1/13 Recap

The SPY continues its breakdown with our first gap below the 100 day. As you’re seeing it is fairly easy to see when the weakness begins, it is just simple moves below moving averages. The next point of interest is 565.15 which was the previous breakout, the horizontal white line below and below that is the 200 day just below 560. This is real now, we filled the election night gap up and all the excitement from that night has worn off. The 8 and 21 ema are sloping down and will be resistance on any moves higher. As I’ve said for a few days now, this isn’t where you want to add things, you want to lighten up on short term trades completely and sell covered calls on the things you want to hold longer term. Things will be ok in time but minimizing the pain in these periods of weakness is the most important thing. The big thing here is you need to reduce tech exposure if short term matters to you because tech is really the only thing getting crushed right now, other sectors aren’t doing so horribly. Longer term tech will be ok so don’t go panic selling quality tech names because of short term weakness, just simply know they will be weak and do not use leverage or short term calls.

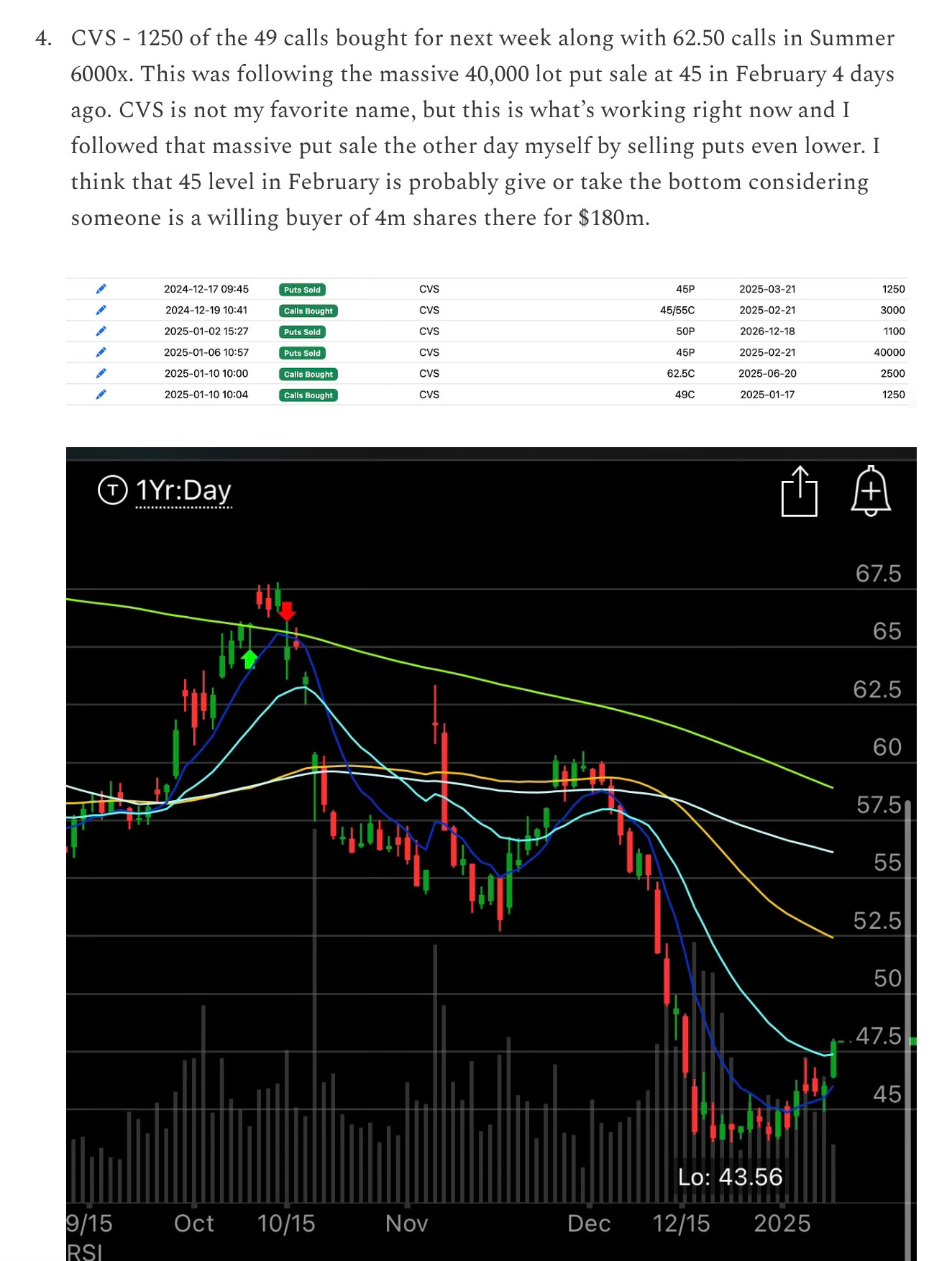

Recent Trades

CVS - In Friday’s recap here I highlighted the big CVS call buys, but the big one was the 40,000 lot put sale early last week. This morning CVS popped over 5% premarket. You’ll notice Friday it reclaimed the 21 ema for the first time since early December too. That’s why the 21 ema is my barometer, it simply tells you when something is in an uptrend or downtrend.

My Open Book