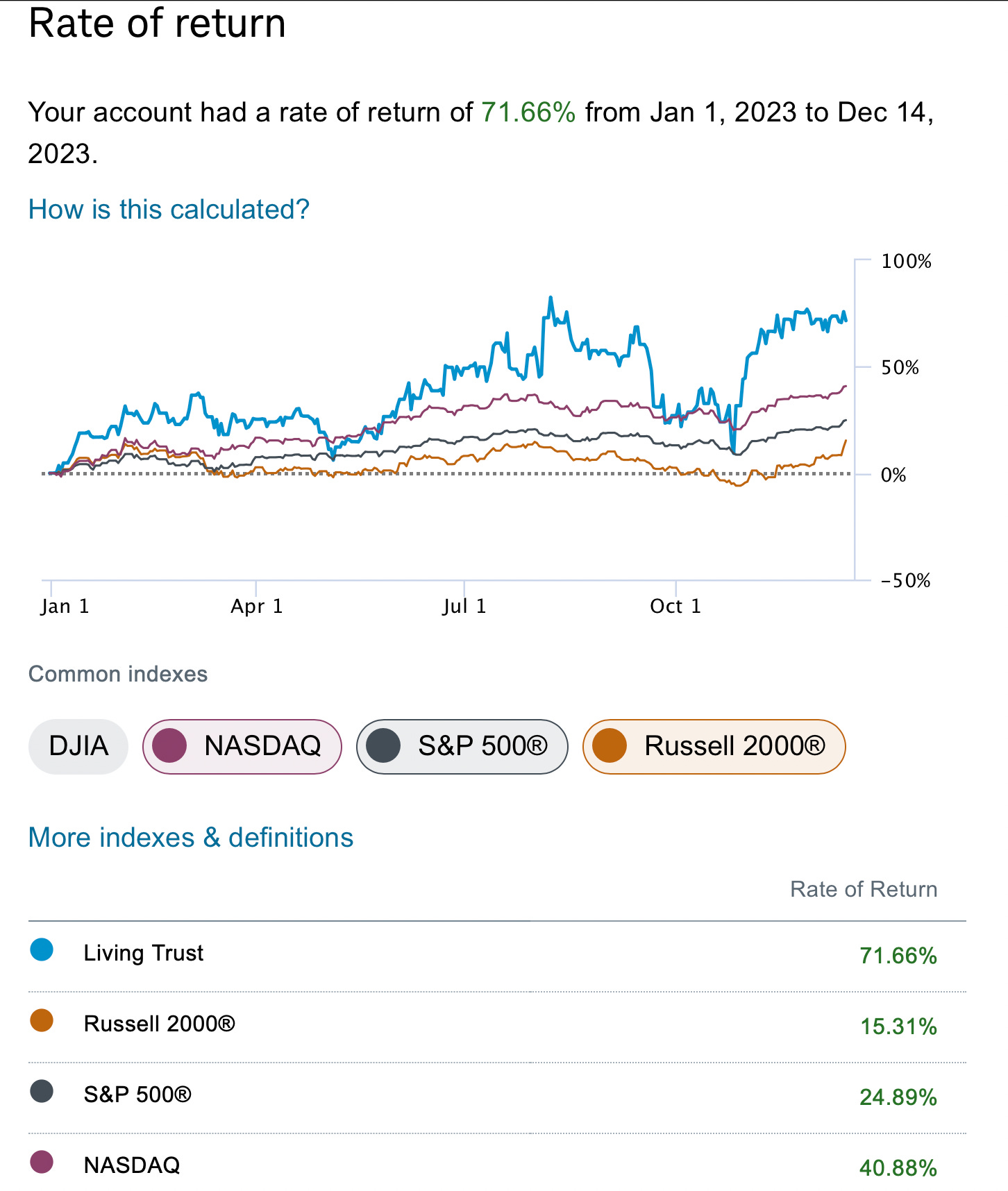

This year alone I’m up 3x the S&P, like I said zero complaints on my end. I’m very happy with how this year went, it got ugly for a couple weeks in October when Amazon was slammed before earnings, my performance fell off a cliff, but I didn’t panic. Ultimately, the name did recover rapidly and my calls did great and if I wasn’t short the January 2025 $200 calls vs my position I would have had an even larger return.

