12/12 Note

Alright guys, I wanted to start this off by saying HZNP was taken out this morning, if you go back through my options tables for last week it had a couple nice trades put on beforehand, funny how that works. I don’t play biotechs so I wasn’t involved but the option flows caught it.

I wanted to send this note out this morning to give you all enough time to prepare. I looked over countless charts, breadth, tons of other internals last night and I just can’t come up with a reason to be in the market here before CPI tomorrow and the FED wed. Again, CPI day is around a 3% move on average, what a mess, we’ve turned every little data point into a shitshow to put it kindly. Everyone is so certain Powell is going up 50 bps, personally I think we might go 75 bps again. The FED hasn’t shown me anything on their end that says they know what they’re doing so I expect a policy mistake from them at this point.

With that said, I decided I will be closing all my positions and coming back on thursday once we have more clarity. I will post the options recaps in the afternoon but I have had a tremendous year and most of you should have as well, there is no sense gambling the next 3 days on the hopes that you “may be right”, I’m not a gambler, I’m a calculated risk-taker and for the moment, this is a coin flip.

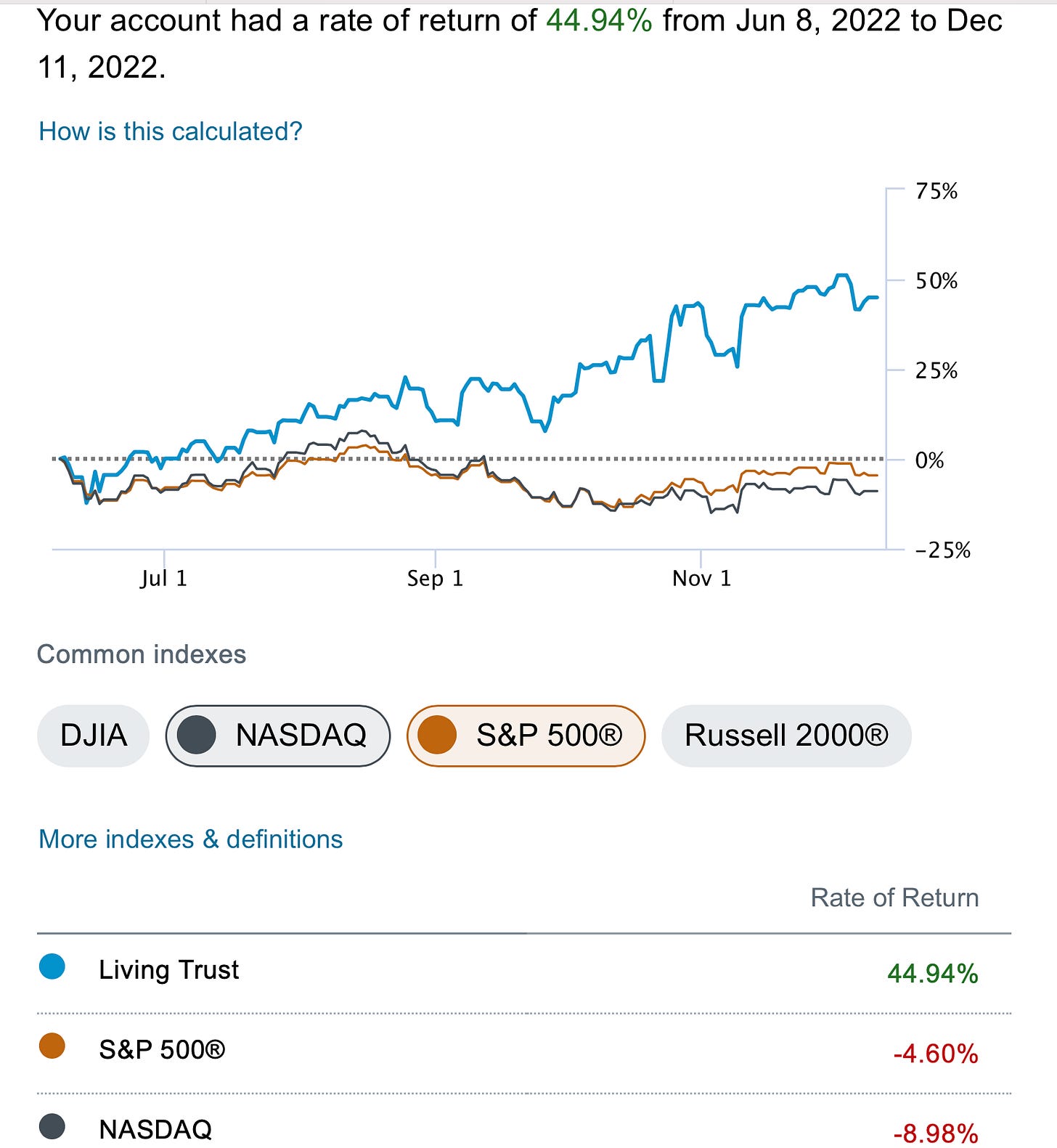

So anyways just wanted to get that out and look, I started writing this on June 8th and I’m up 45% since. The market is down 5% and the Nasdaq is down 9%.

There is just no sense in me or you trying to be a hero when this downtrend line is staring us in the face 3% higher, with the MACD rolling over, the RSI pointing south, and every other technical indicator saying don’t touch stocks. If they go up, cool, we won’t miss much and I will be here thursday waiting for a confirmation on the other side of the downtrend, otherwise, I will remain skeptical of the move up.

Anyways, the choice is yours, I am giving you my side of things. Hope you all have a great day.

Thanks for the repeated warnings. We should all prepare. Are you even closing out positions like your short AMZN 75 puts even though they are so far OTM?

Yesterday you said that if you took a position in SPLK, you would be concerned about the gap below. What is the rationale for thinking that a gap somehow attracts a stock? Are there statistics to back that up? Given two similar charts, one with a gap and one without, what are the odds that the gap will fill vs that the price of the other stock will reach that same price? (BTW, SPLK is up 4% this morning.)