10/29 Recap

We’re going to skip the overall market discussion today because alot will change afterhours when 10% of the market, Google and Microsoft, report. I want to talk more about the option flow I post everyday here and how you should be thinking about it. I always get people saying I don’t have the money to sell puts or I don’t want to play with options and I want to explain some things because there’s always new people. This stuff is just a guide on direction, you can play it in any manner you want, nobody is telling you to buy calls or sell puts. Like yesterday when I posted all those CRM max strike calls, that is probably one you want to be long the next few months, we’ve seen this in the past with AXP,APO,KR, and many more where they start loading these OTM calls and the equity rallies in the coming months. Just because you don’t want calls doesn’t mean you can’t just buy shares in the right direction. Option flow is just a guide on direction.

To begin, where does this option flow come from? Think of all the groups out there investing in the market everyday. The hedge funds, the family offices, etc. There are collectives all over the world making bets in our market every single day and the option flow is public data showing the largest trades. The table I share everyday is just me highlighting what I deem noteworthy as I filter through thousands of trades with my own parameters. Think of each entity as 1 player in the game, that player has tons of due diligence with analysts, research with traders going over levels to play, and strategy sessions with management before that final trade you see is executed. We’re getting to look at the end result of their work while doing none of it ourselves. These groups put in so much time and effort before that final trade is executed that we have to respect their work and figure out if we want to play along.

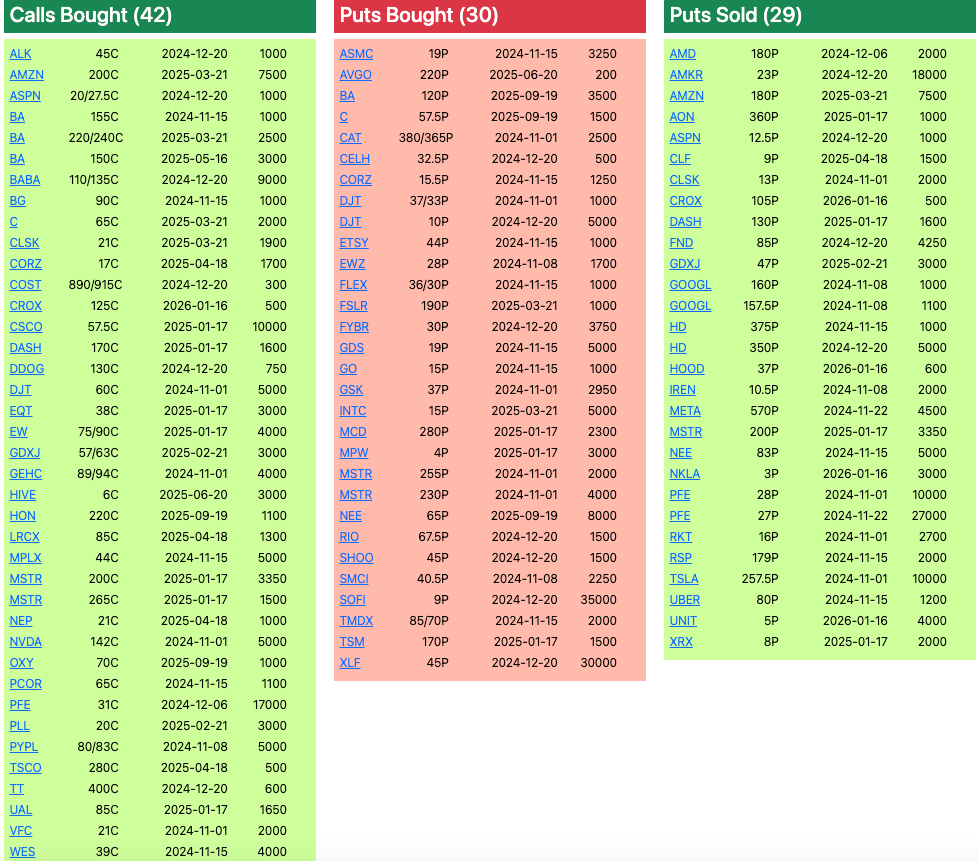

Do the trades work more often than not? Sure, why wouldn’t they, there’s alot of edge in this data. Still, there are many trades that do not work, it isn’t like these funds win every single trade they place. As a whole though, as you begin to understand what to look for in this data, you will increase your probabilities of winning trades. That is why I always implore all of you to go in the community discord, there’s 1000 people there, when a group of smart people all looks at the same data and bounces ideas, good things happen. Let’s look at these 4 from just today and what I had flagged recently.