Also, I added $0 to my trading book in the last 19 months, straight out of the Schwab account………

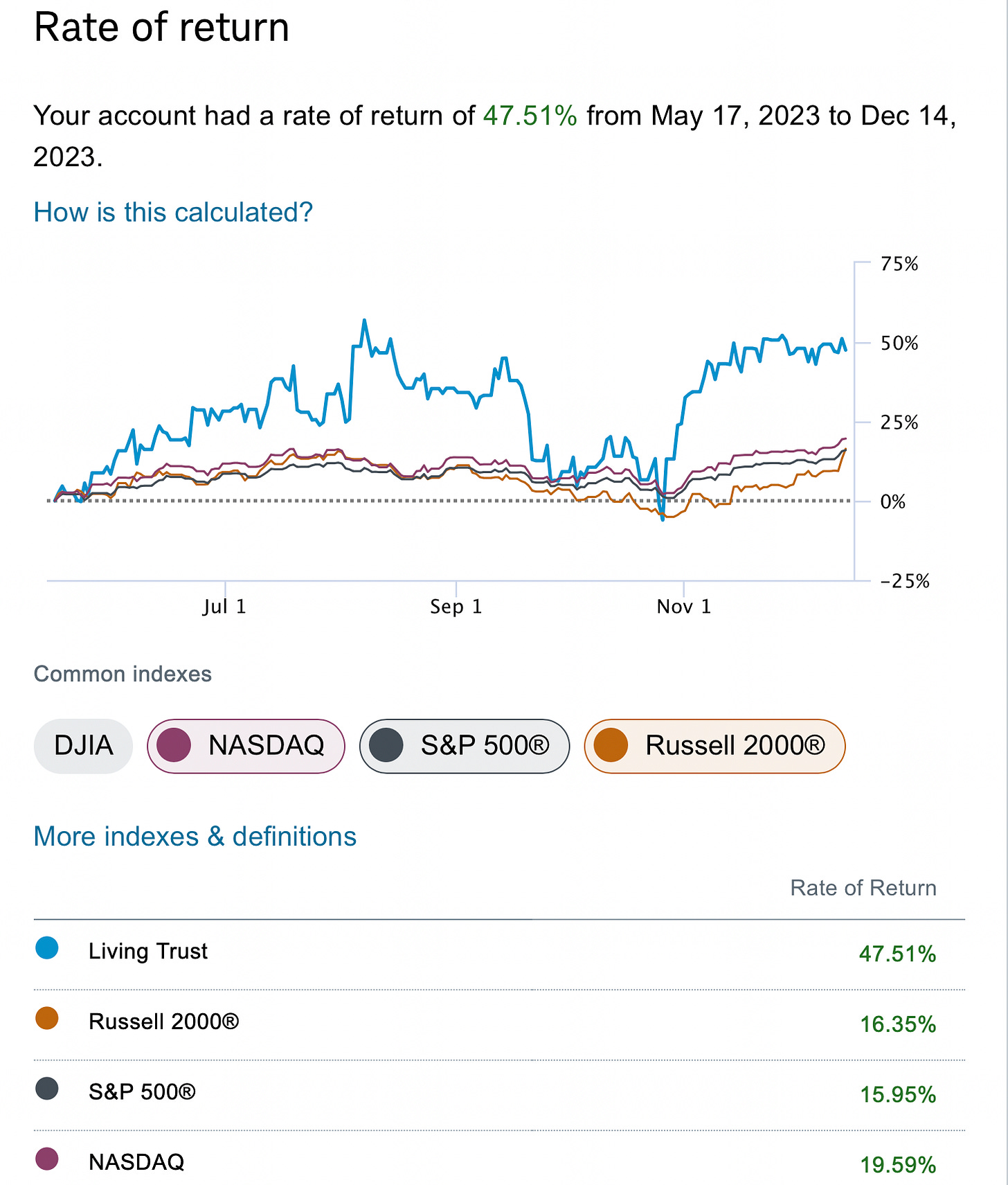

Now some have said well James, you didn’t do much the last 7 months, and that’s true. Since I entered that Amazon trade May 17th, below, I still more than doubled the return of the market. The Amazon leaps returned 47.5% vs 16% for the S&P and 20% for the Nasdaq. The reality is that below is your proof you don’t need to put on countless trades to accomplish your goal. You just have to be right on the direction of whatever you’re trading and utilize leverage appropriately.

