11/14 Recap

The SPY continues its gravitational pull to the 8 ema and we should get a touch today or tomorrow. If it holds, things are ok, if not, that 21 ema just below 590 looms large. It could be argued the last 4 days the red candles are simply us in a bull flag over the 8 ema, we will just have to see but we’ve spent basically the entire time post election hovering around this 590 level building a base.

The DXY rejected this morning’s highs over 107 and could be cooling off for a little. This would be great for equities after this nonstop 6% move the last 45 days. A small pullback here to 104 would be ideal for bulls who would love to see 104 lost.

The IWM, below, is the weakest of the the SPY and QQQ trio as it loses the 8 ema today. The move in small caps has been insane and it really has to hold that 230 level or bigger issues lie ahead.

Recent Trades

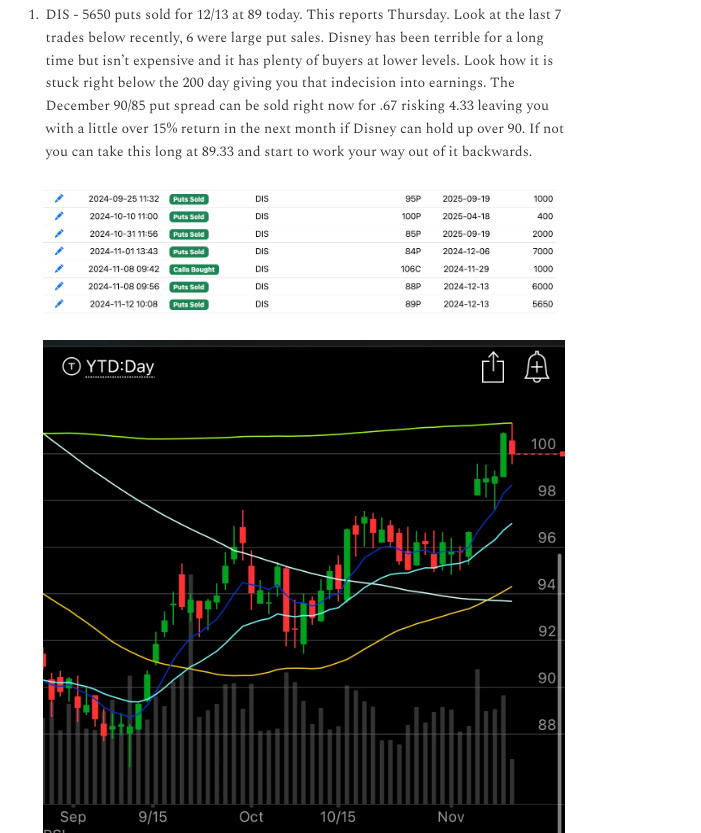

DIS - 2 days ago in the recap here I noted these Disney put sales going off for a long time, today we saw Disney pop 15% to a high of 114.81 and now fall back just below 110. The December put spread I mentioned the other day fetching .67 can now be closed up for .02. I would do it, no sense waiting another month here, you basically maxed out the potential profit here.

Today’s Unusual Options Activity

Here is today’s link to the database, as always it will expire tomorrow at the open and the rest of today’s trades will be added by the afternoon. So check back for the trends and trades.