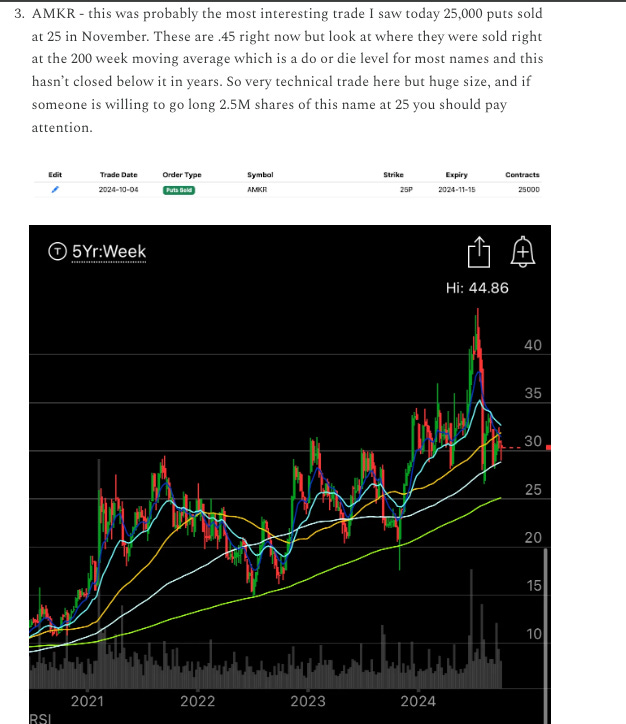

AMKR - In the 10/4 recap here I had noted that this saw a massive put sale at 25 expiring in November 25,000x. This morning it had a terrible reaction on earnings and flushed down to 24.10 and has bounced straight up to 26.90 as I type this. Why? That massive put sale is buoy now, that buyer is sitting right there waiting to be put shares at 25 so buyers all around the name were loading up all around it since someone wanted 2.5M shares at 25. The option flow was dead on with the levels of where this name would bounce.

GLW - I wrote up GLW as a weekend best idea on 10/13 here at the time I suggested selling a put spread around some key levels because all the option flow was pointing in 1 direction and the chart was breaking out. Today GLW is up 7.5% over $50 and the short put spread I suggested is up 80%. We played along in the right direction but in a conservative manner and it worked, you can close that up today, no need to hold until December for another 20%.

