1/16 Recap

The SPY remains in no man’s land, although we reclaimed the 21 ema yesterday, look where we’ve beens tuck the last 2 sessions, right below the 50 day. If we can get over that, then there is tons of upside, but until we do, you can’t just assume we will. Yields are falling which is why small caps are seeing a small tailwind now and megacaps are weak. If that’s going to be the case, you’re going to want to be long TLT, long IWM/ARKK/whatever small caps you want and megacaps will lag for a bit. The market as I mentioned yesterday continues making lower highs, so until it breaks out of that range of lower highs, this is still a bearish trend regardless of the small pops. Look below for confirmation of those lower highs.

Recent Trades

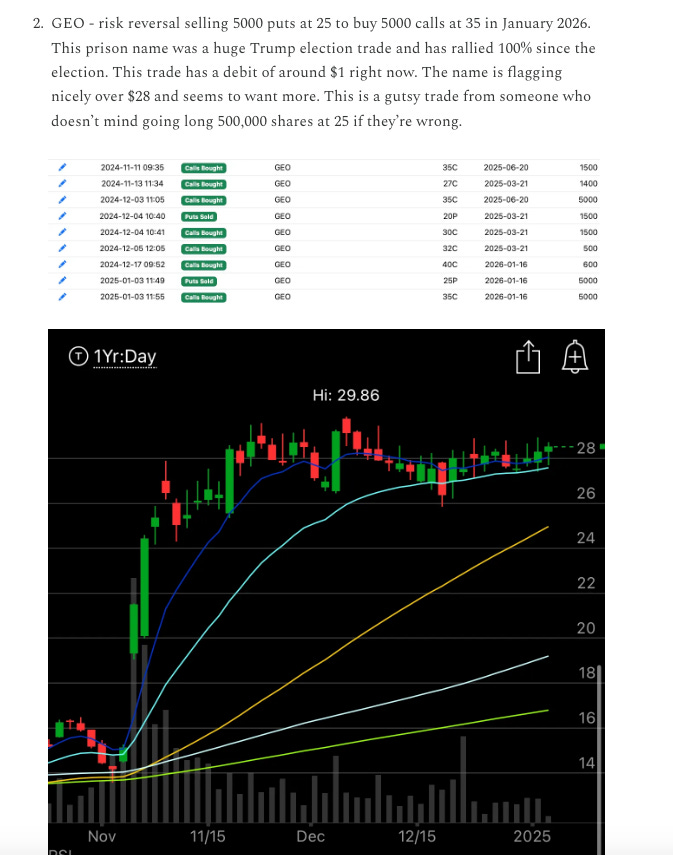

GEO - This trade on 1/3 Here was incredible, this name is up around 20% since then to 34.38 now. That risk reversal is still in the OI and it from a $1 debit at the time to over $5 now in just under 2 weeks. Incredible trade.

My Open Book