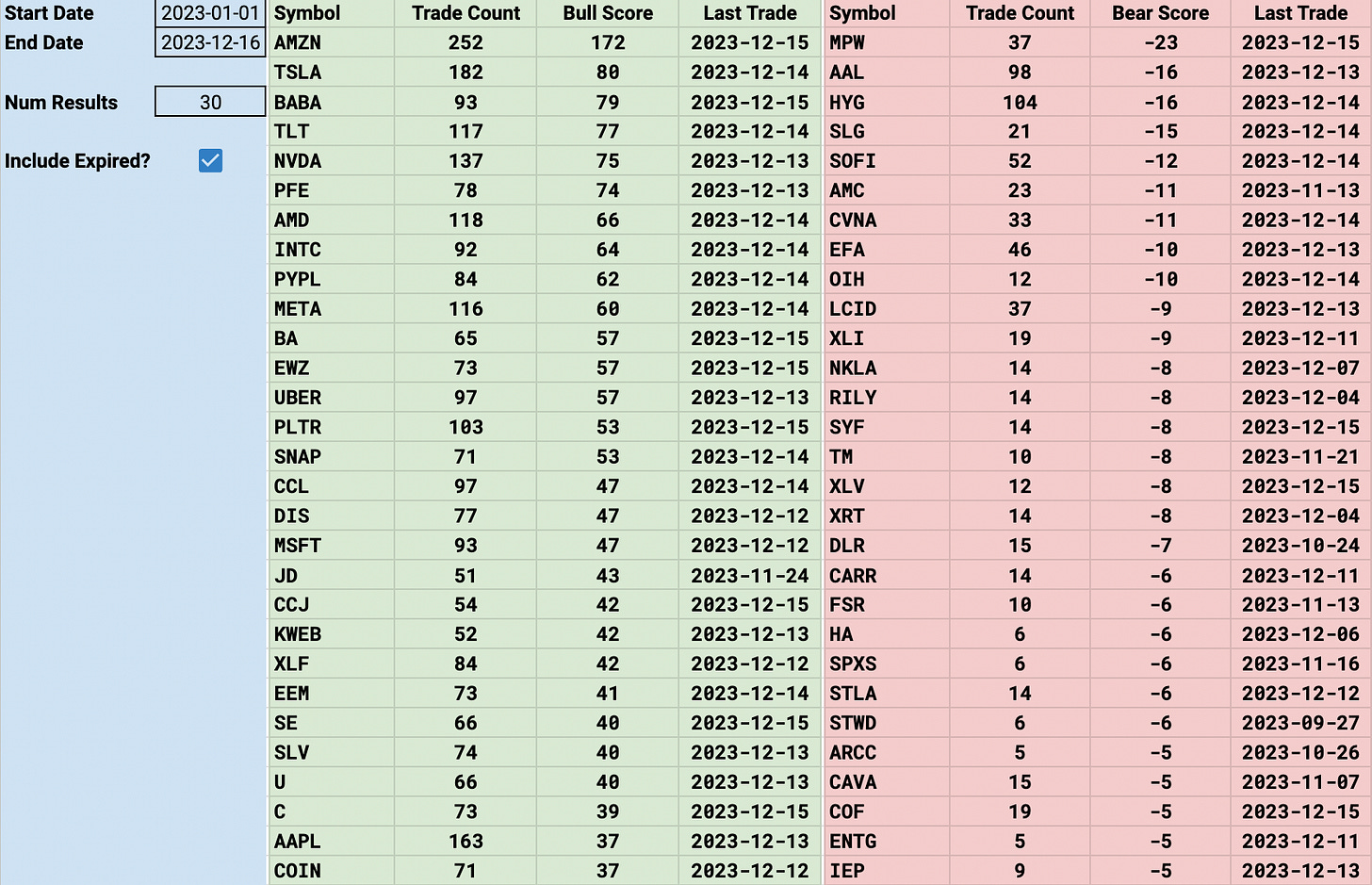

Could I have returned more actively trading? Maybe, but I was certain that the option flow Amazon was seeing which was dramatically beyond what anything else was seeing was a signal a big move was coming. All year long that name has been at the top of the trends, and it makes sense. It is the most important name to hedge funds. There was a list a few months back I posted where it was the top name and 96 funds had it as a top 10 position. It is up something like 75% now in 2023. It remains the most bought name in my database and I’m not adjusting my position at the moment as long as that is the case. Again for reference here is every trade I logged in 2023, Amazon is over 2x the next biggest position in terms of bullish option flow.

Just look at the monthly chart below, I don’t think there is a nicer setup anywhere in this market, we’re finally emerging over a massive resistance at 146.57 and now looking for those all time highs of 188.65 in 2024 which is still dramatically lower than where I think Amazon will be in 2025 where we could possibly hit the max fibonacci extension I have at 255. Those 2026 calls I have are up so much already and by 2026 they could be up 200-400% on a serious amount of capital. Will the market return anything like that? No. It would be silly for me knowing what Amazon has been through the last 36 months to not be here as they normalize their operations. I don’t think any megacap has the potential this does going forward. Will it be the right call? Only time will tell, but I believe in the work I’ve done on it, I believe in the option flow I’m seeing, and I certainly think the risk is worth the potential reward on my end. If I’m wrong, I can cash it all in whenever and go back to actively trading at any time if something happens within Amazon that I don’t like either way you will know when I exit this trade.

At the end of the day, this substack was meant to be a place I could share my musings on the daily options flow I’m seeing. I never once thought this would be one of the top Substacks out there but thanks to you all sticking around that’s what it has become. With that said, I’ve always posted what I’m doing in my attempt to be as upfront and honest with you and if you copied me, congrats you’re up alot. The rest of you who have been trading on your own with this data have done great things from the feedback I’ve gotten.