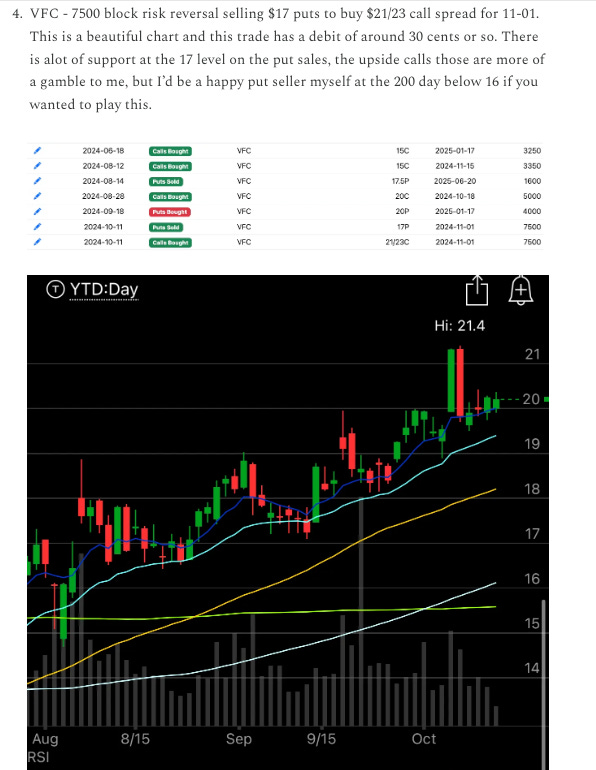

VFC - I highlighted this one on 10/11 here. It is up 24% today after their report. This had tanked hard the last few days closing at 17 yesterday, it hit a high of 21.93 today. Again like the above, the massive put seller was right at 17, that’s it, the stock was not going to close below that level, rarely do the put sellers lose and that is why I always tell you the put sellers are the sharpest players in this game. When we know the levels they’re looking for we can make better informed trades.

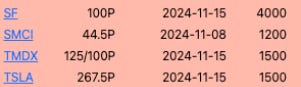

TMDX - This was one I didn’t even highlight but it was in yesterday’s recap if you look at the daily options table I post. A player stepped in and bought 1500 of the 125/100 put spreads on this name. It is down 30% today to 88.xx. Perfect timing. There’s still tons of great trades in the table I just can’t go in depth on every trade placed everyday.

What am I trying to say? Nobody is going to hold your hand in the market and tell you what is going to work. I try to give you real data with ideas of real levels to play off of. All we can do at home is try to create as much of an edge as possible using all this information. Option flow is one part, being able to interpret charts and the flow of money is another part. Those 2 things in my opinion, trump all else in the market.

When we know levels of institutional demand ie where they sell puts and we utilize that to position ourselves around it, we are trading with an edge that someone reading some financials alone does not have. Do financials matter? Sure, but all that is built into a chart and the option flow. Again do you know the process of how funds strategize before placing a trade? The little trade you see here is just hours of work rolled into 1 line on my table. The big money placing these trades, they have a leg up on you which is why they are making the bets they are making. There are no coincidences in this game, we are just trying to embrace the realities of the game and play along using the information we can derive from the bigger players.

Today’s Unusual Options Activity

Here is today’s link to the database as always it will be open until tomorrow morning at the open

Trades Of Interest

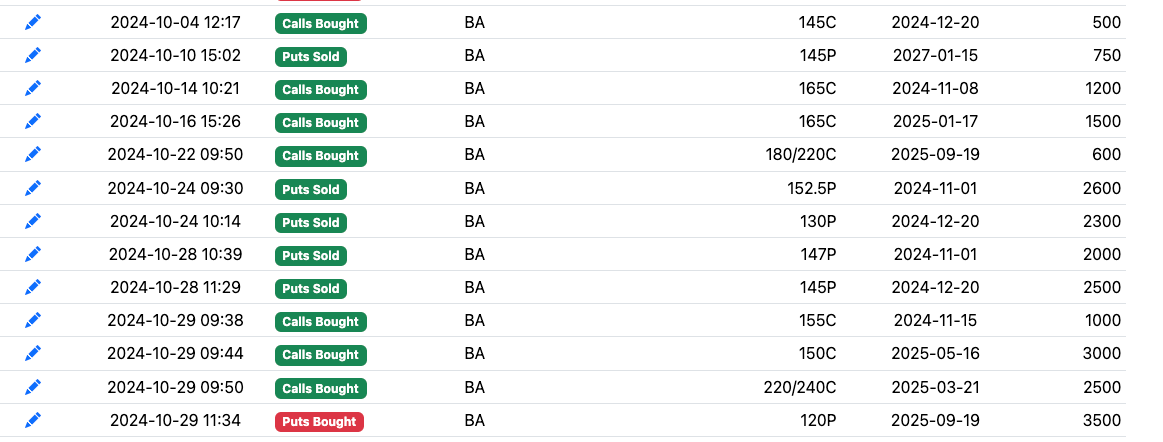

BA - I mentioned Boeing last week but I do think this is bottomed here. Look at all the upside trades over the last month, the big one today was the 3000 May 150 calls, those are over $20 each, a $6M trade. Then the 220/240 call spread in March 2500x. Honestly I would buy shares here and sell upside calls until you’re called. Along with that I’d throw on a risk reversal selling May 130 puts for 6.30 and buying May 200 calls for 4.80. You leave with 1.50 credit and even if the upside doesn’t work, as long as BA stays over 130 you still profit.

DASH - January 130 puts sold to fund January 170 call buys 1600x. This was placed for a debit of 2.35 but be careful this does report tomorrow morning. It is up 8 weeks in a row and really overheated right now, look at the RSI off the charts. I like the put sales because even if it cools off some you can see the 6 weeks it spent at that 130 level in August/September so that should be support. This was a nice put sale, if you want to throw in the upside calls that is your call but with an RSI this extended the odds of it working are lower but it is still possible. A 130/125 January put spread can be sold for .80 risking 4.20 for a near 20% return.

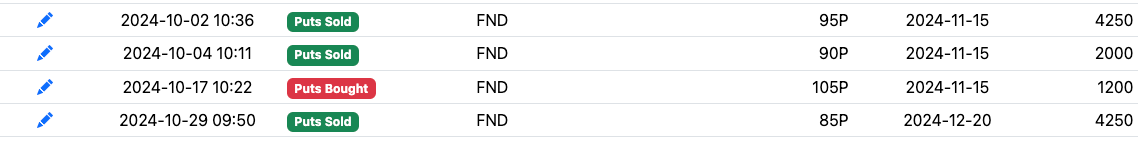

FND - 4250 puts sold at 85 in December for almost $2 each, near $850k in premium. This name has seen a nasty fall the last 5 sessions right into this cluster of moving averages it sits on right now. It’s still over $100 and this player is looking to go long at 85 in a couple weeks. An 85/80 put spread would net .75 risking 4.25 for an 18% return in 7 weeks if you wanted to use a put spread to alleviate margin requirements.

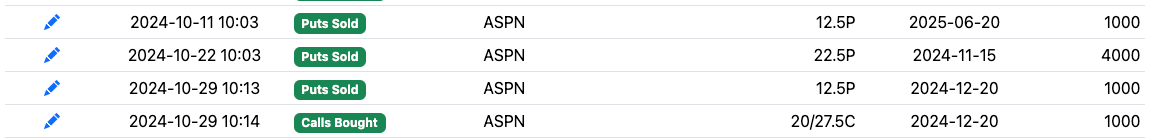

ASPN - risk reversal selling 12.5 puts to fund 20/27.5 call spreads in December 1000x. This follows the 12.5 put sales out in June 2025 early this month. That is a level they keep targeting for put sales and you want to focus on it. This name is really broken below the 200 day so I’d avoid the call spreads for now. The December 12.50 puts are .5 each now giving you a basis of $12.

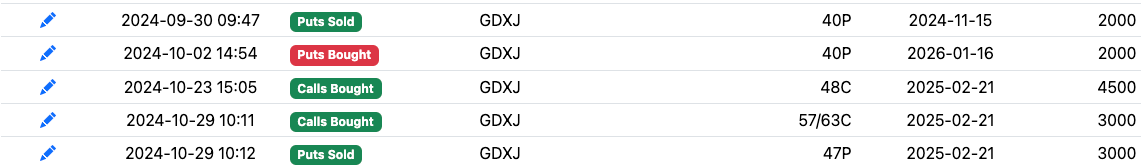

GDXJ - risk reversal selling 3000 puts at 47 to buy a 57/63 call spread in Feb for a $1 credit. This is gutsy trade in the junior gold miners, the puts at 47 make sense right above the 100 day, I think anytime you can place a trade for a credit like this, if its a space you want to be in, and gold is right now, yo want to play along. The 200 day is just over 42 and I’d personally look down there vs 47.

I hope you all have a great rest of your day and I will see you tomorrow.