The discord current trades section has become a place where I see many of you all posting the trades you’re taking off this information and I don’t know how many in there have posted some unbelievable gains on some of these trades. Someone in there made north of $100k this week alone buying common when he saw those weekly CZR calls I posted monday before it jumped 20% by thursday on nothing more than the odd options flow. It’s just great to see and hear how people utilize this data in various ways to fit their trading styles. At the end of the day we’re all on the same team, its all of us vs the market and the more eyes on all this data, the more potential things get seen. If you’re still not in complete understanding of how to work with all this data, join the discord and ask questions, there’s so many people in there who will help you. The link is in the welcome email you got when you signed up. I get it, joining the discord makes it sound like amateur hour, and believe me I know 99% of these things are junk, but this community is incredible. There are some really savvy finance professionals in there. Analysts, traders, portfolio managers, etc. It’s not a room of teenagers trading junk stocks. Plus, how else are you supposed to get hundreds people in a group chat with unlimited file sharing? If you have a better option, I’m all ears, I know the stigma tied to discord but it’s a much better option than Slack which needs you to go back and delete all the files every few weeks.

I hope you all have a great holiday season with your friends and family. The 2024 preview I mentioned above will be the next time you hear from me. I will be back full time live and posting recaps on the first day of the new year.

Been here a while now and very much enjoy what you offer between the write ups and discord. You and Eliant offer the best in the space I believe. I wouldn’t change anything. People have to understand how to use the data. Some are just looking for hand holding and when to enter/exit every trade and this is not for them, which is ok. Appreciate your work and openness to ideas/changing.

Thanks for all you do James. Your insight and the comradery in the discord group is worth 10x what you’re charging. Keep up the great work. Merry Christmas and see you in the chat in the New Year.